Introduction

Hello there! We’re the team at Numberfied, thrilled to share our insights on a question we hear often: “How much do people pay for accounting services?” Specifically, understanding how much accounting services cost is key to making smart financial choices, whether you’re a small business owner in Brisbane or an individual in rural Victoria. In Australia, where tax compliance and financial clarity are essential, knowing these costs helps you avoid surprises and invest in support that grows your wealth. This guide, based on our years of helping clients nationwide, offers clear, practical advice to empower you. Let’s explore what shapes these costs and how Numberfied can make your financial journey smoother.

Why does this matter? Accounting fees aren’t just expenses- they’re investments in peace of mind and growth. From sole traders lodging simple returns to companies managing complex GST, getting the right support saves time and money. We’re excited to break it down, so you can choose services that fit your needs. Ready? Let’s dive into the details.

Key Takeaways on How Much Accounting Services Cost

- Hourly Rates: Accountants typically charge $100-$300 an hour while bookkeepers often charge $40-$70.

- Service Costs: Basic tax returns typically range between $150 to $1,000 while monthly bookkeeping begins at $250.

- Location Impact: Fees in Sydney and Melbourne tend to be 10-20% higher than fees charged in regional areas.

- Tech Savings: Tools like Xero reduce preparation time, lowering your bill.

- Hidden Value: Good accountants find deductions that often exceed their fees.

- Next Step: Numberfied offers custom quotes to match your unique needs.

The Basics: What You Need to Know About How Much Accounting Services Cost

At Numberfied, we work with clients across Australia, and we’ve seen how accounting costs vary. In 2025, with ATO rules tightening, professional help is more valuable than ever. This section covers the essentials to help you plan.

What Drives Accounting Fees?

Several factors determine how much accounting services cost. Location is a big one- firms in cities like Sydney charge $150–$350 per hour due to higher overheads, while regional areas like Tasmania average $100–$200. The accountant’s experience also matters: a junior might bill $80–$150, but a CPA with tax expertise charges $200–$350 for complex work.

Your business size affects costs too. Sole traders pay less for basic tax returns than companies needing ASIC reports. Timing plays a role- rush jobs during tax season (July–October) can add 15–20% to fees. Knowing these helps you budget smarter.

Hourly Rates vs. Fixed Fees: What’s Best?

When exploring how much accounting services cost, billing models matter. Hourly rates ($100–$300) suit one-off tasks like audits but can climb if work takes longer than expected. Fixed fees, like $300–$800 for tax returns, offer predictability, which we at Numberfied love for clients who value certainty. For businesses needing regular BAS or payroll, retainers ($500–$1,500/month) often save 10% compared to hourly billing.

Why Accounting Is Worth the Cost

Paying for accounting might feel like a stretch, but it’s a safeguard against costly mistakes. ATO penalties for late lodgements start at $222, and errors can cost thousands. A good accountant spots deductions- like work-related travel- that save $300–$600 per return. At Numberfied, we focus on strategies that make your fee an investment, often returning more than it costs.

Service Breakdown: How Much Accounting Services Cost for Common Needs

Let’s look at how much accounting services cost depend on complexity, but bundling multiple services often reduces the overall price. Whether you’re an individual or a business, this section has you covered.

Tax Returns: From Basic to Business

Tax returns are a core service, and their cost varies by complexity. Individuals with a single income pay $150–$300 for a straightforward return, especially if using myGov tools. Sole traders face $300–$600 due to business income tracking. Companies with financial statements pay $800–$2,000.

At Numberfied, we use digital tools to streamline data collection, keeping fees competitive. Plus, we hunt for deductions- like home office expenses- that often save more than our fee.

Bookkeeping and Payroll: Ongoing Costs

Bookkeeping keeps your records tidy, with monthly packages costing $250–$800 based on transaction volume (under 100: $250; 500+: $600). Hourly catch-up work runs $40–$70, but regular packages prevent costly clean-ups.

