Introduction

Ever wondered why one bookkeeper’s quote looks nothing like the next? That’s bookkeeping pricing for small businesses in a nutshell it seems straightforward until you dig a little deeper.

At Numberfied, we’ve worked with everyone from Fremantle fish-and-chip shop owners to Toowoomba web designers, and they all ask the same thing: “What’s the real cost?” Fair question.

Think of this as your toolkit for understanding bookkeeping pricing for small businesses, what’s included, what’s extra, and how to spot value when you see it. We’ll guide you through every part of the quote.

Key Takeaways:

- Transparency beats surprises: Know every line item before you sign.

- Volume drives the fee: More transactions mean higher pricing, but not always linearly.

- In-house is rarely cheaper: Factor in payroll, software, and your own time.

- Compliance is non-negotiable: Cheap options often skip ATO essentials.

- Scalable plans grow with you: Start small, add services later.

- Technology lowers the total: Cloud tools cut manual hours.

These points give you a snapshot of bookkeeping pricing for small businesses. Let’s unpack each one.

Breaking Down the Components of Bookkeeping Pricing for Small Businesses

Every bookkeeping quote contains building blocks. Understand them, and you control the final figure for bookkeeping pricing.

Core Transaction Processing

At the heart of any service is recording what comes in and goes out. Providers charge based on the number of entries- bank lines, invoices, bills. A quiet month with fifty transactions costs less than a busy one with five hundred. Australian GST rules add a layer: every taxable supply must be coded correctly, which takes extra care for mixed-use items. This is the base of bookkeeping pricing.

Payroll and Superannuation Management

If you have staff, payroll joins the mix. Calculate gross pay, deduct tax, add super at the correct rate, and lodge via Single Touch Payroll. Errors here trigger ATO penalties, so accuracy is baked into the price. Even one casual employee can push bookkeeping pricing for small businesses upward, but the peace of mind is worth it.

Regular Reporting and Reconciliations

Monthly profit and loss, balance sheet, and bank reconciliations keep you in the loop. These reports spotlight cash gaps before they become crises. Providers bundle them into standard packages, but custom dashboards or weekly flash reports add a premium to bookkeeping pricing for small businesses.

Year-End and Compliance Filings

BAS, IAS, taxable payments annual reports, and end-of-year prep for your accountant all roll into the yearly cycle. Some providers spread this cost across twelve months; others bill at lodgement time. Either way, it’s a fixed part of bookkeeping pricing for small businesses operating in Australia.

Hidden Costs That Surprise Small Business Owners

The quoted fee is only the start. Miss these, and your budget blows out on bookkeeping pricing for small businesses.

Software Subscriptions and Add-Ons

Cloud platforms like Xero or MYOB charge per month. A basic plan suits a sole trader; a growing team needs multi-user access and payroll modules. These licences sit outside the bookkeeper’s fee but are essential for the work to happen, adding to overall bookkeeping pricing for small businesses.

Data Entry Cleanup After DIY Attempts

Many owners try the books themselves, then hand over a mess. Hours of untangling incorrect codes or missing receipts inflate the first invoice. Prevention is cheaper- start with a pro and avoid the correction surcharge that spikes bookkeeping pricing for small businesses.

Late Fees and Penalty Recovery

Miss a BAS deadline and the ATO adds interest. A bookkeeper can sometimes remit penalties, but the time spent corresponding still costs. Reliable bookkeeping pricing for small businesses includes deadline tracking to dodge this trap altogether.

Training and Handover Time

Switch providers mid-year? Expect a handover fee to bring the new team up to speed. Clear charts of accounts and labelled folders from day one keep transitions smooth and costs contained in bookkeeping pricing for small businesses.

In-House Bookkeeping Versus Professional Services

Doing it yourself sounds thrifty- until you tally the actual expense against bookkeeping pricing.

Time Value of Your Expertise

Your hourly rate as a tradie, retailer, or consultant far exceeds a bookkeeper’s. Three hours a week on the books is three hours not earning revenue. Multiply that across a year, and the “savings” vanish compared to professional bookkeeping pricing for small businesses.

Employment Overhead for a Staff Bookkeeper

Salary, super, workers’ comp, leave loading, and desk space add up fast. A part-timer still needs software training and ongoing support. Most small businesses find the total load heavier than the cost of outsourced bookkeeping.

Risk of Errors and Rework

One wrong GST code can trigger an audit. In-house staff, especially juniors, make mistakes that take senior time to fix. Professional services carry insurance and double-check protocols that minimise this drag on pricing.

Factors That Influence Bookkeeping Pricing for Small Businesses

Not every quote looks the same. These variables shape the number on the page for bookkeeping pricing for small businesses.

Business Complexity and Industry

A straightforward online store has fewer moving parts than a builder with progress claims and retentions. Cafes juggle daily cash and tips; medical practices track Medicare gaps. The more layers, the higher the fee- but also the greater the value in expert handling of bookkeeping pricing.

Transaction Volume and Frequency

A seasonal tourism operator spikes in summer; a subscription box business stays steady. Providers often tier pricing by monthly transactions, with discounts for predictable flows. Track your average over three months to forecast accurately for bookkeeping pricing for small businesses.

