Introduction

Effective bookkeeping is the backbone of any successful small business. For Australian small business owners, outsourcing bookkeeping services for small business can save time, reduce errors, and ensure compliance with the ATO. This guide explains the benefits, typical services such as BAS lodgement, payroll, bank reconciliations, and cloud accounting pricing models, and practical tips to choose the right provider.

Why small businesses need professional bookkeeping services

Bookkeeping services for small business offer more than record-keeping. They provide clarity on cash flow, support tax compliance, enable smarter decision-making, and free business owners to focus on growth. With constantly changing tax rules, engaging a professional helps avoid costly mistakes, late lodgements, and penalties from the Australian Taxation Office (ATO).

Key outcomes from professional bookkeeping include accurate financial records, timely BAS lodgement, simplified payroll, better cash flow forecasting, and meaningful management reports. For micro and small businesses, these services can transform how owners manage finances and plan for the future.

Core bookkeeping services are offered to small businesses

Bookkeeping services for small business typically cover a suite of tasks. Whether offered by a dedicated bookkeeper, accounting firm, or virtual bookkeeping service, the following are the most common components:

BAS lodgement and GST management

Business Activity Statement (BAS) lodgement is one of the most critical services for GST-registered businesses. Professional bookkeepers prepare and lodge BAS on behalf of clients, ensuring GST, PAYG withholding, and other obligations are correctly reported. Timely BAS lodgement reduces the risk of ATO penalties and improves cash flow management.

Payroll processing and superannuation

Payroll is time-sensitive and compliance-heavy. Bookkeeping services for small business commonly include calculating wages, processing pay runs, preparing payslips, withholding PAYG tax, and managing superannuation contributions. Many providers also handle Single Touch Payroll (STP) reporting to the ATO.

Bank reconciliations and accounts payable/receivable

Regular bank reconciliations ensure the business’s recorded transactions match bank statements, revealing discrepancies early. Bookkeepers manage accounts payable and receivable, organise supplier invoices, chase overdue payments, and ensure bills are paid on time, helping maintain healthy supplier relationships and accurate financials.

Cloud accounting setup and support

Cloud accounting platforms like Xero, QuickBooks Online, and MYOB have become essential for modern bookkeeping. Bookkeepers set up and migrate accounts to cloud systems, configure the chart of accounts, automate bank feeds, and train staff. Cloud accounting enables real-time access to financial data from anywhere in Australia.

Financial reporting and management information

Beyond compliance, bookkeepers prepare management reports such as profit and loss statements, balance sheets, and cash flow forecasts. These reports provide actionable insights, helping business owners make informed decisions about pricing, investment, and cost control.

Year-end support and BAS audits

Bookkeeping services for small business often include year-end preparation for accountants, compiling records for tax returns, and supporting BAS audits or ATO enquiries. Properly maintained books reduce the time and cost of preparing annual financial statements and tax filings.

Benefits of outsourcing bookkeeping

Outsourcing bookkeeping services for small business delivers numerous benefits:

- Time savings: Owners reclaim hours spent on admin and data entry.

- Improved accuracy: Skilled bookkeepers reduce errors that could trigger audits or fines.

- Scalability: Services can grow as your business expands, adding payroll, inventory managemen, or more frequent reporting.

- Better compliance: Professionals stay current with ATO rules, GST changes, and superannuation obligations.

- Cost-effectiveness: Outsourcing can be cheaper than hiring in-house staff once you factor in salaries, training, and overheads.

- Access to technology: Cloud accounting and automation streamline processes and provide real-time financial visibility.

- Strategic insight: Regular reports and cash flow forecasts help you plan and make confident business decisions.

Pricing models for bookkeeping services

Pricing for bookkeeping services for small business varies by provider, scope, and complexity. Common pricing models include:

Hourly rates

Many bookkeepers charge an hourly rate for tasks such as reconciliations, data entry, and catch-up work. Hourly pricing suits businesses with irregular needs or projects where the scope is uncertain. Hourly rates in Australia typically vary depending on experience and location.

Fixed monthly packages

Fixed monthly pricing is popular for ongoing bookkeeping. Packages are tailored to transaction volume and services required (e.g., weekly payroll, monthly reconciliations, BAS lodgement). Monthly fees provide predictable costs and typically result in better continuity and proactive financial management.

Project-based fees

For one-off tasks such as bookkeeping clean-ups, software migrations, or year-end preparation, bookkeepers often quote a project-based fee. These are useful when you need a defined outcome within a set timeframe.

Value-based or percentage fees

Some providers offer value-based pricing tied to outcomes, for example, a percentage of revenue or cost savings delivered. This model is less common for small business bookkeeping, but it can work where the provider is offering advisory services linked to financial improvement.

What to watch for in pricing

When comparing quotes, confirm what’s included: number of reconciliations per month, BAS frequency, payroll runs, software subscriptions, and support hours. Also check for add-on charges such as catch-up work, payroll end-of-year processing, or lodgement penalties. Transparent fee structures reduce unexpected costs.

