Introduction

Running a small business in Australia means juggling customers, compliance, and cash flow. Using professional bookkeeping services in Australia helps business owners stay compliant with the Australian Taxation Office, control bookkeeping costs, and focus on growth.

Why choose bookkeeping services Australia?

Engaging a bookkeeper or an accounting and bookkeeping firm gives you reliable bookkeeping, accurate records, and timely BAS lodgement. Whether you need a local bookkeeper in Australia or a virtual bookkeeping service, outsourcing bookkeeping can save time and reduce errors.

Benefits include:

- Accurate BAS lodgement and GST reporting to meet ATO deadlines.

- Payroll services including PAYG, superannuation, and single-touch payroll setup.

- Cash flow management to help the business owner plan and grow.

- Support for Xero, MYOB, and other accounting software from expert bookkeepers.

- Affordable bookkeeping packages tailored to bookkeeping needs and bookkeeping tasks.

Services offered by top bookkeeping firms

Bookkeeping services for small businesses often cover regular bookkeeping, online bookkeeping, and monthly bookkeeping. A full-service bookkeeping and accounting firm may also provide advisory services and management services.

- Data entry and reconciliation: daily or weekly bookkeeping to keep records current.

- Payroll management: payslips, payroll tax, super, and STP reporting.

- BAS preparation and lodgement: quarterly or monthly BAS lodgement to the Australian Taxation Office.

- Cloud accounting setup: Xero bookkeeper Australia or MYOB support, migration, and training.

- Outsourced bookkeeping services: virtual bookkeeper options for businesses of all sizes.

How outsourcing bookkeeping helps your business.

Outsourcing bookkeeping reduces bookkeeping costs and frees the business owner to focus on customers. Virtual bookkeeping services Australia provide flexibility, while local bookkeepers and bookkeepers in Australia bring regulatory knowledge and compliance expertise.

Outsourced bookkeeping services deliver:

- Consistent, accurate financial records that improve decision-making.

- Timely BAS lodgement that avoids penalties and keeps the business compliant.

- Improved cash flow forecasting and budgeting advice.

- Access to bookkeeping solutions and accounting software expertise without hiring in-house.

Xero, MYOB, and online accounting

Many businesses choose cloud accounting for real-time insights. A Xero bookkeeper in Australia can set up, customise, and maintain your Xero platform. Online bookkeeping service providers also support MYOB and other bookkeeping software to match your business needs.

Cloud accounting benefits:

- Access financials anytime, anywhere across Australia.

- Automated bank feeds and reconciliations to reduce manual work.

- Integration with payroll, invoicing, and business apps for streamlined workflows.

Choosing the right bookkeeping service

When you find a bookkeeper, consider experience, services offered, and pricing. Many bookkeeping service providers offer bookkeeping packages to suit sole traders, startups, and larger enterprises.

Key factors to choose the right bookkeeping:

- Industry experience and references from Australian businesses.

- Level of support: basic bookkeeping vs bookkeeping and accounting with advisory services.

- Cloud and software expertise: Xero, MYOB, online bookkeeping, and bookkeeping software support.

- Transparent bookkeeping costs and monthly bookkeeping options.

Our Australia Bookkeeping Services

- Daily bookkeeping and bank reconciliations to keep your accounts current and accurate.

- Payroll management, including STP, superannuation processing, and payslip generation.

- BAS and GST preparation, review, and timely lodgement to ATO standards.

- Accounts payable and receivable management to improve cash flow and supplier relationships.

- Monthly management reports with P&L, balance sheet, cash flow analysis, and KPI tracking.

- Cloud migration and setup for Xero, MYOB, QuickBooks, and other accounting platforms.

- End-of-year reconciliation and handover to your accountant for tax preparation.

- Catch-up bookkeeping for businesses that have fallen behind on records.

How Our Process Works

- Discovery call: We assess your needs and existing bookkeeping systems.

- Onboarding: Secure transfer of data, chart of accounts setup, and software configuration.

- Daily/weekly tasks: Regular transaction coding, reconciliations, and supplier/customer management.

- Reporting: Monthly financial reports and a live dashboard to monitor performance.

- Review and support: Ongoing advisory, year-end preparation, and liaison with your accountant.