Level of Automation in Place

Bank feeds, invoice scanning apps, and receipt capture tools slash manual entry. Businesses already using these pay less than those relying on paper piles. Investing in basic tech upfront trims ongoing pricing.

Geographic Location Within Australia

Urban centres have more providers and competitive rates. Regional owners sometimes pay a small premium for specialised knowledge of local grants or drought relief schemes. Virtual services level the field, delivering city expertise to rural postcodes in bookkeeping pricing for small businesses.

Choosing the Right Bookkeeping Package for Your Stage of Growth

One size never fits all. Match the plan to where your business sits today with bookkeeping pricing.

Startup Phase: Essentials Only

New ventures need bank feeds, basic coding, and quarterly BAS. A lightweight package keeps cash flow visible without extras you won’t use. Add payroll later when the first employee starts- keeping bookkeeping pricing for small businesses lean.

Established Trader: Full Compliance Plus Insights

Once revenue stabilises, monthly reports and creditor management become critical. Include aged receivables tracking to chase slow payers. This mid-tier option often proves to be the sweet spot for pricing for small businesses that are turning a consistent profit.

Expansion Mode: Advanced Forecasting and Multi-Entity

Multiple locations, divisions, or ecommerce channels demand consolidated views. Budgeting tools, scenario planning, and intercompany reconciliations justify the top-tier fee. The data drives decisions that fuel the next leap in bookkeeping pricing for small businesses.

Technology’s Role in Managing Bookkeeping Pricing for Small Businesses

Modern tools keep costs down and accuracy up in bookkeeping pricing for small businesses.

Cloud Accounting Platforms

Real-time access means no more waiting for monthly files. You see the exact numbers your bookkeeper sees, instantly. Subscription costs are predictable and shared across clients, lowering the per-business burden in bookkeeping pricing for small businesses.

Automated Data Capture

Snap a receipt on your phone, and optical character recognition populates the ledger. Less typing equals fewer hours billed. Apps integrate directly, turning a cost centre into a streamlined process for bookkeeping pricing for small businesses.

Secure Client Portals

Upload documents, approve payments, and download reports in one place. No email chains or lost USBs. The portal is part of the service, not an extra line item in bookkeeping pricing for small businesses.

Reviewing Your Agreement

A good contract protects both sides and ensures fair pricing for bookkeeping services .

Clear Scope of Work

List every task, deadline, and deliverable. Ambiguity leads to scope creep and surprise invoices. Review the schedule annually as your bookkeeping needs evolve for small businesses.

Performance Metrics and Service Levels

Agree on turnaround times- bank recs within two business days, reports by the fifth. Include a process for escalations so minor issues from fester in bookkeeping pricing for small businesses.

Exit Clauses and Data Ownership

You own your data, always. Specify how files transfer if you part ways. A smooth exit prevents headaches and protects years of records in bookkeeping pricing for small businesses.

Long-Term Savings Through Proactive Bookkeeping

Pay a little now, save a lot later with smart bookkeeping pricing for small businesses.

Early Detection of Cash Flow Issues

Weekly dashboards spot slowing debtors or rising costs before they hurt. Adjust terms or stock levels in time to stay solvent- value built into bookkeeping pricing for small businesses.

Tax Planning Opportunities

Accurate year-to-date figures let your accountant claim deductions you’d otherwise miss. Instant access to depreciation schedules or prepaid expenses maximises refunds through solid pricing.

Informed Expansion Decisions

Want to hire? Open a second site? Model the impact on margins with real data. Confident choices beat gut feel every time- enabled by transparent bookkeeping pricing for businesses.

Conclusion

All sorted – you’re now across the real story behind bookkeeping pricing for small businesses. Every cost explained, every hidden pitfall exposed. Get the balance right, and instead of draining your time, your books will start giving you insights that actually grow the business.

We’re Numberfied – the team that’s turned messy receipts into crystal-clear accounts for owners from Broome to Ballina. Jump onto numberfied.com/au, tell us roughly how many transactions you handle, and we’ll send back a quote that fits your bookkeeping pricing like a glove. No fluff, no upselling – just a straightforward plan to keep your money where it belongs: in your till.

Also Read: How Accounting Services Bookkeeping Can Transform Your Australian Business