How to choose the right bookkeeping provider

Selecting a bookkeeping service for small business should be deliberate. Consider the following steps and criteria:

1. Define your needs

List the tasks you want outsourced: daily transaction entry, BAS lodgement, payroll, payroll STP reporting, debtor management, or periodic reports. Knowing your needs clarifies which provider fits best.

2. Check qualifications and experience

Look for bookkeepers with recognised qualifications (e.g., Cert IV in Accounting and Bookkeeping) or membership of professional bodies. Industry experience with Australian tax rules, BA, S, and STP is essential.

3. Ask about cloud accounting expertise

Choose a provider experienced with Xero, QuickBooks Online, or MYOB if you plan to use cloud accounting. Ask whether they’ll set up your chart of accounts, migrate data, and train staff.

4. Verify compliance and security

Ensure the provider follows data security best practices and is familiar with ATO compliance requirements. Confirm how they handle confidential information and what backups or disaster recovery measures exist.

5. Request references and reviews

Ask for client references or case studies, especially from similar-sized businesses or industries. Online reviews and testimonials can help gauge reliability and service quality.

6. Understand communication and reporting

Discuss reporting frequency, the format of reports, and how you’ll communicate via email, phone, or cloud-based dashboards. A provider who proactively highlights issues and opportunities offers more value than one who only reports figures.

7. Compare pricing and scope

Obtain detailed quotes that outline included services and additional fees. Compare value, not just price. A slightly higher fee that includes proactive advice and timely BAS lodgement may save you money over time.

8. Trial period and flexibility

Consider starting with a short-term agreement or a trial month to evaluate service quality. Check contract terms for notice periods and whether the provider can scale services as your business grows.

Cloud accounting: a must for modern small businesses

Cloud accounting is central to efficient bookkeeping services for small business. It enables automation of bank feeds, invoicing, expense tracking, and real-time reporting. Key advantages include:

- Remote access for owners and bookkeepers

- Automated transaction matching and reconciliations

- Integration with payment platforms, POS systems, and CRMs

- Faster BAS lodgement and STP payroll reporting

- Reduced manual data entry and lower error rates

When choosing a bookkeeping provider, prefer those who can recommend and manage a cloud solution tailored to your industry and goals.

