Introduction

Many business owners across Perth started their companies with big dreams, yet they now find themselves spending far too many evenings sorting through receipts, chasing overdue invoices, or worrying whether the next BAS lodgement will be correct. What every growing Perth business needs is a team of experienced Perth bookkeepers who take the time to understand exactly how the company operates, what the real pressures look like, and where the owner wants to be in the coming years.

At Numberfied, our Perth bookkeepers have been privileged to work with hundreds of local businesses, from busy trades in Wangara and Osborne Park to thriving hospitality venues in Northbridge and professional services firms in West Perth. Our bookkeepers don’t simply process transactions; they become a genuine extension of your team, delivering the kind of clarity and confidence that only comes when bookkeepers truly grasp the unique rhythm of your operation.

When you partner with the right Perth bookkeepers, you can expect:

- Complete accuracy in every payroll run, BAS lodgement, and financial report

- Valuable hours are handed back each week to focus on customers and growth

- Total peace of mind that WA-specific compliance requirements are always met

- Clear, easy-to-read insights that actually help you make better decisions

Why Perth Bookkeepers with Local Knowledge Deliver Better Results

Western Australia has its own legislative landscape, its own economic cycles, and its own way of doing business. Perth bookkeepers who live and work in the city every day stay ahead of payroll tax changes, WorkCover adjustments, and industry-specific concessions that eastern states providers often miss.

Our bookkeepers have watched the January slowdown affect almost every client at some point, seen the Christmas trading surge transform hospitality cash flow, and helped countless owners navigate the unique pressures that come with running a business in Perth’s resources-driven economy. Because our bookkeepers understand these local patterns, the advice, forecasts, and systems they build are grounded in the reality of Perth rather than generic templates.

How Numberfied’s Bookkeepers Support Your Business

Every new relationship with our bookkeepers begins the same way: we listen carefully to your story, your goals, and the specific challenges you face at this time. Only after that conversation do our Perth bookkeepers design a tailored bookkeeping solution that fits seamlessly into your existing business operations.

Whether you are a rapidly growing start-up in Subiaco, an established manufacturer in Welshpool, or a family-owned retailer in Joondalup, our Perth bookkeepers scale the service to match your current needs and adjust it automatically as your transaction volume or complexity changes over time.

The Everyday Tasks Handled by Our Bookkeepers

Payroll processing, leave calculations, superannuation guarantee contributions, and Single Touch Payroll reporting are completed accurately and lodged on time every single cycle by our dedicated bookkeepers, removing one of the biggest administrative burdens from your week.

Accounts payable and receivable management becomes effortless when our bookkeepers code supplier invoices the same day they arrive, schedule payments to optimise cash flow, and follow up overdue customer invoices with the right balance of courtesy and persistence.

Daily bank reconciliations performed by our bookkeepers mean your financial position is always accurate, month-end reporting is ready whenever you need it, and there are never any last-minute surprises.

Advantages You Gain from Experienced Bookkeepers

Great bookkeepers do far more than keep the compliance boxes ticked. When records stay current all year round, our Perth bookkeepers can highlight which products, services, or clients are your true profit drivers and which ones may need attention.

Cash-flow forecasting prepared by our bookkeepers gives you a reliable 13-week rolling view that updates each week automatically, so you always know you can cover payroll, suppliers, and your own drawings even through Perth’s quieter months.

Challenges Solved by Professional Perth Bookkeepers

Mixing personal and business expenses is one of the fastest ways to create tax complications; yet, it often occurs without clear systems in place. Our bookkeepers establish separate accounts and simple rules from the very beginning, so this never becomes an issue.

Waiting until the end of the financial year to organise records creates unnecessary pressure and often means legitimate deductions are missed. Working with Perth bookkeepers who keep everything up to date throughout the year spreads the workload and maximizes every available claim.

Superannuation guarantee increases and tightened ATO scrutiny mean mistakes can be costly. Our Perth bookkeepers track every rate change and deadline automatically, so your obligations are always met correctly.

