Introduction

Running a successful Australian business means constantly juggling priorities, yet few tasks create as much unnecessary pressure as the daily grind of receiving invoices from dozens of suppliers, chasing busy managers for approvals that often take days, manually entering data into accounting software, reconciling statements at month-end, and trying to keep on top of ever-changing ATO requirements while ensuring no payment is made late or duplicated.

The reality for most companies is that internal accounts payable processes have become a significant bottleneck that quietly drains time, increases costs through preventable errors, damages supplier relationships, and leaves finance teams permanently firefighting instead of providing the strategic insight leadership needs. This is exactly why more Australian organisations than ever before are turning to specialist accounts payable outsourcing services in Australia, a proven solution that removes the entire burden while delivering higher accuracy, better cash-flow visibility, and genuine peace of mind from day one.

At Numberfied, we have made it our mission to deliver outstanding accounts payable outsourcing services in Australia that are tailored specifically for local businesses, backed by an all-Australian team who understand your industry, your payment terms, and exactly what keeping the ATO happy really means.

Why Australian Companies Choose Accounts Payable Outsourcing Services

- Dozens of hours previously lost each month to repetitive data entry and endless approval emails are returned immediately for revenue-generating or customer-focused work.

- Costly late-payment penalties disappear completely while suppliers begin offering better terms because payments now arrive consistently early or on time.

- Real-time dashboards provide crystal-clear visibility of every upcoming liability weeks in advance, transforming cash-flow forecasting from guesswork into certainty.

- Full compliance with GST, taxable payments reporting, and all current ATO obligations is maintained effortlessly without diverting internal resources to continual training.

- Seasonal peaks, rapid growth phases, or major project surges are absorbed seamlessly without the need to recruit, train, or manage additional permanent headcount.

The True Impact of Managing Accounts Payable Internally

While most directors and practice managers acknowledge their current process is far from ideal, very few have calculated the full financial and emotional toll until they experience life after implementing professional accounts payable outsourcing services in Australia. Duplicate payments that slip through unchecked, early-payment discounts worth thousands of dollars annually that are routinely missed because invoices sit waiting for approval, and GST coding errors that only surface during BAS lodgement or audit all represent money that walks straight out the door without anyone noticing. At the same time, capable staff who should be analysing spending trends, negotiating better supplier contracts, or supporting strategic decision-making instead find their weeks consumed by low-value administrative tasks that deliver zero competitive advantage.

Everyday Frustrations That Drive Accounts Payable Outsourcing Services

Invoices continue arriving by email, supplier portals, and post with no single source of truth, making it impossible to know whether anything has been lost until an angry supplier phones demanding immediate payment. Key approvers become unavailable because they are travelling between sites, attending client meetings, or simply overwhelmed with higher-priority responsibilities, causing entire payment runs to stall for days and sometimes weeks. Month-end statement reconciliations that should be quick and straightforward stretch into multi-day marathons that exhaust the finance team and dramatically increase the risk of further mistakes.

Regulatory Complexity That Never Stops Growing

Each financial year brings fresh reporting obligations, updated instant asset write-off thresholds, tighter electronic invoicing mandates, and evolving taxable payments annual report requirements that demand ongoing expertise most internal teams simply cannot maintain alongside their already heavy daily transaction workload.

Rapid Business Growth Exposes Manual Process Limitations

A system that felt manageable when invoice volume hovered at a steady, predictable level quickly becomes completely unworkable the moment a major new contract is won, additional locations are opened, or seasonal trading surges hit, leaving owners facing the difficult choice between expensive permanent hiring or discovering the scalable flexibility that professional accounts payable outsourcing services in Australia provide.

How Numberfied Delivers Accounts Payable Outsourcing Services

We have spent years perfecting an approach that integrates perfectly with the way Australian businesses already operate, ensuring the transition is smooth and the ongoing results exceed expectations from the very first payment cycle.

