Introduction

As a small business owner in Australia, managing finances can feel like a never-ending task amid ATO deadlines and daily operations. Accounting outsourced services offer a smart solution, allowing you to delegate bookkeeping, tax returns, and advisory to experts while you focus on growth. These services have become essential for sole traders, startups, and self-employed professionals, providing scalability and peace of mind. In this guide, we delve into why accounting outsourced services are ideal, how they compare to in-house options, and how to choose the right provider for your needs.

Key Benefits of Accounting Outsourced Services

Accounting outsourced services bring significant advantages to small businesses across Australia, helping you navigate complex financial landscapes with ease.

Cost Savings and Efficiency

One major benefit of accounting outsourced services is substantial cost savings, often 40-60% less than hiring a full-time accountant. Without payroll taxes, superannuation, or office space expenses, you pay only for what you need. Outsourced accounting Australia allows flexible monthly fees, freeing cash for business reinvestment.

Access to Expertise and ATO Compliance

Virtual accountant Australia providers bring specialised knowledge of ATO rules, ensuring accurate BAS lodgements and tax returns. They handle changes in legislation, like super guarantee rates or instant asset write-offs, reducing your risk of penalties. This expertise is invaluable for small business accounting outsourcing, where in-house staff may lack depth.

Scalability for Growing Businesses

As your business expands, accounting outsourced services scale seamlessly, adding payroll or advisory services without recruitment delays. Cloud accounting services enable real-time adjustments, perfect for seasonal fluctuations in retail or service industries. This flexibility supports long-term growth without fixed costs.

Enhanced Financial Clarity

Tax and bookkeeping outsourcing provides clear, timely reports on cash flow, profitability, and expenses. With tools like Xero or MYOB, you gain insights that drive better decisions, such as identifying cost leaks or forecasting revenue. For self-employed professionals, this clarity means more time for client work.

In-House vs Outsourced Accounting Comparison

Deciding between in-house and accounting outsourced services depends on your business size and goals. Here’s a balanced view.

Cost and Overhead Differences

In-house accounting costs $70,000–$100,000 annually (salary, super, training), plus software and office space. Accounting outsourced services start at $300–$1,500 per month, with no hidden overheads. Small business accounting outsourcing saves money, especially for startups with variable needs.

Expertise and Training Requirements

In-house staff may require ongoing training to stay ATO-compliant, costing time and money. Outsourced accounting Australia uses certified professionals with up-to-date knowledge, eliminating your training burden. Virtual accountant Australia teams often have industry specialists, offering better advice than a generalist hire.

Flexibility and Scalability

In-house roles are fixed, making scaling difficult during growth spurts. Accounting outsourced services adjust services as needed, add tax planning or payroll without hiring. Cloud accounting services enable remote access, ideal for distributed teams.

Control and Communication

In-house provides daily interaction, but outsourced uses portals for real-time visibility. Choose providers with dedicated account managers for seamless communication. Tax and bookkeeping outsourcing maintains control through approval processes and custom reports.

Essential Services in Accounting Outsourced Packages

The best accounting outsourced services cover a range of tasks to keep your finances in order.

Bookkeeping and Record-Keeping

Core to accounting outsourced services is accurate transaction recording, bank reconciliations, and ledger maintenance. Providers use cloud tools for real-time updates, ensuring ATO-ready records.

BAS and GST Lodgement

Outsourced accounting Australia handles quarterly BAS preparation, GST calculations, and electronic lodgement. This service prevents errors in PAYG and input tax credits, saving you hours.

Tax Returns and Planning

Tax and bookkeeping outsourcing includes preparing and filing annual returns, maximising deductions like home office or vehicle expenses. Forward planning minimises liabilities through strategies like income splitting.

Payroll and Superannuation

Many packages include payroll processing, super guarantee payments, and STP reporting. Virtual accountant Australia ensures compliance with Fair Work and ATO rules, reducing administrative hassle.

Financial Advisory and Reporting

Beyond basics, outsourced accounting in Australia offers monthly reports, cash flow forecasts, and business advice. This helps identify growth opportunities and manage risks effectively.

