Introduction

Running an Australian business means keeping your finances sharp while you chase growth. At Numberfied, we see owners across the country wrestling with the same question: should you go offshore or stick local for bookkeeping? The answer shapes how smoothly your cash flow runs, how safe your data stays, and how much time you get back each week. In this guide, we lay out the real differences between offshore vs local bookkeeping services, point out the wins and the watch-outs, and help you pick the path that fits your operation. Whether you’re a tradie in Brisbane or a retailer in Adelaide, the right setup keeps you compliant and in control.

Quick Wins from This Guide

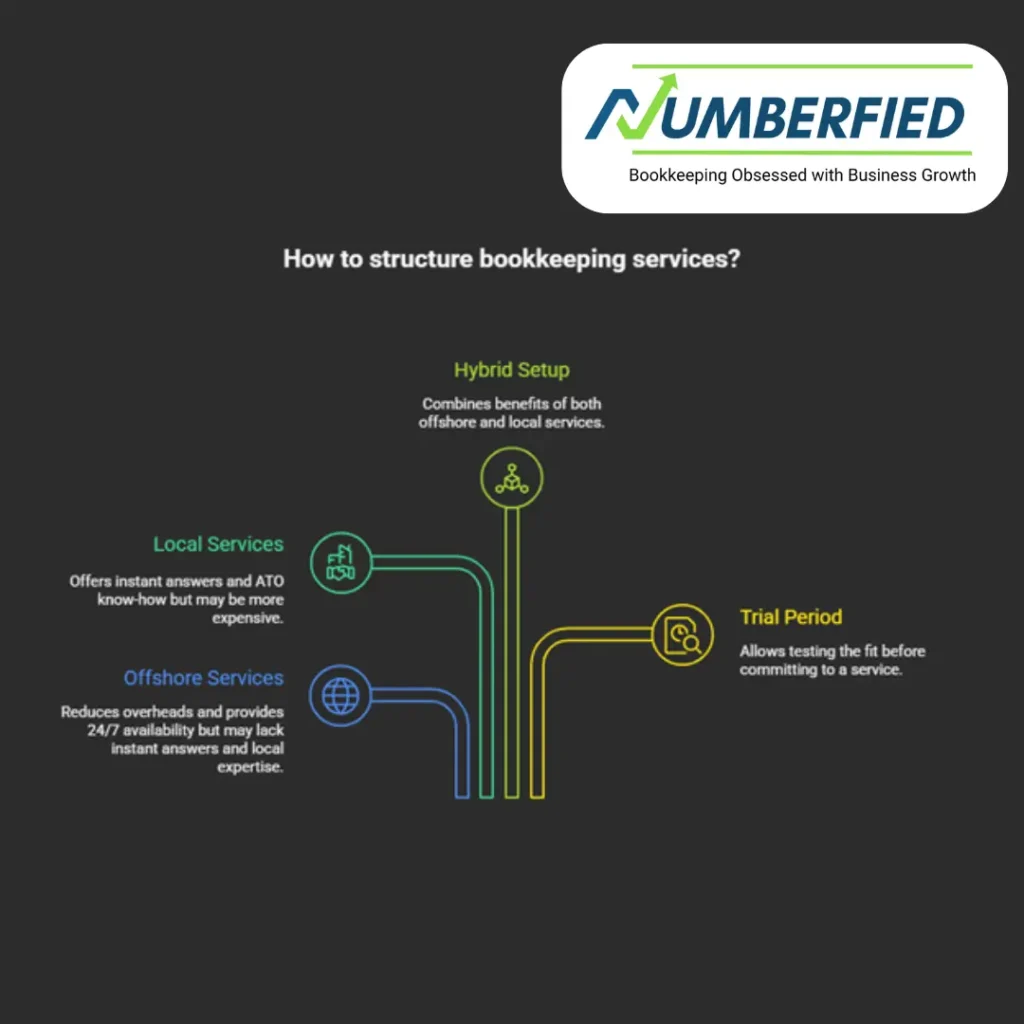

- Offshore cuts overheads and runs 24/7; local delivers instant answers and ATO know-how.

- Compliance stays rock-solid when you choose trained teams and clear contracts.

- Cloud tools make distance irrelevant- accuracy depends on people, not postcode.

- A hybrid setup of offshore vs local bookkeeping services often gives the best of both worlds without the headaches.

- Start with a trial period to test fit before you commit.

What Offshore and Local Bookkeeping Actually Mean

Offshore bookkeeping sends your invoices, receipts, and payroll to a team outside Australia- usually the Philippines, India, or Eastern Europe. They work through secure cloud platforms and follow your instructions to the letter. Local bookkeeping keeps everything in Australia: your provider could be down the road in Perth or across the country in Sydney, but they’re on the same tax calendar and speak the same regulatory language.

