Introduction

As a small business owner or sole trader in Australia, keeping your finances in order is essential for ATO compliance and growth, but the average cost for bookkeeping services can vary widely. Understanding bookkeeping service costs in Australia helps you budget effectively while ensuring accurate records and timely BAS lodgements. Whether you’re a startup in Sydney or a freelancer in Perth, knowing how much bookkeepers charge allows you to make informed decisions without overpaying. In this guide, we explore typical price ranges, influencing factors, comparisons, packages, models, red flags, budgeting steps, top providers, and trends for 2026, empowering you to find the right fit for your business.

Typical Price Ranges for Bookkeeping Services

The average cost for bookkeeping service depends on the format, hourly, monthly, or package-based and your business needs. Here’s a breakdown to help you estimate.

Hourly Rates for Bookkeeping

In Australia, the typical range of how much bookkeepers charge per hour typically ranges from $45 to $90 in 2026. Entry-level or freelance bookkeepers often start at $45–$60 per hour, while experienced professionals with BAS agent certification charge $70–$90. For occasional tasks like year-end clean-ups, hourly billing is flexible, but it can add up for ongoing work.

Monthly Fees for Ongoing Services

Monthly bookkeeping fees in Australia average $300 to $2,000 for small businesses. Basic services for sole traders with low transaction costs $300–$800 per month, while more complex setups with payroll or multiple entities reach $1,200–$2,000. Outsourced bookkeeping prices offer predictability, making them popular for consistent needs.

Package-Based Pricing

The package-based average cost for bookkeeping service often falls between $500 and $3,000 annually or per project. Full-year packages including tax prep might cost $1,500–$4,000, while quarterly BAS bookkeeping costs $200–$500 per lodgement. Packages bundle services like reporting and advisory, providing value for growing businesses.

Factors Influencing the Average Cost for Bookkeeping Service

Several elements affect bookkeeping service costs in Australia. Understanding these helps you negotiate better rates.

Business Size and Transaction Volume

Larger businesses with high transaction volumes pay more; a startup with 50 monthly transactions might cost $400, while a retailer with 500 could exceed $1,500. The average cost for bookkeeping service scales with complexity, as more entries require additional time and software.

Services Included

Basic transaction recording keeps costs low ($300–$600/month), but adding payroll, BAS lodgement, or advisory pushes monthly bookkeeping fees in Australia to $800–$1,500. Outsourced bookkeeping prices rise with value-added features like financial reporting or ATO liaison.

Location and Provider Type

In major cities like Sydney or Melbourne, how much bookkeepers charge is 20–30% higher ($60–$100/hour) than in regional areas ($45–$75). Virtual providers often offer lower outsourced bookkeeping prices due to no office overhead.

Experience and Certifications

Certified bookkeepers (e.g., BAS agents) command premium rates, increasing the average cost for bookkeeping service by 20–50%. Experienced providers ensure compliance, justifying the higher fees for peace of mind.

In-House vs. Outsourced Bookkeeping Comparison

Deciding between in-house and outsourced options impacts the average cost for bookkeeping service. Here’s how they stack up.

Cost Differences

In-house bookkeeping requires a salary of $60,000–$90,000 annually plus super and training, totalling $70,000–$110,000. Outsourced bookkeeping prices average $3,600–$18,000 yearly, saving 50–80% without fixed commitments. For small businesses, outsourcing reduces the average cost for bookkeeping services significantly.

Expertise and Compliance

In-house staff may lack specialised ATO knowledge, risking errors. Outsourced providers offer certified experts, ensuring accurate BAS bookkeeping costs and tax lodgements. This reduces compliance risks, making outsourcing preferable for complex needs.

Scalability and Flexibility

In-house is fixed, limiting scalability. Outsourced services adjust with your business, add payroll during growth without hiring. Monthly bookkeeping fees in Australia provide flexibility for seasonal fluctuations.

Time and Resource Savings

In-house demands management time for training and oversight. Outsourced frees you to focus on core activities, with cloud tools for real-time access. The average cost for bookkeeping services in outsourcing includes efficiency gains.

What to Expect in Different Bookkeeping Packages

Bookkeeping packages vary from basic to full-service, affecting the average cost for bookkeeping service.

Basic Bookkeeping Packages

These cover transaction entry, bank reconciliations, and basic reporting, costing $300–$800 per month. Ideal for sole traders with low volume, they ensure essential compliance without extras.

Standard Packages with BAS

Including BAS lodgement and GST tracking, standard packages average $600–$1,200 monthly. They suit growing businesses needing quarterly submissions, with some financial summaries included.

Full-Service Packages

Full-service includes bookkeeping, payroll, tax prep, and advisory, at $1,200–$2,500 per month. These comprehensive options provide end-to-end support, justifying higher outsourced bookkeeping prices for complex operations.

Common Pricing Models for Bookkeeping Services

Understanding pricing models helps predict the average cost for bookkeeping services.

Hourly Pricing

Hourly rates suit one-off tasks, with how much do bookkeepers charge at $45–$90. It’s flexible but can exceed budgets for ongoing work.

