Introduction

Hello, Australian business owners! We’re the Numberfied crew, here to clear up the mystery around bookkeeping service fees for small business in Australia. Whether you’re running a surf shop in Byron Bay, a bakery in Adelaide, or a freelance gig in Darwin, keeping your finances in order is as essential as a sunny day at the beach. Let’s dive into what these costs look like, with a bit of cheer and insights from our work helping small businesses across Australia.

Key Points

- Bookkeeping service fees for small business vary by business size, complexity, and location.

- Outsourcing to Numberfied saves time and keeps you right with the ATO.

- DIY bookkeeping can lead to costly mistakes. Professional help is worth it.

- Numberfied offers plans tailored to your needs, keeping costs manageable.

Why Bookkeeping Matters for Your Business

Bookkeeping is like the backbone of your business; it keeps everything upright. At Numberfied, we’ve seen how tidy financial records give business owners the clarity to chase their dreams.

Staying Tax-Ready

Good bookkeeping means you’re prepared for GST and payroll filings. Our client Emma, a Perth florist, dodged a $1,000 ATO penalty after we sorted her BAS.

Helping Your Business Grow

Clear books show where your money’s going, letting you make smart choices. A Brisbane cafe owner we helped found $2,500 in savings after we organized his finances.

Bookkeeping vs. Accounting

Bookkeeping tracks daily sales and expenses. Accounting handles bigger tasks like tax planning. Both are crucial, but bookkeeping sets the stage.

What Shapes Bookkeeping Service Fees for Small Business?

Bookkeeping service fees for small business depend on a few things we’ve noticed while helping businesses from Cairns to Hobart. Here’s what affects the price.

Your Business’s Size

A freelancer with a few invoices pays less than a busy Melbourne restaurant. We helped a Tassie sole trader manage her books affordably, while a Sydney retailer needed more support.

How Complex Your Finances Are

Multiple income streams or staff? That’s more work. A Gold Coast event planner we worked with had varied client payments, which took extra time to sort.

In-House or Outsourced?

Hiring a full-time bookkeeper is expensive, with salaries plus super. Outsourcing with Numberfied is more budget-friendly for small businesses.

Your Location

Bookkeepers in cities like Brisbane charge more than those in rural areas like Tamworth. Numberfied keeps pricing fair, no matter where you are.

What to Expect from Bookkeeping Service Fees for Small Business

Let’s break down bookkeeping service fees for small business, based on our experience at Numberfied. Costs depend on how you pay and what your business needs.

Paying by the Hour

Some bookkeepers bill hourly, with rates varying by task. Simple jobs like expense tracking cost less; BAS or payroll takes more effort. We keep rates small-business-friendly.

Monthly Plans

Fixed-fee packages cover transactions, reconciliations, and GST filings. A Newcastle pet shop we helped saved time and money with our tailored plan.

One-Off Jobs

Need a quick fix for overdue books? One-time services are perfect for catching up. We helped a Hobart boutique get back on track fast.

Software Costs

Tools like Xero or MYOB have monthly fees but save time. We cut hours off a Darwin farmer’s bookkeeping by setting up Xero.

DIY Bookkeeping or Hire a Pro?

Tempted to do your own books? It’s like cooking a fancy dinner doable, but tricky. Here’s what we’ve learned at Numberfied.

The DIY Reality

DIY bookkeeping saves money but takes time and risks errors. A Townsville jeweller we helped faced an ATO fine for a DIY mistake. We fixed it, letting her focus on her craft.

Why Professionals Win

A bookkeeper ensures accuracy and frees you to grow your business. We’re a friendly bunch who make numbers less scary.

When to Outsource

If bookkeeping distracts from your customers or growth, outsource it. It’s like hiring a gardener so you can enjoy your backyard.

Real-Life Wins

A Canberra florist we worked with spent hours on books weekly. After outsourcing to us, she gained time to take on new clients, boosting her income.

How Numberfied Keeps Bookkeeping Simple

At Numberfied, we’re all about making bookkeeping easy and affordable for Australian businesses. Here’s how we make it happen.

Plans Just for You

We offer packages tailored to your business, from tradies to shop owners. Our flexible options fit your needs.

Easy-to-Use Tech

We use Xero and MYOB to simplify your books. Even our least techy client, a retiree running a B&B in Yarra Valley, loves how straightforward they are.

Clear Costs

We’re upfront about pricing, no surprises. A Wollongong cafe owner we helped appreciates knowing her costs from the start.

Tips to Save on Bookkeeping Service Fees for Small Business

Want to keep bookkeeping service fees for small business in check? Here are tips from our years helping Australian businesses.

Use Automation

Cloud tools like Xero handle data entry and reconciliations. We helped a Fremantle artist save money with automated workflows.

Check Your Plan

Your business changes, so should your bookkeeping. A quarterly chat with Numberfied ensures you’re not overpaying.

Learn Basic Skills

Want to handle some tasks? Ask for training. We taught a Sydney caterer Xero basics, lowering her costs.

Avoiding Bookkeeping Mistakes

We’ve seen businesses make errors that cost time and money. Here’s how to steer clear.

- Keep Receipts

Lost receipts mean missed deductions. A Brisbane electrician we helped was losing money until we set up digital tracking. - Separate Finances

Mixing personal and business accounts creates chaos. We helped a Melbourne consultant sort hers, saving hours. - Review Often

Outdated books hide problems. Monthly check-ins with Numberfied keep your finances clear. - Ask for Help

Bookkeeping can feel tough, but we’re here. A quick call prevents costly mistakes.

Choosing the Right Bookkeeper

Picking the right bookkeeper is key. Here’s how to find one that fits your business.