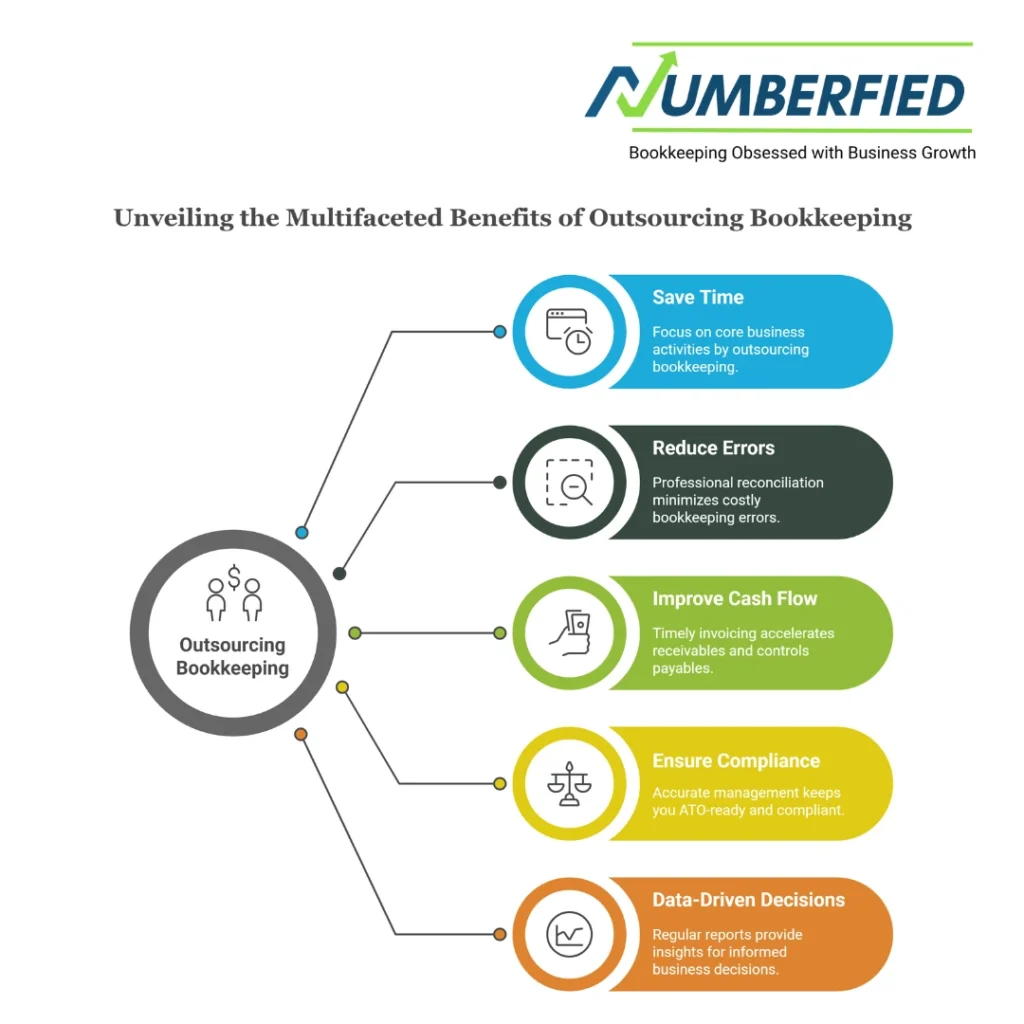

Benefits of Outsourcing Bookkeeping in Australia

- Save time: Focus on core business activities while we handle the books.

- Reduce errors: Professional reconciliation and verified transactions lower the risk of costly mistakes.

- Improve cash flow: Timely invoicing and bill management accelerate receivables and control payables.

- Ensure compliance: Accurate BAS, payroll, and super management keep you ATO-ready.

- Data-driven decisions: Regular reports and KPIs provide actionable insights for growth.

Pricing Options

We offer flexible pricing to suit different needs: hourly rates for ad-hoc work, monthly packages for ongoing bookkeeping, and fixed quotes for one-off projects like migration or clean-up. Contact us for a tailored quote based on transaction volume, payroll size, and reporting complexity.

Who benefits from bookkeeping services?

Small business owners, sole traders, and larger businesses all benefit from expert bookkeeping. Whether you need a virtual bookkeeping service or an in-person bookkeeper, reliable bookkeeping helps ensure compliance, better cash flow, and room to grow.

Get Started

Ready to streamline your finances with expert Australian bookkeeping services? Contact us for a free consultation and customized quote. Provide details about your business size, preferred software, and current bookkeeping challenges to receive an accurate estimate.

Conclusion

Whether you need online bookkeeping, virtual bookkeeping services Australia, or a local bookkeeping firm, expert bookkeeping supports compliance, improves cash flow, and helps your business grow. Contact a reliable bookkeeper today to discuss bookkeeping solutions tailored to your small business’s bookkeeping needs in Australia.

Frequently asked questions

What do Australian bookkeeping services include?

They typically include data entry, bank reconciliations, payroll services, BAS preparation and lodgement, cloud accounting support, and financial reporting.

Can an Xero bookkeeper in Australia handle my BAS lodgement?

Yes. Many Xero bookkeepers are experienced with BAS lodgement and ATO reporting requirements.

How much do bookkeeping services cost?

Bookkeeping costs vary by scope: monthly bookkeeping packages for small business bookkeeping Australia start from affordable rates, while full-service bookkeeping and accounting firms charge more for advisory services.

Should I outsource bookkeeping or hire in-house?

Outsourcing bookkeeping is often cost-effective for small business owners and sole traders, offering access to a team of bookkeepers without payroll overheads.

Do bookkeeping services include payroll?

Yes. Payroll services often include payslips, PAYG, superannuation, and single-touch payroll reporting.

Are virtual bookkeeping services in Australia reliable?

Yes, virtual bookkeeping is reliable when you choose experienced bookkeepers and secure online bookkeeping service providers that follow data protection best practices.

How does bookkeeping help with cash flow?

Regular bookkeeping provides up-to-date financials, helping you forecast cash flow, manage expenses, and identify opportunities to improve profitability.

What’s the difference between a bookkeeper and an accountant?

A bookkeeper manages day-to-day financial records and BAS, while an accountant provides tax advice, lodgements, and higher-level financial planning and advisory services.

Can bookkeepers in Australia work with MYOB?

Yes. Many bookkeeping service providers support MYOB, Xero, and other accounting software to meet diverse business needs.

How do I find a bookkeeper for my business?

Search for top bookkeepers or bookkeeping service providers across Australia, check reviews, and ask about experience with businesses similar to yours. Choose the right bookkeeping based on services, pricing, and software expertise.

Read Also: Virtual Bookkeeping Services for Small Businesses That’ll Change Your Life!