Introduction

Cash flow remains one of the greatest daily pressures for Western Australian business owners because invoices frequently sit unpaid for extended periods while suppliers, payroll, and operating costs continue without pause. Across Perth and regional WA, offering 60- or 90-day payment terms has become standard practice in construction, mining services, wholesale and professional services, yet most SMEs lack the resources to manage these long cycles effectively. Outsourcing accounts receivable in Perth has emerged as a highly effective solution that shortens collection times, reduces overdue balances, and maintains strong customer relationships without adding internal workload or stress.

At Numberfied, our Fremantle-based team provides complete outsourcing accounts receivable in Perth for businesses throughout Western Australia. We take full responsibility for the entire invoice-to-cash process, so you receive payments weeks faster, benefit from accurate weekly forecasts, and finally remove the burden of chasing overdue invoices from your working week.

Key Advantages

- Average reduction in debtor days by 15–30 days within the first three months of partnership

- Professional and consistent follow-up that customers respect and respond to promptly

- Reliable cashflow forecasting that makes payroll and supplier payments predictable

- Complete elimination of internal time and emotional energy spent on collections

- Significant decrease in overdue invoices and exposure to bad-debt write-offs

Why Businesses Are Choosing Outsourcing Accounts Receivable in Perth

Extended Payment Terms Have Become Standard Practice

Securing contracts in Perth and regional WA often requires offering generous credit terms, particularly in project-based industries where 60- to 90-day terms are now expected, creating substantial working-capital gaps that most SMEs struggle to bridge.

Managing Collections Internally Carries Hidden Costs

Attempting to chase payments with existing staff diverts valuable hours into sending reminders and making difficult phone calls, while team members often hesitate to pursue customers they deal with regularly, resulting in inconsistent follow-up and steadily lengthening debtor days.

Professional Outsourcing Delivers Measurable Improvement

When an experienced external team assumes responsibility for receivables, follow-up becomes systematic, courteous, and remarkably effective, prompting customers to pay sooner and allowing your people to concentrate fully on service delivery and business growth.

When You Choose Outsourcing Accounts Receivable in Perth

Immediate Invoice Preparation and Dispatch

Invoices are created and sent the same day work is completed, using your exact branding, payment terms, and supporting documentation to ensure clarity and eliminate any reason for delayed payment.

Pre-Credit Assessment for New Customers

Fast yet thorough credit checks using trusted Australian databases are completed before terms are extended, preventing slow-paying clients from entering your debtor ledger in the first place.

Daily Monitoring with Structured Professional Follow-Up

Every invoice is actively tracked from issuance, with polite automated reminders sent at agreed intervals, followed by courteous phone contact at the optimum moment and escalation only when required and approved by you.

Same-Day Payment Receipting and Reconciliation

Payments are identified, matched, and allocated correctly in your accounting file the moment they appear in your bank account through daily automated bank feeds.

Comprehensive Dispute Handling and Resolution

Any customer query or dispute is investigated immediately, supporting evidence gathered, and a fair outcome negotiated while you remain fully informed and retain final approval on every credit note.

Your Day-to-Day Experience After Outsourcing Accounts Receivable in Perth

A Dedicated WA-Based Credit Controller

You are partnered with one experienced professional who takes time to understand your industry, customer base, and preferred communication style, becoming a true extension of your team.

Customer Communication That Strengthens Relationships

All contact remains polite, solution-focused, and branded as coming from your business, often leading customers to comment positively on the organised and professional approach.

Accurate Weekly Cashflow Forecasts

Every Monday, you receive a clear forecast of expected receipts for the next 30–60 days, broken down by customer and amount, providing genuine confidence for planning.

Insightful Monthly Performance Reporting

At month-end, you are provided with concise reports showing collection effectiveness, debtor-days trends, and plain-English commentary on any accounts requiring attention.

Technology That Powers Outsourcing Accounts Receivable in Perth

Seamless Integration with Your Accounting Software

Direct connections to Xero, MYOB, or QuickBooks Online keep all data in your own file with full real-time access from desktop or mobile at any time.

Intelligent Automated Reminder Workflows

Custom sequences send emails and SMS reminders exactly when required while automatically creating phone follow-up tasks for maximum effectiveness.