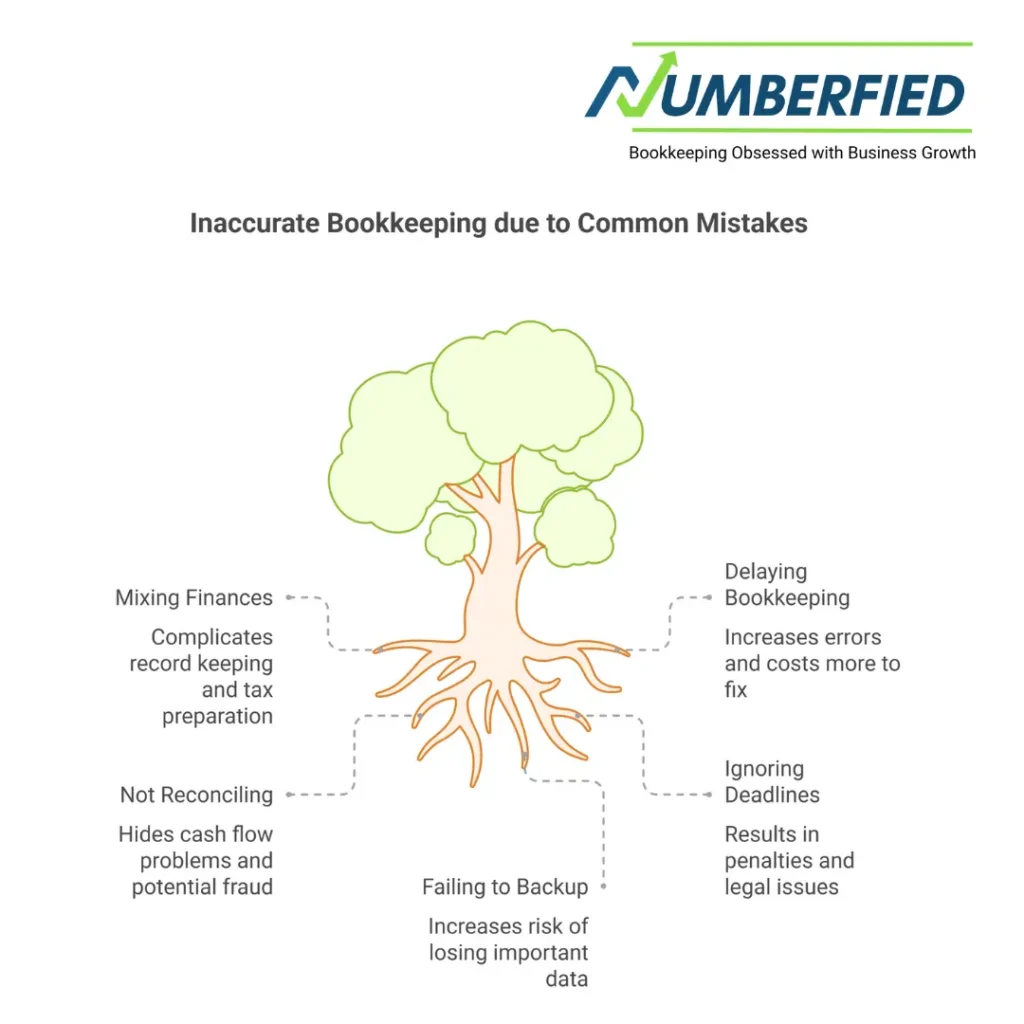

Common mistakes small businesses make with bookkeeping

Understanding common pitfalls helps you avoid them:

- Mixing personal and business finances keeps separate accounts to simplify records.

- Delaying bookkeeping catch-up work is more expensive and error-prone.

- Not reconciling bank accounts regularly hides cash flow issues and fraud.

- Ignoring GST and BAS deadlines leads to penalties.

- Failing to back up data in cloud backups reduces the risk of data loss.

Partnering with a reputable provider of bookkeeping services for small business mitigates these risks.

How bookkeeping supports growth and profitability

Accurate bookkeeping delivers the financial visibility necessary for growth. Regular management reports reveal profitable products or services, identify high-cost areas, and highlight seasonal cash flow needs. With timely data, owners can plan inventory, manage staff costs, and negotiate better supplier terms.

Bookkeepers can also provide KPI dashboards, scenario modeling, and budgeting assistance tools that empower owners to make strategic decisions rather than reactive ones.

Implementing bookkeeping in your small business: practical steps

- Decide on the scope: determine which services you want to outsource.

- Choose software: pick a cloud accounting platform compatible with your provider.

- Gather records: bank statements, invoices, receipts, and payroll records to onboard the bookkeeper.

- Set up a schedule: agree on reporting cadence, BAS schedule, and payroll frequency.

- Communicate responsibilities: clarify what you will do (e.g., uploading receipts) and what the bookkeeper will manage.

- Review regularly: hold monthly or quarterly reviews to discuss reports and action items.

Conclusion

Bookkeeping services for small business in Australia provide essential support for compliance, cash flow management, and strategic planning. By outsourcing tasks such as BAS lodgement, payroll, reconciliation, and cloud accounting, small business owners gain time, accuracy, and insights that drive growth. Evaluate providers on qualifications, cloud expertise, security, pricing transparency, and communication to find the best fit. With the right partner, bookkeeping becomes a competitive advantage rather than a burden.

FAQs

What are bookkeeping services for small business?

Bookkeeping services for small business include recording financial transactions, bank reconciliations, accounts payable and receivable, BAS lodgement, payroll processing, and preparing management reports.

Do I need a bookkeeper if I use cloud accounting software?

Cloud accounting simplifies tasks, but a skilled bookkeeper ensures data is accurate, reconciled, and compliant, and provides useful reports for decision-making.

How often should I have my books reconciled?

Monthly reconciliations are standard, but businesses with high transaction volumes may benefit from weekly reconciliations to maintain up-to-date records.

Can a bookkeeper lodge my BAS with the ATO?

Yes. Many bookkeeping services for small business include BAS preparation and electronic lodgement to the ATO, ensuring correct GST and PAYG reporting.

What is Single Touch Payroll (STP), and do I need it?

STP is an ATO reporting system for payroll in Australia. If you have employees, your payroll must be reported via STP. Bookkeepers can manage STP reporting on your behalf.

How much do bookkeeping services cost in Australia?

Costs vary: hourly rates, monthly packages, or project fees are common. Prices depend on transaction volume, complexity, and service level. Request detailed quotes to compare.

What documents do I need to give a bookkeeper?

Provide bank statements, supplier invoices, customer invoices, payroll records, receipts, and previous BAS statements. For onboarding, historical records help with catch-up work.

How do cloud accounting platforms help?

Cloud platforms automate bank feeds, invoice sending, expense tracking, and reporting. They allow real-time access for owners and bookkeepers, improving accuracy and efficiency.

Can a bookkeeper help with tax planning?

Bookkeepers prepare financial records and reports that support tax planning, but for complex tax strategies, you may need an accountant or tax advisor in addition to bookkeeping services.

How do I switch bookkeeping providers?

Switching involves selecting a new provider, migrating data (often to cloud software), arranging transitional support for catch-up work, and setting a timeline to ensure continuous BAS lodgement and payroll processing.

Also Read: Bookkeeping Services for Small Business in Perth, WA