Introduction

Searching for a reliable Perth bookkeeper who understands local businesses and the needs of small business owners? Whether you run a cafe in Fremantle, a tradie business in Joondalup, or an online store based in the Perth metro, the proper bookkeeping and accounting services can make a measurable difference to cash flow, compliance, and day-to-day decision making.

Why engage a bookkeeper in Perth?

Bookkeeping Perth specialists offer more than transaction entry. Qualified bookkeepers help maintain accurate records, prepare BAS lodgements, manage payroll processing, and reconcile accounts so you can focus on running your business. Outsourced bookkeeping services are a practical option for businesses that want end-to-end bookkeeping and accounting without hiring full-time staff.

Common benefits for Perth businesses include:

- Timely BAS lodgement and lodgment reminders to avoid late lodgement penalties

- Accurate payroll services and superannuation processing for staff

- Bank reconciliation and cash flow reporting to help with business decisions

- Implementation and management of accounting software such as Xero and MYOB

- Access to bookkeepers help and accounting advice without ongoing overheads

What services does a Perth bookkeeper provide?

A professional bookkeeping company in Perth will typically offer a range of bookkeeping and accounting services tailored to your needs. Common services include:

- Daily, weekly, or monthly bookkeeping and reconciliations

- Xero bookkeeping and Xero certified setup, conversion, and training

- MYOB and other accounting software support

- BAS preparation and lodgement, including IAS and BAS lodgement

- Payroll services, PAYG withholding, and superannuation contributions

- End-to-end bookkeeping and accounting solutions for sole traders, tradies, and SMEs

- Outsourced bookkeeping services and regular management reporting

Choosing the right Perth bookkeeping partner

When evaluating bookkeepers and accounting firms in Perth, look for a mix of technical capability and local experience. Key indicators of a strong bookkeeping team include:

- Qualified bookkeepers, registered BAS agents, and, where needed, access to qualified accountants

- Years of experience and a track record of helping local businesses and small businesses

- Xero-certified staff with experience with MYOB or other accounting software

- A focus on compliance with ATO requirements and tax obligations

- Transparent processes for reconciliation, payroll processing, and lodgement

- Ability to provide affordable services that scale with your bookkeeping needs

Perth bookkeeping for different industries

Perth bookkeeping experts work across many industries. Whether you operate in construction, hospitality, retail, or professional services, experienced bookkeepers tailor bookkeeping solutions to industry-specific needs.

Examples of industry-specific support:

- Tradies: job costing, invoicing, cashflow forecasting, and superannuation management

- Retail and hospitality: point-of-sale integration with Xero, stock reconciliation, and BAS lodgement

- Professional services: time billing, debtor management, and monthly financial reporting

Why Xero bookkeeper Perth matters

Xero bookkeeping is often preferred by businesses in Perth for its cloud-based convenience and real-time reporting. A Xero bookkeeper Perth can set up reliable workflows, automate bank feeds, reconcile transactions, and produce management reports that support business decisions.

A Xero-certified bookkeeper typically offers:

- Migration from legacy systems to Xero

- Customised chart of accounts and automated bank rules

- Training for your team and ongoing support

- Integration with payroll and other business apps to reduce manual work

Outsourced bookkeeping vs in-house

Many Perth businesses find that outsourced bookkeeping services offer greater flexibility and cost efficiency. Outsourced bookkeeping teams provide expertise across bookkeeping and accounting needs without the fixed costs of hiring full-time staff.

Outsourced advantages:

- Access to a bookkeeping team with extensive experience and highly qualified staff

- Scalable services that suit seasonal cashflow changes

- More predictable monthly fees and fewer HR obligations

Compliance, BAS, and dealing with the ATO

Compliance is a core part of bookkeeping and accounting services. Qualified bookkeepers and registered BAS agents help ensure your BAS lodgement is accurate and on time. They can also assist with IAS payments, PAYG reporting, and responding to ATO queries to avoid penalties.

Good bookkeeping helps manage tax obligations and minimise risk by keeping proper records for the ATO and for year‑end accounting.

