Introduction

Choosing the best outsourced accounting services can transform cash flow, compliance, and decision-making for Australian small business owners and sole traders. This guide explains why outsourcing accounting matters, key benefits, core services (bookkeeping, BAS lodgement, payroll and STP, bank reconciliations, cloud accounting and financial reporting), pricing approaches, and how to pick the right provider in Australia.

Why Australian business owners should consider accounting outsourcing

Outsourcing accounting lets business owners focus on growth while experts handle compliance and numbers. For many small businesses and sole traders across Australia, using the best outsourced accounting services reduces errors, ensures timely BAS lodgements, and simplifies tax obligations with registered tax agents.

Benefits of outsourcing accounting services in Australia for small businesses

Save time and reduce overheads

Hiring an in-house accountant can be costly. Outsourced services let you access qualified accountants and bookkeeping services in Australia at a fraction of the fixed cost, often via flexible monthly plans.

Access to specialised accounting software expertise

Top outsourced accounting providers are skilled in Xero, MYOB, and QuickBooks. They can set up, optimise, and train you in cloud accounting to improve efficiencies and real-time reporting.

Improved compliance and reduced risk

Registered tax agents and experienced outsourcing firms keep up with ATO rules, ensuring accurate GST, BAS lodgement, and payroll compliance, including Single Touch Payroll (STP).

Scalable outsourced services

As your business grows, outsourced services scale from basic bookkeeping services to full financial reporting and advisory.

Core bookkeeping services in Australia

Bookkeeping is the foundation of the best outsourced accounting services. Core bookkeeping services include transaction coding, reconciliations, expense categorisation, and bank feed management. Reliable bookkeeping services in Australia ensure timely records for BAS and tax time.

BAS lodgement and tax services for an Australian business

BAS (Business Activity Statement) lodgement is critical for GST, PAYG, and other obligations. Outsourced accounting services often include quarterly or monthly BAS preparation and lodgement by a registered tax agent, reducing penalties and ensuring accurate reporting.

Payroll, STP, and payroll services in Australia

Payroll management includes payslips, superannuation calculations, and Single Touch Payroll (STP) reporting to the ATO. The best outsourced payroll services ensure on-time payments, correct tax withholding, and up-to-date super contributions for employees and contractors.

Bank reconciliations and accounting work accuracy

Regular bank reconciliations remove discrepancies between bank statements and your accounting records. Outsourced providers perform reconciliations to maintain clean ledgers, which is essential for cash flow forecasting and financial reporting.

Cloud accounting

Cloud accounting is central to modern outsourcing. Leading accounting outsourcing services in Australia offer setup, migration, and ongoing management for Xero, MYOB, and QuickBooks, enabling secure access and real-time financial tracking.

Financial reporting and accounting outsourcing services

Quality outsourced accounting firms produce monthly management reports, profit and loss statements, balance sheets, and cash flow reports. These financial reporting outputs support budgeting, tax planning, and strategic decisions for Australian business owners.

Pricing models for the best outsourced services

Hourly pricing

Hourly rates are suitable for ad-hoc tasks like cleanup work, BAS amendments, or short-term projects. This model offers flexibility but can be unpredictable for ongoing work.

Fixed monthly pricing

Fixed monthly packages are common for ongoing bookkeeping, payroll, and BAS lodgement. They provide predictable costs and are ideal for most small businesses and sole traders seeking continuous support.

Project-based pricing

Project pricing fits migrations, software integrations, or year-end reconciliations. It’s a one-off fee based on scope and deliverables.

Who benefits most from outsourcing

Outsourced accounting suits:

- Small businesses with limited admin capacity

- Sole traders and freelancers needing BAS and tax support

- Startups that prefer scalable, cost-effective accounting

- Growing businesses require robust financial reporting

- Owners who want to outsource bookkeeping or payroll to a trusted outsourcing provider

How to choose the best outsourced accounting services in Australia

Check industry and software experience

Choose providers experienced with Xero, MYOB, or QuickBooks and with clients in your industry.

Verify qualifications and tax agent registration.

Ensure the firm employs or partners with registered tax agents and qualified accountants for compliance and BAS lodgement.

Understand service scope and SLAs

Clarify what’s included: bank reconciliations, BAS lodgement, payroll/STP, monthly reports, response times, and fees for extras.

Ask about security and data access.

Confirm cloud security practices, backup, and access controls. Good providers offer secure client portals and role-based access.

Compare pricing models and value.

Balance cost with services offered. A low monthly fee may exclude payroll or BAS lodgement; read the inclusions carefully.

Request references and a free consultation.

Many accounting services in Australia offer a free consultation. Ask for client references and examples of work for businesses similar to yours.

