Introduction

As a small business owner or sole trader in Perth, Western Australia, keeping accurate financial records is essential for compliance, cash flow, and growth. Whether you need a regular bookkeeping service or occasional support, a local Perth bookkeeper can simplify your accounting and let you focus on growing your business.

Why professional bookkeeping matters for small businesses

Good bookkeeping is more than entering invoices. It’s about reliable financial management that supports day-to-day decisions, satisfies BAS and ATO requirements, and ensures you have the information to grow your business. Outsourced bookkeeping services for small business give you peace of mind and free up time to concentrate on customers and strategy.

Core bookkeeping services Perth small businesses need

A professional bookkeeping service will tailor services to suit your business. Typical offerings include:

- Bank reconciliations and daily transaction coding

- Accounts payable and receivable management (invoices, statements, receivable follow-up)

- Payroll processing, superannuation, and single-touch payroll reporting

- BAS preparation and lodgement, GST calculation, and ATO compliance

- Financial reports: profit & loss, balance sheet, and cash flow statements

- Month-end and year-end close assistance for your accountant

- Subscription management and expense categorisation in accounting software

- Data migration and setup for Xero, MYOB, and other accounting software

Benefits of hiring a Perth bookkeeper

Partnering with a bookkeeper in Perth, WA can deliver tangible benefits:

- Accurate, up-to-date financial records that improve decision-making

- Compliance with GST, BAS, and ATO requirements to reduce risk

- More time to focus on core business activities and grow your business

- Streamlined processes and automation using Xero or MYOB

- Reduced payroll errors and on-time employee payments

- Customisable bookkeeping packages tailored to your business needs

BAS, GST, and ATO compliance

Meeting ATO obligations is a critical part of bookkeeping for small business. Your Perth bookkeeper will:

- Calculate and prepare regular BAS lodgements and GST reporting

- Keep records that satisfy ATO audits and compliance checks

- Provide clear documentation and backup for claims and adjustments

Regular reconciliations and timely BAS lodgements help avoid penalties and maintain smooth relations with the ATO.

Payroll services: accurate and compliant

Payroll is often one of the most administratively heavy tasks for a small business owner. A bookkeeper can manage:

- Employee pay runs and payslips

- Superannuation calculations and payments

- Single Touch Payroll (STP) reporting to the ATO

- Leave accruals, PAYG withholding, and tax reporting

Outsourcing payroll reduces errors, keeps staff paid on time, and ensures compliance with Australian employment obligations.

Xero and MYOB support

Many Perth small businesses rely on cloud accounting software. A certified Xero bookkeeper in Perth can:

- Set up and customise your Xero file to suit your business structure

- Migrate data from spreadsheets or MYOB

- Provide training so you or your team can manage basic tasks

- Integrate invoicing, bank feeds, and apps to streamline receivable and payable workflows

Whether you use Xero or MYOB, your bookkeeper will recommend the best tools to simplify your accounting and improve cash flow visibility.

Outsourced bookkeeping vs in-house bookkeeper

Choosing between outsourced and in-house bookkeeping depends on your business needs and budget.

Outsourced bookkeeping

- Cost-effective: pay for the services you need rather than a full-time salary

- Access to experienced professionals and specialist tools

- Scalable: packages can grow as your business grows

- Reduced need for training and HR overheads

In-house bookkeeper

- Immediate daily access and face-to-face collaboration

- Better for businesses with high transaction volumes needing an on-site presence

- May offer closer control but higher ongoing costs

Many Perth small business owners choose a hybrid approach: an outsourced bookkeeper for month-end, BAS, and reporting while retaining an in-house staff member for day-to-day admin.

How bookkeeping services can help you focus on growing your business

A reliable bookkeeper removes administrative burdens so you can focus on customers, sales, and business growth. By streamlining processes, implementing accounting software, and delivering clear financial reports, bookkeeping services let you make confident decisions about cash flow, pricing, and investment.