Branded 24/7 Customer Payment Portal

Customers can log in anytime to view outstanding invoices and settle instantly by credit card, BPAY, or direct transfer, often clearing balances the same day.

Concerns About Outsourcing Accounts Receivable in Perth

Customer Reaction to Professional Follow-Up

Experience shows customers pay faster and frequently appreciate the clear, respectful process rather than feeling pursued or pressured.

Maintaining Control and Visibility

You retain complete transparency with access to every communication and final sign-off on escalation steps while the proven system operates smoothly.

Suitability for Smaller Debtor Books

Many satisfied clients manage modest debtor ledgers where even a modest improvement in collection speed creates meaningful cashflow relief.

Results WA Businesses Achieve by Outsourcing Accounts Receivable in Perth

Substantial Reduction in Debtor Days

Most clients experience a 15–30 day drop in average debtor days within the first ninety days of partnership.

Lower Bad-Debt Exposure

Early and consistent intervention prevents small overdue balances from escalating into uncollectable debts.

Confident and Accurate Cashflow Planning

Stable payment patterns transform forecasting from guesswork into a reliable management tool.

Getting Started with Outsourcing Accounts Receivable in Perth

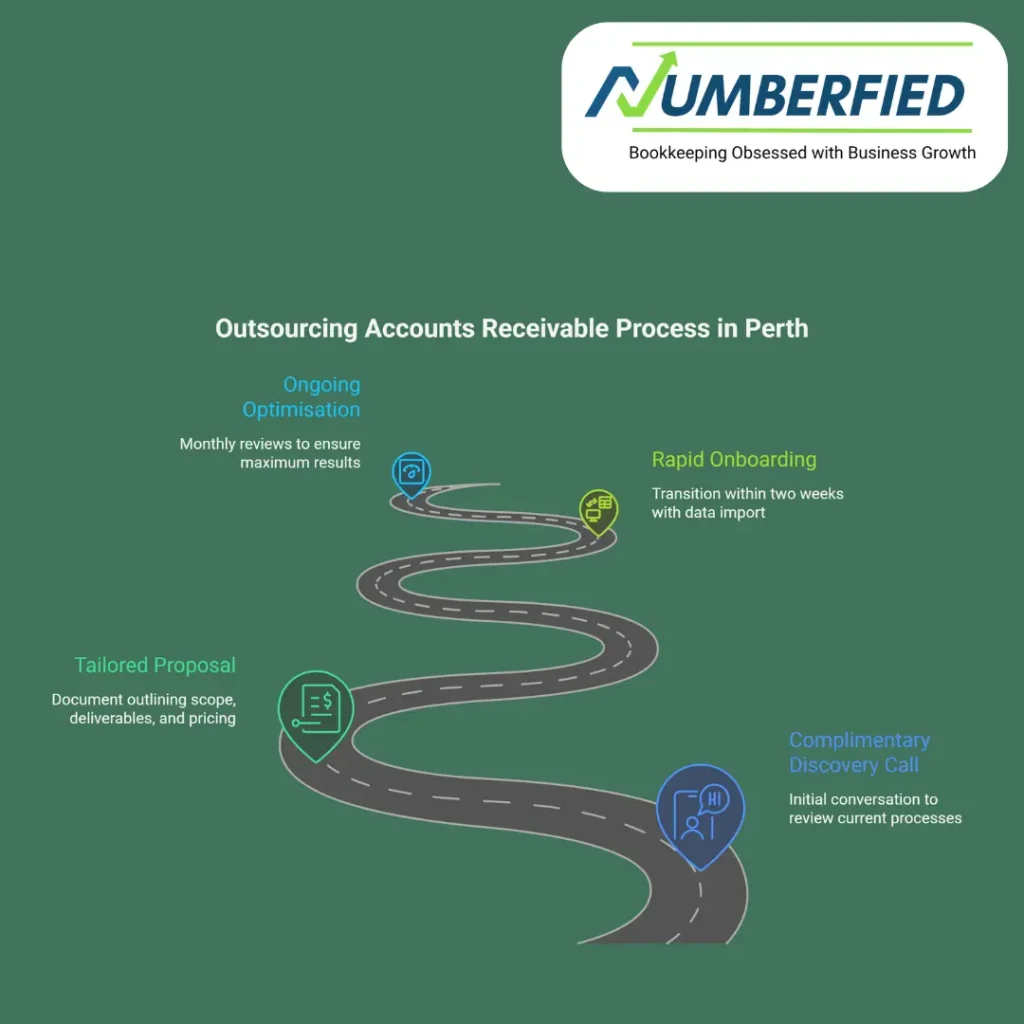

Step 1 – Complimentary Discovery Call

A relaxed 20–30 minute conversation to review your current process and identify immediate opportunities for faster collections.

Step 2 – Tailored Proposal

A clear document outlining scope, deliverables, and transparent monthly pricing with no lock-in contracts.

Step 3 – Rapid Onboarding

Complete transition within two weeks, including data import, template creation, and system connections with zero disruption to customers.

Step 4 – Ongoing Optimisation

Monthly reviews ensure the service continues to deliver maximum results as your business evolves.

Conclusion

Outsourcing accounts receivable in Perth provides Western Australian SMEs with a professional, scalable, and highly effective way to convert outstanding invoices into available cash significantly faster than managing the process internally. The combination of local knowledge, dedicated credit controllers, intelligent automation, and complete transparency delivers shorter debtor days, reduced risk, and the freedom to focus on growth rather than collections.

If slow payments are restricting your ability to meet obligations or seize opportunities, outsourcing accounts receivable in Perth with Numberfied offers the practical solution you need.

Visit https://numberfied.com/au/ today to arrange your free consultation and discover exactly how quickly your cash flow can improve.

Frequently Asked Questions

How quickly do businesses see better cash flow after outsourcing accounts receivable in Perth?

