Introduction

Managing the finances of a growing business in Perth can quickly become one of the most time-consuming and stressful parts of your week, especially when receipts pile up, BAS deadlines loom, and payroll needs attention. Choosing an experienced bookkeeper in Perth removes that burden entirely and provides you with something far more valuable: complete clarity about your finances and the freedom to focus on what you do best. At Numberfied, we have been helping Perth business owners just like you for years, delivering accurate records, timely lodgements, and straightforward advice that actually makes a difference to the bottom line.

We regularly hear from new clients who have spent countless evenings and weekends trying to keep their books in order, only to feel overwhelmed and unsure whether everything is correct. When they bring us on board as their bookkeeper in Perth, the relief is almost instant. Suddenly, the paperwork is handled professionally, compliance is taken care of, and they finally receive financial reports that are easy to understand and genuinely helpful in making decisions.

Here’s the difference our clients notice within the first month of working with a dedicated bookkeeper in Perth from the Numberfied team:

- Accurate, up-to-date records available any time you need them

- BAS, IAS, and payroll obligations are lodged correctly and on time, every single time

- Clear monthly reports that show exactly how the business is performing

- More hours in the week to focus on customers, growth, and family

- Confidence that the ATO and other regulators are delighted

Why Perth Businesses Trust Numberfied as Their Bookkeeper in Perth

Deep Understanding of the Western Australian Business Landscape

Living and working in Perth means we understand the unique rhythm of business here, from the seasonal flows in tourism and hospitality along the coast to the project-based nature of mining services and construction south of the river. Your bookkeeper in Perth at Numberfied stays up-to-date with local regulations and economic shifts, ensuring your compliance is never left to chance.

Personal Service from a Local Perth Team

When you call or email us, you speak directly to a member of our Perth-based team who already knows your business and your file inside out. There are no offshore call centers or endless ticket systems – just straightforward, friendly support from people who genuinely care about your success.

Secure Cloud Technology That Works the Way You Do

All of your financial information lives securely in the cloud, meaning you can check your profit, cash flow, or outstanding invoices from your phone while you’re on site, meeting clients in the city, or relaxing at home after work. Modern bookkeeping from a forward-thinking bookkeeper in Perth should be this simple and accessible.

The Core Services Your Bookkeeper in Perth Delivers Every Day

Comprehensive Day-to-Day Bookkeeping and Reconciliation

Every sale, purchase, and expense is accurately recorded as it occurs, with bank feeds connected directly to your file and reconciliations completed regularly. This attention to detail by your bookkeeper in Perth ensures nothing is ever missed, and your reports are always reliable.

Complete Payroll Management and Superannuation Compliance

From calculating wages, deductions, and leave entitlements to processing payments and lodging Single Touch Payroll reports, your bookkeeper in Perth handles the entire process so your team is paid correctly and you remain fully compliant with current legislation.

Accurate BAS, IAS, and Annual Reporting

Activity statements are prepared carefully, thoroughly checked, and lodged electronically before the deadline, providing you with complete peace of mind. If your industry requires Taxable Payments Annual Reports, your bookkeeper in Perth takes care of those, too.

Accounts Receivable, Payable, and Cash-Flow Support

We can create and send invoices on your behalf, follow up on overdue accounts professionally, and manage supplier payments to maximize early-payment discounts, helping your cash flow stay healthy throughout the year.

How Partnering with a Professional Bookkeeper in Perth Saves You Money

Eliminating Expensive ATO Penalties and Interest Charges

Even a minor error on a BAS or payroll report can result in significant fines. The accuracy and diligence of an experienced bookkeeper prevent those costly mistakes before they happen.

Maximising Legitimate Tax Deductions

Many business owners unintentionally miss deductions they are entitled to claim. Your bookkeeper in Perth reviews every transaction and ensures you receive the full benefit available under Australian tax law.

Informed Decisions Backed by Real-Time Financial Insights

When your numbers are current and accurate, you can confidently decide whether to hire new staff, invest in equipment, or take on larger projects, safe in the knowledge that your bookkeeper in Perth has provided you with the complete picture.