Invoices Flow Directly to Us Through Secure Channels

Suppliers simply email invoices to a unique Numberfied address we provide exclusively for your company, or you forward them with one click if you prefer to see them first; many clients also grant secure portal access, so invoices from major suppliers download automatically without any manual handling required at all.

Every Invoice Receives Technology and Human Verification

State-of-the-art optical character recognition instantly extracts supplier name, ABN, invoice number, date, line-item descriptions, amounts, and GST components, then a member of our fully Australian team completes a detailed verification against your chart of accounts, purchase orders where applicable, and any special coding rules you operate.

Approval Workflows Mirror Your Internal Structure

We build routing rules that reflect the real hierarchy inside your organisation, whether that means sequential approvals across multiple cost centres and departments, simultaneous sign-off for urgent site expenses, or automatic escalation after a set time with clear, mobile-friendly notifications delivered instantly to the right people wherever they happen to be.

Payment Execution Remains Under Your Control

Once every required approval is recorded in the system, we generate payment files in precisely the format your bank or accounting package expects, then wait for your final authorisation before anything is released, ensuring you never surrender ultimate oversight while eliminating the entire administrative burden from your team.

What Makes Numberfied Preferred for Accounts Payable Outsourcing Services

Clients repeatedly tell us they chose Numberfied and stay with us year after year because we genuinely operate as a seamless extension of their own finance function rather than feeling like a distant third-party provider.

Dramatic Time Recovery That Transforms Team Capacity

Most organisations recover the equivalent of one full-time employee within the first month alone, freeing staff to focus on high-value analysis, supplier negotiations, customer relationships, and strategic projects that actually move the business forward.

Accuracy That Virtually Eliminates Payment Errors

Multiple verification layers, combined with proactive duplicate detection, three-way matching where required, and regular supplier statement reconciliations, mean that mistakes that once cost thousands of dollars annually have become exceptionally rare events.

Real-Time Intelligence for Confident Decision-Making

Live dashboards and fully customisable reports deliver instant insight into aged payables, upcoming cash requirements, spending patterns by category, department, project, or supplier, information that was previously only available after hours or days of manual compilation and spreadsheet work.

Critical Factors When Selecting Accounts Payable Outsourcing Services

Experience has shown that long-term success depends heavily on the following elements.

Demonstrated Expertise Across Australian Industries

The ideal provider already possesses a deep understanding of local payment practices, whether that involves construction progress claims and retentions, medical bulk-billing cycles, franchise royalty reporting, not-for-profit grant acquittals, or any other sector-specific requirement you face.

Complete Data Sovereignty and Security in Australia

All processing, storage, and backups must remain exclusively within Australia under strict privacy legislation, protected by enterprise-grade encryption, continuous monitoring, and regular independent security audits.

Transparent, Volume-Based Pricing That Flexes

The best arrangements adjust monthly cost in line with actual invoice volume, ensuring you pay less during quieter periods while guaranteeing unlimited capacity when activity spikes without surprise charges or service degradation.

Common Concerns About Accounts Payable Outsourcing Services

Every prospective client raises perfectly valid questions before making the decision, and we welcome the opportunity to answer them fully.

Will I Still Maintain Absolute Control?

Without question, you define all approval thresholds, retain final payment release authority, receive comprehensive reporting whenever you want it, and most clients report feeling significantly more in control than they ever did with internal processes.

How Long Does Onboarding Take?

From discovery call to first completely outsourced payment run usually requires only three to five weeks, during which we operate in parallel with your existing team to guarantee zero disruption to suppliers or cash flow.

What Happens With Unexpected Volume Spikes?

Our systems and Australian staffing model scale instantly to accommodate any increase without delay, reduction in accuracy, or additional penalty fees; capacity concerns simply cease to exist.

