For small businesses and sole traders in Perth and across Western Australia, outsourcing accounting and bookkeeping can simplify operations, improve compliance, and support growth. This guide explains what outsourced accounting and bookkeeping services include, the benefits over in-house teams, pricing flexibility, and how to choose the right outsourcing partner.

What are outsourced accounting and bookkeeping services?

Outsourced accounting and bookkeeping services mean you engage an external provider an accounting firm or bookkeeping outsourcing partner to manage day-to-day accounting processes and financial management tasks. Services range from end-to-end bookkeeping and data entry to full accounting, payroll, BAS preparation, financial reporting, and tax support.

Providers typically use cloud-based accounting software, such as Xero, MYOB, or QuickBooks, and complementary tools like Dext to automate receipts, invoices, and reconciliations.

Typical services included

Most outsourced bookkeeping and accounting packages for small businesses in Australia include:

- End-to-end bookkeeping: bank reconciliation, transaction categorisation, data entry, and supplier invoices.

- Payroll: pay runs, superannuation, STP, and payroll compliance.

- BAS preparation and lodgement: GST, PAYG, and BAS reporting in line with ATO requirements.

- Monthly or quarterly financial reporting: cash flow statements, profit & losses, and balance sheets.

- Accounts payable and receivable management: invoicing, debtor follow-up, and supplier payments.

- Cloud accounting setup and migration: Xero, MYOB, or QuickBooks implementation and training.

- Ad-hoc accounting services: BAS audits, year-end preparation, tax support, and advanced accounting advice.

Benefits of outsourcing vs in-house

Outsourcing accounting and bookkeeping offers practical advantages for small businesses and sole traders:

- Reduce costs: No need for a full-time in-house accountant or bookkeeper, plus lower overheads for software and training.

- Save time: Free up your time to focus on core business activities and drive business growth.

- Scalable support: Services scale as your business grows from basic bookkeeping to advanced accounting and business planning.

- Access to accounting professionals: Gain experienced accountants and bookkeepers with specialised knowledge of Australian accounting, BAS, and ATO compliance.

- Improved accuracy and security: Outsourcing partners use established processes and advanced security for financial records and cloud-based accounting.

- Better financial reporting: Regular reports help manage cash flow, facilitate invoice collections, and inform strategic planning.

Compliance and ATO considerations

Compliance is a key reason to choose a trusted Australian accounting provider. A quality outsourcing partner will:

- Understand ATO requirements for BAS, GST, PAYG withholding, and superannuation.

- Prepare and lodge BAS correctly and on time to avoid penalties.

- Maintain compliant payroll processes and ensure Single Touch Payroll (STP) reporting is accurate.

- Provide documentation to support audits and year-end tax lodgements.

For businesses in Perth and WA, working with accountants familiar with local regulations and industry nuances reduces audit risk and ensures reporting aligns with Australian accounting standards.

Pricing flexibility and engagement models

Outsourcing solutions offer flexible engagement models to suit different business needs and budgets:

- Fixed monthly packages for ongoing bookkeeping and payroll.

- Hourly or retainer arrangements for ad-hoc accounting services.

- Project-based pricing for migrations, audits, or year-end work.

- Hybrid models combining in-house oversight with outsourced processing.

Pricing depends on transaction volume, payroll complexity, number of legal entities, and the level of financial reporting required. Many providers offer affordable packages tailored to sole traders and small businesses in Australia to reduce costs while delivering compliant, scalable accounting services.

