Introduction

Operating a business is like juggling flaming torches while hanging a unicycle—thrilling, but one mistake and you’re in a pickle. Between keeping customers happy, managing stock, and sneaking in a coffee, who’s got time to tussle with numbers? That’s where outsourced profit-first bookkeeping services swoop in like a friend with a nippy beer, helping you keep earnings first and priority last.

At Numberfied, we’re not just about tidy books—we’re your growth buddy, here to help you scale, make smarter choices, and maybe chuckle over a stray receipt. Let’s dive into why outsourced profit-first bookkeeping services are your business’s new best mate.

What You’ll Learn

- Outsourced profit-first bookkeeping services put your profits first, not last.

- They save time and keep your finances ATO-compliant.

- Numberfied’s your partner for growth, not just number-crunching.

- Exact books guide you to better decisions and more money in your pocket.

- Outsourcing allows you to concentrate on your affection, not paperwork.

1. What Is Profit-First Bookkeeping and Why Outsource It?

Profit-First is a game-changing technique that flips conventional bookkeeping on its authority; securing your business prioritizes earnings from every dollar made. Outsourced profit-first bookkeeping services take this system off your plate, allowing professionals to handle it.

The Profit-First Basics

Unlike traditional bookkeeping, which pays expenses first and hopes for leftovers, Profit-First allocates profit upfront and then covers costs. An outsourced profit-first bookkeeping service sets up accounts to make this happen, ensuring you always pocket a profit.

Why SMEs Need It

Small businesses often work to see actual profits after invoices stack up. Outsourced profit-first bookkeeping services assure you’re not just enduring but flourishing. Our pal Sarah, a Melbourne cafe owner, used Profit-First to save 10% of every sale, funding a new espresso machine in just a few months.

Why Outsource?

DIY bookkeeping is like trying to cut your hair—risky and messy. Outsourced profit-first bookkeeping services bring expertise, saving you from errors and freeing up time. I once tried managing my side hustle’s books myself and ended up with a tax fine that stung worse than a jellyfish.

2. How Profit-First Bookkeeping Saves You Money

Outsourced profit-first bookkeeping services aren’t just about keeping books tidy—they’re about keeping more cash in your pocket while dodging financial headaches.

Guaranteed Profits

Profit-First ensures you take a cut before paying bills, so you’re not left with crumbs. An outsourced profit-first bookkeeping service sets this upright. A Sydney tradie we helped saved $5,000 in six months, enough for a new ute.

Fewer Costly Mistakes

Bookkeeping mistakes, such as skipping deductions or misfiling Business Activity Statements (BAS), can be expensive. Outsourced profit-first bookkeeping services catch these early. A Brissy retailer avoided a $2,500 ATO fine after their bookkeeper fixed a GST mix-up.

Smarter Spending

Profit-First shows where your money’s going, helping you cut waste. Outsourced profit-first bookkeeping services provide clear reports. A Perth baker slashed $3,000 in yearly flour costs after spotting overpayments, thanks to her bookkeeper.

3. Boosting Growth with Profit-First Bookkeeping

Outsourced profit-first bookkeeping services don’t just track numbers—they fuel your business’s growth by giving you clarity and confidence to make bold moves.

Clear Financial Picture

Profit-First books show what’s working, like your top products. An outsourced profit-first bookkeeping service turns data into insights. An Adelaide florist doubled down on wedding bouquets after seeing they were her biggest earner, lifting sales by 15%.

Planning for Expansion

Want a second shop or new staff? Outsourced profit-first bookkeeping services create budgets to make them a reality. A Tassie mechanic used Profit-First to save for a new hoist, doubling his workload without stress.

Risk-Proofing Your Business

Growth can be a gamble without precise numbers. An outsourced profit-first bookkeeping service tracks cash flow to avoid pitfalls. A Darwin gym saved for slow months, keeping the lights on during a quiet spell.

I’ve seen mates struggle to grow because their books were a mess. One cafe owner nearly gave up until she outsourced profit-first bookkeeping services, which showed her how to save for a new location.

4. Why Numberfied’s Your Profit-First Partner

At Numberfied, we’re not your average bookkeepers. We’re your cheer squad, blending outsourced profit-first bookkeeping services with Aussie charm to help your business shine.

Beyond Basic Bookkeeping

We don’t just crunch numbers—we explain them over a virtual coffee. Our outsourced profit-first bookkeeping services make you feel like a financial pro without the jargon.

Tailored for Aussie Businesses

From Freo cafes to Canberra startups, we get SMEs. Our outsourced profit-first bookkeeping services cater to your unique goals, whether you’re a solo professional or a growing retailer.