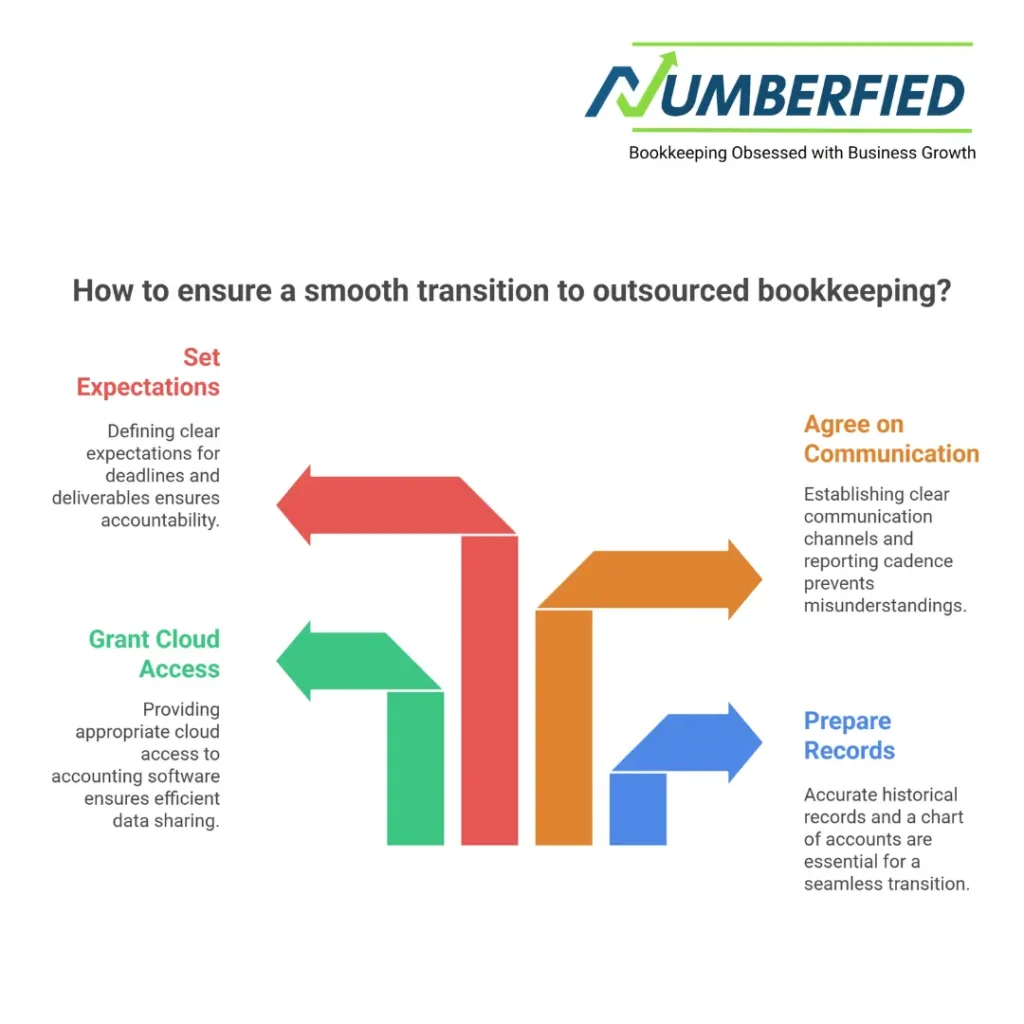

Tips for a smooth transition to outsourced bookkeeping services

- Prepare accurate historical records and a chart of accounts.

- Grant appropriate cloud access to Xero, MYOB, or QuickBooks.

- Agree on communication channels and reporting cadence.

- Set clear expectations for BAS dates, payroll cycles, and deliverables.

Final checklist for choosing outsourced accounting services in Australia

- Confirm Xero, MYOB, or QuickBooks expertise.

- Verify tax agent registration and qualifications.

- Compare hourly vs fixed monthly vs project pricing.

- Ask for references and a free consultation.

- Ensure clear service scope: bookkeeping, BAS, payroll/STP, reconciliations, and reporting.

Conclusion

Finding the best outsourced accounting services for your Australian small business or sole trader practice means matching your needs with a provider that offers the right mix of bookkeeping services, payroll and STP expertise, BAS lodgement, cloud accounting skills, and clear pricing. With careful selection, outsourcing accounting can save time, keep you compliant, and give you clearer financial insight to grow your business.

FAQ

What are the best outsourced accounting services for small businesses in Australia?

The best outsourced accounting services offer bookkeeping, BAS lodgement, payroll/STP, bank reconciliations, cloud accounting support (Xero, MYOB, QuickBooks), and timely financial reporting, backed by registered tax agents.

How much do outsourced accounting services cost?

Costs vary: hourly rates can range widely depending on experience; fixed monthly packages for small businesses typically start from a few hundred AUD per month and increase with complexity; project fees depend on scope.

Can an outsourced accountant handle my BAS lodgement and ATO obligations?

Yes, many providers are registered tax agents and handle BAS preparation and lodgement, PAYG and GST reporting, ensuring compliance with ATO requirements.

Is Single Touch Payroll (STP) included in payroll services?

Most outsourced payroll services include STP reporting, payslips, and superannuation calculations. Verify inclusion in your service agreement.

Which cloud accounting software should I use: Xero, MYOB, or QuickBooks?

Choice depends on business needs. Xero is popular for ease-of-use and integrations, MYOB suits some Australian compliance needs, and QuickBooks is strong for US-influenced workflows. An outsourced provider can recommend and implement the best option.

How quickly can I switch to an outsourced accounting firm?

Transition times vary. Basic bookkeeping can be moved in days; full migrations and historical clean-ups can take weeks. Good providers offer a structured onboarding plan.

Are outsourced accounting services secure?

Reputable firms use cloud security, two-factor authentication, and role-based access. Confirm their security policies and data handling practices.

Will outsourcing reduce my tax bill?

Outsourcing itself doesn’t reduce tax, but accurate bookkeeping and timely reporting help ensure you claim legitimate deductions and avoid penalties, which can improve net outcomes.

Can sole traders benefit from outsourcing accounting?

Yes. Sole traders benefit from reliable BAS lodgement, simplified bookkeeping, tax planning, and time savings, making outsourced services a cost-effective option.

How do I know if an outsourced firm is trustworthy?

Check qualifications, tax agent registration, client testimonials, cloud software partnerships, and whether they offer a free consultation or trial. Transparency on fees and SLA terms is also key.

Also Read: Why the Best Outsourced Accounting Services Are Your Australian Business’s Superpower!