What Sets Numberfied Apart from Other Bookkeepers in Perth

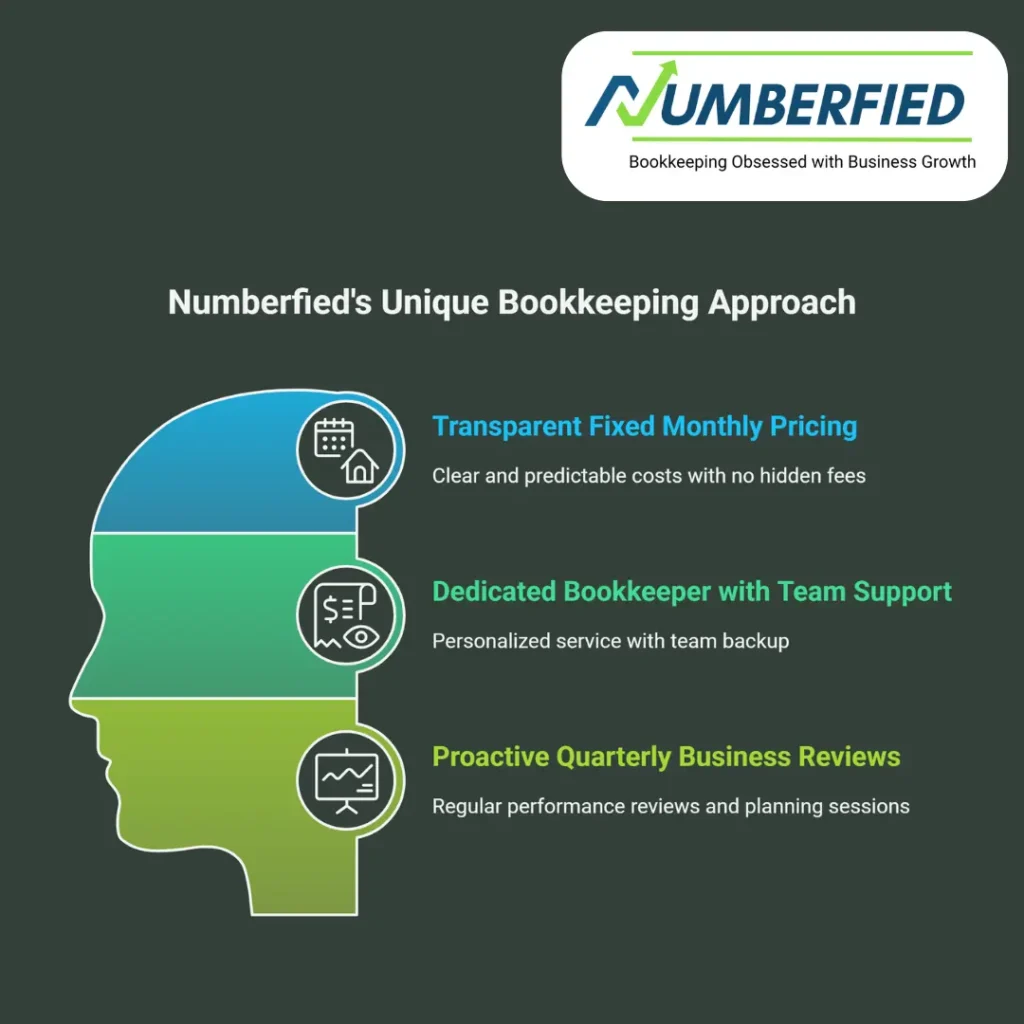

Transparent Fixed Monthly Pricing

From the very first conversation, you know exactly what your investment will be each month, with no hidden extras for phone support, additional lodgements, or quarterly reviews; everything is included when you choose Numberfied as your bookkeeper in Perth.