Payroll for small teams (1–5 staff) costs $50–$150 per run, covering super and PAYG. Numberfied’s bundled packages ($400–$1,000 quarterly) ensure compliance without stress, saving you time for your business.

BAS and GST: Compliance Costs

GST-registered businesses file quarterly BAS, costing $120–$250 per lodgement. Annual reconciliations add $200–$500. High transaction volumes, like in e-commerce, increase fees due to data matching. Using Xero automates this, cutting prep time. Numberfied’s BAS packages start at $150, helping you claim credits and stay ATO-compliant.

City vs. Country: How Much Accounting Services Cost by Region

Australia’s regions have unique pricing dynamics. As a national firm, Numberfied sees these differences daily. Here’s how much accounting services costs stack up.

Sydney and Melbourne: Higher Fees, Higher Value

In these cities, how much accounting services cost reflects urban demand- hourly rates hit $180–$350, and tax returns range from $250–$1,200. Bookkeeping for medium businesses costs $500–$1,500 monthly. The premium comes from experienced pros navigating competitive markets. Numberfied keeps costs fair with fixed packages, delivering city expertise to all.

Brisbane, Perth, Adelaide: Mid-Range Options

Hourly rates in Brisbane and Perth range between $140-$250 an hour with tax returns between $200 and $800 respectively for startups while Adelaide provides lower rates ($120-222). Numberfied tailors services specifically to each local industry – such as Perth’s mining sector – to ensure maximum relevance.

Regional Areas: Budget-Friendly Expertise

Rural Australia sees hourly rates of $100–$200, with tax returns at $150–$400. Virtual services eliminate travel add-ons ($50–$100). Numberfied’s remote support delivers urban-quality advice at regional prices, perfect for farmers or small-town retailers.

What Impacts Your Bill? Key Drivers of How Much Accounting Services Cost

Beyond service type, specific factors shape your final invoice. Understanding them helps you control expenses.

Your Business Structure Matters

Sole traders spend $500–$1,500 annually on accounting, while companies with trusts or audits pay $2,000–$5,000. Multiple entities can double costs. Numberfied reviews structures to simplify, saving you money.

Accountant Expertise and Qualifications

CPAs charge 20–30% more ($200–$350/hour) than tax agents ($80–$150) for strategic advice. Their expertise often saves thousands via tax planning. Start with agents for basics, then upgrade as needed- Numberfied guides this transition.

Transaction Volume and Timing

High-transaction businesses, like online stores, pay $600+ monthly for bookkeeping. Filing outside peak season saves 10–15% on rush fees. Track records digitally to ease year-end work, a tip we share with all clients.

Saving Money: Tips to Reduce How Much Accounting Services Cost

We love helping clients keep costs down without cutting quality. Here are proven ways to save.

Use Technology to Streamline

Software like Xero or MYOB ($30–$60/month) automates data entry, reducing billable hours by 20–30%. Numberfied trains clients to use these tools, boosting efficiency and cutting fees. It’s a small upfront cost for big savings.

Pick the Right Firm for Your Needs

Mid-sized firms like Numberfied offer expertise at better rates than large firms. Solos may charge less ($80/hour) but lack capacity for complex work. Compare three quotes and bundle services for 10–20% discounts.

Plan Ahead and Bundle Services

Early tax prep avoids rush fees. Bundling tax, BAS, and bookkeeping saves 15–20%. Numberfied’s annual retainers lock in rates, protecting against price hikes and ensuring predictable budgeting.

When to Spend More: The Value of Premium Accounting

Higher fees can deliver outsized returns. We help clients spot these moments.

Strategic Advice That Saves Big

Tax planning ($500–$1,500/session) unlocks incentives like R&D credits, saving $10,000+. For businesses expanding, this advice is critical. Numberfied’s team focuses on strategies with clear ROI.