- Look for Experience

Choose someone who knows your industry. At Numberfied, we’ve worked with everyone from farmers to retailers, so we understand your needs. - Find a Good Match

Your bookkeeper should feel like a friend. We’re approachable and make finance chats enjoyable. - Check Their Tools

Ensure they use software like Xero or MYOB. We use these to keep your books efficient. - Demand Clear Pricing

Transparency matters. A Darwin client we helped loved our upfront costs, with no hidden fees.

Conclusion

Bookkeeping service fees for small business in Australia don’t have to be confusing. Professional bookkeeping saves time, ensures ATO compliance, and lets you focus on what you love. At Numberfied, we’re here to make your financial life as easy as a sunny arvo at St Kilda. Ready to get your books in order? Visit Numberfied for a free chat, and let’s find a plan that suits your business perfectly!

Also Read: How Support for Solo Accountants Can Transform Your Australian Business

FAQs

1. What affects bookkeeping service fees for small business?

Fees depend on your business’s size, complexity, and location. Numberfied offers customized plans to keep costs affordable for you.

2. Is DIY bookkeeping worth trying?

It can save money at first but risks mistakes that lead to fines. A client we helped paid a penalty for a DIY error. Numberfied keeps things accurate.

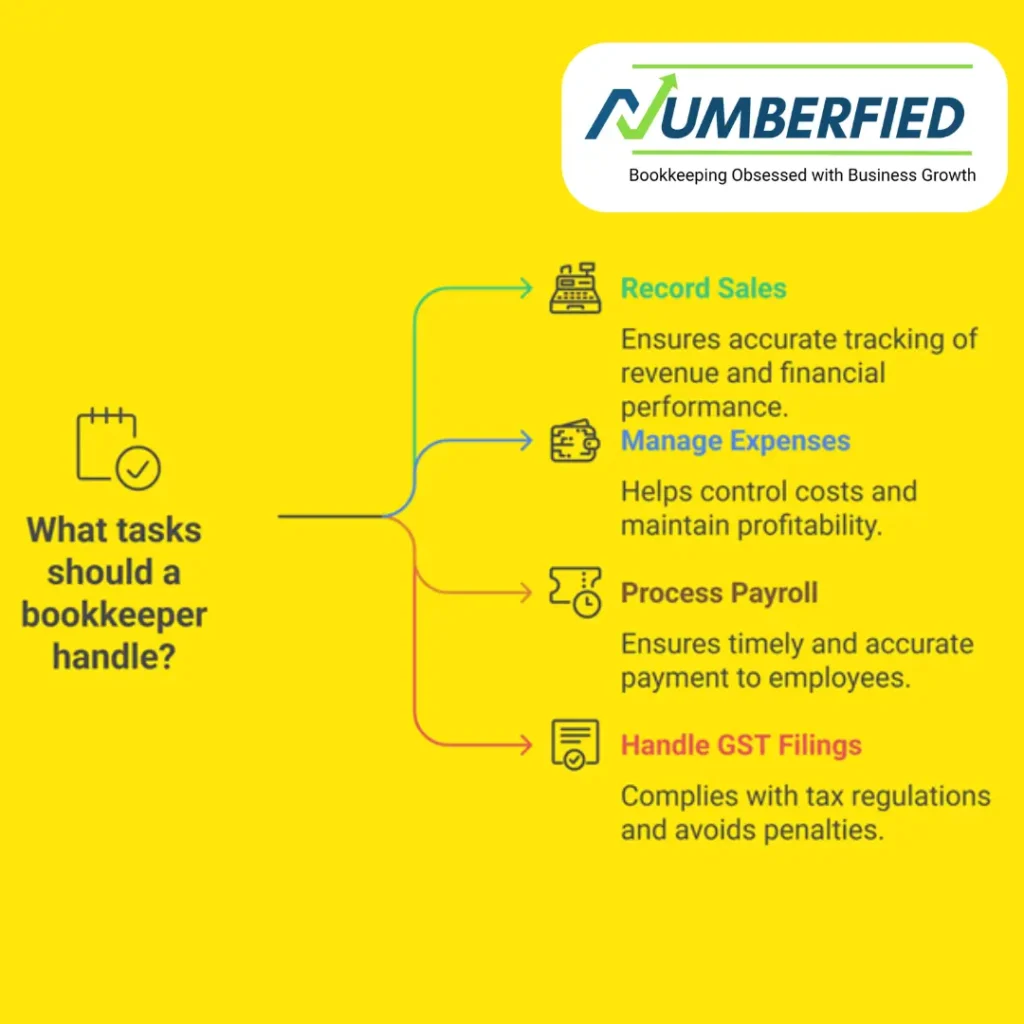

3. What tasks does a bookkeeper handle?

They record sales, expenses, payroll, and GST filings. At Numberfied, we manage these to keep your business running smoothly.

4. Can I claim bookkeeping fees on my taxes?

Usually, yes, as a business expense. Check with your accountant to confirm for your situation.

5. How often do I need a bookkeeper?

Busy businesses need weekly help; smaller ones can do monthly. Numberfied adjusts to your needs.

6. Do fees differ across Australia?

Yes, cities often have higher rates than rural areas. Numberfied provides fair pricing nationwide.

7. What’s included in a monthly bookkeeping plan?

Plans cover transaction tracking, reconciliations, GST prep, and reports. We tailor them to your business.

8. How can I keep bookkeeping costs low?

Organize records, use automation, and review plans regularly. Numberfied helps you save time and money.

9. Why pick Numberfied for bookkeeping?

We’re affordable, clear, and love supporting Australian businesses. Visit Numberfied to learn more.

10. How do I start with Numberfied?

Call us for a free consult. We’ll review your needs, suggest a plan, and get your books sorted fast.