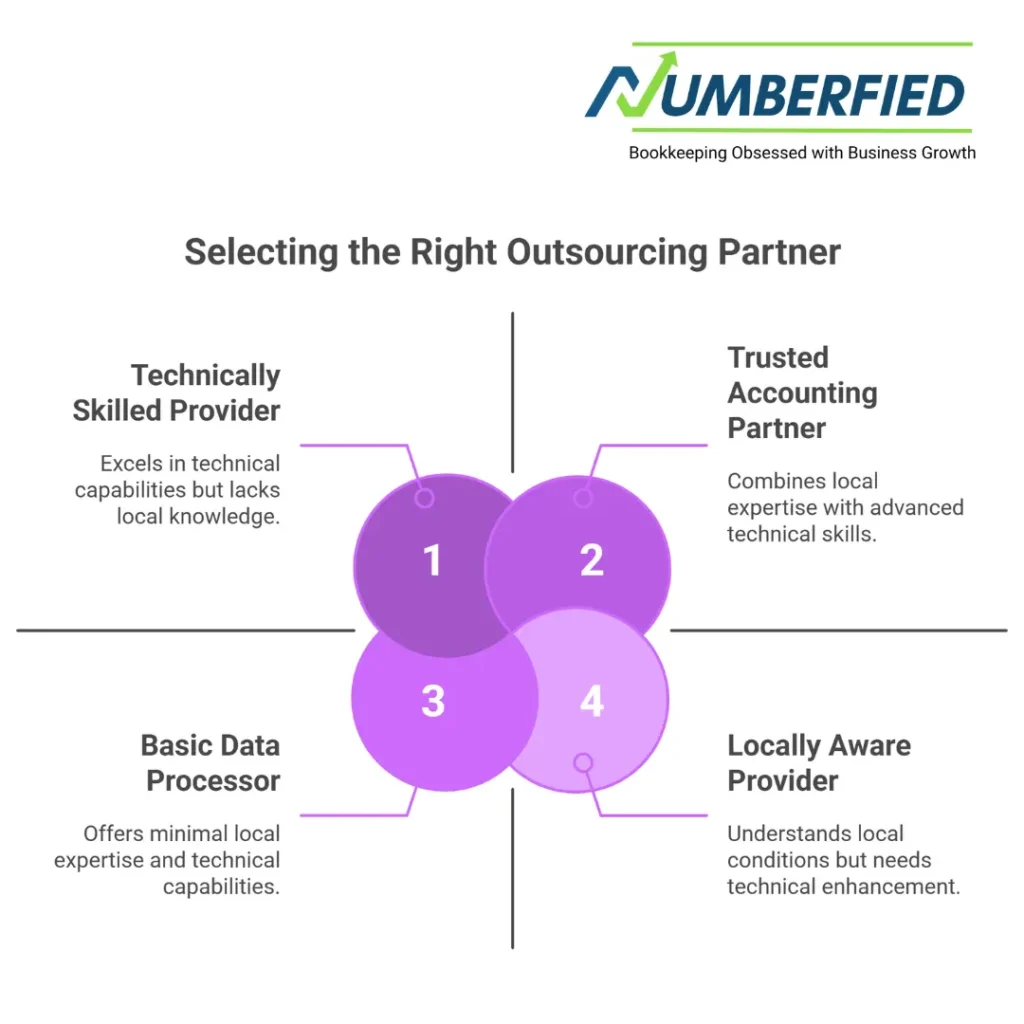

Choosing the right provider in Perth or Western Australia

When selecting an outsourcing partner, consider:

- Local expertise: A bookkeeper or accountant familiar with Western Australian small business conditions, ATO matters, and local industries.

- Technical capabilities: Experience with Xero bookkeeping, MYOB, QuickBooks, and tools like Dext or other bookkeeping software.

- Service scope: Does the provider offer payroll, BAS, end-to-end bookkeeping, tax support, and financial planning?

- Security and compliance: Advanced security practices and clear compliance processes for sensitive financial records.

- Scalability: Ability to grow services as your business expands, including advanced accounting and advisory.

- References and trust: Check client testimonials, industry reputation, and whether they act as a trusted accounting partner rather than just a data processor.

Look for bookkeeping services in Australia that operate as an extension of your accounting team and align with your business goals.

How outsourcing improves cash flow and business growth

Reliable bookkeeping and timely invoicing accelerate cash flow. Outsourced teams help by:

- Implementing automated invoicing and follow-ups to reduce days sales outstanding.

- Providing timely cash flow forecasts and financial reporting.

- Identifying cost savings and tax opportunities.

- Allowing owners to focus on core activities that grow the business.

With accurate financial records and expert advice, small businesses can make informed decisions and plan for sustainable growth.

Common tools and integrations

Cloud-based accounting and bookkeeping software streamlines outsourced accounting:

- Xero bookkeeping and Xero integrations for bank feeds and reconciliations.

- MYOB and QuickBooks for businesses with different preferences.

- Dext for receipt capture and automated data entry.

- Payroll integrations for STP and superannuation management.

Choosing a provider that supports your preferred accounting software makes the transition smoother and ensures continuity in financial reporting.

Practical steps to start outsourcing

- Audit your current accounting processes and identify pain points (time-consuming tasks, compliance risks).

- Decide which functions to outsource first: bookkeeping, payroll, BAS, or full accounting.

- Choose a provider with relevant experience ask about Xero, MYOB, and payroll expertise.

- Plan the migration: data transfer, software setup, access controls, and training.

- Establish communication, reporting cadence, and service level expectations.

Conclusion

Outsourcing accounting and bookkeeping services is a practical way for small businesses and sole traders in Perth and Western Australia to save time, reduce costs, and ensure ATO-compliant financial management. If you want to simplify your accounting processes, focus on core activities, and grow your business with expert support, contact a trusted local provider to discuss tailored outsourcing solutions and a no-obligation quote.

Ready to explore outsourcing accounting and bookkeeping? Get in touch with a Perth-based bookkeeper or accountant to assess your needs and start simplifying your financials.

FAQ

What is the difference between outsourced bookkeeping services and outsourced accounting services?

Bookkeeping focuses on daily transaction recording, reconciliations, and invoicing. Accounting includes higher-level tasks: financial reporting, tax, BAS preparation, and advisory services.

Can outsourcing help with BAS and ATO compliance?

Yes. Experienced bookkeeping and accounting firms prepare and lodge BAS, manage GST, T, and ensure payroll and superannuation meet ATO requirements.

Which software should I use Xero or MYOB?

Both are widely used in Australia. Xero is popular for cloud-based bookkeeping and integrations; MYOB suits some businesses with specific needs. A provider should advise which best fits your business.

Is outsourcing accounting suitable for sole traders?

Absolutely. Outsourcing can be cost-effective for sole traders, offering compliance, accurate records, and time savings without hiring in-house staff.

How secure are outsourced financial records?

Reputable providers use advanced security, secure cloud platforms, and access controls. Ask about their data security practices before signing up.

Will I lose control of my finances if I outsource?

No. A good outsourcing partner provides transparent reporting and retains you as the decision-maker while handling processing and compliance.

How much does outsourcing cost?

Costs vary by transaction volume, payroll complexity, and service level. There are fixed monthly packages, hourly rates, and project fees. Many providers offer packages tailored to small businesses in Australia.

Can I switch providers if I’m unhappy?

Yes. Look for providers that support smooth data migration and can export records in standard formats for a seamless transition.

Do outsourced teams handle payroll and superannuation?

Most do. They manage pay runs, STP reporting, super contributions, and payroll compliance for Australian businesses.

How quickly can I start outsourcing?

Onboarding typically takes a few weeks: setting up accounting software, transferring data, and defining processes. Simple bookkeeping migrations can be faster.

Also Read: Save Hours and Cash When You Outsource Bookkeeping Services for Your Small Business in Australia!