Introduction

Every Australian business owner hits the point where the shoebox of receipts just will not cut it anymore. That is when the question pops up: accounting vs bookkeeping- which one do I actually need? Here at Numberfied, we chat to people in exactly your spot every week. A cafe owner in Bondi, a plumber in Geelong, a tech startup in Brisbane- they all want the same thing: finances that make sense without eating their weekends. This guide spells it out in plain English. You will walk away knowing what each service does, when to bring it in, and how we can take the hassle off your plate.

Key Takeaways:

- Bookkeeping = daily money tracking.

- Accounting = turning those numbers into plans and tax returns.

- Start simple, scale up.

- We are one call away from sorting it for you.

What is Bookkeeping and Why Does it Matter?

Bookkeeping is the nitty-gritty of writing down every dollar that moves. Think of it as the diary your bank account keeps.

Daily Tasks in Bookkeeping

Monday morning: the weekend takings hit the account. The bookkeeper logs the sales, splits the GST, marks which invoices are paid. Tuesday: a supplier invoice lands in the email- scan, code, schedule payment. Wednesday: payroll run- wages out, super calculated, PAYG withheld. By Friday the bank is reconciled to the cent. Nothing flashy, just accurate.

In Australia that means every line item carries the right GST code- tax invoice, input-taxed, GST-free. One wrong click and your BAS is out. Solid bookkeeping stops that headache before it starts.

Benefits for Small Businesses

Picture this: you are on site quoting a job, and your phone pings – cash balance updated, invoice sent, payment due in 7 days. That is bookkeeping working for you. No more ringing the bank or digging through statements at 10 pm.

We see owners breathe easier once the paperwork is off their desk. One less fire to fight means more energy for customers and family.

Common Tools Used

Xero tops the list for most of our clients – feeds straight from the bank, an app on your phone, and ATO pre-fill for BAS. MYOB still has fans in manufacturing. QuickBooks suits retail. Whatever you pick, the bookkeeper lives in it daily.

We get you set up, import the chart of accounts, and show you the two or three buttons you actually need. The rest happens behind the scenes.

