Introduction

G’day, accounting colleague. Picture this: you finish the daily grind of data entry and reconciliations by lunchtime, then spend the rest of the day giving clients the sharp advice they signed up for. That’s the everyday reality when you bring white label bookkeeping into your practice.

Here at Numberfied, we see Australian firms wrestling with tight deadlines, rising client demands, and the constant pull to do more with less. White label bookkeeping hands the routine number-crunching to a trusted partner who works behind the scenes, yet every report lands in the client’s inbox wearing your logo. The result? You stay in full control of the relationship while delivering polished work without hiring extra staff.

In the pages ahead, we’ll walk through the clear wins of white label bookkeeping and share straightforward steps any firm- from Bondi to Broome- can take right now. Let’s get started.

Key Takeaways on White Label Bookkeeping

- Free up your team: Hand off daily entries and bank feeds so your people tackle strategy instead.

- Keep overhead low: Skip the cost of new hires and still meet every deadline.

- Grow without limits: Take on extra clients and know the backend will handle the load.

- Strengthen client trust: Deliver branded reports on time, every time.

- Open new income lines: Bundle bookkeeping with advisory and watch margins rise.

- Play to your strengths: Focus on the high-value work only you can do.

These points sum up the practical edge white label bookkeeping gives Australian practices. Now let’s dig into the details.

Understanding White Label Bookkeeping Services

White label bookkeeping is a partnership where a specialist team manages the books and you present the finished product as your own. It’s built for the Australian market, with full attention to local rules and software.

What White Label Bookkeeping Really Means

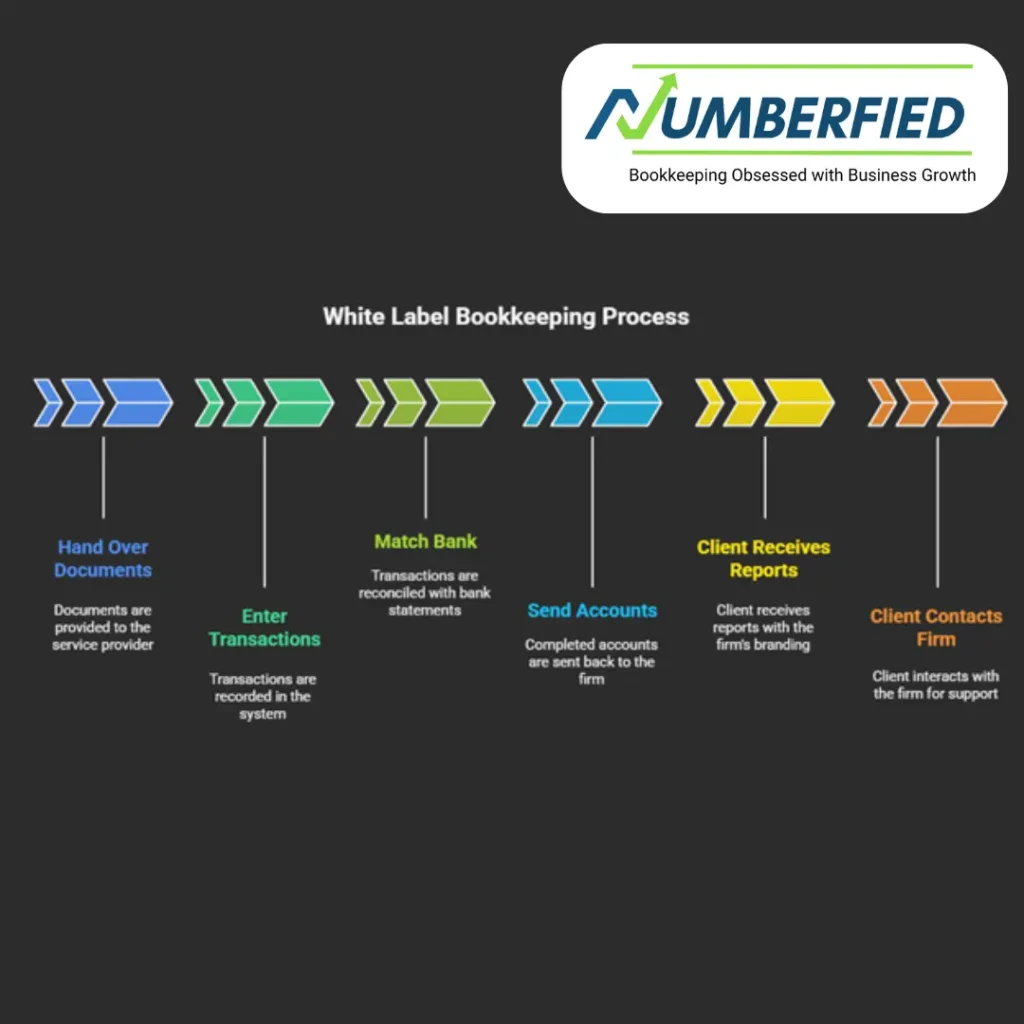

You send over the raw data- bank feeds, receipts, invoices- and the provider records every transaction, reconciles accounts, and prepares statements. The files come back with your letterhead, your colours, your tone. Clients never spot the join. For firms running Xero, MYOB, or QuickBooks, the data flows straight in and out without double-handling. The provider follows ATO lodgement schedules, calculates GST correctly, and flags anything that needs your sign-off. You stay the face of the service; the heavy lifting happens quietly.

