Introduction

Hey there, small business hustlers! I’m Nathan Baws, the founder of Numberfied, and let me tell you, I’m excited to share something that’s transformed tiny startups into thriving empires: small business bookkeeping. Forget the nerdy accountant stereotypes-think of this as your business’s superpower. When I kicked off my first gig, a beat-up coffee cart, I thought bookkeeping was just for folks with fancy calculators. Man, was I wrong? It’s the heartbeat of success, and I’m here to walk you through why it’s your golden ticket to growth, with a few laughs and stories from the trenches.

Picture yourself slinging cupcakes or fixing bikes, too busy to track every dime. Then, tax season hits, and you’re buried in crumpled receipts. I’ve been there, done that, got the stress headache. Small business bookkeeping isn’t just about dodging those nightmares-it’s about building a business that thrives. With Numberfied, we don’t just clean up your books; we hand you the tools to spot opportunities, save cash, and dream big. Buckle up for this adventure to make your numbers your best friend.

Key Takeaways:

- Small business bookkeeping is your roadmap to more intelligent choices and fatter profits.

- Skip it, and you’re inviting tax trouble or cash flow issues.

- Numberfied turns bookkeeping into your growth buddy, not a chore.

- Easy habits and tools can make crunching numbers weirdly fun.

Why Small Business Bookkeeping Is Your Secret Weapon

It’s Your Money’s GPS

Running a business without bookkeeping is like driving cross-country with no map. You might get somewhere, but you’re likely to be lost. Small business bookkeeping tracks every penny-sales, expenses, profits-so you know exactly where you stand. I once helped a buddy with a taco truck who thought he was killing it. His books? A mess. It turns out that his “famous” burritos were losing money due to the high cost of ingredients. We tweaked his menu, and he bought a second truck. That’s the power of knowing your numbers.

Taxes Don’t Have to Suck

Tax season can feel like a punch in the gut, but good bookkeeping makes it a walk in the park. Organised records mean no scrambling for receipts or sweating IRS letters. In my first year with the coffee cart, I forgot to track mileage. I missed out on $800 in deductions-ouch. Numberfied’s platform keeps your books tax-ready, so April’s just another month.

Decisions That Feel Like Winning

Want to hire help or launch a new product? Bookkeeping gives you the confidence to make decisions without guessing. I remember agonising over buying a fancy espresso machine. My books showed I could afford it, and it boosted sales by 25%. Small business bookkeeping, with Numberfied’s help, turns maybes into sure things.

Sleep Better, Stress Less

Messy books are a one-way ticket to anxiety town. Knowing your finances are tight? That’s pure zen. I used to lie awake, wondering why my bank account looked so sad. Spoiler: I hadn’t logged a big supplier bill. Bookkeeping clears the fog, and clean reports make it a breeze.

Bookkeeping Boo-Boos You Gotta Avoid

Mixing Money Like a Bad Smoothie

Using your debit card for business stuff is like blending spinach and gummy bears-gross and confusing. Early on, I paid for coffee beans with my account. My accountant nearly had a meltdown untangling it. Keep business and personal separate.

Skipping the Small Stuff

That $4 parking fee or $12 client coffee? Please write it down! Little expenses add up like ants at a picnic. I once ignored a pile of “small” costs, only to find they ate 15% of my profits. Small business bookkeeping catches those leaks before they sink you.

I’ll Do It Tomorrow Syndrome

Putting off bookkeeping is like skipping laundry-eventually, you’re out of clean socks. I used to stuff receipts in a glovebox, swearing I’d sort them later. Guess what? Later never came. Carve out an hour a week. Numberfied’s quick setup makes it painless, I promise.

Forgetting to Double-Check

If your books don’t match your bank, you’re in for trouble. Reconciling catches mistakes like double charges. I once missed a $150 error because I skipped this step. Numberfied’s dashboard pings you when things don’t add up, saving you time and effort.