What to expect from a professional Perth bookkeeper

A professional bookkeeping service in Perth will typically:

- Conduct an initial review of your bookkeeping and accounting needs

- Recommend accounting software and implement best-practice systems

- Provide regular financial reports, cash flow forecasts, and reconciliation

- Manage payroll, superannuation, and BAS lodgements

- Offer advice to support better business decisions and growth

Qualifications and experience

Look for bookkeepers with documented qualifications, such as a Bachelor of Commerce or a Bachelor’s degree in accounting, and years of experience in the field of bookkeeping. Senior bookkeepers and bookkeeping experts often have a long history in the accounting industry and may work alongside qualified accountants to deliver broader financial services.

Some bookkeeping and accounting services will highlight years of experience in bookkeeping or even 25 years of experience at a firm level. What matters most is relevant experience helping businesses like yours.

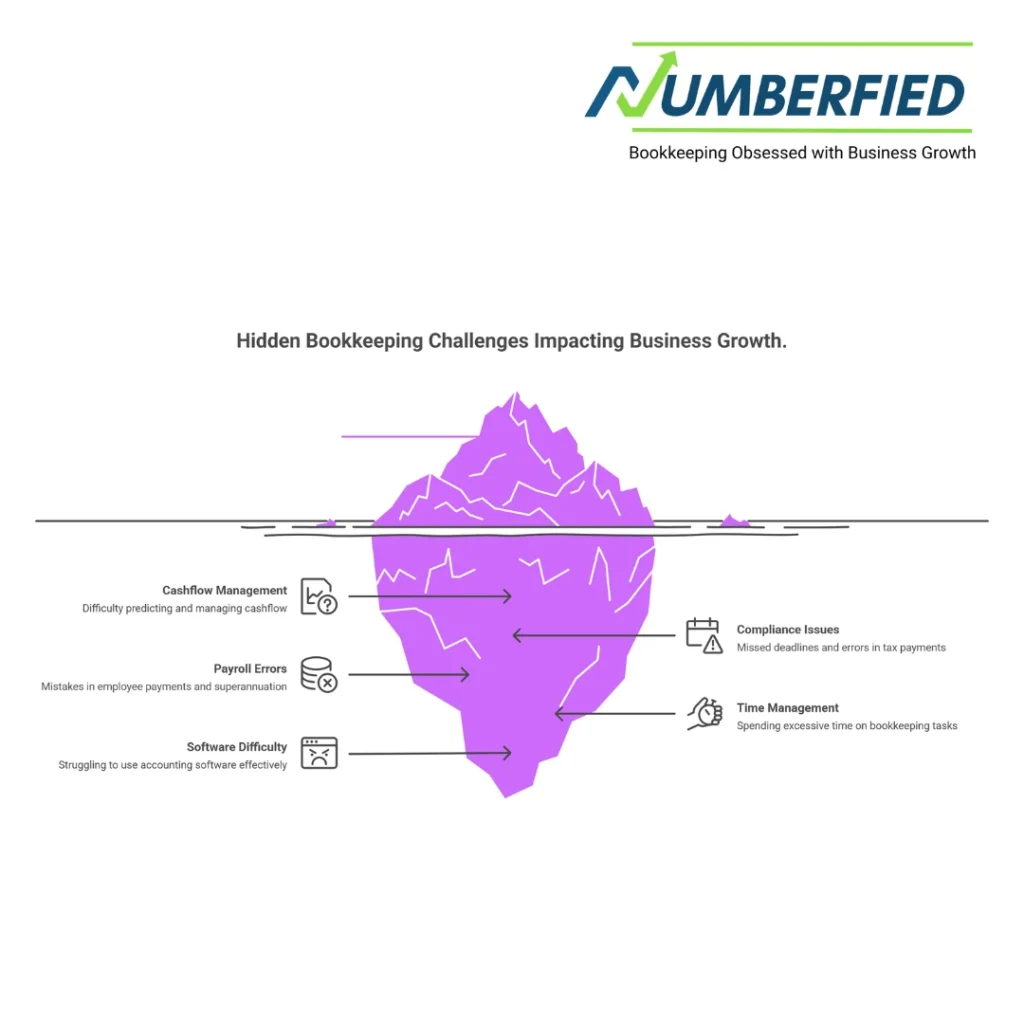

Common signs you need a Perth bookkeeper

Consider engaging bookkeeping and accounting services if you experience any of the following:

