Introduction

Outsourced accounts payable services help small businesses and finance managers in Australia streamline supplier payments, reduce processing errors, and improve cash flow. By delegating accounts payable (AP) tasks to expert providers using cloud accounting platforms like Xero, MYOB, and QuickBooks, companies can focus on growth while maintaining accurate and timely supplier relationships.

What are outsourced accounts payable services?

Outsourced accounts payable services are third-party solutions that manage the full AP lifecycle on behalf of a business. They handle tasks from invoice receipt and coding to approvals, payment execution, and reporting. Services can be delivered as a fully managed package or as targeted support for specific AP tasks.

Core services offered

Typical outsourced accounts payable services include:

- Invoice processing: capture, OCR, data entry, and validation of supplier invoices.

- Approval workflows: automated routing and digital approvals to speed up processing and maintain audit trails.

- Payment scheduling and execution: manage payment runs, bank uploads, and electronic payments (BPay, EFT, direct credit).

- Supplier management: onboarding, master data maintenance, dispute resolution, and payment terms negotiation.

- Reporting and analytics: cash flow forecasting, aged payables, spend analysis, and custom reports aligned with your accounting system.

Key Benefits

- Cost Reduction: Lower overhead by converting fixed payroll costs into variable service fees and reducing errors that lead to duplicate payments or late fees.

- Improved Efficiency: Faster invoice processing through standardized workflows, automation, and trained AP specialists.

- Enhanced Accuracy: Fewer manual entry errors and better matching of purchase orders, receipts, and invoices.

- Scalability: Easily handle seasonal fluctuations, growth, or acquisitions without hiring and training additional staff.

- Stronger Controls and Compliance: Segregation of duties, audit trails, and adherence to regulatory and internal policies.

- Better Cash Flow Management: Strategic payment scheduling and early-payment discount capture.

Typical Services Included

- Invoice receipt and capture (email, EDI, scanned paper)

- Optical Character Recognition (OCR) and data validation

- Three-way matching (invoice, PO, receipt) and exception handling

- Vendor statement reconciliation and inquiry management

- Payment processing (ACH, virtual cards, checks) and remittance

- Supplier onboarding and master data management

- Month-end close support and AP reporting

How the Process Works

Outsourced accounts payable services typically follow a clear process: capture incoming invoices, extract and validate data, match invoices to purchase orders or receipts, route exceptions for resolution, schedule and execute payments, and provide reporting. Many providers offer configurable SLAs, dashboards, and direct integration with ERP systems to ensure seamless end-to-end processing.

Security and Compliance

Security is a priority in outsourced accounts payable services. Providers implement access controls, encryption, secure file transfer, and SOC or ISO certifications. Audit-ready records, role-based access, and strong vendor verification processes help meet internal controls and regulatory requirements.

Pricing Models

Common pricing approaches include per-invoice fees, tiered monthly subscriptions, transaction-based pricing, or blended models. When evaluating cost, consider not just the fee per invoice but the potential savings from reduced errors, improved discounts captured, and lower internal overhead.

How outsourced AP supports Australian businesses

Outsourcing accounts payable delivers measurable benefits across operations and finance:

- Improved cash flow: Professional AP teams optimize payment timing, capture early payment discounts, and provide accurate forecasting to protect working capital.

- Fewer processing errors: standardised workflows, automated data capture, and reconciliation reduce human error and rework.

- Timely supplier payments: reliable payment scheduling strengthens supplier relationships and reduces the risk of late fees or disruption to supply.

- Scalability: services scale with transaction volume without the need to recruit or train in-house staff.

- Regulatory compliance and auditability: consistent processes and digital records support GST obligations and audit readiness.

Technology: Xero, MYOB, and QuickBooks

Modern outsourced accounts payable providers integrate with common cloud accounting platforms used across Australia:

- Xero: seamless invoice sync, bill payment, and reconciliation with strong reporting and workflow add-ons.

- MYOB: integration for bills, supplier management, and payment exports suitable for SMEs using MYOB Business or AE.

- QuickBooks: automated data capture and bank reconciliation combined with AP workflows and payments.

Integration with these platforms ensures accurate ledger posting, up-to-date supplier balances, and real-time visibility for finance managers.