First Step Toward Accounts Payable Outsourcing Services

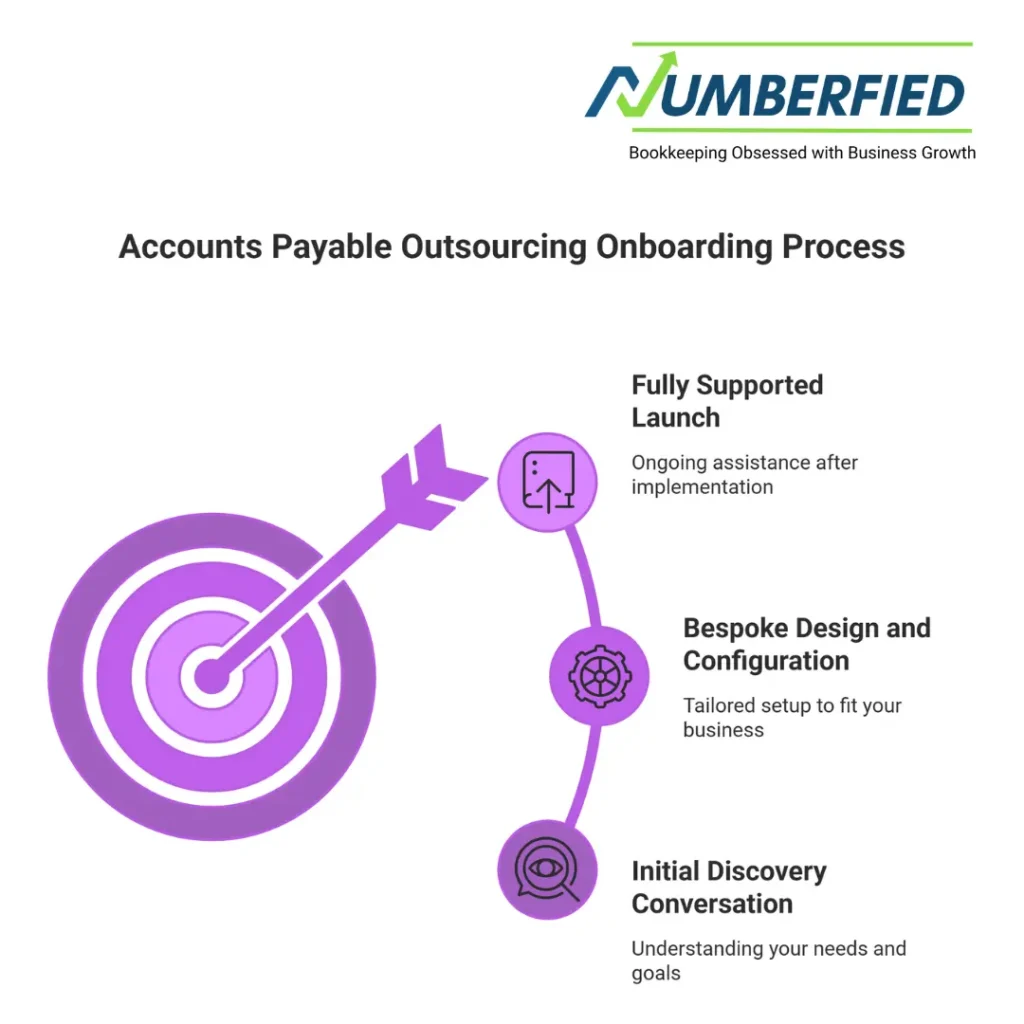

We have deliberately designed onboarding to be as straightforward and risk-free as possible for every client.

Initial Discovery Conversation

We invest time listening carefully to your current workflows, biggest pain points, compliance requirements, and specific outcomes you want to achieve before recommending anything.

Bespoke Design and Configuration Phase

Every approval rule, report format, software integration, coding structure, and communication preference is built exactly the way your organisation operates today.

Fully Supported Launch With Ongoing Assistance

Your dedicated Numberfied contact remains available by phone, email, or video call long after the initial implementation period ends, ensuring you always have local support on hand.

The Strategic Future of Accounts Payable for Australian Businesses

Leading organisations have already transformed accounts payable from a necessary overhead into a genuine source of competitive advantage through reliable, professional accounts payable outsourcing services in Australia, enjoying stronger supplier partnerships, optimised working capital, reduced operating costs, and actionable financial intelligence month after month.