Audits and Compliance Protection

Audits ($1,000–$3,000) prevent fines of $20,000+ from ATO errors. Our proactive compliance packages ($800/year) keep you safe, blending affordability with security.

Building Long-Term Wealth

Ongoing accounting isn’t just about compliance- it’s about growth. Deduction strategies save $2,000+ annually, and forecasting supports smarter investments. Numberfied’s plans turn fees into future gains.

Conclusion: Take Control of Your Finances with Numberfied

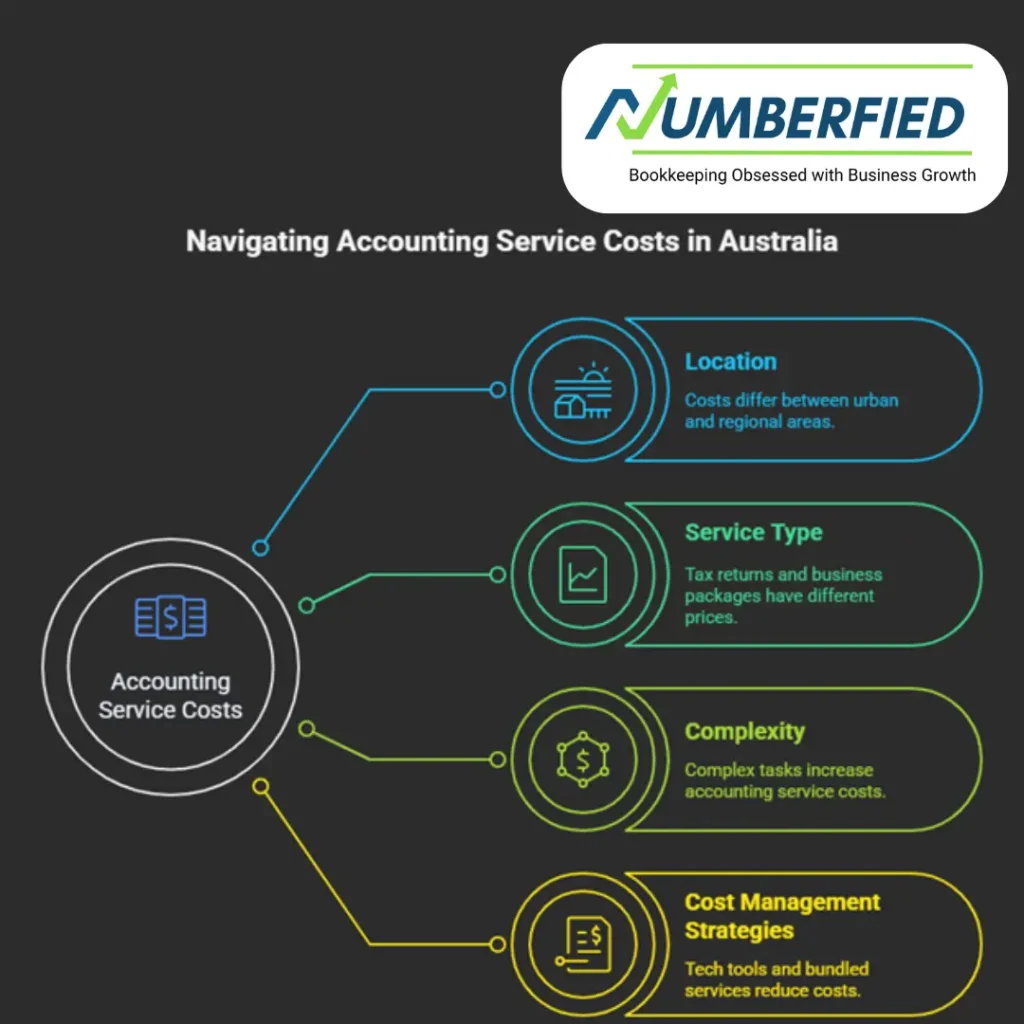

We’ve explored how much accounting services cost across Australia, from $150 tax returns to $1,500 monthly business packages. Costs vary by location, service, and complexity, but smart choices like tech tools and bundled services keep them manageable. At Numberfied, we’re passionate about making these numbers work for you, whether you’re in bustling Melbourne or a quiet regional town.Visit https://numberfied.com/au/ for a tailored quote. Let’s make your finances joyful and stress-free together.

