Introduction

Running a business in Perth keeps you busy enough without the books turning into a second full-time job. Most owners we meet started their companies to build something they care about, not to spend nights chasing paperwork or stressing about the next BAS. The good news is that bookkeeping in Perth, WA, does not have to feel hard or take over your life.

At Numberfied, we have looked after Perth businesses for years, tradies out in the suburbs, cafes in the city, medical rooms in Claremont, builders, retailers, the lot. We know exactly what works here and what causes headaches. This guide is everything we wish every new client already knew about bookkeeping in Perth, WA.

What you actually gain when the books are done properly:

- You always know how much cash is in the bank

- Deadlines stop being a surprise

- Weekends stay yours

- You make decisions from facts, not guesswork

Local Rules You Need to Know for Bookkeeping in Perth, WA

WA Does Things a Little Differently

Payroll tax kicks in at a different threshold here, workers’ compensation categories vary by industry, and some concessions only apply in Western Australia. Miss one of those details and the bill arrives later.

Single Touch Payroll Is Now Non-Negotiable

Every pay run goes straight to the ATO the moment you process it. The software handles it automatically these days, but only if everything is set up correctly from the start.

Public Holidays and Awards in WA

We have our own set of public holidays and regional variations on modern awards. Getting loadings or penalties wrong is one of the fastest ways to end up with a Fair Work claim.

Choosing What Works for Your Perth Business

Keep It In-House or Outsource It?

Some owners like to stay hands-on. Others are happy to never see another receipt. Most end up somewhere in the middle. We handle the repetitive work, and they keep the final sign-off.

Cloud Software Has Changed Everything

Being able to check the numbers from your phone on site or from home on a Sunday night makes a massive difference. The big three Xero, MYOB, and QuickBooks Online all do the job well here in Perth.

When It Is Time to Bring in Help

If you are still doing the books yourself after 6 pm or on weekends, or if you feel a knot in your stomach every time BAS time rolls around, that is the signal.

Simple Daily Habits That Keep Bookkeeping in Perth, WA Under Control

Deal with It on the Day

As soon as a transaction happens, handle it immediately. Pull out your phone, snap a clear photo of the receipt, approve the invoice in your accounting software, and code the payment to the correct account. The whole process takes literally ten seconds while everything is still fresh in your mind and the paperwork is in your hand. Leave it until the weekend or month-end, and those same ten-second jobs pile up into a frustrating two- or three-hour marathon of trying to remember what each receipt was for. Doing it on the day is the single biggest time-saver for any Perth business owner.

Reconcile the Bank Every Morning

Grab your morning coffee, open the banking app or Xero/QuickBooks/Myob feed, and match yesterday’s transactions. Five minutes is usually all it takes when you do it daily. The bank feed updates overnight, so discrepancies jump out immediately instead of hiding for weeks. When you keep this habit, month-end reconciliation in Perth, WA, becomes a complete non-event. No surprise transactions, no panicked searches, just a clean file ready for BAS or the accountant.

One Quick Weekly Check-In

Block out ten minutes every Friday afternoon or Monday morning if that suits you better. Open your dashboard and glance at three things. Profit for the week, which invoices are still outstanding, and what bills are due in the next couple of weeks. That’s it. For most small-to-medium businesses in Perth, this short weekly pulse is enough to stay completely on top of the numbers without drowning in reports.

Payroll Without the Drama

Getting Awards and Allowances Right

Modern Awards in Western Australia are complex. Saturday loadings, Sunday penalties, late-night penalties, split-shift allowances, meal allowances, the list goes on. Get the rules loaded correctly into your payroll system once, or have your bookkeeper do it, and every pay run looks after itself. The software automatically applies the correct rates, calculates overtime accurately, and ensures 100% compliance without requiring constant manual adjustments.

Super Is Watched Closely Now

The ATO now data-matches every dollar you report on employee STP against what the super funds actually receive. One late or missed super payment triggers an automatic alert, and the letters start arriving fast. When super is calculated and paid on time with every payroll, and most cloud systems can schedule it automatically, you never have to worry about ATO super enquiries again.

Leave Balances That Actually Match Reality

Set the opening annual leave, personal leave, and long-service leave balances correctly when you move to a new system, and let the software accrue and deduct automatically from then on. Employees can see their own balances in real time through an app, and you’ll never have a shock claim at the end of the year because the numbers always match reality.

Cash Flow: The Real Reason Bookkeeping in Perth, WA Matters

A Rolling 13-Week Forecast Changes Everything

Take five minutes once a week to update your known receipts and payments into a simple 13-week cash flow forecast. Suddenly, you can see exactly when money is coming in and going out. You’ll know weeks in advance whether you can comfortably cover rent, wages, tax payments, and still pay yourself. No more sweating on Thursday night, hoping the bank balance lasts until Friday’s deposits.