Why Perth Businesses Choose Numberfied as Their Perth Bookkeepers

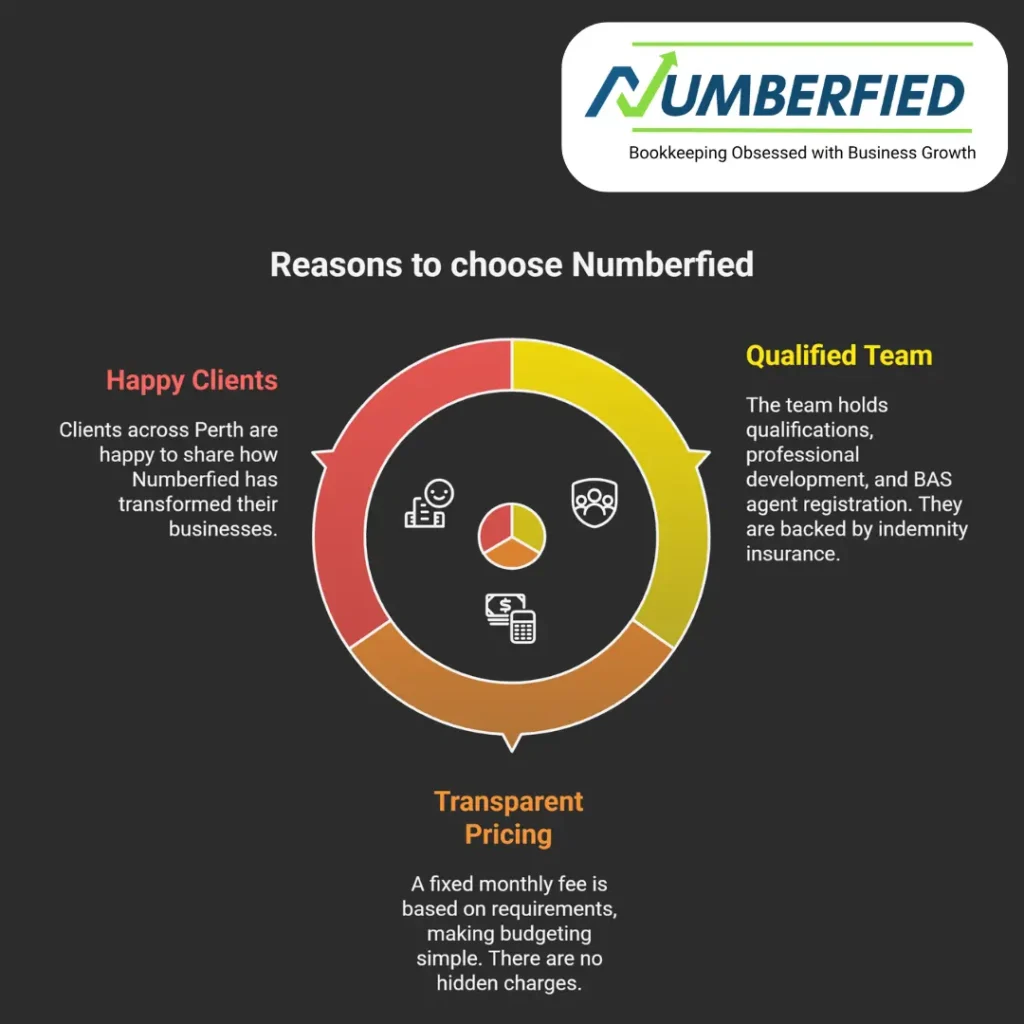

Every member of our team of bookkeepers holds recognised qualifications, ongoing professional development, and current BAS agent registration, backed by full professional indemnity insurance for complete protection.

You receive one transparent fixed monthly fee based on your actual requirements, giving you certainty and making budgeting simple, with no hidden charges from your bookkeepers.

Clients right across Perth, from Scarborough surf schools to Malaga transport companies and Nedlands medical centres, are happy to share how working with our bookkeepers has transformed their businesses.

Getting Started with Your New Perth Bookkeepers

- Book a complimentary 20–30 minute discovery call with our bookkeepers

- Receive a detailed, no-obligation proposal within 48 hours

- Enjoy a smooth onboarding process managed entirely by your Perth bookkeepers

Conclusion

Choosing the right Perth bookkeepers is one of the smartest decisions you will ever make for your company’s future. At Numberfied, our Perth bookkeepers are proud to be the trusted financial partner that Perth businesses rely on to keep the numbers accurate while they focus on building something remarkable.

