Introduction

G’day, legends! We’re the team at Numberfied, and we’re stoked to help clear up the mix-up around accounting vs bookkeeping services. Think of your business like a classic backyard barbie-bookkeeping handles the daily sizzle, making sure the snags are turning just right, while accounting steps back and plans the full feast, from the lamb chops to the pavlova and everything in between.

Not sure which one your business actually needs? No worries. Whether you’re a Trader in Sydney, running a busy cafe in Adelaide, or running a retail shop up in sunny Cairns, we’re here to break down the real differences between accounting vs bookkeeping services-without the jargon, and with plenty of real-world examples to guide you.

Let’s dive in and get your finances sorted, all with a grin and a helping hand.

Key Takeaways:

- Bookkeeping tracks daily dollars; accounting plans your big wins.

- Both keep you mates with the ATO and stress-free.

- Numberfied crafts solutions for any Australian business, big or small.

- Picking the right service saves you time, cash, and headaches.

What’s the Go with Accounting vs Bookkeeping Services?

At Numberfied, we hear it all the time: What’s the difference between accounting vs bookkeeping services? It’s like choosing between a barista and a coffee roaster-both make your morning brew, but they do it differently. Let’s break it down so you know what each brings to your business table.

Bookkeeping: Your Daily Money Mate

Bookkeeping is about logging every sale, expense, and invoice. It’s the grunt work that keeps your finances neat as a pin. We use tools like Xero to make it quick, so you’re not buried in receipts.

Accounting: Your Financial Game Plan

Accounting takes those numbers and spins them into gold. It’s about analysing data, planning taxes, and mapping your business’s future. Think of it as the coach who turns your team into premiership winners.

Why You Need Both in Your Corner

Together, accounting vs bookkeeping services are like meat and three veg-complete and balanced. We helped a Melbourne florist track daily sales with bookkeeping and plan a new shop with accounting. Their business is blooming!

A Real Story from the Trenches

One of our clients, a Perth Trader, thought bookkeeping alone would do. After we added accounting, they saved $10,000 by tweaking their tax plan. That’s the power of both services working together.

Bookkeeping: Keeping Your Finances Shipshape

When weighing accounting vs bookkeeping services, bookkeeping is your trusty mate who keeps the financial ship steady. It’s about making sure every dollar is accounted for, so you’re ready for anything.

Logging Every Cent

Bookkeepers record every transaction, from coffee sales to supplier bills. This stops chaos dead in its tracks. We once found $5,500 in missing expenses for a Brisbane cafe, saving them from a tax mess.

Ready for Tax Time

Bookkeeping gets your BAS sorted for the ATO. No more EOFY panic! A Tasmanian retailer we work with said our bookkeeping made their tax season smoother than a sunny day at Bondi.

Freeing Up Your Day

Sorting receipts is about as fun as a rainy arvo. Our automated systems let you focus on what you love, like crafting pies or fixing pipes. A Darwin baker now spends weekends with her kids, not paperwork.

Dodging Costly Slip-Ups

One wrong number can mean ATO trouble. Our bookkeeping caught an error for an Adelaide plumber, saving them $2,200 in fines. That’s cash they kept in their pocket!

Accounting: Your Ticket to Business Growth

In the battle of accounting vs bookkeeping services, accounting is where your business gets wings. It’s about turning numbers into plans that help you grow, save, and dream big.

Plotting Your Path Forward

Accountants whip up budgets and forecasts to guide your moves. We helped a Cairns tour operator launch a new route, boosting their profits by 14% with our number-crunching.

Slashing Your Tax Bill

Accountants hunt for deductions to keep your taxes low. A Sydney retailer saved $8,500 after we found deductions they’d missed. It’s like finding a tenner in your old jeans!

Your Financial Coach

Accountants are like a mate who’s got your back. When a Hobart gym owner faced rising costs, we suggested tweaks that saved $12,000 a year. That’s more cash for new gear.

Winning Over Investors

Planning to expand? Clean financials impress lenders and investors. We helped a Gold Coast shop secure a loan with our sharp reports, paving the way for a second store.