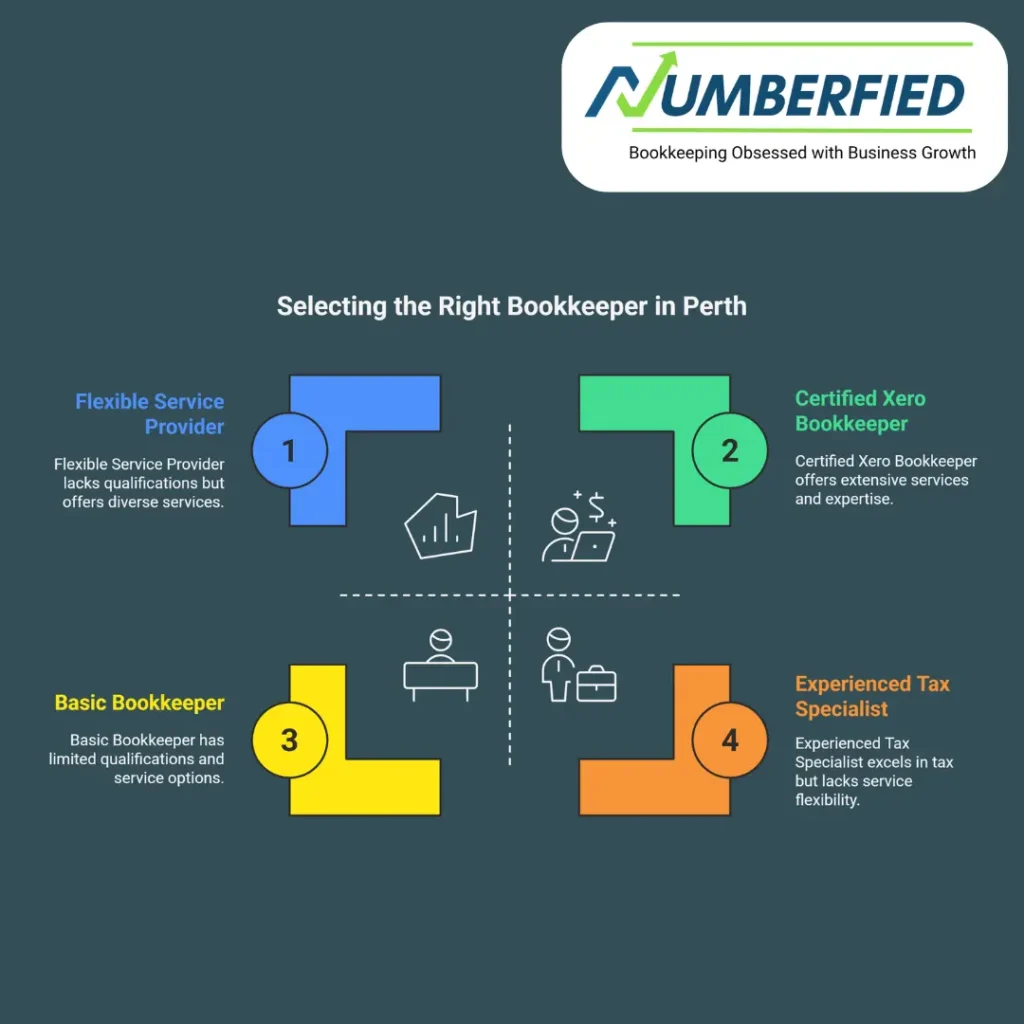

Choosing the right bookkeeper in Perth

When selecting a bookkeeper, Perth business owners can trust, consider these factors:

- Qualifications and experience with small businesses and Australian tax rules

- Experience in Xero and MYOB, looking for an Xero bookkeeper in Perth with certifications

- Range of services: payroll, BAS, accounts payable, and receivable

- Flexible bookkeeping packages that suit your business needs and budget

- Local reputation and client testimonials from Perth businesses

- Clear communication and a commitment to helping you grow your business

Ask potential bookkeepers about their approach to compliance, how they customise services, and what software integrations they recommend. A good bookkeeper will help you simplify paperwork and provide financial clarity.

