Introduction

G’day, Australian business owners! Let’s face it—running a business is like juggling flaming torches while riding a unicycle. Between keeping customers happy, managing stock, and sneaking in a coffee, who has time to wrestle with Business Activity Statements? That’s where outsourced BAS preparation comes in, saving you from tax-time tantrums and letting you focus on what you love.

At Numberfied, we’re not just about ticking boxes for the ATO—we’re your cheer squad, helping you grow, make smarter choices, and maybe even chuckle over a stray receipt. Let’s dive into why outsourcing your BAS is the game-changer your business needs.

What You’ll Learn

- Outsourced BAS preparation saves time and keeps you ATO-compliant.

- Pros catch errors and maximise deductions, saving you cash.

- Numberfied’s your growth partner, not just a paperwork pusher.

- Clear BAS records fuel better business decisions.

- Outsourcing frees you to focus on customers, not spreadsheets.

1. What Is BAS and Why Does It Matter?

The Business Activity Statement (BAS) is the ATO’s way of keeping tabs on your GST, PAYG, and other tax bits. It’s a regular report every Australian business with GST registration needs to lodge, and it can feel like a pop quiz you didn’t study for. Outsourced BAS preparation takes the stress off your plate.

BAS Basics for Beginners

BAS tracks your GST collected and paid, plus other taxes like PAYG withholding. Lodged quarterly or monthly, it’s how you settle up with the ATO. Miss it, and you’re in for fines. A pro handles this smoothly, so you don’t have to.

Why It’s a Big Deal

Accurate BAS lodgments keep you compliant and avoid penalties. They also give you a snapshot of your cash flow. Our mate Tom, a Sydney tradie, used his BAS insights to spot slow-paying clients and tighten his invoicing, boosting his bank balance.

The DIY Danger Zone

Doing your BAS yourself sounds brave, but it’s like cutting your own hair. One slip, and you’re overpaying GST or missing deductions. Outsourced BAS preparation ensures every dollar’s accounted for, no scissors required.

2. How Outsourced BAS Preparation Saves You Time and Money

Handing your BAS to pros isn’t just convenient—it’s a money-saving, stress-busting move. At Numberfied, we see outsourced BAS preparation as your ticket to more beach time and less spreadsheet time.

Fewer Hours, More Freedom

BAS prep can eat up days, especially if you’re digging through receipts. Outsourcing gives you back hours to charm clients or catch a wave. One client, a Melbourne baker, reclaimed 5 hours a quarter—enough to test new sourdough recipes!

Catching Costly Errors

Mistakes like double-counting GST or missing input tax credits can cost hundreds. Pros spot these gremlins. We helped a Brisbane cafe owner fix a $2,000 BAS error, saving them a fine and funding a new coffee machine.

Maximising Deductions

Your BAS is a chance to claim GST credits on business expenses. A bookkeeper knows what’s claimable—like that new laptop or fuel for deliveries—ensuring you don’t leave money on the table.

3. The Growth Boost from Outsourced BAS Prep

BAS prep isn’t just keeping the ATO happy—it’s a secret weapon for growth. Numberfied uses outsourced BAS preparation to give you insights that spark big wins.

Clearer Numbers, Smarter Moves

Your BAS data shows where your money’s going. Pros turn this into insights, like spotting high-cost suppliers. We helped an Adelaide retailer switch vendors, saving $3,000 a year—enough for a snazzy new sign.

Planning with Confidence

Want to hire staff or open a new shop? Accurate BAS records make budgeting a breeze. A Perth florist used her BAS reports to plan a second store, doubling her revenue without a hitch.

Scaling Without Stress

Growth is exciting but tricky. Outsourced BAS preparation ensures your taxes are sorted, so you can focus on big moves—like launching a new product—without worrying about ATO surprises.

4. Why Numberfied’s Your BAS Buddy

At Numberfied, we’re not your average bookkeepers. We’re here to make BAS prep easy, fun, and growth-focused, with a sprinkle of Australian charm.

More Than Just BAS

We don’t just lodge your BAS—we explain what it means for your business. Over a virtual coffee, we’ll walk you through your numbers, so you feel like a financial wizard without the pointy hat.

Tailored for Australian Businesses

From Darwin cafes to Tassie tradies, every business is unique. We customise our outsourced BAS preparation to fit your needs, ensuring you get the right support, no matter your size or industry.