Accounting vs Bookkeeping Services: The Key Differences

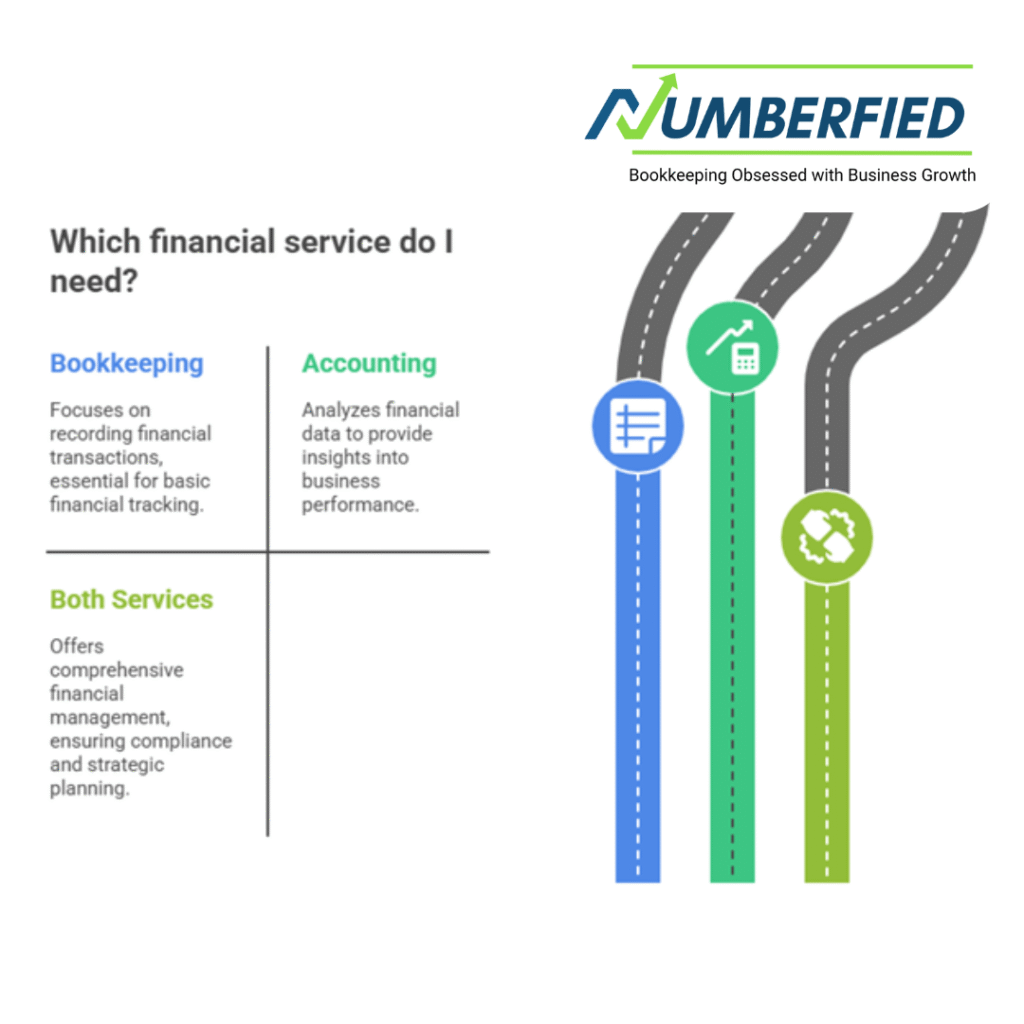

Still puzzled about accounting vs bookkeeping services? Let’s lay it out plain as day to help you pick what your Australian business needs, whether you’re a sole trader or a growing mob.

What Each Does

Bookkeeping tracks daily transactions like sales and bills. Accounting dives deeper, analysing data for taxes and strategy. Both keep your business humming.

Skills in Play

Bookkeepers need a keen eye for detail; accountants need big-picture brains. At Numberfied, our team’s got both, so your finances are always in top nick.

Time and Effort

Bookkeeping’s an ongoing job, keeping your records fresh. Accounting pops up for big moments like tax time or planning. We balance both to keep things smooth.

What’s the Damage?

Bookkeeping’s usually cheaper since it’s routine. Accounting costs more but delivers growth. We tailor both to fit your wallet, no matter your business size.

Keeping the ATO Happy with Both Services

The ATO’s tougher than a footy final, but accounting vs bookkeeping services have your back. At Numberfied, we make sure your business stays compliant and stress-free.

BAS and GST Sorted

Bookkeepers prep your BAS; accountants make it tax-smart. We saved a Melbourne cafe $3,200 by catching a GST mistake. No fines, no fuss!

Payroll Without the Drama

Bookkeeping tracks payroll; accounting ensures super and tax compliance. We helped a Broome Trader dodge a $2,500 fine by nailing their payroll setup.

Staying Ahead of the Game

Tax rules change faster than a Sydney storm. Our team keeps your books and plans up to date, like when we guided an Alice Springs retailer through new super laws, saving $1,900.

Avoiding ATO Nightmares

Errors can spark audits or fines. Our services caught a mistake for a Newcastle client, saving them $4,500 and a heap of worry. That’s Numberfied at work!

Why Numberfied’s Your Best Bet for Both Services

At Numberfied, we’re not just number-crunchers-we’re your business’s biggest fans. Our take on accounting vs bookkeeping services is all about making your life easier with a bit of fun thrown in.

Built for You

We take the time to understand how your business works-whether you’re up in Darwin or down by the Sunshine Coast. Everything we offer is shaped to fit what you actually need, like a suit that’s made just for you.