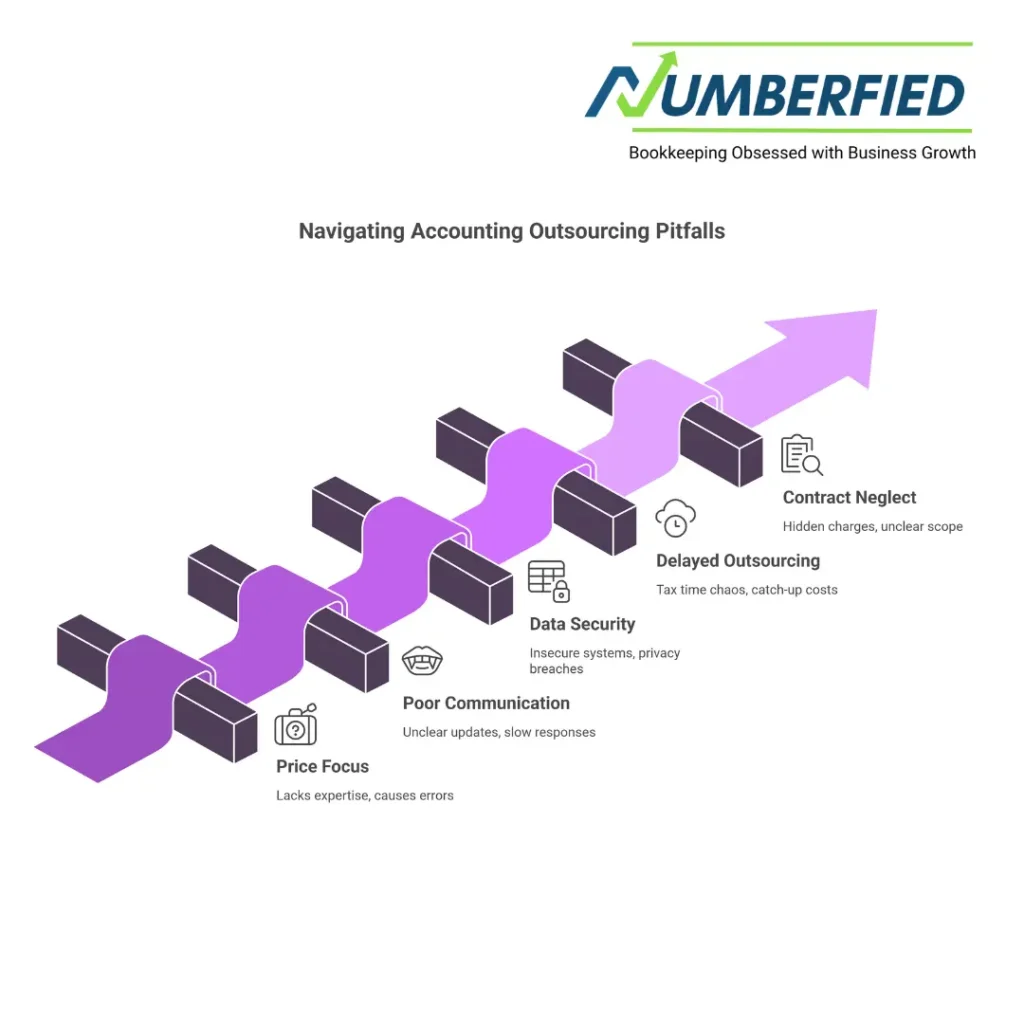

Common Mistakes to Avoid with Accounting Outsourced Services

Even with expert help, pitfalls can occur. Here’s how to steer clear.

Choosing Based on Price Alone

Low-cost providers may lack expertise, leading to errors. Look for value in accounting outsourced services, balance fees with qualifications and reviews.

Poor Communication Expectations

Assume regular updates; set expectations for response times and reporting frequency. Outsourced accounting Australia succeeds with clear channels like client portals.

Ignoring Data Security

Choose providers with secure cloud systems and privacy policies. Tax and bookkeeping outsourcing must comply with Australian privacy laws to protect your financial data.

Delaying Outsourcing

Many wait until tax time chaos. Start early with a virtual accountant in Australia to build accurate records from the beginning, avoiding catch-up costs.

Not Reviewing Contracts

Read the terms for scope, fees, and termination. Ensure accounting outsourced services include revisions and no hidden charges.

Step-by-Step Guide to Choosing Accounting Outsourced Services in Australia

Follow this guide to find the right partner.

Step 1: Assess Your Business Needs

Identify requirements: bookkeeping only, full tax services, or advisory? Consider transaction volume, industry, and ATO obligations for tailored outsourced accounting in Australia.

Step 2: Research Providers

Search for TPB-registered agents with positive reviews on Google or ProductReview.com.au. Check specialisations in small business accounting outsourcing.

Step 3: Evaluate Qualifications

Confirm tax agent registration and experience with your entity type. Ask for case studies from similar clients in tax and bookkeeping outsourcing.

Step 4: Check Technology and Tools

Ensure they use ATO-approved software like Xero or MYOB for seamless integration. Cloud accounting services should offer real-time access and secure data handling.

