Introduction

Running a small business in Australia? You already know — the days are full, the list never ends, and somehow, there’s always more to do. Between looking after customers, sorting suppliers, and trying to keep your head above water, your time disappears fast. But there’s one quiet part of your business that holds everything together — your small business bookkeeping service.

It’s not the flashiest part of running a business. But getting your bookkeeping right? That’s what keeps things steady. It keeps your money organised. It helps you make decisions with confidence. And it saves you from that horrible guessing game when it’s time to deal with tax or check your bank balance.

At Numberfied, we’ve seen it all — business owners all over Australia struggling with messy books and late nights spent sorting receipts. We help tidy things up so you can breathe easier. And we’d love to help you, too.

Quick Takeaways:

- A reliable small business bookkeeping service keeps your money organised and your records neat.

- Less stress, fewer surprises when tax time rolls around.

- Proper bookkeeping gives you a clearer view of your business, day to day.

- Outsourcing helps avoid costly mistakes and gives you time back.

- Numberfied offers friendly, simple bookkeeping support to businesses right across Australia.

What Is a Small Business Bookkeeping Service?

The Basics Explained

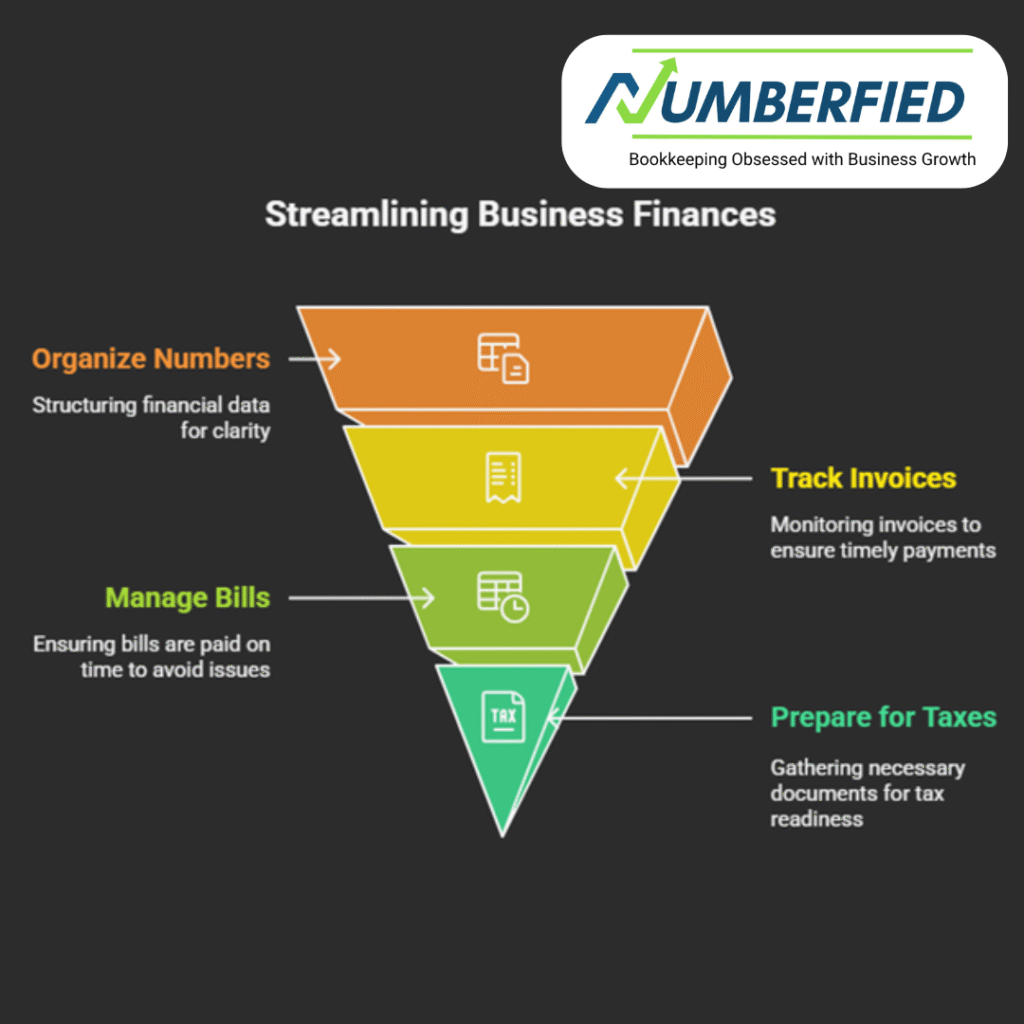

A small business bookkeeping service does more than just track numbers. It keeps your business organised. It records your income. It lists every expense. It keeps track of invoices, bills, and payments.