Australian businesses turn to both models for different reasons. Startups chasing every dollar often test offshore first. Established firms with complex BAS or industry-specific rules lean local. The choice boils down to volume, urgency, and how much hand-holding you need.

Tasks Handled Offshore

Data entry, bank feeds, creditor payments, payroll runs, basic reports. All done overnight if you’re on the east coast.

Tasks Handled Locally

Everything offshore covers, plus on-demand advice, face-to-face catch-ups, and direct liaison with your accountant at tax time.

Why Location Still Matters

ATO deadlines don’t shift for time zones. Local teams lodge BAS the day it’s due; offshore needs tight checklists to hit the same mark. That’s why understanding offshore vs local bookkeeping services helps you plan smarter.

Why Offshore Bookkeeping Works for Some Australian Businesses

Lower labour rates overseas translate into real savings. A growing e-commerce store in Melbourne can process thousands of transactions each month without blowing the budget. Time zones become an asset- upload today, wake up to reconciled accounts tomorrow. Scalability is built in: add hours or headcount without local hiring delays.

Our clients who choose offshore tell us the biggest win is predictability. Fixed scopes mean no surprise invoices, and cloud dashboards let them check progress anytime.

Straight Cost Benefits

You pay for the work, not the office or the super guarantee. The difference funds marketing or new stock.

Round-the-Clock Workflow

West coast businesses finish at 5 pm; their offshore team starts at 8 am local time. Work never sleeps.

Easy Ups and Downs

Peak season coming? Ramp up capacity for three months, then scale back. No awkward conversations.

Where Offshore Bookkeeping Can Trip You Up

Distance can slow urgent fixes. A payroll glitch at 4 pm Friday needs a same-day answer- offshore might mean Monday. Compliance gaps appear if the provider hasn’t kept pace with the latest ATO ruling. Data security relies on encryption and access logs; one weak link and you’re exposed.

Keeping ATO Happy from Afar

Contracts must spell out GST codes, STP filing, and super calculations. Regular spot-checks catch drift early.

Communication That Actually Works

Set daily stand-ups or shared Slack channels. Async updates beat waiting for email threads.

Locking Down Your Numbers

Demand ISO 27001 certification and two-factor logins. Run penetration tests quarterly.

The Clear Strengths of Local Bookkeeping

Nothing beats picking up the phone and getting an answer in your accent, your time zone. Local bookkeepers know the difference between a cafe in Bondi and a quarry in Kalgoorlie. They spot deductible expenses you’d miss and flag cash-flow crunches before they bite.

Face-to-face meetings build trust. When your provider has met your team, they understand the rhythm of your business. That’s why local bookkeeping remains a powerful component of offshore vs local bookkeeping services.

Instant ATO Alignment

BAS lodged at 4:59 pm on the 28th? Done. No currency conversion, no translation layer.

Advice That Saves Tax

Local eyes catch industry-specific claims- think instant asset write-offs for tradies or R&D concessions for tech firms.

The Downsides of Staying Local

Australian wages and rent push fees higher. A solo bookkeeper in a regional centre might juggle too many clients during EOFY. Growth can outrun capacity- suddenly, you’re on a waitlist for extra hours.

Smart owners plan ahead: lock in capacity or blend in offshore vs local bookkeeping services for flexible support.

Price Tag Reality

You pay for proximity and expertise. Budget accordingly or negotiate fixed monthly retainers.

Regional Access Gaps

Alice Springs or Burnie options are thinner. Virtual local services are closing the divide.

Side-by-Side Cost Breakdown

Offshore usually starts lower and stays flexible- pay per transaction or per hour. Local often bundles compliance and advice into a monthly fee. Neither is inherently “cheaper” long-term; it depends on error rates and time saved.

Run a simple test: track your current bookkeeping hours for one month, multiply by your effective rate, then compare Offshore vs Local Bookkeeping Services. The gap usually surprises people.

Fee Models Explained

Offshore: task-based or hourly. Local: retainer or value-based.

Hidden Costs to Watch

Offshore- onboarding and quality control. Local- peak-season surcharges.

ROI Beyond the Invoice

Fewer corrections, faster decisions, less tax stress. Measure those.

Staying Legal Whichever Path You Take

The ATO doesn’t care where the work happens- you sign the return. Contracts must cover accuracy, deadlines, and privacy. Local providers carry BAS Agent registration; offshore partners need equivalent oversight.

Must-Have Contract Clauses

Error correction timeline, ATO lodgement responsibility, data retention policy.

Privacy Law Checklist

Australian Privacy Principles apply everywhere. Confirm offshore servers meet the standard.

Audit-Ready Records

Both models deliver if the process is documented. Cloud trails make this easy.

Tools That Make Location Irrelevant

Xero, MYOB, QuickBooks Online- pick one and both offshore and local teams plug in. Bank feeds pull transactions automatically. Approval workflows route invoices to your phone. Dashboards update in real-time for Offshore vs Local Bookkeeping Services.