Conclusion

Nothing gives the Numberfied team greater satisfaction than watching Australian business owners and finance leaders reclaim their time, reduce stress, and regain complete confidence in their numbers. If you are ready to eliminate invoice chaos permanently and experience a calmer, more controlled payables environment, we would be delighted to show you exactly how straightforward and rewarding accounts payable outsourcing services in Australia can be for your organisation.

Contact us today at https://numberfied.com/au for a relaxed, no-obligation conversation about transforming your accounts payable function once and for all.

FAQ

What Tasks Are Included in Accounts Payable Outsourcing Services in Australia?

Accounts payable outsourcing services in Australia typically cover the complete end-to-end process: receiving invoices in any format, accurate data capture and GL coding, obtaining all required internal approvals according to your exact rules, handling every supplier query, preparing payment batches, executing approved payments through your bank, performing monthly statement reconciliations, and delivering comprehensive reporting while you retain final release control.

How Do Providers Protect Data with Accounts Payable Outsourcing Services in Australia?

Leading accounts payable outsourcing services in Australia process and store all information exclusively within ISO 27001-certified local data centres using end-to-end encryption, multi-factor authentication, continuous monitoring, regular independent penetration testing, and annual SOC 2 compliance audit reports, happily shared during onboarding.

Are Accounts Payable Outsourcing Services in Australia Cost-Effective for Low Volumes?

Absolutely, many long-standing clients began processing fewer than 150 invoices monthly and quickly discovered that accounts payable outsourcing services in Australia delivered returns many times the investment through eliminating errors, capturing discounts, and dozens of recovered staff hours every month.

Will Suppliers Notice Changes with Accounts Payable Outsourcing Services in Australia?

In most cases, suppliers notice nothing at all except faster responses and more reliable payment timing, outcomes that frequently lead to improved trading terms and priority service from key partners when using accounts payable outsourcing services in Australia.

Can Accounts Payable Outsourcing Services in Australia Handle Complex Coding?

Yes, experienced providers routinely configure unlimited approval levels, job-costing allocations, inter-company recharges, grant tracking, retention management, and any other structure your organisation requires within accounts payable outsourcing services in Australia.

Do Accounts Payable Outsourcing Services in Australia Capture More Early-Payment Discounts?

The majority of clients find they capture significantly more discounts because invoices are processed and approved days or even weeks faster than was possible internally through professional accounts payable outsourcing services in Australia.

Which Systems Integrate with Accounts Payable Outsourcing Services in Australia?

Established accounts payable outsourcing services in Australia maintain live integrations with Xero, all MYOB variants, QuickBooks Online, Reckon, NetSuite, SAP, Pronto, TechnologyOne, Sage, and virtually every platform used by Australian businesses.

Who Handles Supplier Communication in Accounts Payable Outsourcing Services in Australia?

Your dedicated Australian team manages every supplier interaction professionally and promptly, only escalating genuine policy decisions to you, dramatically reducing interruptions to your internal staff when using accounts payable outsourcing services in Australia.

How Do Accounts Payable Outsourcing Services in Australia Help During Audits?

Complete digital audit trails, consistent coding practices, and instant document retrieval enable auditors to work far more efficiently while strengthening your overall compliance position noticeably with accounts payable outsourcing services in Australia.

Can We Exit Accounts Payable Outsourcing Services in Australia If Needed?

Reputable providers fully support a smooth transition by supplying all historical data in your preferred format, detailed procedure documentation, and hands-on assistance throughout the handover period, although most clients choose to continue indefinitely because accounts payable outsourcing services in Australia simply work better.

Take the first step toward a dramatically simpler, more controlled tomorrow. Visit https://numberfied.com/au today and let the Numberfied team show you exactly how refreshing life becomes when accounts payable outsourcing services in Australia finally remove the daily invoice battle from your week.

Also Read: 10 Ways Accounts Payable Outsourcing Services Will Save Your Business Time and Money