Fixed Monthly Retainers

Monthly bookkeeping fees in Australia provide predictability at $300–$2,000. Retainers cover a set scope, with add-ons for extras like payroll.

Package or Tiered Pricing

Tiered models offer basic, standard, and premium levels. BAS bookkeeping costs are often bundled, making it easy to scale as needed.

Value-Based Pricing

Some providers charge based on value delivered, like tax savings achieved. This aligns costs with outcomes, potentially lowering the average cost for bookkeeping service long-term.

Red Flags in Bookkeeping Pricing

Watch for these signs of poor value in bookkeeping service costs in Australia.

Unusually Low Fees

Below-average outsourced bookkeeping prices may indicate inexperience or shortcuts, leading to errors or non-compliance. Average rates ensure quality.

Hidden Fees

Beware of undisclosed charges for revisions, calls, or software. Transparent monthly bookkeeping fees in Australia include all essentials.

No Clear Scope

Vague descriptions lead to extra costs. The best providers detail what’s included in the average cost for bookkeeping service.

Pressure for Long Contracts

Avoid providers pushing lengthy commitments. Opt for flexible terms to test the service.

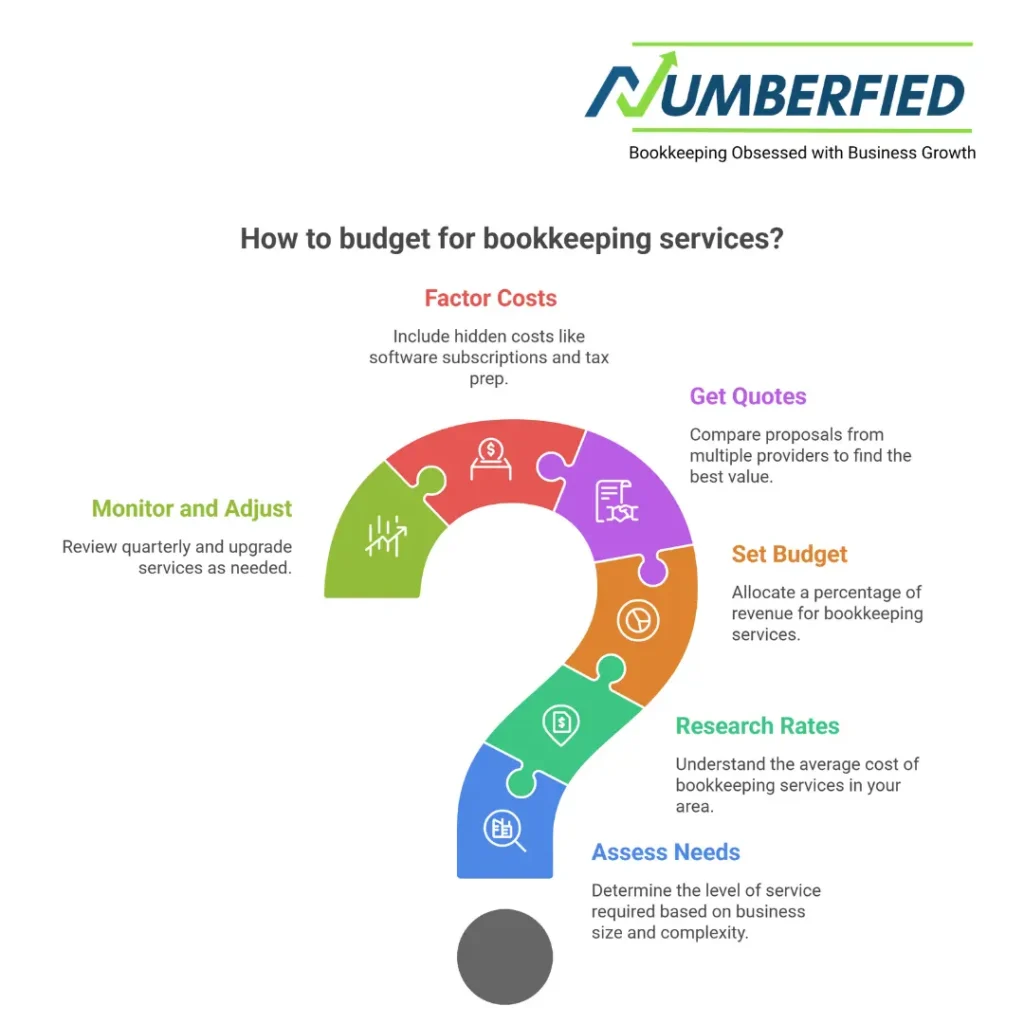

Step-by-Step Guide to Budgeting for Bookkeeping

Budgeting ensures you get value from the average cost for bookkeeping service.

Step 1: Assess Your Financial Needs

Review transaction volume, BAS requirements, and growth plans. Sole traders may need basic, while companies require full-service.

Step 2: Research Market Rates

Compare how much bookkeepers charge in your area $300–$2,000 monthly is average. Use online calculators or forums for insights.

Step 3: Set a Budget Range

Allocate 1–3% of revenue for bookkeeping. For $200,000 turnover, budget $200–$600 monthly for outsourced bookkeeping prices.