Tools to Make Bookkeeping Your Jam

Cloud Software: Your Time-Saving Sidekick

Forget paper ledgers-cloud tools like QuickBooks or Xero sync with your bank and do the heavy lifting. I started with a spiral notebook (yep, I’m that old), but cloud software changed my life.

Spreadsheets: Cheap and Cheerful

On a shoestring budget? Google Sheets is your friend. I ran my coffee cart’s books on spreadsheets, colour-coding like a kid with crayons. They’re great for starters, but you gotta stay on top of updates.

Bookkeepers: Your Financial Fairy Godmother

If numbers make you dizzy, consider hiring a professional. A good bookkeeper spots errors and opportunities you’d miss. I brought one on when my cart turned into a shop, and it was like hiring a wizard. Numberfied also offers affordable outsourcing options.

Apps for Hustlers on the Move

Always running around? Mobile apps let you snap receipts or send invoices from the gas station. I log expenses while waiting for my latte-multitasking for the win.

How Bookkeeping Lights the Path to Growth

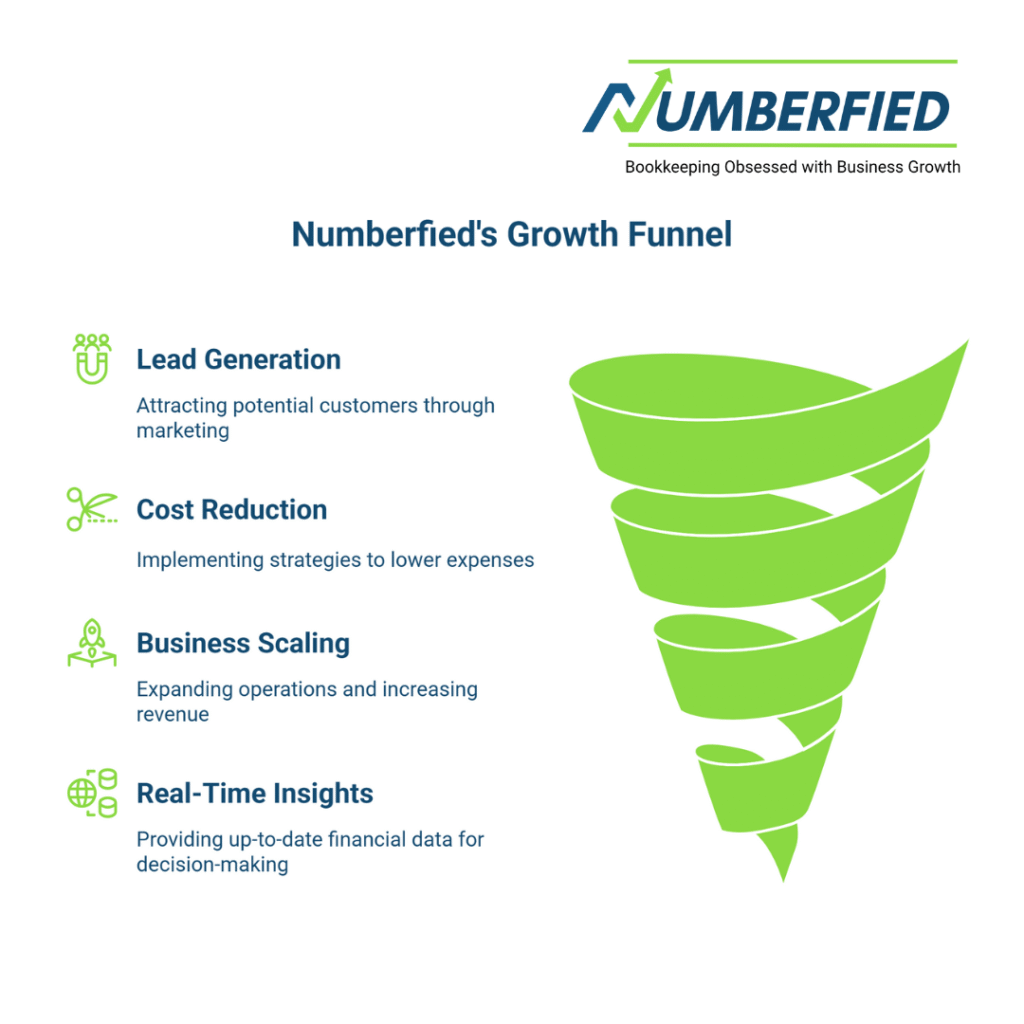

Spotting Your Cash Cows

Bookkeeping shows which products or services generate revenue for your bank. A dog groomer I know thought her baths were the star, but her books said nail trims were the real money-makers. She leaned into it and doubled her income. Small business bookkeeping digs up those hidden gems.

Keeping Cash Flowing

Cash flow is your business’s heartbeat. Without it, you’re toast. Bookkeeping tracks money in and out, so you’re never caught short.

Wooing Investors

Are you dreaming of big funding? Investors drool over clean books. Messy ones? Instant dealbreaker. I bombed a pitch once with half-baked records-learned my lesson. Effective bookkeeping for small businesses makes you appear professional to investors.

Planning Your Big Leap

Are you eyeing a second location or a new product? Your books tell you if it’s doable. A baker friend used her numbers to justify purchasing a new oven, which resulted in a 30% increase in sales. Bookkeeping turns dreams into plans.

Smart Habits to Scale Like a Boss

Automate Like a Lazy Genius

Automation is like having a robot intern. Auto-sort expenses, send repeat invoices, track mileage-Numberfied handles it. I automated my invoicing and got my evenings back for pizza and Netflix. It’s a game-changer.

Monthly Money Check-Ins

