Introduction:

Running a small business or operating as a sole trader in Australia means juggling customers, operations, and compliance. Outsourced accounting and bookkeeping services give you access to professional financial management without hiring full-time staff. By outsourcing tasks such as BAS lodgement, payroll, bank reconciliations, and cloud accounting set-up, you free up time to focus on growth while maintaining accurate records and meeting ATO requirements.

This detailed guide explains the benefits, typical services, pricing models, and practical tips to choose the right outsourced accounting and bookkeeping services for your Australian business. Whether you’re a micro business, a growing SME, or a sole trader, understanding these options will help you make an informed decision and get the best value.

Key Benefits of Outsourced Accounting and Bookkeeping Services

1. Cost Savings

Outsourcing often costs less than hiring an in-house accountant or bookkeeper. You avoid payroll taxes, superannuation, training, and overheads. Outsourced accounting and bookkeeping services typically offer flexible packages so you pay only for what you need.

2. Access to Expertise

Reputable providers employ qualified bookkeepers, BAS agents, and accountants who understand Australian tax law, GST, PAYG, and reporting standards. This expertise reduces errors and helps you claim legitimate deductions.

3. Time Efficiency

Administrative and compliance tasks consume time. Outsourcing these functions returns hours to business owners, enabling focus on sales, product development, and customer service.

4. Better Compliance and Reduced Risk

Regular BAS lodgements, payroll processing, and lodgement deadlines are managed professionally. This reduces the risk of ATO penalties, late lodgement fee,s and compliance breaches.

5. Improved Cash Flow Management

Timely invoicing, accurate reconciliations, and detailed financial reporting give you a clear view of cash flow, enabling smarter decisions about spending, inventory, and growth.

6. Scalability

As your business grows, outsourced accounting and bookkeeping services can scale up quickly—adding more frequent reporting, payroll functions or strategic advisory without the delays of recruitment.

Typical Services Offered by Outsourced Accounting and Bookkeeping Providers

Outsourced accounting and bookkeeping services for Australian small businesses and sole traders commonly include the following. Many providers bundle services or offer à la carte options so you can tailor a package to suit your needs.

BAS Lodgement and GST Management

BAS lodgement is one of the most important tasks for GST-registered businesses. Providers prepare and lodge Business Activity Statements (BAS) on your behalf, ensure GST is correctly accounted for, reconcile GST liabilities, and advise on GST treatment for supplies, exports, and mixed-use items.

Payroll and PAYG Withholding

Payroll services cover payslip preparation, PAYG withholding calculations, superannuation guarantee contributions, Single Touch Payroll (STP) reporting, and end-of-year payment summaries. Outsourced payroll ensures staff are paid on time and that PAYG and super obligations are met.

Bank Reconciliations and Credit Card Reconciliations

Reconciliations match transactions in your accounting system to bank statements. Regular reconciliations catch errors, detect fraud early, and provide an accurate snapshot of available funds.

Cloud Accounting Setup and Management

Most outsourced accounting and bookkeeping services are built around cloud accounting platforms such as Xero, MYOB, or QuickBooks Online. Providers will set up your chart of accounts, integrate bank feeds, configure payroll, and train you or your staff to use the system efficiently.

Accounts Payable and Receivable Management

Management of supplier invoices, payment scheduling, creditor reconciliations, invoicing customers, aged receivables follow-up, and credit control activities helps maintain healthy supplier and customer relationships and protect cash flow.

Financial Reporting and Management Accounts

Monthly or quarterly management accounts, profit and loss statements, balance sheets, and cash flow reports give insight into performance. Many providers also offer KPI tracking, budgeting, and forecasting services tailored to Australian businesses.

End of Financial Year Support and Tax Preparation

Outsourced accounting and bookkeeping services often include preparation of end-of-year financial statements, liaising with tax agents, compiling tax data for company or sole trader tax returns, and ensuring records are ready for lodgement.

Ad-hoc Projects and Advisory Services

Need help with a one-off migration to cloud accounting, system clean-up, ATO audit,s or business structuring advice? Many firms offer project-based services to support transitions and strategic decisions.

Pricing Models for Outsourced Accounting and Bookkeeping Services

Understanding pricing helps you choose a provider that aligns with your budget and needs. Common pricing models in Australia include:

1. Hourly Rates

Hourly pricing suits ad-hoc work, catch-ups, or irregular tasks. Rates vary depending on the provider’s expertise and location. Expect experienced bookkeepers and BAS agents to charge a competitive hourly fee, while senior accountants or specialised advisory work attracts higher hourly rates.

2. Monthly Fixed Fees

Fixed monthly packages are popular because they provide predictability. Packages are typically tiered by the volume of transactions, frequency of reporting, payroll run,s and additional services like BAS lodgement. A monthly fee can cover ongoing bookkeeping, reconciliations, BAS lodgement, and regular reporting.

3. Project-Based Pricing

For migrations, clean-ups, or one-off advisory engagements, providers quote a project fee based on scope and deliverables. This model is useful for moving to cloud accounting, converting records for a tax agent, or preparing end-of-year statements.

