Introduction

Running a small or medium business in Australia isn’t a walk in the park. From handling customers to keeping up with suppliers, there’s always something that needs your focus. That’s why bookkeeping services for small medium businesses are such a lifesaver. Lots of Australian business owners count on them to ease the pressure of managing their finances. At Numberfied, we’re all about making the money side straightforward and hassle-free, so you can put your energy into what matters most – growing your business.

Key Takeaways:

- Bookkeeping services for small medium businesses help save time and ease stress.

- Keeping accurate books leads to smarter decisions and helps you spot new opportunities sooner.

- The right software combined with expert help keeps your finances running efficiently.

Why Bookkeeping Services for Small Medium Businesses Matter

The Backbone of Your Business

Bookkeeping services for small medium businesses keep your money matters clear and organised. Without them, it’s easy to miss deadlines, forget expenses, or get tangled up in tax rules.

Avoiding Financial Headaches

Trying to do your books alone? Mistakes happen. Payments get late. Compliance can slip. With Numberfied’s team on your side, you can relax knowing the job’s done right.

Growing with Confidence

When your books are up to date, decisions become easier. You’ll see where every dollar is coming from and going to – helping you plan your next move without guessing.

What Do Bookkeeping Services for Small Medium Businesses Include?

Daily Transaction Recording

Keeping track of your income and expenses every day helps your records stay up to date and cuts down the stress when the end of the financial year rolls around. That’s one of the key services bookkeeping services for small medium businesses offer.

Payroll Management

Managing wages, superannuation, and employee entitlements can get complicated fast. With the right team handling this, like at Numberfied, you don’t have to worry about getting it wrong.

BAS Preparation and Lodgement

Making sure your Business Activity Statements are correct and submitted on time is essential. Numberfied takes care of this, so you avoid penalties and stay compliant.

How to Choose the Right Bookkeeping Services for Small Medium Businesses

Experience Matters

Find bookkeeping services for small medium businesses that really understand your industry and the unique challenges you face. Experience like that makes a big difference.

Tech Savvy Bookkeepers

No matter if you use Xero, MYOB, or QuickBooks, your bookkeeper should know their way around the software. Good bookkeeping services for small medium businesses need bookkeepers who can handle the tech without fuss, so your accounts stay on track.

Communication is Key

A good bookkeeper doesn’t keep you guessing. They’ll break down your financial reports in plain language and check in regularly. That way, you always know what’s going on with your business money.

Benefits of Outsourcing Bookkeeping Services for Small Medium Businesses

Save Time and Focus on Growth

Bookkeeping services for small medium businesses free up your time, so you can focus more on your customers and growing your business.

Reduce Costs and Errors

Having professionals handle your books means fewer costly mistakes and less need for expensive corrections down the track.

Access to Expertise

Using bookkeeping services for small medium businesses like Numberfied means you get access to experts who know Australian tax laws inside out. This keeps you compliant and saves you from unnecessary hassles down the track.

Real-Life Stories: How Numberfied Helps Australian Businesses

Sarah’s Cafe Success

Sarah was drowning in paperwork and bookkeeping before she found Numberfied’s bookkeeping services for small medium businesses. Now, her finances are organised and up to date. This has helped her confidently expand her menu and focus on her customers.

Tom’s Construction Business

Tom spent hours each week trying to keep his books straight. After outsourcing to Numberfied, he saved time and stress. With clear financial reports, he managed his cash flow better and took on bigger projects with confidence.

Laura’s Online Retail Store

Laura struggled to keep up with her sales and expenses. Numberfied stepped in and made her bookkeeping simple. They helped her claim all the deductions she was entitled to, which boosted her profits nicely.

Tips to Maximise Your Bookkeeping Services for Small Medium Businesses

Keep Your Records Updated

Send your receipts and invoices as you get them. Don’t let them pile up. This way, bookkeeping services for small medium businesses can keep things moving without hold-ups.

Regular Reviews and Meetings

Try to catch up with your bookkeeper every month or every few months. Talk about how things are going and what your goals are. It helps keep your business steady.

Leverage Technology

Cloud accounting software is handy. It keeps your financial info all in one spot and easy to check anytime you want. Makes life easier for you and your bookkeeper.

Conclusion

Bookkeeping services for small medium businesses aren’t just about crunching numbers – they’re there to help your business grow. With the Numberfied team on your side, you get clear, accurate, and timely financial management that takes the stress off you. If you’re ready to make your finances easier to handle and focus on what really counts, head to Numberfied.com https://numberfied.com/au/ today and find out how we can help your business succeed.