Step 5: Compare Quotes and Value

Get detailed proposals outlining services, fees, and inclusions. Compare value, not just price, look for extras like tax planning with a virtual accountant in Australia.

Step 6: Meet the Team

Schedule calls to assess communication and fit. Discuss how they handle ATO audits or complex queries.

Step 7: Start with a Trial

Many offer trial periods. Monitor service quality before committing to long-term.

Top Providers and ATO Trends in 2026

Leading providers for accounting outsourced services in 2026 include:

- H&R Block is affordable for sole traders

- TaxStore personalised small business focus

- Bench virtual accountant Australia with fixed pricing

- Pilot tech-driven for startups

- Local firms like My Accountant offer hands-on support

ATO trends emphasise e-invoicing adoption, STP Phase 2 for all employers, and increased data matching for deductions. Outsourced accounting Australia now uses AI for faster BAS processing and predictive tax planning. Providers are integrating ESG reporting as sustainability becomes key for grants. Choose those with strong cybersecurity, as ATO focuses on data protection.

Conclusion

Accounting outsourced services are a game-changer for Australian small businesses, delivering cost savings, expertise, scalability, and compliance. By choosing the right provider, you gain financial clarity and time to grow. Whether you’re a sole trader or startup, outsourced accounting in Australia is the way forward. Ready to transform your finances? Request a free consultation today and discover how we can support your success.

FAQs

Is outsourcing legal in Australia?

Yes, outsourcing is completely legal in Australia and widely practised by businesses of all sizes. It is regulated under the Corporations Act, Fair Work Act, and Privacy Act, with requirements for data security, worker rights (if onshore), and compliance with ATO rules for tax and BAS lodgements. Many small businesses legally outsource accounting, IT, HR, and customer service to local or offshore providers.

How much does it cost to outsource an accountant?

Outsourcing an accountant in Australia typically costs $300–$2,000 per month for small to medium businesses. Basic bookkeeping and BAS lodgement start around $400–$800, while full-service packages (including tax returns and advisory) range from $1,000–$2,000+. Hourly rates average $150–$350 for specialist work, depending on complexity and provider location.

What are the 4 types of outsourcing?

The four main types of outsourcing are offshore (to distant countries like India or the Philippines for cost savings), nearshore (to nearby countries with similar time zones), onshore (within Australia for easier communication and compliance), and business process outsourcing (targeting specific functions like accounting, payroll, or customer support).

What are accounting outsourcing services?

Accounting outsourcing services involve hiring an external provider to handle financial tasks such as bookkeeping, BAS lodgement, tax returns, payroll, and financial reporting. These services are usually delivered remotely using cloud platforms like Xero or MYOB, allowing businesses to access expert accountants without employing in-house staff.

What is the accounting outsourcing process?

The accounting outsourcing process begins with assessing your needs, selecting a provider, signing a contract, and securely sharing access to your accounting software. The provider then handles daily bookkeeping, reconciliations, BAS preparation, tax lodgement, and reporting, with regular communication and reviews to ensure accuracy and compliance.

Why are accounting jobs being outsourced?

Accounting jobs are being outsourced to reduce costs, access specialised expertise, improve efficiency through technology, and allow businesses to focus on core activities. Cloud tools and offshore/nearshore providers offer 24/7 support and scalability, while Australian firms provide local knowledge and ATO compliance. It also addresses skill shortages and high in-house salary expenses.

What are the 4 types of accountants?

The four main types of accountants are financial accountants who prepare external reports and statements. management accountants (provide internal data for decision-making), tax accountants (focus on tax compliance and planning), and auditing accountants (review financial records for accuracy and regulatory compliance). Each specialises in different areas of financial management and reporting.

What are accounting outsourced services?

Accounting outsourced services mean delegating financial tasks like bookkeeping, BAS/GST lodgement, payroll, tax returns, and reporting to an external firm or virtual team. These services are delivered remotely via secure cloud platforms, offering cost-effective expertise and scalability for Australian small businesses.

How much does it cost to outsource an accountant?

Outsourcing an accountant in Australia generally costs $400–$2,000 per month for small businesses. Basic packages (bookkeeping and BAS) start around $500–$900, while comprehensive services (tax returns, advisory, payroll) range from $1,200–$2,000+. Hourly rates for specialist work average $150–$350.

What are the 4 types of outsourcing?

The four types of outsourcing are offshore (to distant low-cost countries), nearshore (to nearby countries with similar time zones), onshore (within Australia for compliance and communication), and business process outsourcing (specific functions like accounting or IT support). Each type balances cost, quality, and control differently for Australian businesses.

Also Read: How Accounting Services Bookkeeping Can Transform Your Australian Business