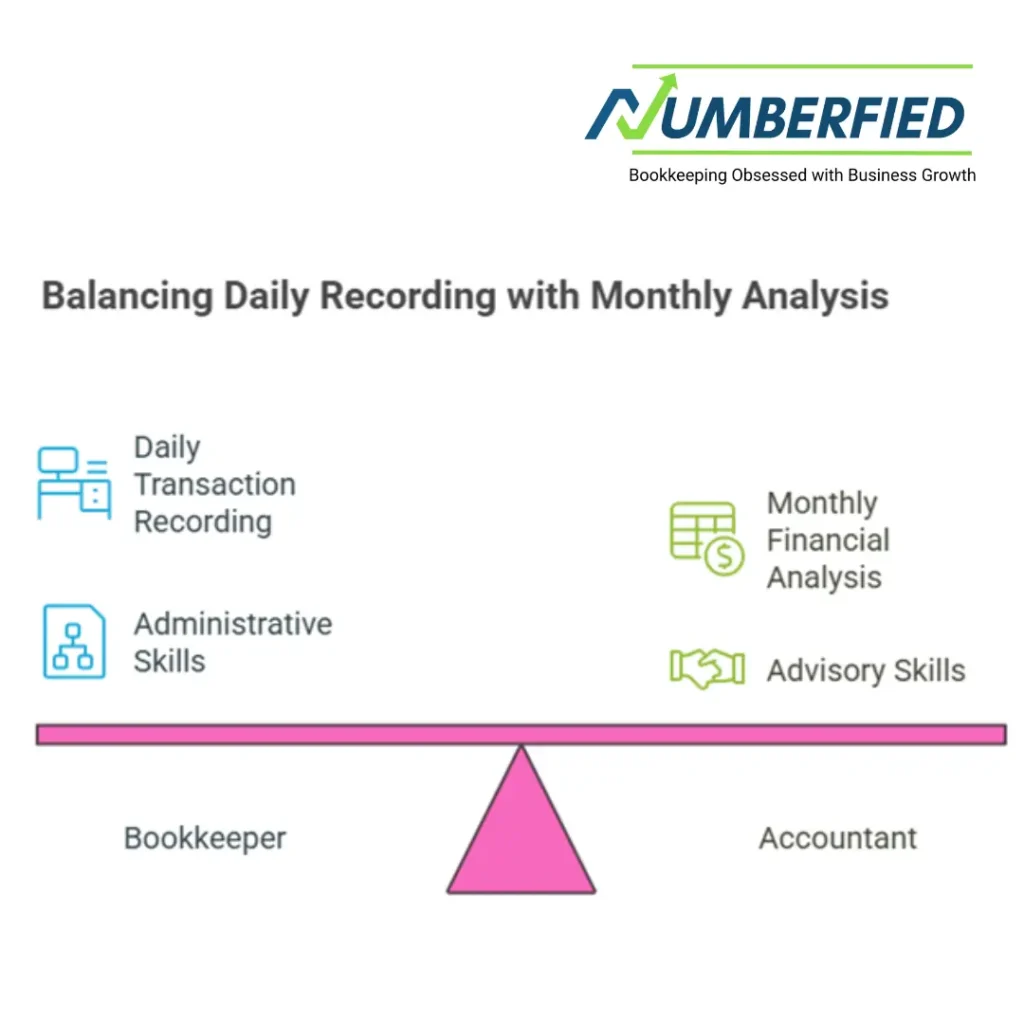

Exploring Accounting vs Bookkeeping in Depth

Mixing up the two is common. Let us clear the fog on accounting vs bookkeeping once and for all.

Scope of Work Comparison

Bookkeeper: “Here is what happened this week- $4,320 in, $2,100 out, GST collected $320.” Accountant: “Your margin is slipping on product X, rent is eating 18% of turnover, and you can claim an extra $6k on that fit-out if we accelerate depreciation.”

One records history. The other writes the next chapter.

Expertise Required

Bookkeepers usually hold a Cert IV, know the software backwards, and spot a dodgy receipt a mile off. Accountants carry a degree, CPA or CA letters, and years interpreting the Tax Act. When the ATO sends a letter, the accountant knows whether to fight or fold.

Impact on Compliance

Bookkeeping feeds the BAS- every quarter without fail. Accounting lodges the tax return, claims R&D concessions, sets up payroll tax if you cross the threshold. Miss either and the fines stack up fast.

When to Choose Bookkeeping Services

Most businesses start here. It is the low-drama entry point.

Ideal for Startups

First six months: 50 transactions a week, one bank account, cash sales. Bookkeeping keeps the train on the tracks without the price tag of a full accountant.

Signs You Need Bookkeeping Help

- Receipts live in the glovebox.

- You guess the GST figure when the accountant rings.

- Reconciling the bank eats your Sunday.

Any one of those is the cue. Hand it over and reclaim your weekends.

Cost-Effective Options

Basic package- $250 a month- covers bank feeds, invoicing, monthly reconciliation, BAS prep. Scale up as transactions grow. Fixed price, no surprises.

When Accounting Services Become Essential

Growth changes the game. Accounting vs bookkeeping now leans heavily toward the accountant.

Growth Phase Indicators

- First employee on the books.

- Turnover nudges $500k.

- Bank asks for a proper profit & loss before the next loan.

Time to level up.

Tax Planning Advantages

End of financial year is not a surprise party. The accountant flags capital purchases in May, moves depreciation, reviews fringe benefits. Result: lower tax, more cash in the bank.

Strategic Business Advice

Quarterly catch-up: “Sales are up 15% but wages 22%- here is where to trim.” Or “Cash will be tight in August- let us line up an overdraft now.” That is accounting earning its keep.

Integrating Accounting vs Bookkeeping for Best Results

The magic happens when the two talk to each other.

Building a Hybrid Approach

Weekly bookkeeping → monthly accountant review → quarterly strategy session. Clean data flows uphill, smart advice flows down.

Technology Integration Tips

One Xero file, two logins. Bookkeeper codes daily. Accountant locks the period, runs reports, unlocks again. Zero double-handling.

Team Collaboration Benefits

Bookkeeper spots a big refund from a supplier- flags it. Accountant checks if it is capital or revenue. Decision made in a day instead of a month.

Common Mistakes in Accounting vs Bookkeeping Decisions

Learn from the ones who went before you.

Treating Them as Interchangeable

Asking a bookkeeper to value your business for sale is like asking a plasterer to wire the house. Possible, but expensive and risky.

Delaying Professional Help

“I’ll fix the books in July.” July becomes December, interest charges mount, ATO knocks. Start small, stay current.

Ignoring Australian Regulations

Super rate jumps, payroll tax kicks in at state level, instant asset rules change. Local knowledge beats Google every time.

How Numberfied Supports Your Choice in Accounting vs Bookkeeping

We keep it Australian, practical, and personal.