A Laugh Along the Way

Tax stuff can be dry, but we keep it light. One client cracked up when we sorted their “miscellaneous pie expense” pile into proper BAS categories. Who says numbers can’t be fun?

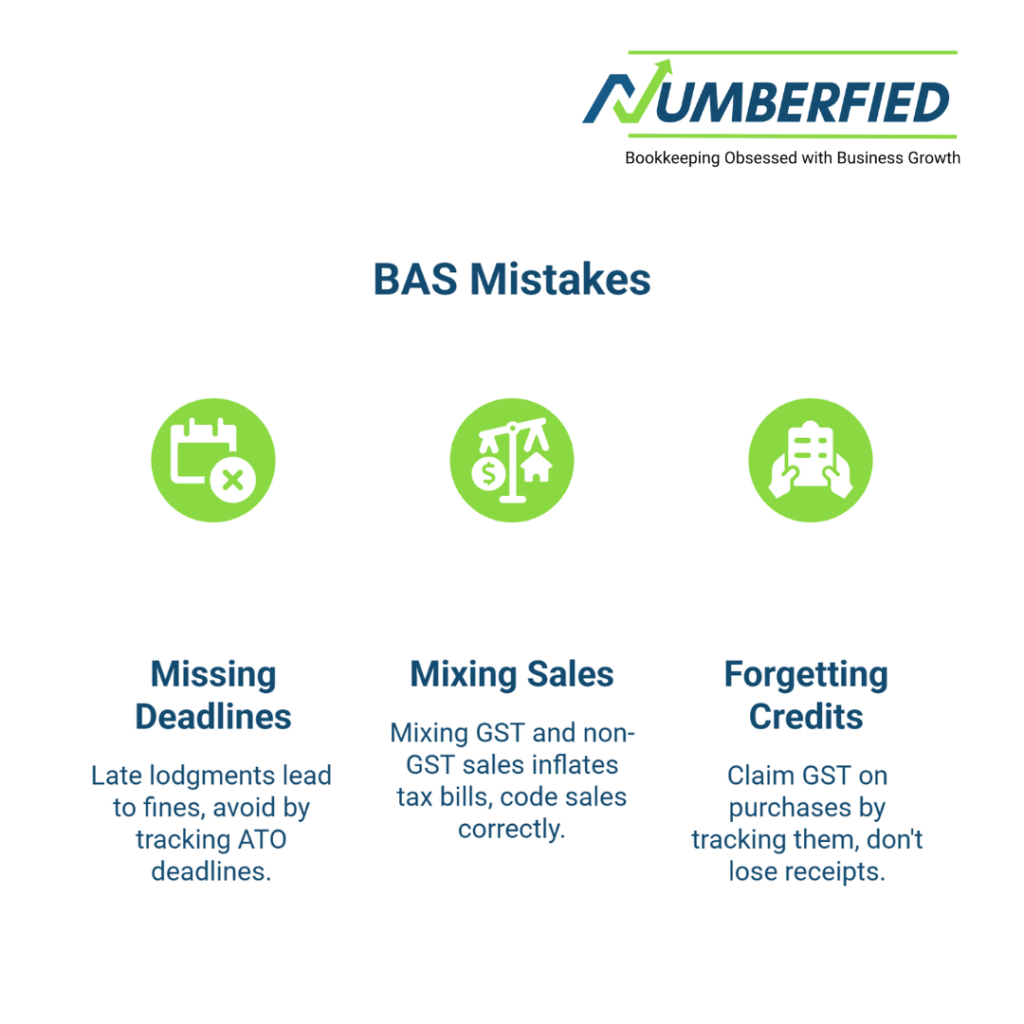

5. Common BAS Mistakes to Dodge

Even sharp business owners trip up on BAS. Outsourced BAS preparation helps you skip these pitfalls and keep your books sparkling.

Missing Deadlines

Late BAS lodgments can cost you hundreds in fines. Pros track ATO deadlines, so you’re never caught out. A Gold Coast gym owner avoided a $900 penalty thanks to their bookkeeper’s reminders.

Mixing GST and Non-GST Sales

Not all sales attract GST, and mixing them up can inflate your tax bill. A bookkeeper ensures every sale is coded right, saving you from overpaying. We caught this for a Canberra freelancer, saving them $1,200.

