Introduction

Most small business owners in Australia never planned to become bookkeepers. Yet somehow the job lands on your desk anyway: receipts piling up, BAS deadlines creeping closer, payroll questions popping up on a Friday afternoon. Online accounting services fix that. Everything that used to steal your evenings now happens quietly in the background, handled by people who actually enjoy numbers.

At Numberfied, we focus on one thing: giving Australian owners accurate books, lodged obligations, and clear reports without the hassle of doing it yourself or hiring someone full-time. From Darwin to Hobart, from a one-person trade business to a cafe with twenty staff, our clients all say the same thing: they finally have their time back.

Key advantages

- See your numbers any time on your phone or laptop

- All ATO and Fair Work rules were followed correctly

- One simple monthly fee

- Real Australian accountants you can call

- More hours to spend on customers and growth

What Online Accounting Services Actually Include

Understanding the Core Components

Online accounting services take care of the full financial picture the same way an in-house accountant would, except everything lives securely in the cloud, and a qualified team does the work for you.

Daily Transaction Processing and Reconciliation

Your bank feeds connect straight into the file. Every payment in or out appears the moment it happens. We check and code it the same day, so your profit and loss are always current. No more discovering last quarter’s mistakes when the BAS is due.

Payroll and Employee Payment Management

We calculate wages using the right award or agreement, take out the correct PAYG, pay super to the right funds on time, and send payslips through a portal your team can actually use. Single Touch Payroll is lodged automatically every pay run.

GST, BAS, and Tax Compliance Support

Every quarter, we prepare your BAS, double-check the GST, make sure you claim every credit you’re entitled to, and lodge it on time. You just get a copy in your inbox for your records.

Why Small Business Owners Across Australia Choose Online Accounting Services

Freedom to Work from Anywhere

Run your business from a job site in Perth, a home office in Adelaide, or a co-working space in Melbourne. Your numbers are always with you.

Significant Time Savings Each Week

Owners who used to spend weekends catching up now finish Friday knowing everything is done. That time goes straight back into the business or family.

Reduced Risk of Costly Compliance Mistakes

One wrong GST code or a late super payment can trigger penalties and interest. Having qualified eyes on your file every day keeps those risks tiny.

How Online Accounting Services Use Modern Cloud Technology

Leading Australian-Compatible Software

We work with Xero, MYOB, and QuickBooks Online because they connect smoothly to Australian banks and talk directly to the ATO.

Secure Data Storage and Access

Your information stays encrypted on Australian servers. Security is the same standard the banks use, with two-factor login and daily backups.

Instant Collaboration and Transparency

Log in whenever you like and see exactly what’s been done. Ask a question in the file, and your accountant answers it there. No more endless email chains.

The Real Cost Benefits of Online Accounting Services

Predictable Monthly Investment

You pay one agreed fee each month based on your transaction volume. No surprise invoices, no extra charges for software or updates.

No Hidden Expenses or Surprises

Everything is covered: the software licence, cloud hosting, training, support, and compliance updates.

Higher Productivity Across Your Entire Team

When your staff stops chasing receipts and fixing spreadsheets, they get back to the work that actually brings money in.

Getting Started with Online Accounting Services in Three Simple Steps

Step 1: Initial Conversation and Needs Review

A relaxed 20-30 minute call where we listen to what’s working and what’s not. You leave knowing exactly how we can help.

Step 2: Smooth Data Transition

We collect your past records, connect the bank feeds, and set everything up. Most businesses are live within two to four weeks, and no lodgement is ever missed.

Step 3: Ongoing Partnership and Regular Reviews

We check in after the first month to make sure everything feels right, then keep delivering the same standard every month after that.

Common Business Situations

Starting a New Business or Side Hustle

The early days of a new venture are exciting, but the financial setup can quickly become overwhelming. We help you choose the right business structure for tax purposes, register for GST and an ABN if needed, build a chart of accounts that matches your industry, and connect bank feeds from day one. Every invoice you raise and every expense you pay is recorded correctly from the very first transaction, so when tax time or your first BAS arrives, everything is already in order, and you avoid the panic that hits most new owners.

Preparing for Growth or Hiring Staff

Many businesses reach a turning point when revenue is rising, and the first employees are coming on board. Suddenly, payroll, workers’ compensation, super guarantee, leave entitlements, and Single Touch Payroll become daily realities. Moving to online accounting services at this stage means the extra complexity is handled smoothly. We set up award interpretations, automate pay runs, track leave balances, and make sure every payment is correct and on time, letting you focus on training your new team members instead of learning payroll software.

Recovering from Bookkeeping Backlogs

It happens to almost every growing business at some point: the books fall months behind because you’ve been busy winning work. Invoices haven’t been entered, receipts are in a shoebox, and the thought of catching up feels impossible. Our team steps in, works through the backlog systematically, reconciles every bank statement, and brings everything current, usually within a few weeks. More importantly, we then put daily processes in place so the file stays up to date forever, and you never face the same mountain again.