True Blue Know-How

We’re Australians who live and breathe local tax laws. From GST to super, we’ve got the smarts to keep your business on the right track.

No More Financial Stress

We make numbers fun-well, as fun as they can be! A Perth client called us their financial fairy godmother after we sorted their books in a week.

Always There for You

We’re not a one-off deal. Our bookkeeping keeps you current, and our accounting plans your future, giving you confidence all year round.

How to Pick Between Accounting vs Bookkeeping Services

Choosing between accounting vs bookkeeping services is like picking between a flat white and a long black-both are great, but it depends on what you need. Here’s how to decide.

Know Your Business Needs

Small businesses might start with bookkeeping for daily tracking. Growing ones need accounting for strategy. We helped a Brisbane retailer mix both for a 10% profit boost.

Check Your Budget

Bookkeeping’s easier on the wallet for tight budgets; accounting adds value for growth. Numberfied offers packages that work for any Australian business.

Plan for the Long Haul

Bookkeeping keeps you compliant now; accounting sets you up for tomorrow. We helped a Tasmanian cafe owner scale up with a combo of both services.

Have a Yarn with Us

Not sure what’s right? A quick chat with Numberfied can clear things up. We’ll point you to the services that’ll make your business shine.

Real-Life Wins with Accounting vs Bookkeeping Services

Nothing beats a good yarn to show how accounting vs bookkeeping services can transform your business. Here are some stories from our Numberfied clients across Australia.

The Sydney Sparky

A local electrician was drowning in receipts. Our bookkeeping tidied their books, and our accounting found $7,000 in tax savings. They’re now planning a second van.

The Adelaide Baker

This cafe owner was stressed about BAS. Our bookkeeping kept their records spot-on, and our accounting helped them budget for a new oven, boosting sales by 8%.

The Cairns Retailer

A shop owner needed a loan. Our accounting reports impressed the bank, securing funding for a second store. Bookkeeping kept their daily sales on track.

The Darwin Gym

Rising costs were a headache for this gym. Our accounting suggested cuts that saved $13,000 a year, while bookkeeping ensured their payroll was ATO-compliant.

Conclusion

When it comes to accounting vs bookkeeping services, both play a top role in keeping your business steady. Bookkeeping handles the day-to-day money stuff-keeping your records neat and up to date-while accounting helps you plan for what’s ahead, spotting trends and guiding smart decisions.

At Numberfied, we know how to make the numbers work in your favour, with a plan built just for you-always delivered with a friendly grin. Whether you’re a solo operator out in Alice Springs or growing fast in Melbourne, we’ve got the tools and know-how to back your goals.

Want to take the pressure off and get your finances sorted? Head over to https://numberfied.com/au/ and let’s talk about how we can help your business hit new heights.

FAQs

1. What’s the difference between accounting and bookkeeping services?

Bookkeeping’s all about keeping records-what you earn, what you spend. Accounting takes those numbers and figures out where your business stands. You need both to stay on top of things. That’s why we offer full accounting and bookkeeping services in one place, so it’s all sorted without the hassle.

2. Do I need both services for my small business?

Most businesses benefit from both. Bookkeeping keeps your records tidy; accounting helps you plan. We helped a Perth cafe save $4,000 by using both to catch errors and optimise taxes.

3. How much should I budget for these services?

Costs vary by business size. Bookkeeping’s cheaper for routine tasks; accounting adds strategic value. Numberfied offers clear, custom packages-visit https://numberfied.com/au/ for a quote that fits your wallet.

4. Can I do my own bookkeeping or accounting?

You can, but it’s risky. Mistakes can cost thousands in ATO fines. Our services saved a Melbourne Trader $3,000 by fixing errors. Let Numberfied handle it so you can focus on your work.

5. How often should I use bookkeeping services?

Weekly or monthly bookkeeping keeps your finances in check. We ensure your books are ready for the ATO, making tax time easy. A Brisbane client said it was their smoothest EOFY ever.

6. How does accounting help my business grow?

Accounting gives you budgets, forecasts, and tax savings. We helped a Cairns shop boost profits by 12% with our plans. It’s like having a financial GPS for your business.

7. Why choose Numberfied for these services?

We’re Australian locals who know tax laws like the back of our hand. Our tailored services, using tools like Xero, make finances easy. Clients love our friendly, no-fuss approach.

8. How do these services keep me compliant with the ATO?

Bookkeeping preps your BAS; accounting ensures tax savings. We saved a Sydney client $3,800 by catching a GST error. Numberfied keeps you in the ATO’s good books.

9. Can these services help me get a business loan?

Absolutely! Clean books and accounting reports impress lenders. We helped a Darwin retailer secure funding for a new store with our professional financials.

10. How do I kick things off with Numberfied?

Just visit https://numberfied.com/au/ and tell us about your business. We’ll create a plan that fits like a glove. Our team’s ready to make your finances a breeze, with a smile!