Also Read: 10 Must-Know Outsourcing Benefits That’ll Turbocharge Your Australian Business

FAQs

1. So, what do bookkeeping services for small medium businesses actually do?

Basically, they keep tabs on all your money – what comes in and what goes out. It’s sales, bills, wages, all that jazz. Keeps your records tidy so you’re not guessing where your business stands.

2. Why should small and medium businesses bother with bookkeeping services?

Well, it stops you from stressing when tax time rolls around. When your books are in order, you avoid nasty surprises and can make better choices for your business.

4. Can these services help with tax stuff?

For sure. If your records are neat and up-to-date, tax returns become way easier, and you’re less likely to get fined by the tax office.

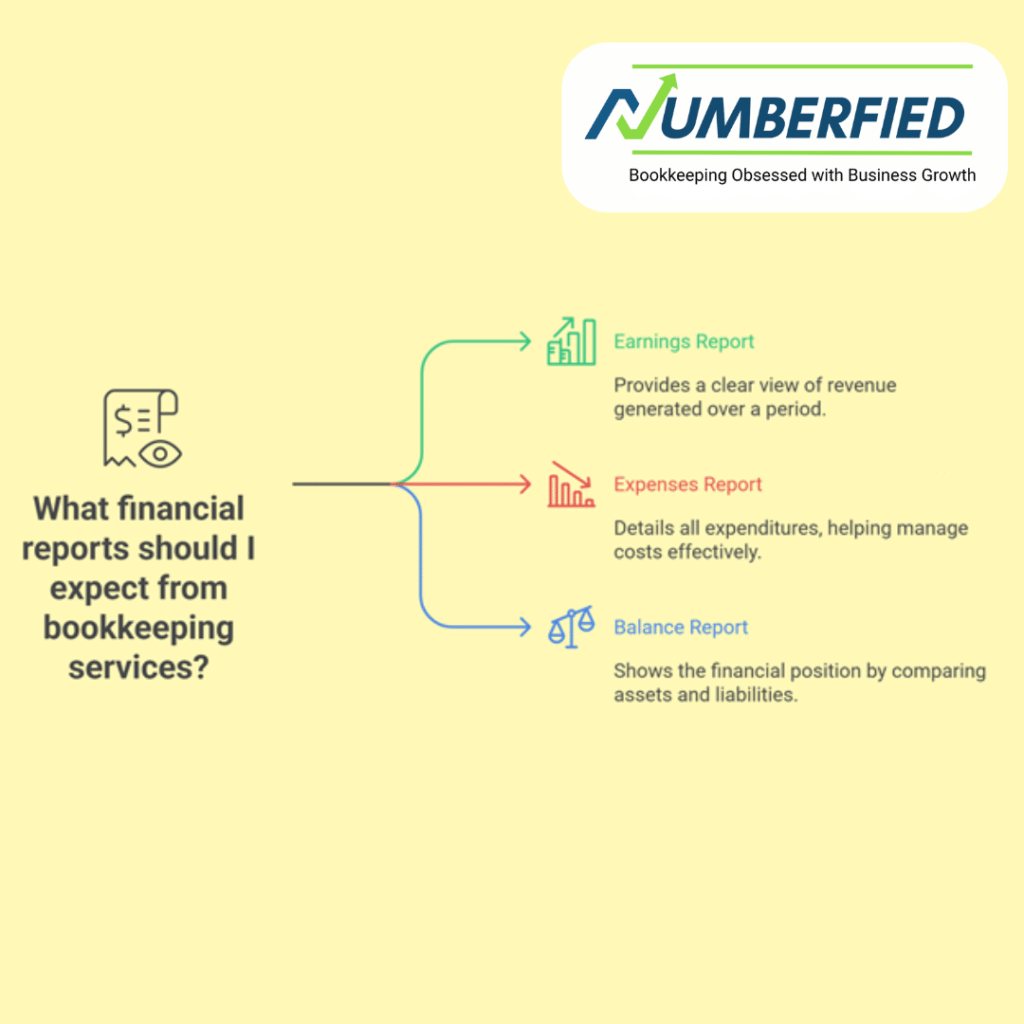

5. What reports do bookkeeping services provide?

You’ll get reports showing what you’ve earned, what you’ve spent, and what’s left. It gives you a clear idea of how your business is doing financially.

7. Are bookkeeping services pricey for small medium businesses?

Costs depend, but many find it saves money in the long run by cutting mistakes and freeing up time to focus on business.

8. How do I pick the right bookkeeping service?

Look for someone who gets your business type and knows the software you use. It helps if they’re easy to talk to and have good reviews.

9. Can bookkeeping services help me grow my business?

Absolutely. When you know exactly where your money’s going and coming from, you can plan for growth with confidence.

10. What happens if I don’t keep proper bookkeeping?

You risk making costly mistakes, missing tax deadlines, and losing track of your cash flow – which can cause big headaches later.