FAQs

Are You Wondering How Much Accounting Services Costs in Australia?

A basic tax return typically costs $150-$300 depending on deductions such as work expenses; sole traders typically incur higher costs due to extra paperwork associated with business records. At Numberfied, our experts search deep to uncover every eligible deduction available – often saving more than our fee itself while making the entire process straightforward and worry free for our clients!

Do accountant rates depend on qualification?

Yes. For basic tasks, less experienced accountants generally charge $80-$150 an hour while CPAs with deep tax knowledge charge $200-$350; these higher fees often pay dividends when finding credits that were overlooked earlier on in your financial reporting cycle. At Numberfied we work to match you up with an expert to match both price and expertise for optimal accounting services costs depending on their level of experience – helping you understand exactly how much accounting services cost depending on experience levels.

Should small businesses opt for fixed fees or hourly billing?

Firm fees (usually around $500-$1,500 yearly for tax and BAS filing), provide budget certainty over hourly billing which varies wildly, as do hourly rates that range between $100 and $300 an hour – our Numberfied packages lock costs down with regular check-ups so as to minimize surprises when considering accounting services cost for your business.

Why do accounting fees cost more in big cities such as Sydney?

Sydney office costs and demand for skilled professionals increase hourly rates between $180-$350 an hour while regional areas charge $100-$200; Numberfied offers city expertise at fair prices so all can access professional accounting services regardless of where they’re based – which affects how much accounting services cost throughout Australia overall.

outsourcing bookkeeping for new businesses?

Absolutely. Bookkeeping services start from $250 monthly for small transaction volumes, with hourly rates from $40-$70 for catch-up services. Xero can save both time and money. With Numberfied startup plans including training to manage simple tasks yourself while we handle compliance for reduced long-term costs; how much accounting services costs manageable during early growth stages.

What factors contribute to business tax returns being more costly than individual ones?

Complex structures, trusts or high sales volumes make business returns significantly more expensive compared to individual returns (average costs range between $800-$2,000 for businesses vs $300 for individuals) plus extra reporting such as ASIC filings can add extra costs; with technology tools to streamline and minimize fees while still guarantee accuracy helps understand how much accounting services cost for both entities vs individuals more clearly.

How much does payroll cost for a team of five employees?

Its Payroll costs generally run between $50-$150 per pay cycle or $200-$500 quarterly when including super and tax compliance compliance costs. Numberfied integrates seamlessly with payroll apps so as to minimize errors while keeping costs consistent as your team grows – it’s an affordable peace-of-mind investment and serves as an indicator for how much accounting services cost ongoing operations.

Are Accounting Fees Tax-Deductible?

Yes, tax preparation and compliance expenses can be claimed as deductions on tax returns and expenses lists. Sole traders typically claim 100% while businesses list expenses accordingly. Numberfied helps track these savings to maximize savings up to 30% through GST credits alone!

When does a retainer make sense for accounting needs?

For businesses filing BAS quarterly or needing ongoing advice, retainers ($500-$1,500 per month) can save 10-15% in comparison with hourly rates. Numberfied customises their retainers according to your workload with flexibility for growth as necessary – perfect for companies wanting predictable costs and greater control over how much accounting services cost month over month.

How Can Numberfied Reduce my Accounting Expenses?

Our use of technology like Xero allows us to cut expenses by 15-20%; bundle services together for 20% savings, and plan ahead in order to avoid ATO fines. Custom plans start at highly competitive rates while free audits often lead to immediate gains. Visit https://numberfied.com/ for a comprehensive view on how much accounting services cost today.