Without it, your accounts can quickly become messy. With it, your records stay clean and up to date. You always know where you stand. And when tax time arrives? You’re ready.

Why Bookkeeping Matters

Running a business without good bookkeeping is like driving with your eyes closed. You won’t know where the money is going. You might forget bills. You could miss claiming expenses.

And when tax time shows up? You’ll be guessing. That’s risky.

A proper small business bookkeeping service keeps everything clear. No surprises. No panic. Just simple, organised records.

How a Service Like Numberfied Helps

At Numberfied, we do more than set up your books. We stay with you, month after month. We handle the recording. We make sure your accounts balance. We take care of BAS. We sort your GST. We prepare you for the end of financial year.

Our small business bookkeeping service means less stress for you. Your numbers stay tidy. You stay focused on running your business. We handle the rest.

The Real Benefits of Outsourcing Your Bookkeeping

It Saves You Time

Running a business takes energy. You spend your day looking after customers, sorting stock, managing staff, chasing payments. There’s always more to do.

Trying to keep your accounts in order after hours? That’s a fast track to burnout.

A small business bookkeeping service takes that stress away. We handle the numbers, so you can focus on what really matters — growing your business and having time for yourself.

You Get Accurate Records

A small error can turn into a big headache. Lose one receipt? Forget to track a payment? It all adds up. Suddenly, your books are out of balance.

A small business bookkeeping service helps avoid those slip-ups. You get qualified people checking the details. Your records stay clean and reliable, ready for tax time or business decisions.

You Stay Compliant

Keeping up with tax rules in Australia isn’t easy. They change often, and missing something can mean penalties.

We stay across the latest ATO updates for you. With our help, your business stays compliant. No last-minute stress. No wondering if you’ve missed a deadline. That’s the peace of mind a small business bookkeeping service provides.

Common Bookkeeping Mistakes And How to Avoid Them

Mixing Business and Personal Finances

Using the same account for everything might seem easy — but it creates a mess later. It makes it harder to track business expenses and impossible to prepare clear reports.

A smart move? Keep your business and personal finances separate from day one. A small business bookkeeping service can help you get this set up properly.

Falling Behind on Record-Keeping

It’s easy to say, I’ll deal with the books later. But before you know it, weeks have passed. The paperwork piles up. It’s stressful, and mistakes sneak in.

Regular bookkeeping, done by professionals, keeps your records neat and saves you hours of sorting down the line.

Trying to Do It All Yourself

Many small business owners try to manage everything themselves, including the books. But bookkeeping takes skill and attention to detail.

Without training, mistakes are common — and those mistakes can cost you money.

A small business bookkeeping service lets you stay focused on running your business. We look after the numbers. You stay in control.

What to Look for in a Small Business Bookkeeping Service

Experience with Australian Businesses

When it comes to your books, local knowledge matters. The rules and challenges Australian small businesses face aren’t the same as overseas. You want someone who understands how things work here — someone who knows the ins and outs of tax, BAS, and business regulations.

Choosing a small business bookkeeping service that works with Australian businesses every day makes a real difference. They know what to expect, and they know how to keep your accounts in order.

Personalised Support

Every business is different. Your bookkeeping shouldn’t be a one-size-fits-all approach. The best services take the time to get to know you. They’ll ask about your industry, how your business operates, and what support you actually need.

A reliable small business bookkeeping service will tailor their approach to suit your goals, your workload, and your budget.

Use of Modern Tools

These days, bookkeeping isn’t just about paperwork and calculators. The right tools make everything simpler.

We use trusted platforms like Xero and MYOB to manage your accounts efficiently. But the tools are only part of it. Behind the software is a team of real people, making sure your books are accurate and your questions are answered. That’s what you get with a proper small business bookkeeping service.

How Technology Makes Bookkeeping Easier

How to Keep Track of Your Finances Without the Headache

Let’s be honest, keeping an eye on your business finances can feel like a full-time job. But cloud tools like Xero help make it simpler. You can check your numbers any time—at home, between meetings, even sitting at the café.