4. Value-Based or Retainer Models

Some firms offer retainers for ongoing advisory and CFO-style services. This model is beneficial for businesses seeking strategic input, cash flow forecasting, and regular financial planning beyond basic bookkeeping.

Pricing Considerations

- Transaction volume: Higher volumes increase time and cost.

- Complexity: Multiple entities, inventory, or multi-state operations add complexity.

- Payroll frequency: Weekly pay runs require more processing time than monthly payroll.

- Level of service: Basic data entry costs less than proactive advisory services.

- Software costs: Cloud accounting subscriptions and integrations may be billed separately.

How to Choose the Right Outsourced Accounting and Bookkeeping Provider

Selecting the right provider is critical. The right relationship should reduce stress, improve compliance, and support growth. Use this checklist when evaluating outsourced accounting and bookkeeping services:

1. Verify Qualifications and Registrations

Ensure the provider employs registered BAS agents for BAS lodgement and qualified accountants for tax and advisory work. Check memberships, certifications, and ongoing professional development.

2. Experience with Australian Small Businesses and Sole Traders

Industry experience matters. A provider familiar with your sector will understand common tax treatments, grant opportunities, and industry benchmarks.

3. Cloud Accounting Expertise

Confirm experience with your preferred cloud platform (Xero, MYOB, QuickBooks Online). Ask about integrations (POS, e-commerce, inventory) and whether they’ll set up bank feeds and automation.

4. Security and Data Privacy

Ask about data storage, backups, encryption, and access controls. Australian businesses must protect sensitive financial data and comply with privacy obligations.

5. Communication and Accessibility

Good communication is essential. Clarify response times, reporting frequency, and account management structure. Know who your main contact will be and how support is delivered (phone, email, portal).

6. Clear Scope and Deliverables

Get a written scope of work that specifies tasks, deliverables, and turnaround times. This avoids misunderstandings about “what’s included” in the package.

7. Pricing Transparency

Request a clear fee schedule with any additional costs listed (software subscriptions, bank feed setup fees, out-of-pocket expenses). Understand billing cycles and cancellation terms.

8. Trial or Pilot Period

If possible, start with a short engagement or a single service (for example, BAS lodgement or monthly reconciliations) to assess fit before committing to a long-term contract.

9. References and Reviews

Seek testimonials, case studies, and references from similar businesses. Online reviews can highlight strengths and areas to avoid.

10. Cultural Fit and Responsiveness

Your provider should align with your business values, be proactive and responsive, and offer practical insights you can act on.