Visit https://numberfied.com/au today or call our friendly bookkeepers to arrange your free discovery session. We look forward to learning about your business and demonstrating how straightforward bookkeeping can be when you have the right team behind you.

FAQs

How quickly can bookkeepers at Numberfied start helping my Perth business?

Our experienced Perth bookkeepers prioritise getting you relief fast. In most cases, full onboarding is completed within 10 to 14 days, and if you have urgent deadlines such as an overdue BAS, payroll run, or Single Touch Payroll issue, our bookkeepers can jump in immediately, often within 24 to 48 hours, to handle the pressing tasks while the longer-term systems are set up.

Do the Perth bookkeepers at Numberfied force clients to change their existing accounting software?

Absolutely not. Our bookkeepers are certified across all major platforms and work happily with whatever you are already using, whether that is Xero, MYOB, QuickBooks Online, Reckon, Sage, or any other system. We adapt to your setup rather than making you adapt to ours, so there is no disruption to your team or workflows.

Are Numberfied’s Perth bookkeepers registered BAS agents?

Yes, every team member who prepares and lodges BAS, IAS, or TPAR statements for clients is a fully registered BAS agent with the Tax Practitioners Board. This registration is a legal requirement in Australia, and our bookkeepers maintain it along with ongoing professional education to stay current with all ATO changes.

What happens if my Perth business is audited while using Numberfied’s bookkeepers?

You are fully supported. Our bookkeepers manage the entire audit process from start to finish, prepare all requested documentation, and liaise directly with the ATO or WorkCover on your behalf. Because records are kept accurate and current all year round, audits are far less stressful and usually resolved quickly.

Can the Perth bookkeepers at Numberfied fix several years of messy or neglected records?

Yes, this is one of the most common projects our bookkeepers handle. We regularly take over businesses with two, three, or even more years of backlog and bring everything up to date. These cleanup projects often uncover missed deductions, correct superannuation shortfalls before penalties arise, and give you a clean slate moving forward.

How do Numberfied’s Perth bookkeepers protect my financial data?

Your data security is non-negotiable. Our bookkeepers use bank-grade 256-bit encryption for all file transfers and cloud storage, host everything in Australian data centres only, enforce two-factor authentication across the team, and carry full professional indemnity and cyber insurance. Regular third-party security audits give both you and our bookkeepers complete confidence.

Do the Perth bookkeepers support e-commerce and online businesses?

Definitely. Our bookkeepers integrate all major e-commerce platforms, including Shopify, WooCommerce, BigCommerce, Amazon, and eBay, as well as payment gateways such as Stripe, PayPal, Afterpay, Zip, and Square, so daily sales, fees, refunds, and payouts reconcile automatically with no more manual spreadsheets or missed transactions.

Will I still need my accountant if I have Numberfied’s Perth bookkeepers?

You will still engage your accountant for final tax returns, tax-planning advice, and complex structuring. However, because our bookkeepers keep your file 100% current and reconciled all year, your accountant typically spends far less time and charges you less at year-end, and they receive a clean audit-ready file every time.

What size Perth businesses do Numberfied’s bookkeepers work with?

Our bookkeepers look after everyone from sole traders and start-ups turning over $100k to $200k, right through to established companies with $10 million+ turnover and 50+ employees. The service scales seamlessly with the same team and same attention to detail, whether you have 20 transactions a month or 2000.

How do I know choosing Numberfied’s Perth bookkeepers is worth the investment?

Most Perth clients recover the monthly fee many times over through dozens of hours saved each month with no more evenings or weekends on bookkeeping, penalties and interest avoided because BAS, payroll tax and super are always correct, better decision-making from accurate real-time reporting, lower accountant fees at year-end, and increased profit from identifying underperforming products or services early.

Our bookkeepers are happy to connect you with current clients in similar industries for references, or you can start with our no-obligation discovery call to see the difference firsthand. Ready to hand the paperwork over to experienced Perth bookkeepers who actually understand your local business? Book your complimentary 20 to 30-minute discovery call today at https://numberfied.com/au/ or phone our friendly Perth team.

Also Read: Why Accountant Services for Small Business Are Your Australia’s Ventures Secret Weapon