Schedule a monthly “money date” to review your books. I do mine with a cold brew, flipping through reports like it’s a juicy novel. It catches trends-like creeping supply costs-before they bite.

Stash Cash for Taxes

Tax bills hit like a rogue wave. Set aside 20-30% of your income monthly. I got slammed with a $4,000 tax bill once because I didn’t.

Get Nosy About Your Numbers

Don’t just log data-ask what it’s telling you. Why did sales jump? Why are utilities up? I caught a vendor overcharging me because I got curious. Numberfied’s reports make it easy to play detective.

Teach Your Crew

Got staff? Train them to log sales or expenses. My barista used to “forget” cash tips, throwing off my books. A quick lesson fixed it.

Numberfied: Your Bookkeeping Cheer Squad

More Than Crunching Numbers

Numberfied’s not your dad’s accounting tool. We’re your growth coach, helping you snag leads, cut costs, and scale big. Our platform makes small business bookkeeping a tool for winning, not a snooze.

Made for the Little Guys

Big firms chase corporate bucks, but we’re all about small businesses. Our tools are simple, cheap, and packed with what you need. I built Numberfied because I know the grind of running a small shop.

From the Heart

I started Numberfied after watching friends’ businesses struggle due to poor bookkeeping. It hit me hard. We’re here to make small business bookkeeping a joy, not a pain. Our team’s like your business family, rooting for you.

Live Updates, No Lag

Numberfied’s team shows your profits, expenses, and cash flow in real-time. It’s like having a crystal ball for your business. I check mine daily-it’s my morning ritual.

Next-Level Bookkeeping Tricks for Go-Getters

Predict Like a Pro

Use your books to guess future sales or cash flow. I helped a boutique owner anticipate a holiday rush, enabling her to stock up and have a successful season. Numberfied’s team forecasting tools take the guesswork out.

Track the Cool Metrics

Beyond profits, consider factors such as customer acquisition cost or inventory turnover. I ignored these once and ended up with stale coffee beans-no doubt a rookie move. Numberfied highlights the numbers that drive growth.

Ditch Paper

Go digital with receipts and invoices. I lost a key receipt in a storm once-true story, a total mess. Our Cloud storage keeps everything safe and searchable; no soggy paper is needed.