FAQs

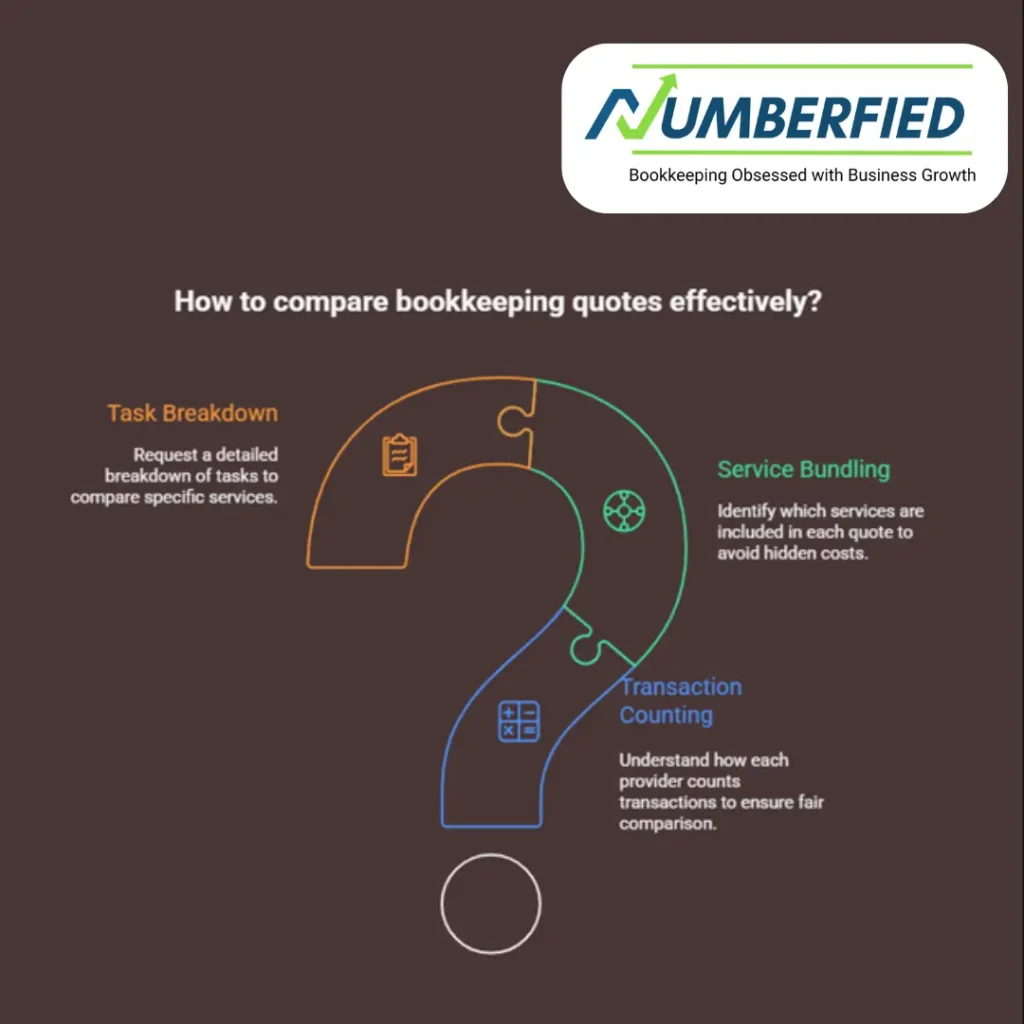

Why does bookkeeping pricing for small businesses vary so much between quotes?

Each provider counts transactions differently and bundles services in unique ways. One might include BAS lodgement, another charges it separately. Always ask for a breakdown by task to compare apples with apples in pricing.

Can I reduce bookkeeping costs by doing some tasks myself?

Yes- handle invoice issuance and receipt collection via apps, then send clean data to the bookkeeper. You cut entry time while keeping the compliance heavy lifting professional. Just don’t touch the final reconciliations; errors there undo the savings in bookkeeping pricing for small businesses.

What happens if my transaction volume jumps unexpectedly?

Most providers offer flexible tiers. Give a month’s notice and move up a plan. Some include a buffer of extra transactions at no charge to smooth seasonal spikes in bookkeeping pricing for small businesses.

Are there upfront fees when starting bookkeeping services?

A one-off setup fee often covers the chart of accounts mapping, software connection, and opening balances. It’s a fixed cost that prevents ongoing inefficiencies. Ask if it can be spread over the first three months in bookkeeping pricing for small businesses.

How do I know if I’m overpaying for my current bookkeeping?

Benchmark your fee against transaction count and services delivered. Request a free review from another provider- many, including Numberfied, will analyse your last invoice and highlight savings without obligation in bookkeeping pricing for small businesses.

Does bookkeeping pricing include advice on cutting expenses?

Basic packages focus on recording; premium ones add management reports with cost-centre analysis. Choose the level that matches your need for insights versus pure compliance in bookkeeping pricing for small businesses.

What if I only need bookkeeping during tax season?

Year-round plans are usually cheaper per month than ad-hoc peak pricing. Even quiet months benefit from bank recs and creditor management. Consider an annual contract with lighter off-season support in bookkeeping pricing for small businesses.

How does payroll affect bookkeeping pricing for small businesses?

Each employee adds PAYG withholding, super calculations, and STP lodgements. Expect a clear per-employee add-on rather than a vague percentage. Fair Work changes are tracked automatically, keeping you compliant in bookkeeping pricing.

Can I switch bookkeepers without disrupting my BAS cycle?

Yes- time the change right after a lodgement. Provide the new team with prior BAS workings and a trial balance. A two-week parallel run catches any discrepancies before go-live in bookkeeping pricing for small businesses.

Is it worth paying more for a bookkeeper who knows my industry?

Absolutely. A provider familiar with job costing for tradies or inventory for retailers codes transactions faster and flags sector-specific deductions. The higher rate often pays for itself in tax savings and efficiency in bookkeeping pricing.