Forgetting Input Credits

You can claim GST on business purchases, but only if you track them. Losing receipts or miscoding expenses means missed credits. Outsourced BAS preparation keeps every claim on point.

6. How to Choose the Right BAS Prep Service

Not all BAS services are created equal. Here’s how to pick a winner for your Australian business.

Look for ATO Expertise

Your BAS prepper should know ATO rules like the back of their hand. Choose a service with certified bookkeepers who stay updated on tax changes, ensuring your lodgments are bulletproof.

Clear Communication

Nobody wants jargon. Pick a service that explains your BAS in plain English, like a mate at the pub. At Numberfied, we make sure you get your numbers without the headache.

Scalability Matters

Your business will grow, and your BAS needs will too. Choose a service that can handle monthly lodgments or complex GST as you scale, keeping your books ready for the big leagues.

Conclusion

BAS doesn’t have to be a buzzkill. With outsourced BAS preparation, you’re not just staying compliant—you’re unlocking time, money, and insights to grow your business. At Numberfied, we’ve seen Australian businesses go from BAS dread to business success with our help. From catching errors to spotting growth opportunities, we’re here to be your partner, not just your bookkeeper.

Ready to ditch the stress and make your numbers work for you? Give Numberfied a holler today—let’s make BAS your business’s new best mate!

Also Read: How a Bookkeeper Perth Can Supercharge Your Small Business

FAQs

Why is BAS preparation so critical for businesses?

BAS is your handshake with the ATO, reporting GST, PAYG, and more. Getting it right keeps you compliant and avoids fines that hurt. It also shows how your business is tracking financially. A Perth retailer dodged a $1,500 fine by lodging accurately. Mess it up, and you could overpay taxes or miss deductions. BAS prep saves time, letting you focus on customers. It’s not just paperwork—it’s peace of mind.

How often do businesses need to lodge BAS?

Most businesses lodge quarterly, but high-turnover ones do it monthly. Deadlines depend on your ATO cycle—usually 28 days after the period ends. A bookkeeper tracks these, so you don’t miss out.

Can’t software handle BAS prep?

Software like MYOB helps track transactions, but it’s not a brain. It won’t catch errors or spot claimable credits. A bookkeeper ensures your data’s right before lodging. Software’s a tool; pros make it work magic. Without expertise, you’re risking mistakes that cost you.

How does BAS prep ensure ATO compliance?

BAS prep tracks your GST, PAYG, and other taxes accurately, meeting ATO deadlines. Pros organise receipts and code transactions to avoid audits. They also maximise deductions, saving you tax. Compliance keeps your business safe from penalties and ready for ATO scrutiny.

What businesses need BAS preparation?

Any GST-registered business must lodge BAS, from cafes to freelancers. Retailers report sales, tradies track expenses, cash or otherwise—BAS covers it all. Whether you’re solo or growing, BAS prep ensures your taxes are right and your records clear for growth.

How does BAS prep save money?

Pros catch errors, claim all GST credits, and prevent fines, putting cash back in your pocket. A Gold Coast client saved $1,200 by fixing a BAS overpayment. They also optimise expenses and spot trends, like high supplier costs. Accurate BAS records help you budget blowouts, ensuring you don’t overpay taxes or miss savings.

What happens if you miss a BAS deadline?

Late BAS can trigger fines of $200 and up, depending on your turnover. Repeated misses invite ATO audits, which are no party. Pros track deadlines to keep you safe. Missing deadlines also messes with cash flow tracking, hurting your planning. Stay on time to avoid stress.

How do you know if your BAS is accurate?

Accuracy comes from reconciling transactions, checking GST codes, and tracking credits. Errors like miscoded sales can inflate your tax bill. A pro bookkeeper reviews every detail to ensure it’s airtight. Clear reports show you’re on track, giving confidence for audits.

Can BAS prep improve cash flow?

Absolutely! BAS tracks GST and PAYG, showing your cash position. Pros spot issues like unclaimed credits or slow payers. Clear records help you plan for lean times or big buys, keeping your business steady. It’s a cash flow lifeline.

How do you start with a BAS prep service??

Find a service with ATO expertise and clear communication. Contact them for a chat about your business—they’ll assess your needs. Most offer tailored plans, from basic BAS to full bookkeeping. Look for services with flexibility to grow with you. Numberfied’s a great place to kick things off!!