Check Your Vendors

Your books may indicate that you’re overpaying suppliers. I caught a 10% price hike in my records and renegotiated. Regular checks keep vendors honest.

Budget for Big Moves

Planning a big purchase? Your books show if you can swing it. A client bought a new truck after her books confirmed she had the cash.

The Feel of Bookkeeping

Confidence, Not Panic

Messy books are a stress bomb. I used to dread checking my account, scared of surprises. Clean books? Total confidence boost.

Pride in Your Wins

Seeing profits climb or expenses drop is like watching your kid score a goal. I still smile when I see the numbers on my old cart grow. Small business bookkeeping lets you give yourself a pat on the back.

More Fun, Less Fuss

Good bookkeeping frees you to do what you love-whether it’s crafting products or chatting with customers. Numberfied takes the grunt work out so you can enjoy the ride.

Connection to Your Dream

Your books tell your business’s story. Every sale, every expense-it’s your journey in numbers. I take pride in seeing my hard work reflected in the results. Numberfied makes that story clear and inspiring.

Conclusion

Small business bookkeeping isn’t just numbers-it’s your path to freedom, growth, and big wins. From catching profit leaks to planning your next leap, it’s your secret sauce. I’ve watched it transform my coffee cart and countless other businesses.

With Numberfied, you’re not alone-you’ve got a partner to make your numbers shine. Ready to take charge? Hit us up for expert help. Let’s make your business boom!

FAQs

What’s small business bookkeeping all about?

It’s tracking every dollar-sales, expenses, taxes-so your business stays organised. It’s not just for taxes; it shows you where you’re winning or losing. You’ll dodge penalties, make smarter calls, and sleep better knowing your finances are solid. It’s like giving your business a trusty sidekick.

Can I handle my own bookkeeping?

You bet! If you’re organised, DIY is a cinch. Start with spreadsheets or software, and commit to weekly updates. I ran my cart’s books solo at first, but it took discipline. If numbers aren’t your thing, consider hiring help, but stay informed.

How does bookkeeping help me grow?

It shows where your money is made and spent. A client found that her yoga classes offered private sessions, so she shifted her focus and tripled her profits. Bookkeeping also keeps cash flow steady and wows investors.

What’s the dumbest bookkeeping mistake?

Mixing personal and business cash is a train wreck. I did it once, and my accountant nearly cried. It screws up taxes and hides your profits. Use separate accounts, period. Small business bookkeeping needs clarity.

How often should I check my books?

Weekly, like a quick doctor’s visit. I do mine on Fridays with a coffee, catching errors early. Monthly deep dives spot trends, like rising costs. Skipping checks is like ignoring a weird car noise. Don’t wait for a breakdown.

Why pick Numberfied?

We’re built for small businesses. We don’t just track numbers; we help you grow, cut costs, and snag leads. I started Numberfied to save entrepreneurs from bookkeeping headaches. Our platform is simple, cheap, and feels like a buddy cheering you on. That’s why we stand out.

My books are a mess-how do I catch up?

Don’t freak out. Grab bank statements, receipts, whatever you’ve got. Sort by date, then categorise. Set a weekly habit to stay caught up. You’ll feel like a champ.

How does bookkeeping help with taxes?

It keeps you ready for tax season, with every deduction tracked. I missed $1,200 in deductions my first year-painful. Numberfied team will help flag tax-deductible expenses and estimate your bill, so no surprises. It’s like having a tax guru on speed dial, keeping you legal and saving money.

Can bookkeeping fix cash flow issues?

Yes! It tracks money in and out, so you’re not blindsided. A client avoided layoffs by spotting late payers in her books.

Is bookkeeping worth it for a tiny hustle?

Even a side gig needs it. It keeps you legal, shows profits, and sets you up to grow. My coffee cart started with $300, and tracking every sale helped me scale.