Most businesses begin receiving payments 10–20 days faster within the first four to six weeks. By the end of the third month, a consistent 15–30 day improvement is usually achieved as customers adapt to the structured follow-up and professional invoicing process.

Will customers know I am outsourcing accounts receivable in Perth?

All communication is issued using your business name, branding, and email addresses wherever possible. From the customer’s perspective, the only noticeable change is clearer invoices and more consistent follow-up, not external involvement.

Can you manage construction progress claims when outsourcing accounts receivable in Perth?

Yes, we manage progress claims, variations, retention monies, and release schedules in line with the Security of Payment requirements. This is handled daily for builders, subcontractors, and suppliers across Perth and Western Australia.

What happens if a customer disputes an invoice after outsourcing accounts receivable in Perth?

Your dedicated accounts receivable controller contacts the customer promptly, gathers supporting documentation, and works toward resolution. You remain fully informed, and no credit note is issued without your approval.

Do you integrate with industry software when outsourcing accounts receivable in Perth?

We integrate directly or import efficiently from systems such as Pronto, TechnologyOne, Agrimaster, Phoenix, Greentree, and other platforms commonly used across WA industries, including mining, agriculture, and transport.

Is there a minimum debtor size to start outsourcing accounts receivable in Perth?

No minimum applies. We support businesses issuing only a small number of invoices each month, as well as companies managing large, complex debtor books.

How are late-paying customers handled after outsourcing accounts receivable in Perth?

We apply agreed escalation steps such as structured payment plans, credit limit reviews, personal guarantees, or cash-on-delivery terms. Every step is discussed with you and approved before action is taken.

Can I outsource only overdue collections when outsourcing accounts receivable in Perth?

Yes, many businesses begin with overdue follow-up only. Once they experience improved cash flow and reduced stress, they often expand to full invoice-to-cash management.

What reports do I receive after outsourcing accounts receivable in Perth?

You receive aged debtor reports, collection effectiveness summaries, debtor-days trend analysis, cash receipt breakdowns, and concise commentary highlighting risks and priority actions.

How is data kept secure when outsourcing accounts receivable in Perth with Numberfied?

All data is protected using end-to-end encryption, stored on Australian-based servers, secured with multi-factor authentication, and reviewed through regular independent security audits.

Also Read: Save Hours and Cash When You Outsource Bookkeeping Services for Your Small Business in Australia!