Step 4: Get Multiple Quotes

Request detailed proposals from 3–5 providers. Compare scope, inclusions, and fees for the best value.

Step 5: Factor in Hidden Costs

Include software subscriptions or tax prep add-ons. Calculate the total annual average cost for bookkeeping service.

Step 6: Monitor and Adjust

Review quarterly. As your business grows, upgrade packages to match needs without overspending.

Top Providers and Trends in Bookkeeping Services in 2026

In 2026, bookkeeping service costs Australia are influenced by AI and remote trends. Top providers include:

- Bookkeeper.com.au Affordable outsourced options

- Xero-certified firms are Strong for cloud integration

- Bench Virtual with fixed pricing

- TaxStore Comprehensive with BAS focus

- My Accountant Local, personalised service

Trends show AI automating 60% of entries, reducing the average cost for bookkeeping service by 20%. Virtual providers dominate, with 75% of small businesses outsourcing. ATO e-invoicing mandates drive integrated software, while sustainability reporting becomes standard in premium packages.

Conclusion

Understanding the average cost for bookkeeping service empowers Australian small businesses to choose wisely, balancing quality and budget. From hourly rates to full-service packages, the right provider delivers compliance, savings, and clarity. Whether you’re a startup or an established trader, investing in bookkeeping is an investment in your success.

Ready to optimise your finances? Request a free quote from a trusted provider today and take control of your books.

FAQ

Are bookkeepers cheaper than accountants?

Yes, bookkeepers are generally cheaper than accountants in Australia. Bookkeepers typically charge $45–$90 per hour or $300–$2,000 per month, while accountants (especially CPAs) charge $150–$400 per hour or $800–$3,500+ for similar work. The difference comes from bookkeepers focusing on day-to-day record-keeping, while accountants handle complex tax planning, audits, and advisory services.

Is a bookkeeper or an accountant more costly?

Accountants are more costly than bookkeepers. A bookkeeper’s services usually range from $300–$2,000 monthly for small businesses, while an accountant’s fees often start at $800–$3,500 for tax returns and can reach $1,000–$3,000+ monthly for full advisory. Accountants command higher rates due to their qualifications, tax expertise, and ability to handle compliance and strategic planning.

How much does a bookkeeper cost in Australia?

In Australia, a bookkeeper typically costs $45–$90 per hour or $300–$2,000 per month for small businesses in 2026. Basic services for sole traders start around $400–$800 monthly, while full-service packages with BAS, payroll, and reporting range from $1,200–$2,000+. Costs depend on transaction volume, business complexity, and whether the bookkeeper is BAS-registered.

Is a bookkeeper better than an accountant?

Neither is inherently better; it depends on your needs. A bookkeeper is ideal for day-to-day record-keeping, reconciliations, and basic BAS lodgement at a lower cost. An accountant is better for tax planning, complex returns, audits, and strategic advice. Many small businesses use both: a bookkeeper for routine tasks and an accountant for tax and compliance.

Is it better to do bookkeeping or accounting?

It’s better to do both, but in the right order. Bookkeeping (daily transaction recording) is the foundation; accurate books make accounting (tax returns, financial analysis) easier and more reliable. Small businesses should handle or outsource bookkeeping regularly and use an accountant for tax preparation and planning to ensure compliance and maximise deductions.

Do I need a bookkeeper or an accountant?

Most small businesses need both, but start with a bookkeeper if your finances are simple. A bookkeeper handles daily records, BAS, and payroll affordably. An accountant is essential for tax returns, complex deductions, audits, or business structuring. Many use a bookkeeper for routine work and an accountant annually or quarterly for tax and advice.

How much should you charge as a bookkeeper?

In Australia, bookkeepers should charge $45–$90 per hour or $400–$2,500 per month per client in 2026. Start at $50–$70/hour or $500–$1,000/month for basic services, and $80–$90/hour or $1,500–$2,500 for full-service (BAS, payroll, reporting). Charge based on value, transaction volume, and expertise, certified BAS agents can command higher rates.

How much do bookkeepers charge per hour in Australia?

Bookkeepers in Australia charge $45–$90 per hour in 2026. Junior or freelance bookkeepers typically charge $45–$65 per hour, while experienced, BAS-registered, or full-charge bookkeepers charge $70–$90+ per hour. Rates are higher in major cities like Sydney and Melbourne and lower in regional areas.

How much should I pay for bookkeeping services?

Small businesses in Australia should pay $300–$2,000 per month for bookkeeping services. Basic packages for sole traders start at $400–$800, while comprehensive services (including BAS, payroll, and reporting) range from $1,200–$2,000+. The right price depends on transaction volume, business complexity, and whether advisory is included.

What is the going rate for a full-charge bookkeeper?

The going rate for a full-charge bookkeeper in Australia is $60–$100 per hour or $1,800–$4,000 per month in 2026. Monthly retainers commonly range from $2,000–$3,500 for comprehensive service, including reconciliations, payroll, BAS, and financial statements. Rates are higher for experienced professionals or complex clients.

Also Read: Save Hours and Cash When You Outsource Bookkeeping Services for Your Small Business in Australia!