A Dedicated Bookkeeper Supported by the Whole Team

You build a relationship with one primary bookkeeper who learns the details of your business, yet the entire Perth team is familiar with your file and ready to step in seamlessly whenever needed.

Proactive Quarterly Business Reviews at No Extra Cost

Every three months, we sit down with you either in person or online to review performance, discuss opportunities, and plan the months. Many of our clients tell us these sessions alone make their bookkeeper in Perth invaluable.

Getting Started with Your New Bookkeeper in Perth

The onboarding process is deliberately simple and fast. After an initial, no-obligation call to learn about your business and current setup, we provide a fixed monthly quote. Once you’re ready to proceed, your dedicated bookkeeper in Perth begins work, and most clients are fully operational within five to ten working days.

There are no long-term lock-in contracts. We believe you should stay with us because you’re delighted with the service, not because paperwork ties you in.

The Perth Industries We Support Every Day

Tradies and contractors who spend their days on site, cafe and restaurant owners managing rosters and high-volume sales, professional service firms tracking billable hours, and fast-growing startups scaling rapidly, whatever your industry, your bookkeeper in Perth at Numberfied has the experience to keep your finances running smoothly.

Moving from DIY Bookkeeping to a Professional Bookkeeper in Perth

Most business owners discover that the time they spend doing their own books plus the risk of errors and penalties costs far more than the modest monthly fee for a professional bookkeeper in Perth. The real value, however, comes from the clarity, confidence, and extra hours you gain every week.

Conclusion

Choosing a reliable, local bookkeeper in Perth is one of the best decisions you can make for your business and your peace of mind. At Numberfied, we combine genuine Perth expertise with modern systems and a commitment to making your life easier.

Visithttps://numberfied.com/au/ now to book a free, no-obligation discovery call, or simply call us on the phone and chat with our friendly Perth team. We’re ready to welcome you and show you just how straightforward professional bookkeeping can be.

Frequently Asked Questions

How soon can a bookkeeper from Numberfied in Perth start working on my files?

For the majority of Perth businesses, we are fully onboarded and operating smoothly within five to ten working days. We begin processing current transactions immediately and work backwards through any catch-up requirements, so you feel the benefits straight away.

Will I need to change my existing accounting software?

No changes are required. Your bookkeeper in Perth works seamlessly with Xero, MYOB, QuickBooks Online, or any other platform you already use, and we can advise on cloud migration later if you ever wish to upgrade.

Can a bookkeeper in Perth rescue years of disorganised or overdue records?

Absolutely, catch-up and clean-up projects are something we handle regularly. Many Perth clients arrive with boxes of receipts and overdue lodgments, and we systematically bring everything up to date and compliant again.

Is the Numberfied team actually based in Perth?

Yes, our entire bookkeeping team is Australian-based, with most of us located right here in Perth, giving you local knowledge and support whenever you need it.

What support do you offer if the ATO decides to audit my business?

Your records will be thorough, well-organised, and audit-ready at all times. Should an audit occur, your bookkeeper in Perth will assist by providing all required documentation quickly and confidently.

Do you manage Single Touch Payroll requirements?

Every payroll we process is fully STP-compliant, with reports submitted to the ATO in real time as required by current legislation.

Can I continue to approve my own payments?

Of course, most clients retain complete control of their bank accounts while their bookkeeper in Perth ensures every transaction is correctly categorised and reconciled.

Are there any lock-in contracts?

There are no long-term lock-in contracts. We simply ask for 30 days’ notice if you ever wish to leave, although the majority of our Perth clients choose to stay for many years.

Is BAS preparation and lodgement included in the monthly fee?

Yes, all activity statements, payroll tax, end-of-year preparation, and any other regular lodgements are covered within your fixed monthly fee.

How do I know that engaging a bookkeeper in Perth is worth the investment?

Almost every client finds the monthly fee is more than recovered through time saved, penalties avoided, additional deductions claimed. Better business decisions made, and the genuine peace of mind is priceless.

Also Read: Save Hours and Cash When You Outsource Bookkeeping Services for Your Small Business in Australia!