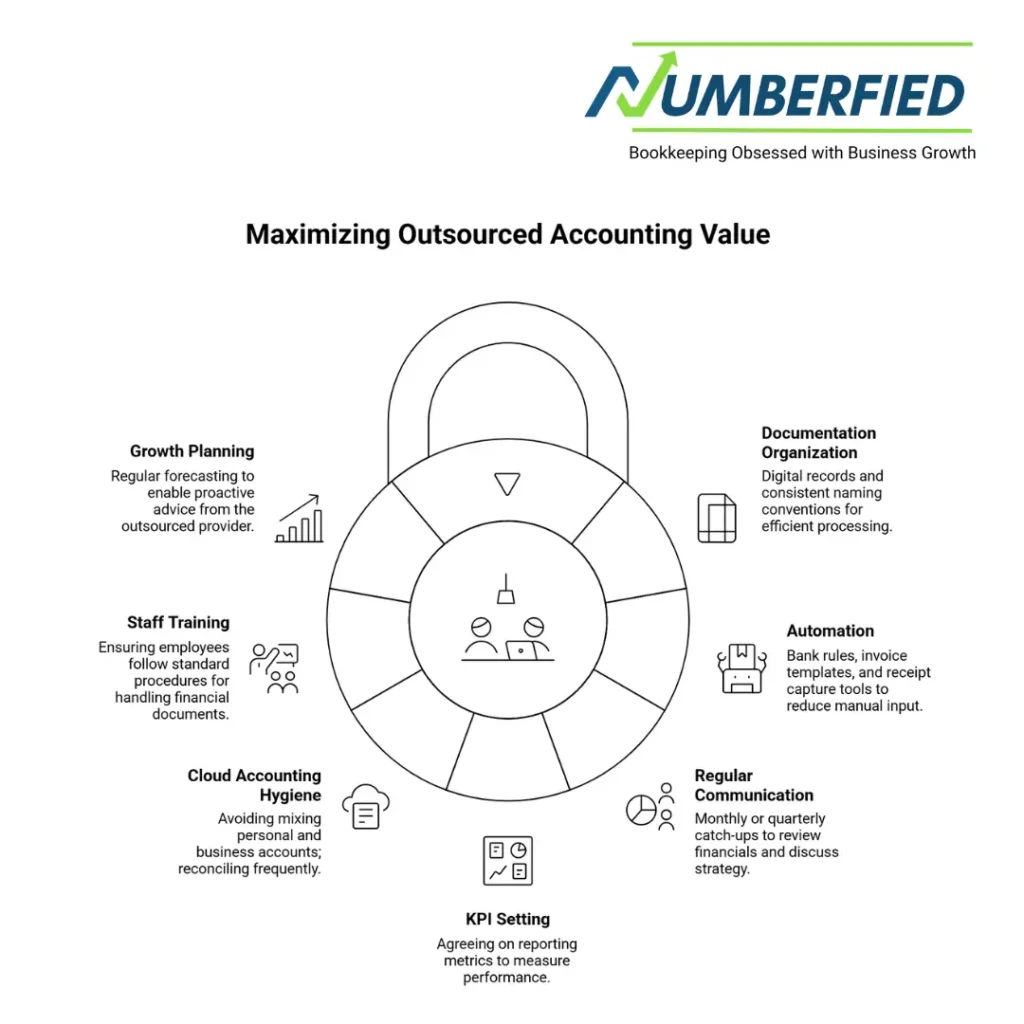

Practical Tips to Get the Most from Outsourced Accounting and Bookkeeping Services

- Organise your documentation: Use digital records and consistent naming conventions for invoices and receipts to speed up processing.

- Automate where possible: Bank rules, invoice templates, and receipt capture tools reduce manual input and human error.

- Maintain regular communication: Schedule monthly or quarterly catch-ups to review financials and discuss strategy.

- Set clear KPIs: Agree on reporting metrics (cash runway, gross margin, debtor days) to measure performance.

- Keep your cloud accounting clean: Avoid mixing personal and business accounts; reconcile frequently.

- Train staff on processes: If employees handle receipts or timesheets, ensure they follow standard procedures.

- Plan for growth: Regular forecasting helps the outsourced provider offer proactive advice ahead of needs.

Sole Trader Moving to Cloud Accounting

Consider a sole tradie switching from manual receipts and spreadsheets to outsourced accounting and bookkeeping services. The provider sets up Xero, establishes bank feeds, configures invoice templates, and implements receipt capture via a mobile app. Monthly reconciliations and BAS lodgements are handled by a registered BAS agent. The tradie receives weekly cashflow summaries and a quarterly review that identifies opportunities to claim additional deductible expenses. Time spent on admin drops dramatically, and the tradie avoids BAS mistakes that previously triggered ATO enquiries.

Conclusion

For many Australian small businesses and sole traders, outsourced accounting and bookkeeping services deliver better compliance, time savings, and cost efficiency. Whether you need BAS lodgement, payroll, reconciliations, or cloud accounting setup, outsourcing gives you access to professional support tailored to your needs. Evaluate providers by qualifications, cloud expertise, security, pricing transparency, and cultural fit. Start with a pilot engagement if unsure, and use regular reporting and KPIs to monitor performance. With the right provider, outsourced accounting and bookkeeping services become a strategic asset that supports growth and reduces administrative burden.

FAQs

What is the difference between outsourced accounting and in-house bookkeeping?

Outsourced accounting and bookkeeping services are provided by an external firm or contractor. In-house bookkeeping employs staff within your business. Outsourcing offers flexibility, access to broader expertise, and often lower fixed costs compared with hiring in-house.

Can an outsourced provider handle BAS lodgement and PAYG?

Yes. Registered BAS agents can prepare and lodge BAS on your behalf. Many providers also manage PAYG withholding, STP reporting, and superannuation obligations.

Will I retain access to my financial records when I outsource?

Yes. Cloud accounting platforms allow both you and your provider to access records concurrently. You keep ownership and can view reports at any time.

How secure is my financial data with an outsourced service?

Reputable providers use secure cloud platforms with encryption, two-factor authentication, and regular backups. Ask providers about their security policies and data handling procedures.

How much do outsourced accounting and bookkeeping services cost?

Costs vary by transaction volume, services required, and provider expertise. Options include hourly rates, fixed monthly fees, and project-based pricing. Small businesses often find a monthly package most predictable.

Can outsourcing help me if I’m behind on my bookkeeping?

Yes. Many providers offer catch-up or clean-up packages to bring records up-to-date before moving to ongoing monthly services.

Do I need to use cloud accounting to outsource?

Cloud accounting is strongly recommended as it enables real-time collaboration, automation, and remote access. Many outsourced accounting and bookkeeping services specialise in cloud platforms.

How do I choose between a bookkeeper and an accountant?

Bookkeepers handle day-to-day transaction recording, reconciliation, and BAS preparation. Accountants provide tax advice, financial statements, and strategic planning. Many outsourced firms include both skill sets or partner with tax agents.

Will outsourcing work for a one-person business?

Absolutely. Outsourced accounting and bookkeeping services are ideal for sole traders who need compliance support without the overhead of staff. Packages can be tailored to occasional invoicing and simple BAS obligations.

How quickly can I start with an outsourced provider?

Onboarding timelines vary. A simple set-up on a cloud accounting platform can be completed in days, while migrations and clean-ups may take weeks, depending on the state of your records.

Also Read: Outsourced Accounting and Bookkeeping Services for Small Businesses in Perth & Western Australia