Why outsourcing is cost-effective compared with in-house AP teams

Outsourcing accounts payable is often more cost-effective than maintaining an internal AP team, especially for small to medium businesses:

- Lower overheads: avoid salaries, superannuation, recruitment, training, and workspace costs.

- Variable pricing: pay for services based on transaction volumes rather than fixed staff costs.

- Improved productivity: specialised providers deliver faster processing and fewer errors, lowering total cost per invoice.

- Access to expertise: benefit from best-practice processes, compliance knowledge, and dedicated AP technology without investing in internal capability.

For many Australian businesses, the predictable fees and operational efficiencies of outsourced AP deliver a clear ROI within months.

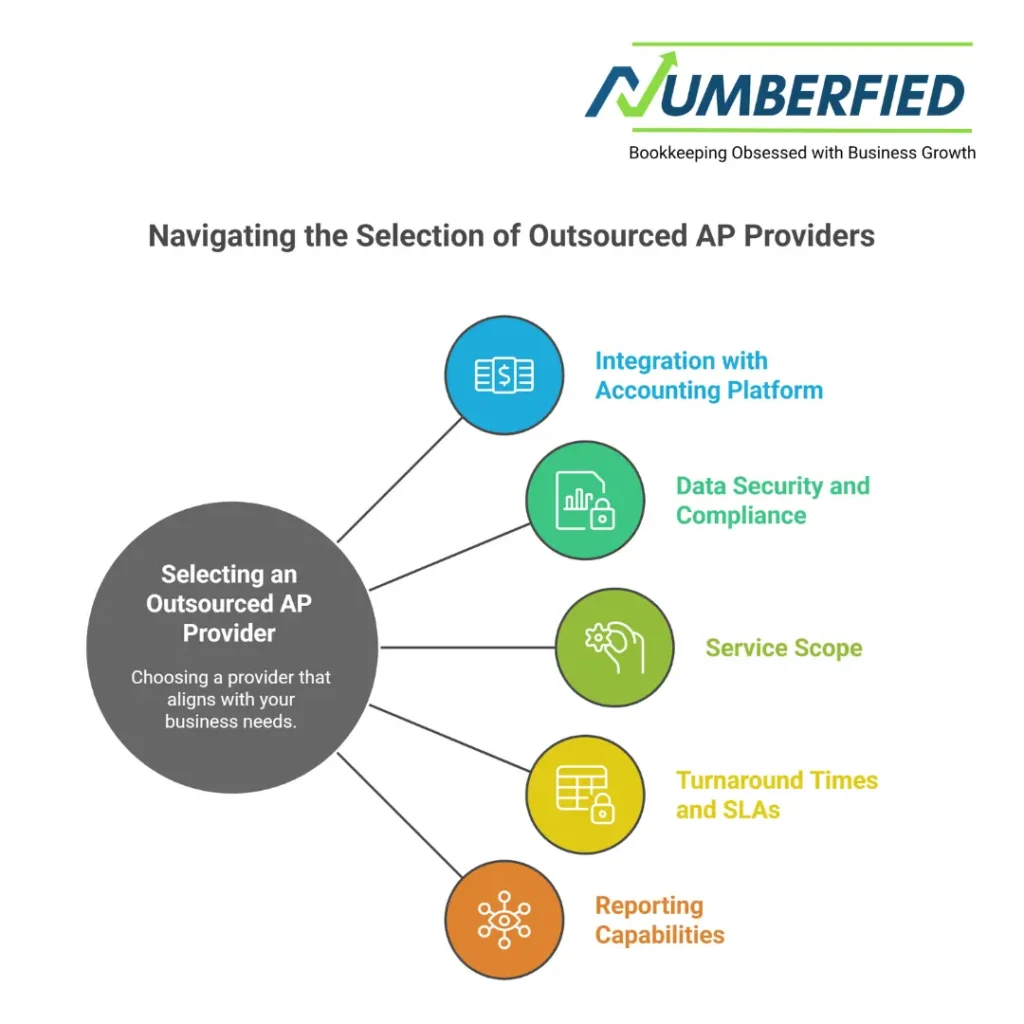

How to choose an outsourced accounts payable provider

Consider these factors when selecting a provider:

- Integration with your accounting platform (Xero, MYOB, QuickBooks).

