Introduction

Most business owners in Western Australia did not start their companies because they love reconciling bank statements at midnight or working out whether an employee’s shift attracts a 25% or 50% penalty rate. Yet that is exactly where many find themselves every week.

Outsourced accounting services in Perth and right across WA have changed that for hundreds of local businesses. Instead of trying to be an expert in tax law, payroll awards, and cloud software on top of everything else, you hand the entire finance function to a team that lives and breathes it every day.

We are Numberfied, a Fremantle-based practice working with owners from Kununurra to Esperance. We take care of the numbers properly so you can get back to running your business and enjoying your evenings.

What “Outsourced Accounting Services” Actually Means Day-to-Day

When you move to outsourced accounting services with us, these are the tasks we remove from your plate completely:

- Every bank transaction is coded the same day it appears

- Supplier invoices entered, matched to purchase orders, and queued for payment

- Customer invoices raised and emailed (or sent straight from your own system)

- Weekly or fortnightly payroll run with correct award rates, allowance, and deductions

- Superannuation paid to the right funds before the quarterly deadline

- BAS prepared, checked twi,ce, and lodged early

- Monthly reports that actually tell you what is going on, not just pages of numbers

You still see everything in real time. You still approve payments. You just never have to do the work yourself again.

Who We Work With Across Western Australia

Our clients include:

- Builders and tradies in Perth’s northern and southern corridors

- Medical and allied health practices from Joondalup to Mandurah

- Cafes, restaurants, and pubs from Fremantle to Margaret River

- Professional firms (lawyers, engineers, architects) in West Perth and the CBD

- Mining contractors and fly-in-fly-out support businesses in the Pilbara and Goldfields

- Retail stores and tourism operators in Broome, Exmouth, and Albany

- Family-owned manufacturing and transport companies throughout the South West

If you lodge a BAS, pay staff, or pay super, we already look after several businesses just like yours.

The Real Cost of Doing It Yourself

Consider a typical Perth business that turns over $1–5 million and employs five to fifteen staff members. Keeping the books in-house usually looks like one of these options:

- The owner does it after hours, 15–30 hours a month, which could be spent working

- A part-time or full-time bookkeeper’s salary + super + WorkCover + training + software

- An internal accountant has a significantly higher cost

Then add the hidden costs: late super penalties, incorrect penalty rates that lead to Fair Work claims, GST errors that trigger audits, and the simple fact that most internal staff are not tax specialists.

Outsourced accounting services in Perth typically deliver a senior accountant, payroll expert, and tax specialist combined for less than the fully loaded cost of one reasonable employee and with none of the risk.

How Payroll Is Handled

Western Australia has some of the most complex payroll rules in the country. Mining, hospitality, construction, health, and retail all have different awards, different allowances, and different penalty rate structures.

When you use our outsourced accounting services:

- Every employee is set up with the correct modern award or enterprise agreement

- Rosters, timesheets, or clock-in data flow straight into the payroll system

- Weekend, public holiday, overtime, and allowance calculations are automatic and correct

- Payslips go out on time, and employees can log in to view them anytime

- Single Touch Payroll events are sent to the ATO the moment payroll is finalised

- Super is calculated and paid well before the quarterly cut-off

We have processed payroll for FIFO workers on 2-and-1 rosters, for hospitality staff finishing at 3 am, and for medical receptionists on salaried contracts. Whatever your setup, we have done it before.

Management Reports That Actually Get Read

Most business owners we meet receive a standard profit-and-loss once a year from their tax accountant and nothing in between. That is not enough to run a modern business.

Every month you receive from us:

- A one-page summary in plain English highlighting the three things you most need to know

- Profit and loss compared to last year and to the budget

- Cash movement summary where money came in and where it went

- Aged debtors and creditors lists with notes on anything overdue

- Key ratios for your industry.

If something looks off, we call you before you even notice.

The Software and Security Behind the Service

We use only Australian-compliant, cloud-based software:

- Xero

- MYOB AccountRight Live

- QuickBooks Online

All bank feeds are automatic. All data is encrypted and stored in Australian data centres. You can log in from your phone, tablet, or computer and see exactly what we see, whenever you want.

Receipts and invoices are captured by taking a photo or forwarding an email; no more storing paper in shoeboxes.