A Bit of Fun

Bookkeeping can be dull, but we keep it lively. One client laughed when we sorted their “emergency Tim Tam fund” into proper categories. Outsourced profit-first bookkeeping services don’t have to be a snooze!

Working with Numberfied reminds me of my old retail job—numbers scared me until a mate explained them plainly. Now, we do that for you with outsourced profit-first bookkeeping services.

5. Common Bookkeeping Mistakes to Avoid

Even savvy business owners trip up on bookkeeping. Outsourced profit-first bookkeeping services keep you clear of these traps, saving you time and money.

Mixing Personal and Business Cash

Using your business card for personal stuff? Big no-no. It’s a tax nightmare. Outsourced profit-first bookkeeping services keep things separate and organised. A Gold Coast gym owner learned this after mixing up gym and holiday expenses.

Ignoring Cash Flow

Cash flow is your business’s heartbeat. Skip it, and you’re in trouble. Outsourced profit-first bookkeeping services track it closely. A Sydney shop owner avoided late payments, saving $4,000 on a loan.

Losing Receipts

Misplaced receipts are a tax-time horror show. Outsourced profit-first bookkeeping services help them stay organised. A Brissy freelancer saved hours by using a bookkeeper’s app to snap receipts on the go.

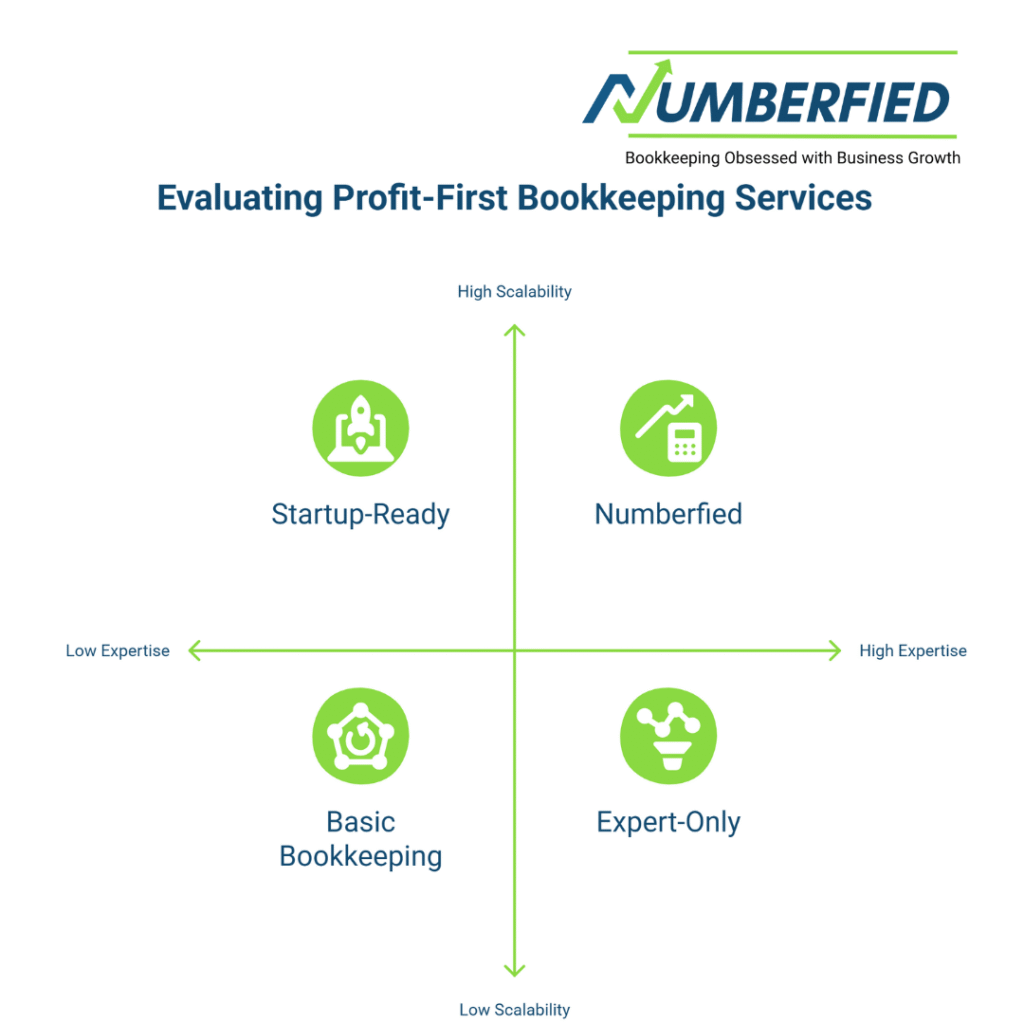

6. Choosing the Right Profit-First Bookkeeping Service

Not all bookkeeping services are created equal. Here’s how to pick outsourced profit-first bookkeeping services that’ll make your business pop.