When you use a proper small business bookkeeping service, it’s set up for you the right way from the start. That means your records stay tidy, your numbers are easy to find, and you aren’t stuck sorting through paperwork at 10pm.

Why Bank Feeds Make Life Easier

Nobody enjoys typing up every single transaction. It’s tedious and mistakes creep in. That’s where linking your bank account to your bookkeeping software makes a real difference.

Once it’s connected, the numbers flow in on their own. You don’t have to sit there matching payments or chasing receipts. It saves time and keeps your accounts neat.

And when you work with a reliable small business bookkeeping service, they’ll make sure this is set up properly, so you don’t have to stress about missing anything.

No More Lost Receipts — Keep Your Records Sorted

It’s easy for paperwork to pile up. A few misplaced receipts here, a missing invoice there — before you know it, finding what you need feels impossible. And when tax time arrives? It’s one big headache.

That’s why going digital makes life simpler. Your invoices, reports, and receipts are stored safely online. You can pull them up anytime — no digging through drawers or shoeboxes.

A reliable small business bookkeeping service takes care of this for you. Everything’s neat, secure, and ready when you need it. Less stress. More time for your business.

Why So Many Australian Businesses Work With Numberfied

We Make Bookkeeping Straightforward

Let’s be honest — sorting receipts and chasing spreadsheets isn’t why you started your business. But ignoring them only causes trouble down the track.

That’s where we come in. Our team keeps your accounts organised and explains everything clearly, without the accounting jargon.

With our small business bookkeeping service, your books stay in order, and you stay in control — no more guesswork.

Friendly, Personal Support

We care about your business, and we take the time to understand it. You’re not treated like a number on a page. We build real relationships with our clients. You’ll always have someone to talk to — and real people to help you succeed.

Affordable, Transparent Pricing

Bookkeeping shouldn’t break the bank. Our small business bookkeeping service offers affordable, clear pricing. No hidden fees. No lock-in surprises. Just reliable support that fits your budget.

Conclusion

Sorting out your business finances might not be thrilling, but it’s essential. If your records are a mess, everything feels harder — chasing payments, paying tax, or even just knowing where your business stands.

That’s where a proper small business bookkeeping service comes in. It takes that headache away. Your numbers get organised. Invoices are tracked. Bills don’t slip through the cracks. And when tax time rolls around? You’re ready — no scrambling for receipts.

At Numberfied, this is what we do. We handle the messy bits, so you don’t have to. Want to make life easier? Visit https://numberfied.com/au/ today and let us help get your books sorted — properly.

Also Read: 10 Must-Know Outsourcing Benefits That’ll Turbocharge Your Australian Business

FAQs

1. What does a small business bookkeeping service actually cover?

In simple terms? We help keep your business finances tidy. That means keeping track of what’s coming in, what’s going out, managing invoices, keeping an eye on your bank accounts, and making sure everything meets ATO requirements. No guesswork, no stress.

2. How often should I update my books?

Best advice? Don’t leave it too long. A little time each week or month saves you headaches later. It keeps your records neat and makes tax time far less painful.

3. Can software replace a bookkeeper?

Software is great — but it’s not perfect. It won’t notice every little error. That’s why our small business bookkeeping service uses smart tech like Xero, but always has real people checking things over.

4. How much does it cost?

It really depends. Every business has different needs. We offer pricing that’s clear, fair, and tailored — so you only pay for what you actually need, with no hidden fees.

5. Do I still need an accountant?

Yes, you do. Bookkeeping handles the daily records. Accountants focus on tax, strategy, and business planning. The two go hand in hand — and we’re happy to work alongside your accountant.

6. Is this service good for new businesses?

Definitely. A proper small business bookkeeping service helps you stay organised from the beginning, which makes growing your business much smoother.

7. Can you help with BAS and GST?

Yes, we handle that. We prepare and lodge your BAS and take care of GST requirements, so you stay compliant.

8. Do you work with businesses outside my area?

We sure do. Our small business bookkeeping service works right across Australia thanks to secure online tools.

9. What types of businesses do you support?

We help all sorts — from tradies and online shops to cafes and professional services. If you own a small business, we can help.

10. How do I get started?

It’s easy. Head to https://numberfied.com/au/, book a chat, and we’ll walk you through your options.