Core Platforms for Australian Rules

Xero leads for ATO pre-fill. MYOB still rules for job costing.

Add-Ons Worth Adding

Dext for receipt capture, Spotlight Reporting for board packs.

Automation Roadmap

Start with bank rules, graduate to AI forecasts. Same path either model.

Real Stories from Australian Businesses

A Gold Coast tour operator doubled turnover and kept bookkeeping costs flat by going offshore for data entry and local for strategy. A Tasmanian manufacturer ditched spreadsheets for a local Xero specialist and shaved two days off monthly close.

Offshore Win

Sydney online retailer processed 10,000 orders monthly without hiring.

Local Win

Perth cafe group turned late BAS penalties into on-time refunds.

Hybrid Sweet Spot

Canberra consultancy runs payroll offshore tax local- best of both.

How Numberfied Fits Your Picture

We’re based in Fremantle but serve Australia-wide. Our model pairs offshore processors with Australian accountants who know your industry. You get overnight turnaround plus same-day advice. No lock-in contracts, just monthly rolling plans.

What You Actually Get

Clean books, ATO lodgements, growth reports, unlimited email support.

Compliance Guarantee

Every BAS reviewed by a registered BAS Agent before lodgement.

Next Step

Book a 20-minute scoping call at https://numberfied.com/. We map your needs and quote on the spot.

Conclusion: Your Decision Framework

Offshore vs local bookkeeping services both keep Australian businesses running- just in different gears. Offshore delivers speed and savings for routine work. Local brings nuance and immediacy for compliance and strategy. Most growing firms end up blending the two.

Ask yourself three questions:

- How many transactions do I process monthly?

- How often do I need same-day answers?

- What’s my risk tolerance for data overseas?

The answers point to your starting model. From there, trial for 30 days and adjust.

At Numberfied, we’re ready to build the exact mix that lets you sleep easy and grow faster. Head to https://numberfied.com/ and let’s get your books working for you, not against you.

FAQs

1. Which is cheaper, Offshore vs Local Bookkeeping Services?

Offshore starts lower because labour markets differ, but local often includes advisory that prevents expensive mistakes. Compare total cost of ownership: fees plus your time fixing errors. Many clients find hybrid splits the difference perfectly.

2. Can offshore bookkeepers lodge my BAS?

When comparing offshore vs local bookkeeping services, BAS lodgement is one key difference. Offshore bookkeepers can prepare the numbers, but only a registered BAS Agent in Australia can review and lodge them. At Numberfied, we manage that review in-house so the process stays seamless and fully compliant.

3. How do I know my data is safe offshore?

Data security is perhaps the biggest concern when weighing the options of offshore vs local bookkeeping services. Ensure your provider uses encrypted connections, tight access logs, and regular security checks. We go the extra step by running quarterly security tests and store all backups in secure data centres in Australia to meet the local standards for data protection.

4. What if I need an answer on a Friday afternoon?

Among the key differentiators between offshore vs local bookkeeping services is response time. A local bookkeeper can provide an immediate response to questions, whereas an offshore team often requires you to depend on after-hours availability or a contact person on location.

5. Will the ATO accept records prepared overseas?

Yes. The ATO accepts records prepared overseas under offshore vs local bookkeeping services, provided they’re accurate and accessible on request. Cloud accounting software timestamps every entry, creating an audit trail the ATO recognises and approves.

6. How long to switch providers?

Switching between offshore vs local bookkeeping services typically takes two to four weeks. This includes data migration, software setup, and a short parallel run. We handle the transition from start to finish to ensure your reporting deadlines stay on track.

7. Do local bookkeepers charge more in peak season?

Cost differences between offshore vs local bookkeeping services can appear during peak periods like EOFY. Some local firms raise rates seasonally, but at Numberfied, we offer fixed monthly pricing year-round to prevent surprise increases.

8. Can I start small and scale later?

Scalability is one of the main advantages in offshore vs local bookkeeping services. Start with basic bank reconciliations, then add payroll or management reporting as your business grows. Our flexible plans can expand or contract with just 30 days’ notice.

9. What software works best for both models?

Cloud technology bridges the gap between offshore vs local bookkeeping services. We recommend Xero for real-time collaboration, Dext for automated receipt capture, and Fathom for reporting. This same tech stack works whether your team is in Manila or Melbourne.

10. Why pick Numberfied over going direct offshore?

The best of both worlds in offshore vs local bookkeeping services means offshore pricing with Australian accountability. With Numberfied, you get one point of contact, one invoice, and zero compliance worries. Book a call at https://numberfied.com/ to see how our hybrid model delivers cost efficiency and full compliance.

Also Read: Why Accounts Receivable Outsourcing Services Will Skyrocket Your Australian Business