- Frequent cashflow surprises or uncertainty about cashflow forecasts

- Late lodgement notices or issues with BAS and IAS payments

- Payroll headaches and superannuation errors

- Too much time spent on bookkeeping instead of growing your business

- Difficulty using accounting software like Xero or MYOB

How bookkeepers help with business decisions

Accurate bookkeeping provides the foundation for better business decisions. Regular financial reports show where profit is made, where costs can be reduced, and how cash flow can be improved. Bookkeeping and accounting services help you interpret these reports and plan for the future.

Local bookkeeping – benefits for Perth businesses

A local bookkeeper understands Perth-specific issues such as local tax deadlines, industry norms, and the operational rhythms of businesses in WA. Local bookkeeping teams are also available for face-to-face meetings when needed and can coordinate with your accountant for end-of-year reporting.

Conclusion

Choosing the right Perth bookkeeper can transform how you run your business. From Xero bookkeeping and payroll services to BAS lodgement and cashflow reporting, a professional bookkeeping partner helps you stay compliant and make better business decisions. Whether you need outsourced bookkeeping services or local bookkeeping support, there are affordable services ready to help your business thrive.

If you’d like to discuss your bookkeeping needs or explore how a Perth bookkeeping service can help your business, get in touch for a friendly, no-obligation chat about bookkeeping solutions tailored to your business.

FAQ

What is the difference between a bookkeeper and an accountant?

A bookkeeper focuses on day-to-day financial record-keeping, reconciliations, payroll, and BAS lodgement. An accountant provides higher-level services such as tax planning, financial statements, and strategic advice. Many bookkeeping services work alongside qualified accountants to meet all accounting and bookkeeping needs.

Do I need an Xero bookkeeper in Perth?

If you use Xero or plan to move to cloud accounting, a Xero-certified bookkeeper in Perth can set up the system, automate processes, and train your staff. Xero bookkeeping often improves cash flow visibility and streamlines BAS lodgement and payroll services.

Can an outsourced bookkeeping service handle payroll and superannuation?

Yes. Many outsourced bookkeeping services in Perth manage payroll processing, PAYG withholding, and superannuation contributions, ensuring compliance and on-time payments.

How often should my books be reconciled?

Reconciliation frequency depends on transaction volume. Small businesses may reconcile weekly or monthly. More active businesses or those with complex payroll might require weekly or even daily reconciliation to maintain accurate cash flow and reporting.

Are bookkeepers registered BAS agents?

Some bookkeepers are registered BAS agents, which means they can legally lodge BAS on your behalf. Always confirm registration if you want a provider to manage your BAS lodgement and lodgment obligations with the ATO.

What industries do Perth bookkeepers serve?

Local bookkeeping services support a wide range of industries, including tradies, hospitality, retail, professional services, and e-commerce. Experienced bookkeeping teams tailor solutions to industry-specific requirements.

How do I find the right bookkeeping company in Perth?

Look for a bookkeeping company with extensive experience, qualified bookkeepers, positive client references, Xero or MYOB expertise, and a clear scope for services. A short introductory consultation will help you assess fit and affordability.

What services does a Perth bookkeeper typically provide?

A Perth bookkeeper can manage day-to-day transaction recording, bank reconciliations, payroll processing, BAS preparation, accounts payable and receivable, and regular financial reporting to help businesses stay compliant and informed.

How do I choose the right Perth bookkeeper for my small business?

Look for a Perth bookkeeper with relevant experience in your industry, up-to-date qualifications or certifications, strong references, and good communication skills. Confirm they understand local tax rules and BAS requirements and ask about their software expertise (e.g., Xero, MYOB, QuickBooks).

Can a Perth bookkeeper help with cloud accounting and software setup?

Yes, many Perth bookkeepers specialise in cloud accounting and can recommend, set up, and migrate your accounts to cloud platforms, train staff, and ensure your system is configured for accurate reporting and compliance.

Also Read: Why Accounts Receivable Outsourcing Services Will Skyrocket Your Australian Business