Our Bookkeeping Solutions

Bank feeds live, invoices out same day, payroll lodged before close of business Friday. You get a one-page summary every Monday morning.

Comprehensive Accounting Services

BAS, IAS, TPAR, taxable payments annual report, divisible trusts- whatever your structure throws at us, we have done it before.

Personalised Consultation Process

Jump on a 15-minute call. Send three months of statements. We quote fixed fees on the spot. Onboard in a week.

Real Stories from the Coalface

Jess- Byron Bay yoga studio. Started with shoebox receipts. Now Xero hums, BAS auto-lodges, Jess teaches sunrise classes instead of counting coins.

Mick- Adelaide electrical contractor. Needed a tender bond. We pulled two years of clean accounts together in four days. Tender won, cash flow intact.

Choosing the Right Provider

Tick these boxes:

- BAS agent number on the invoice.

- Office hours that match yours.

- Someone who answers the phone.

We do.

Getting Started Step by Step

- Book the call- link in bio.

- Email last quarter statements.

- Quote back within 24 hours.

- Go live next Monday.

Conclusion

Sorting accounting vs bookkeeping is less about choosing one forever and more about using the right tool at the right time. Keep the daily records tight with bookkeeping. Bring the accountant in when tax, growth, or borrowing is on the table. Do both well, and your business runs smoother than a Friday arvo knock-off.

The Numberfied crew is ready to jump in- whether you need a bookkeeper tomorrow or an accountant before June 30. Head to https://numberfied.com/ and book the free 15-minute call. Let us turn your numbers into something you actually understand.

FAQs

What is the real difference in Accounting vs Bookkeeping day to day?

Bookkeeping is sitting with your bank feed every morning, putting every dollar in the right spot: sales, wages, materials GST. By lunchtime, the books are perfect. Accounting vs Bookkeeping is simple: one is daily admin, the other is monthly advice. Accountant opens the same file, clicks reports, and tells you if job XYZ is making money or costing you a fortune.

My turnover is 180k, do I need full Accounting vs Bookkeeping or just bookkeeping?

Pure bookkeeping keeps BAS correct and bank balance live every single day. Most blokes at your size just add an accountant once a year for the tax return and to grab every deduction on tools and vehicle. That combo of basic bookkeeping plus year-end accounting vs bookkeeping split works for thousands of tradies.

How does the BAS go from bookkeeping to the ATO?

Bookkeeper codes every transaction: G1 sales, 1A GST collected, 1B GST paid. Quarter-end end the software spits out perfect BAS numbers. Accountant or BAS agent checks it and lodges. That is Accounting vs Bookkeeping working together perfectly.

I hate surprise bills how do you price Accounting vs Bookkeeping?

Bookkeeping is fixed monthly, say 300 bucks for up to 100 transactions. Accounting is separate fixed fee for quarterly reviews and year-end work. We quote both sides of Accounting vs Bookkeeping after we see your file no hidden extras ever.

About to hire my first apprentice, when do I need an accountant?

Right now. Payroll, Super Workers Com, Single Touch Payroll all that stuff. Bookkeeper can run the pays, but accountant sets it up bulletproof from day one. That is classic Accounting vs Bookkeeping teamwork.

Everyone says use Xero will it talk to both sides of Accounting vs Bookkeeping?

Yes one file one login each. The bookkeeper enters the account, the accountant reviews it, and you look at the phone app. Perfect Accounting vs Bookkeeping setup.

Rough ballpark, what do I put aside monthly?

Sole trader 50 transactions 250 bookkeeping, plus 150 a month into the accounting bucket covers everything. That split keeps Accounting vs Bookkeeping costs predictable all year.

Can one firm really handle both Accounting vs Bookkeeping properly? Been doing it for years, same team, same file, one invoice. Bookkeeper flags something odd accountant jumps in same day. Clients love true Accounting vs Bookkeeping under one roof.

Already stuffed the books. Can you fix it?

Happens every week. Fixed fee clean up project untangle the mess then roll into normal monthly Accounting vs Bookkeeping service. Cheaper than ATO fines every time.

How do I know you get my industry?

Send your ABN or quick description. We have current clients in plumbing, electrical, medical, franchises, online stores most trades. If we are not the perfect Accounting vs Bookkeeping fit for your game, we will tell you straight and send you to someone who is.

Also Read: Save Hours and Cash When You Outsource Bookkeeping Services for Your Small Business in Australia!