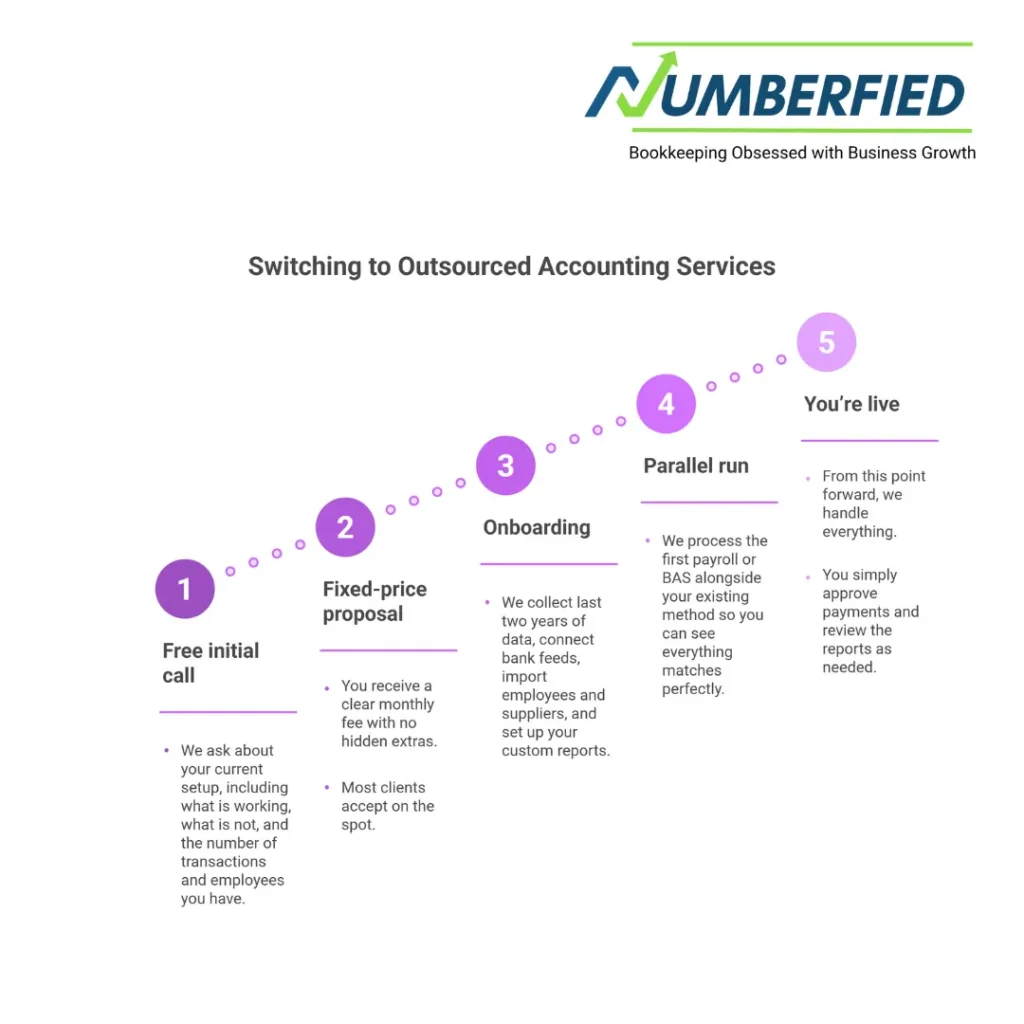

Switching to Outsourced Accounting Services

Step 1: Free initial call

We ask about your current setup, including what is working, what is not, and the number of transactions and employees you have.

Step: Fixed-price proposal

You receive a clear monthly fee with no hidden extras. Most clients accept on the spot.

Step 3 Onboarding

We collect the last two years of data, connect bank feeds, import employees and suppliers, and set up your custom reports.

Step 4:Parallel run

We process the first payroll or BAS alongside your existing method so you can see everything matches perfectly.

Step 5 You’re live

From this point forward, we handle everything. You simply approve payments and review the reports as needed.

Long-Term Advantages That Compound Over Time

After the first year, most of our clients notice:

- Cleaner data for bank finance applications (easier and faster approvals)

- Accurate job costing or divisional reporting that drives better pricing decisions

- Proper records for succession planning or eventual sale

- Zero ATO or Fair Work surprises

- Owners who finally take holidays without forwarding payroll spreadsheets to themselves

Conclusion

Outsourced accounting services in Perth and throughout Western Australia are no longer a luxury or something only big companies do. They are the simplest way for an owner to get senior-level financial expertise, iron-clad compliance, and genuine peace of mind without employing a full finance team.