- Data security and compliance standards (encryption, Australian data handling policies).

- Service scope: end-to-end AP vs. partial support.

- Turnaround times and SLAs for invoice processing and payment runs.

- Reporting capabilities and customisation to meet management needs.

Implementation and change management

Transitioning to outsourced accounts payable typically involves mapping your current process, setting up integrations, defining approval workflows, and training key staff. A phased approach minimises disruption:

- Discovery and process mapping.

- Pilot with a subset of suppliers or invoices.

- Full rollout and optimisation.

- Ongoing review and performance reporting.

Next steps for finance managers and business owners

Evaluate your current AP process, quantify costs and pain points, and request proposals from providers who integrate with Xero, MYOB, or QuickBooks. A short pilot will demonstrate improvements in cash flow, error reduction, and supplier satisfaction before committing to a longer contract.

Conclusion

Outsourced accounts payable services offer a practical, cost-effective solution for Australian businesses seeking better cash flow control, fewer processing errors, and reliable supplier payments. With the right provider and cloud accounting integration, AP becomes a strategic function that supports growth and financial stability.

Frequently asked questions

What are the top outsourced accounts payable services available in Australia?

Leading outsourced accounts payable services in Australia are provided by specialist bookkeeping and accounting firms that offer end-to-end AP management, including invoice processing, approvals, payments, and reporting. These providers typically integrate with Xero, MYOB, and QuickBooks and focus on compliance, security, and cash flow optimisation rather than generic data processing.

Which companies offer automated accounts payable outsourcing solutions?

Many Australian AP outsourcing providers use automation tools such as OCR invoice capture, workflow approvals, and cloud accounting integrations. These solutions are commonly delivered by firms specialising in outsourced finance, cloud bookkeeping, and managed accounting services rather than standalone software vendors.

How do I choose the best outsourced accounts payable provider for a small business?

Small businesses should choose a provider that offers Xero, MYOB, or QuickBooks integration, strong data security, transparent pricing, and scalable services. Look for providers that act as an extension of your finance team, offer clear SLAs, and understand Australian GST and compliance requirements.

What is the average cost of outsourced accounts payable services in Australia?

Costs vary depending on invoice volume and service scope. Most providers charge per invoice, via tiered monthly packages, or a fixed subscription. For small businesses, outsourcing is usually more cost-effective than hiring in-house AP staff due to lower overheads and fewer processing errors.

What benefits do Australian businesses get from outsourcing accounts payable?

Key benefits include improved cash flow management, fewer processing errors, timely supplier payments, stronger internal controls, and reduced operational costs. Outsourcing also improves audit readiness and allows businesses to scale without increasing headcount.

Are there accounts payable outsourcing services specialising in retail businesses?

Yes. Many Australian providers support retail businesses by handling high invoice volumes, supplier reconciliations, three-way matching, and payment scheduling. These services are often tailored to businesses with multiple suppliers and frequent purchasing cycles.

How do outsourced accounts payable services handle invoice processing and approval?

Invoices are captured digitally via email, scanning, or EDI, processed using OCR, validated, and matched to purchase orders or receipts. Automated approval workflows route invoices to authorised staff, creating a clear audit trail before payment execution.

Which outsourced accounts payable services support electronic payments in Australia?

Most outsourced AP providers support electronic payments such as EFT, BPAY, direct credit, and bank file uploads. Payment scheduling is aligned with cash flow forecasts and approval controls to ensure accuracy and compliance.

Where can I find reviews of outsourced accounts payable providers in Australia?

Reviews can be found on provider websites, Google Business profiles, LinkedIn recommendations, and independent business service directories. Case studies and testimonials from Australian businesses also help assess reliability and service quality.

Can I integrate outsourced accounts payable services with my existing accounting software?

Yes. Reputable providers integrate seamlessly with Xero, MYOB, and QuickBooks, ensuring accurate ledger posting, real-time visibility, and continuity of your existing accounting processes without replacing your current system.

Also Read: Why Outsourced Accounts Payable Services Are Your Aussie Business’s Secret Weapon