Bookkeeping packages and pricing

Many bookkeeping services offer packages tailored to different stages of business growth. Packages commonly include:

- Starter: basic bank reconciliations, invoicing, and BAS preparation for sole traders

- Standard: payroll, accounts payable/receivable, and monthly reporting for small business

- Premium: cash flow forecasting, customised reporting, and regular advisory sessions

Choose a package that suits your business size and transaction volume. You can often upgrade as your business expands and requires more advanced financial management.

What to expect when you engage a Perth bookkeeper

Onboarding with a professional bookkeeper usually involves:

- Discovery meeting to understand your business needs and financial systems

- Review of current financial records and accounting software

- Set up or optimise Xero or MYOB and bank feeds

- Agreement on reporting frequency and communication channels

- Ongoing support, BAS lodgements, and access to financial reports

This structured approach helps ensure accurate record keeping and a quick transition with minimal disruption.

Local expertise matters

Engaging a Perth-based bookkeeper means you get someone who understands local business conditions, industry-specific challenges, and Australian compliance requirements. They can provide practical advice to help you manage cash flow, GST, and payroll while you focus on delivering excellent products and services to your customers.

Conclusion

If you’re a small business owner or sole trader in Perth ready to streamline your financial records, improve compliance, and gain peace of mind, contact a local bookkeeper who understands Australian rules and your business needs. Discuss customised bookkeeping packages, Xero or MYOB support, and payroll services that suit your business. Get in touch today to explore how professional bookkeeping services for small business can help you grow.

Frequently asked questions

What does a bookkeeper do for a small business?

A bookkeeper maintains financial records, reconciles bank accounts, manages invoices and payments, processes payroll, prepares BAS, and produces regular financial reports to support business decision-making.

Do I need a bookkeeper if I use Xero?

While Xero simplifies bookkeeping, a qualified Xero bookkeeper Perth ensures your accounts are correctly set up, reconciled, and compliant with ATO requirements, and can save you time and errors.

How often should bookkeeping be done?

Frequency depends on transaction volume. Monthly bookkeeping is common, but businesses with higher activity may require weekly or fortnightly services for accurate cash flow management.

Can a bookkeeper help with BAS lodgements?

Yes. Bookkeepers prepare BAS, calculate GST, and ensure lodgements meet ATO deadlines, helping you remain compliant and avoid penalties.

What’s the difference between a bookkeeper and an accountant?

Bookkeepers handle daily financial records and transactional tasks. Accountants provide tax advice, financial strategies, and year-end services. Many businesses use both, with the bookkeeper preparing records for the accountant.

How much does bookkeeping cost in Perth?

Costs vary by service scope, software, and transaction volume. Packages range from affordable starter plans for sole traders to comprehensive monthly services for growing businesses. Ask for a customised quote to suit your business.

Can a bookkeeper manage payroll and superannuation?

Yes. Many Perth bookkeepers process payroll, calculate superannuation obligations, and submit Single Touch Payroll reports to the ATO.

Is outsourcing bookkeeping secure?

Reputable bookkeeping services use secure cloud accounting software, encrypted data transfer, and strict confidentiality policies to protect your financial information.

Will a bookkeeper help me with cash flow forecasting?

Yes. Experienced bookkeepers can produce cash flow forecasts and reports to help you plan for seasonal changes, expenses, and business growth.

How do I find a reliable bookkeeper in Perth?

Look for local experience, Xero or MYOB certifications, client references, and clear bookkeeping packages. A good bookkeeper will also demonstrate how they can customise services to suit your business needs.

Also Read: Best Bookkeeping Services for Small Business in Australia