Profit-First Expertise

Ensure your service is thoroughly familiar with the Profit-First system, both in terms of its inner workings and overall functionality. Outsourced profit-first bookkeeping services should set up profit accounts and guide you through them, not just log transactions.

Clear Communication

Jargon’s a buzzkill. Pick outsourced profit-first bookkeeping services that explain things like a mate, not a textbook. Numberfied’s team makes your numbers easy to get.

Scalability Matters

Your business will grow, and so will your bookkeeping needs. Outsourced profit-first bookkeeping services should flex with you, from startup to big player. Select one that is ready for your next step.

My cousin’s bakery nearly hired a cheap bookkeeper who didn’t understand the Profit-First method. Luckily, she switched to outsourced profit-first bookkeeping services, which helped her save for a second shop.

Conclusion

Outsourced profit-first bookkeeping services aren’t just about clean books—they’re about setting your earnings first and building a business that flourishes. From saving money to fueling development, Profit-First transforms the way you handle your finances. At Numberfied, we’ve seen Aussie SMEs go from stressed to stoked with our outsourced profit-first bookkeeping services and growth-focused support. Ready to ditch the financial chaos and make your business a ripper? Give Numberfied a shout today—let’s make your profits soar!

Also Read: Why an Outsourced CFO for SMEs Is Your Business’s Game-Changer

FAQs

1. Why is Profit-First bookkeeping a big deal for businesses?

Profit-First ensures you pocket a profit from every sale before paying bills, unlike traditional methods that leave you with little to no profit. Outsourced profit-first bookkeeping services set up accounts to make this happen, keeping your business in the black. It’s a game-changer for SMEs struggling to see real cash after expenses. It also simplifies taxes and growth planning. Without it, you’re just hoping for scraps.

How often should I correct my books with Profit-First?

Weekly or monthly updates keep your Profit-First system buzzing. Regular checks ensure profits are allocated and bills are covered without ambushes. Outsourced profit-first bookkeeping services handle this, so you’re always on track. It also helps you determine trends, such as slow payers. Leaving it too long is like missing a leaky tap—things get dirty fast.

Can’t I operate accounting software for Profit-First?

Software like Xero tracks numbers but doesn’t know the Profit-First method. It won’t set up profit accounts or guide you on allocations. Outsourced profit-first bookkeeping services bring expertise to make the system work. A bookkeeper adds the smarts to catch errors and optimize profits. Software is a tool, not a strategist.

How does Profit-First ensure I stay ATO-compliant?

Outsourced profit-first bookkeeping services assure your BAS, PAYG, and tariffs are filed correctly and on time, avoiding ATO penalties. They track GST and premises, keeping records audit-ready. Compliance means more cash for growth, not penalties. Without it, you risk expensive blunders or audits.

What businesses benefit from Profit-First bookkeeping?

Any SME—cafes, tradies, freelancers—wins with Profit-First. Outsourced profit-first bookkeeping services are tailored to meet the needs of retailers, startups, and solo operators. Whether you’re just beginning or scaling, it ensures returns and clarity. No business is too small to prioritize profit.

How does Profit-First save me money?

Outsourced profit-first bookkeeping services identify waste, such as overpriced suppliers, and claim deductions. It also prevents fines for bookkeeping errors. More cash stays in your pocket for growth or emergencies.

What if I miss an ATO deadline?

Missing deadlines, such as BAS, can cost you hundreds in fines, even thousands for repeat slip-ups. Outsourced profit-first bookkeeping services track due dates, so you’re never late. Late lodgments also mess with cash flow planning. Staying on time keeps your business safe.

How do I know my books are accurate?

Outsourced profit-first bookkeeping services reconcile accounts, check entries, and provide clear reports. Errors like double-charged expenses get caught early. Accurate books mean confident decisions and no ATO surprises. Regular checks are your safety net.

Can Profit-First help with cash flow?

You bet! It tracks every dollar, ensuring profit and expenses are covered. Outsourced profit-first bookkeeping services identify issues such as late payers. Clear records help plan for lean times, keeping your business steady.

How do I start with Profit-First bookkeeping?

Reach out to a Profit-First-savvy service for a chat. They’ll assess your business and set up profit accounts. Outsourced profit-first bookkeeping services like Numberfied’s tailor plans to grow with you. Please select a service that caters to SMEs and keeps it simple.