Perth Has Clear Seasonal Patterns

Most Perth industries have predictable cycles. January is dead quiet for trades and professional services, December and January are massive for hospitality and retail, and April to June picks up for everyone as EOFY approaches. Accurate, up-to-date bookkeeping spots these seasonal patterns early so you can staff up, stock up, or save cash at exactly the right time.

Clean Numbers Open Doors

When you need finance for a new work van, bigger premises, equipment loan, or a line of credit, the bank’s first request is almost always the last twelve months of clean, reconciled profit and loss and balance sheet reports. Up-to-date bookkeeping in Perth, WA, means you can say yes, here they are the same day, instead of scrambling for weeks and missing the opportunity.

BAS and Tax Time That Do Not Ruin Your Month

BAS Becomes a Quick Review

With daily reconciliations and proper coding all quarter, lodging BAS in Perth, WA is reduced to opening the pre-filled activity statement, checking the software-calculated figures make sense, and hitting submit. Ten to fifteen minutes instead of several stressful days.

Start the Tax Pack Early

Put aside a small amount of work each month. Run the preliminary reports, check for anything unusual, and set aside deductible receipts. By the time June rolls around, 90 % of the tax pack is already done. EOFY becomes calm and controlled instead of the usual chaos.

Give Your Accountant Clean Files

Hand over accurate, fully reconciled files, and your accountant can spend their time finding legitimate deductions and tax-saving strategies instead of hunting for missing transactions or correcting errors. They finish faster, charge you less, and usually save you far more than the bookkeeping effort ever costs.

The Tools That Actually Help

Receipt Apps That Work on Site

Whether you’re at the servo, a job site, or a lunch meeting, snap the fuel docket, material invoice, or meal receipt with your phone, and it’s uploaded, OCR-read, and sitting in your accounting software before you even drive away. No more lost dockets or shoeboxes of paper.

Timesheets That Feed Straight into Payroll

Ditch the paper timesheets. Your crew clocks on and off using an app on their phone with GPS if you need it. Hours flow straight into payroll, overtime and allowances apply automatically, and the pay run is ready with almost no manual entry.

Backups You Never Have to Think About

Everything lives in the cloud with automatic daily backups and version history. Drop your laptop in the Swan River or have it stolen from the ute. Log in from any device, and every transaction, every receipt, every report is still there, exactly as it was. Peace of mind without any extra effort.

Keep these simple habits going, and bookkeeping in Perth, WA, stops being a burden and becomes the tool that actually helps you run a smoother, more profitable business.

Growing Without the Bookkeeping Growing Pains

When the Simple Setup Is No Longer Enough

Extra bank accounts, stock, jobs, or staff usually mean it is time for the next level of detail.

Job Costing for Tradies and Builders

Know exactly which job made money and which one did not before you quote the next one.

Getting Ready for Finance or a Sale

Two or three years of spotless reports make banks and buyers move much faster.

Conclusion

Bookkeeping in Perth, WA, only feels complicated until the right systems and habits are in place. Once everything runs smoothly, you wonder why it ever felt hard in the first place.

We love helping Perth owners get to that point where the numbers are accurate, the stress is gone, and the business can grow without the books holding it back.

If you are ready for bookkeeping in Perth, WA that actually feels easy, drop us a line at https://numberfied.com/au or call 08 6555 3966. We would love to have a no-pressure chat and show you what is possible.

FAQs

How long does it take to switch to cloud bookkeeping in Perth, WA?

Most businesses complete the switch to cloud bookkeeping in Perth, WA, within two to four weeks. We manage the full data transfer, connect all bank feeds, customise the chart of accounts, and provide hands-on training so your team feels confident from day one. The result is seamless bookkeeping in Perth, WA, with no disruption to your daily operations.