Making the Most of Online Accounting Services: Practical Tips

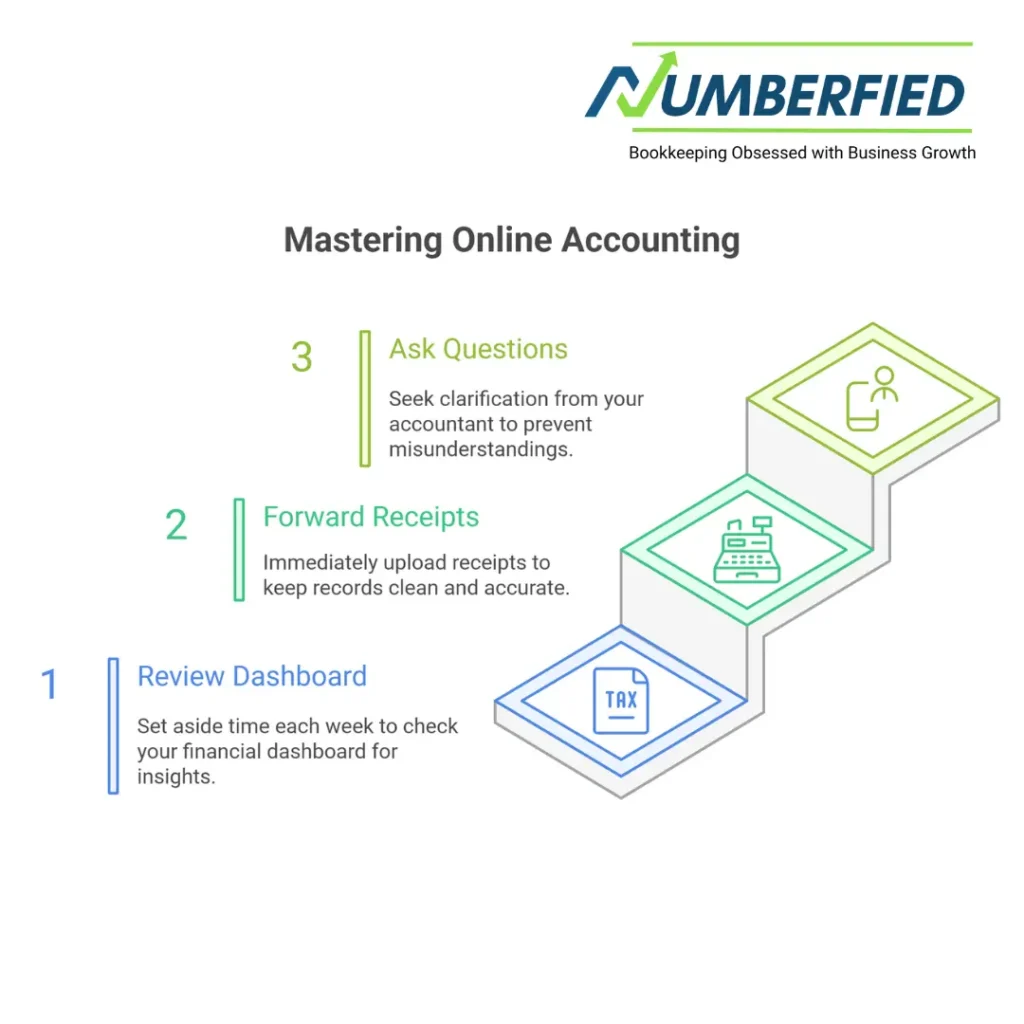

Review Your Dashboard Weekly

Set aside five or ten minutes every Friday afternoon to open the dashboard on your phone or computer. Look at cash in the bank, money owed to you, money you owe suppliers, and profit for the month so far. You’ll quickly spot slow-paying customers, rising expenses, or cash flow dips before they become problems. Owners who do this simple check stay calm and in control all month.

Forward Receipts Immediately

The moment you pay for fuel, buy materials, or grab a business lunch, take a quick photo with your phone or forward the email receipt straight to your dedicated upload address. It lands in the system instantly and gets coded that same day. This habit keeps the file clean, makes GST claims accurate, and means you never lose a tax-deductible expense again.

Ask Questions as They Arise

No question is too small. If you’re unsure whether an expense is deductible, how to code something unusual, or what a report figure actually means, send your accountant a quick message or pick up the phone. Getting clarity straight away prevents small confusions from turning into bigger issues later, and most questions are answered the same day.

Conclusion

Online accounting services give Australian small business owners something priceless: certainty about their numbers and time to grow their business. The books stay accurate, the ATO stays happy, and you stay in control, all without the stress of doing it yourself.

At Numberfied, we’re proud to look after owners right across the country. If you’re ready to simplify your finances and get your evenings back, let’s talk.

Visit https://numberfied.com/au/ today to book your free consultation and discover how easy online accounting services can be.

Book a FREE strategy call with Numberfied

Frequently Asked Questions

What exactly does “online accounting services” mean for an Australian small business?

It means qualified accountants manage your bookkeeping, payroll, GST, and BAS using cloud software while you keep full access and control. Everything is done for you, but you can still see and use the file whenever you need.

Can I still see and control my own financial data?

Yes. You get your own login and can check reports, run profit figures, or export data any time you like. Most owners look in once or twice a week just to stay informed.

Are online accounting services suitable for sole traders with low turnover?

Definitely, many sole traders use us simply to track expenses properly and make tax time straightforward. The fee scales with your activity, so it stays affordable.

How does payroll work through online accounting services?

You tell us hours worked or salaries, we do the rest: correct award rates, PAYG, super payments, and STP reporting. Your team gets payslips in their inbox or portal.

What happens if I receive an ATO notice or query?

Forward it straight to us. Because we’re a registered tax agent, we can deal directly with the ATO and sort it out quickly on your behalf.

Is there a minimum contract period?

No minimum term. You stay because the service works for you, not because you’re locked in.

How quickly can online accounting services start for my business?

Most clients are up and running within two to four weeks. If you have a pressing deadline, we can often move faster.

Do you provide advice on improving profitability?

Every month, we point out trends and simple changes that could make a difference, whether it’s pricing adjustments or cost savings.

Can family members or other advisors access the file?

Yes. We set up extra logins with whatever level of access you want so partners, spouses, or your external accountant can jump in when needed.

What support do I receive day-to-day?

You have a dedicated accountant and a client manager. Email or call any business day and you’ll hear back the same day, usually within a couple of hours.

Also Read: Why Accountant Services for Small Business Are Your Australia’s Ventures Secret Weapon