If you are tired of doing the books yourself, worried about making a costly mistake, or simply want your weekends back, talk to us.

Visit https://numberfied.com/au/ and book a free, no-obligation call. We will tell you exactly what your monthly fee would be and how quickly we can take everything off your plate.

FAQ

How much time do I have to leave my bookkeeper before starting outsourced accounting services?

Most clients give 30–60 days to their existing provider, so the handover to outsourced accounting services is smooth and professional. We prepare a detailed handover checklist, contact your current accountant directly (with your permission), request all historical files, and make sure nothing is missed. We have never had a handover go wrong, even when the previous accountant was reluctant to release files.

Can you work with my existing Xero/MYOB/QuickBooks file when I transition to outsourced accounting services?

We almost always keep your existing file when you switch to outsourced accounting services and simply take over access. In the first two weeks, we review the chart of accounts, clean up any old errors, lock prior years to prevent accidental changes, and reorganise tracking categories so reporting becomes far more useful. Starting fresh is rarely necessary and would only happen if the current file were completely unusable.

What if I only want payroll outsourced and nothing else at the beginning of outsourced accounting services?

That is one of the most common ways businesses start with outsourced accounting services. Many clients begin with just payroll and BAS because those are the areas that cause the most stress and risk. Once they see how accurate and painless outsourced accounting services make those tasks (and how much time it saves), they usually transfer bookkeeping and reporting across within three to six months. You can add or remove services at any time.

Do you provide a backup person if my main accountant is away, once I’m using outsourced accounting services?

Every client file in our outsourced accounting services is known by at least two senior team members, often three. If your usual accountant is on leave or sick, another senior person steps in immediately and already knows your payroll deadlines, BAS due dates, and any special rules. You never experience a delay because one person is unavailable.

How do you handle WorkCover and payroll tax reconciliations for WA businesses?

As part of our outsourced accounting services, we reconcile WorkCover wages quarterly or annually (depending on your insurer) and prepare the annual reconciliation statement, so you avoid underpayment penalties. For payroll tax, we track the WA threshold monthly, lodge returns when required, and apply any regional concessions you are entitled to. Many clients receive unexpected refunds because previous calculations were conservative.

Can outsourced accounting services help with R&D tax incentive claims or export grants?

Yes, outsourced accounting services at Numberfied include preparing dozens of successful R&D tax claims each year for manufacturing, software development, engineering, and agricultural businesses. We also handle Export Market Development Grants and other state or federal grant applications from eligibility assessment through to lodgement and dealing with AusIndustry or Austrade on your behalf.

What about fuel tax credits for tradies and transport businesses with outsourced accounting services?

In our outsourced accounting services, we calculate fuel tax credits every BAS based on your actual fuel invoices or the best apportionment method (whichever gives the better result). Many tradies are surprised by how much they have been missing because their previous bookkeeper used a simple percentage instead of actual usage. We make sure you claim the maximum legitimate amount every quarter.

Do you attend my office, or is everything remote with outsourced accounting services?

Day-to-day outsourced accounting services are handled remotely for speed and efficiency, but we are always happy to visit your premises anywhere in the Perth metro area. We regularly travel to Osborne Park, Welshpool, Canning Vale, Jandakot, Mandurah, and Bunbury for onboarding meetings, training sessions, or annual planning days. Regional clients usually prefer video calls, but we have driven to Geraldton and Albany when needed.

How are software subscription costs handled when I use outsourced accounting services?

You pay the software company (Xero, MYOB, or Intuit) directly for your subscription, which typically costs $30–$80 per month, depending on the plan. When you join our outsourced accounting services, we are added as your advisor or partner at no additional cost to you. If you are currently paying for features you don’t need, we often downgrade your plan, saving you money from day one.

What are the youngest and oldest businesses you have taken on with outsourced accounting services?

The newest was a cafe that had only been trading for six weeks. We set up Xero from scratch as part of their outsourced accounting services, connected bank feeds, imported opening balances, and processed their first payroll and BAS. The oldest was a fourth-generation engineering firm using a manual cashbook since 1978. With outsourced accounting services, we converted 45 years of history into Xero, cleaned decades of errors, and now run everything in the cloud. There is no business too new or too established for outsourced accounting services to help.

Also Read: How Accounting Services Bookkeeping Can Transform Your Australian Business