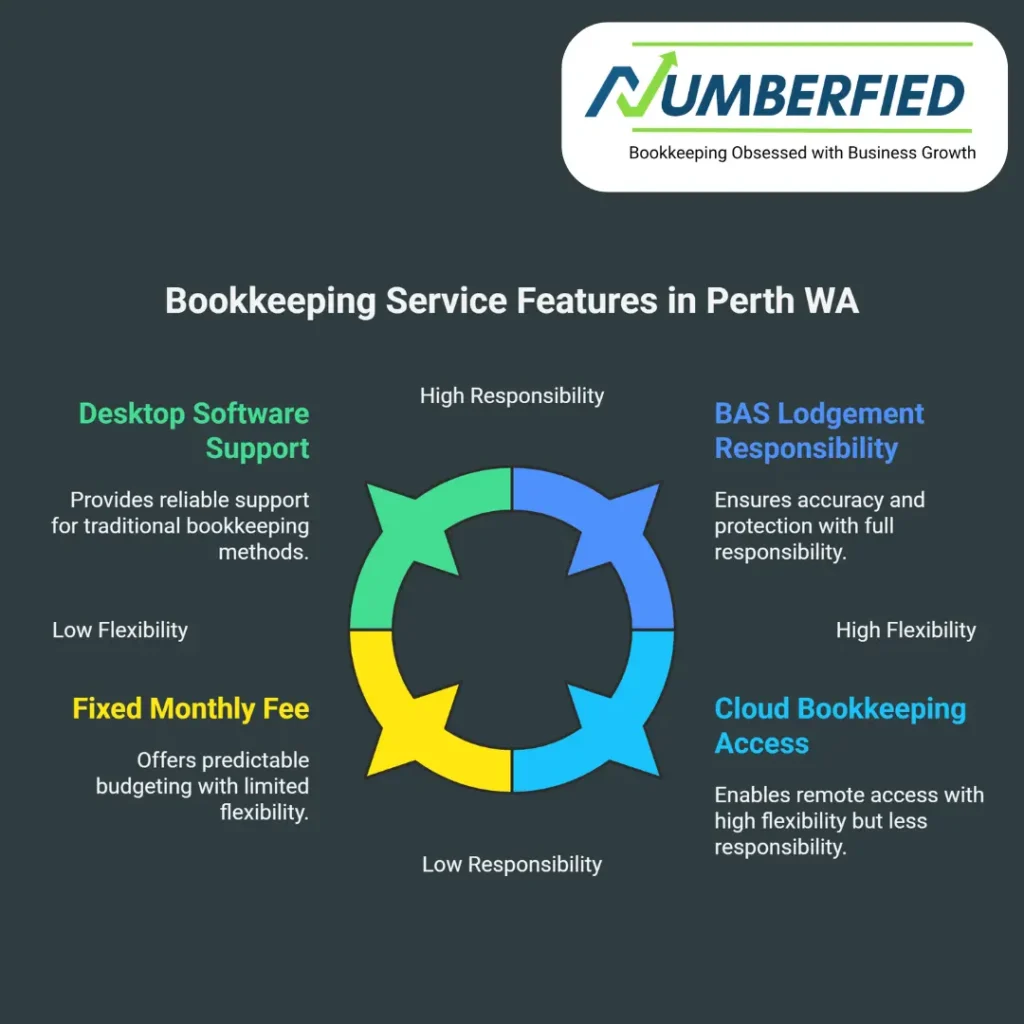

Can I still use my old desktop MYOB file for bookkeeping in Perth, WA?

Yes, many long-established Perth businesses continue running perfectly well on desktop software for their bookkeeping in Perth, WA. We support desktop versions happily and only recommend moving to cloud bookkeeping in Perth, WA when you want the freedom to access files anywhere or reduce backup worries.

Who is actually responsible if something goes wrong with my BAS lodgement?

When we handle your BAS as part of our bookkeeping in Perth, WA service and lodge on your behalf as registered BAS agents, we take full responsibility for accuracy. You remain completely protected, and we manage any ATO queries directly so you never have to get involved.

How does Numberfied price bookkeeping in Perth, WA?

You receive one clear, fixed monthly fee for bookkeeping in Perth, WA, calculated from your actual transaction volume and the level of support you choose. No hourly billing and no surprise charges, just predictable, transparent pricing that makes budgeting simple.

Do you only work with certain industries for bookkeeping in Perth, WA?

No, our bookkeeping in Perth, WA covers every sector: trades, hospitality, medical and allied health, retail, construction, professional services, importers, e-commerce, and many more. The systems and processes flex to match exactly what your industry needs.

What happens during the free discovery call about bookkeeping in Perth, WA?

We spend 20–30 minutes talking about your current bookkeeping in Perth, WA setup, the frustrations you face, and what you would love the numbers to do for your business. You walk away with honest feedback, quick wins you can apply straight away, and a clear plan – all with zero sales pressure.

Can bookkeeping in Perth, WA, be managed while I’m on site all day?

Absolutely. With modern cloud bookkeeping in Perth, WA, you can approve invoices, capture receipts, check your cash position, and even run payroll directly from your phone while you’re on site or between jobs. Many of our tradies and builders manage their entire bookkeeping in Perth, WA, this way.

How far back can you clean up messy records with bookkeeping in Perth, WA?

We regularly bring bookkeeping in Perth, WA, files current from three, five, or even seven years behind. It becomes a structured project with agreed stages and timelines, and clients often recover extra deductions that more than cover the clean-up cost.

Will my accountant still be involved if I use Numberfied for bookkeeping in Perth, WA?

Yes, your accountant stays fully involved for tax planning and final returns. Our bookkeeping in Perth, WA, simply keeps the file clean, reconciled, and ready all year, so they can focus on strategy instead of fixing errors, and their fees are usually lower as a result.

What if I only need part-time help with bookkeeping in Perth, WA?

Many clients start with targeted support just for payroll and BAS, or quarterly catch-ups and clean-ups, and add more as the business grows. You choose exactly the level of bookkeeping in Perth, WA, you need right now; it can scale up whenever you’re ready.

Also Read: How Accounting Services Bookkeeping Can Transform Your Australian Business