How the Model Has Taken Off in Australia

A few years back, most firms kept bookkeeping in-house. Then came staff shortages, new super rules, and the push for real-time reporting. Practices in every state started looking for a better way. White label bookkeeping filled the gap. Regional firms in particular found they could match city standards without poaching scarce talent. Today, from Geelong cafes to Darwin tradies, the model keeps books accurate and advisors focused.

Why Local Firms Choose This Path

Australian businesses want one trusted contact for compliance and growth advice. When you handle the basics flawlessly, clients relax and listen to your bigger ideas. White label bookkeeping removes the friction of late-night reconciliations and lets you serve more sectors- retail, construction, medical- without stretching thin.

Boosting Day-to-Day Efficiency with White Label Bookkeeping

The first thing most firms notice is how much faster the workday moves once routine tasks leave the office.

Clearing the Routine Backlog

Data entry, coding expenses, chasing missing invoices- these eat hours. Shift them to a white label team and the same work finishes overnight. Month-end closes that once dragged into the weekend now wrap up mid-week. Your staff open their laptops to clean ledgers ready for review, not piles of unposted transactions.

Plugging into Everyday Tools

Most providers link directly to the software you already use. Bank feeds land automatically, reconciliations run on schedule, and exceptions pop into a shared queue for your quick approval. No more exporting CSV files or re-keying numbers. The setup takes a couple of weeks, then runs on autopilot.

Tracking the Time Saved

Pick one metric- hours per client file- and measure it before and after. Firms we work with typically shave off a third of the bookkeeping time within the first quarter. That reclaimed capacity becomes billable advisory hours or simply a saner schedule.

Cutting Costs with White Label Bookkeeping

Money talks, and white label bookkeeping keeps more of it in your pocket.

Skipping the Hiring Cycle

Posting a job ad, interviewing, onboarding, and training a bookkeeper costs thousands before they post their first journal. White label bookkeeping swaps that fixed expense for a variable fee tied to actual client volume. No payroll tax, no leave loading, no downtime when work is light.

Watching the Bottom Line Improve

Run a simple comparison: cost per client before versus after the switch. Most Australian firms see the needle move in the first full financial year, with the gap widening as client numbers climb.

Scaling Up Smoothly Thanks to White Label Bookkeeping Services

Growth used to mean panic-hiring. Now it means sending an email to your provider.

Adding Clients Without Adding Chaos

Sign a new client on Friday, forward the login details, and the books are live by Monday. The white label team absorbs the extra volume; your office rhythm stays the same. Seasonal spikes- EOFY, Christmas retail- become manageable instead of overwhelming.

Rolling Out New Service Lines

Once the main work is steady, white label bookkeeping lets you add more without the hassle. You can include payroll, management reports, or cash-flow forecasts under your own brand. Clients usually take up the extras because everything feels familiar and runs on the same routine.

Planning the Next Leap

Sit down quarterly with your provider to map capacity. Know exactly how many extra files the partnership can handle before you need to discuss expanded terms. That clarity lets you quote new business with confidence.

Keeping Clients Happy Through White Label Bookkeeping

Happy clients stay, pay on time, and send referrals. White label bookkeeping is the quiet engine behind that loyalty.

Delivering Rock-Solid Accuracy

Nothing erodes trust faster than a mismatched bank balance. White label teams live and breathe reconciliations; errors drop to near zero. Clients open reports that balance first time, every time.

Spending More Face-to-Face Time

With the grunt work gone, your meetings shift from “here’s what went wrong” to “here’s how we grow”. Clients feel the difference and book the next appointment before they leave the room.

Turning One-Offs into Lifers

Consistent delivery plus proactive insights equals sticky relationships. Ask any firm using white label bookkeeping for a year- they’ll tell you renewal rates climb and referral conversations start naturally.

Staying Compliant and Safe with White Label Bookkeeping

Australian regulators don’t give second chances. White label partners build compliance into every process.

Meeting ATO Deadlines Without Stress

BAS due? Super cleared? The provider tracks every obligation and lodges on your behalf- or prepares the file for your final click. Audit trails are complete, timestamps logged, nothing left to chance.

Protecting Client Data

Encrypted connections, role-based access, and regular penetration tests keep information secure. Your firm stays compliant with the Privacy Act while the provider handles the tech heavy lifting.

Building a Bulletproof Routine

Run mock audits with the white label team each year. Spot any weak points early and tighten procedures before they become issues. The exercise doubles as staff training and keeps everyone sharp.

Tapping Specialist Skills via White Label Bookkeeping Partnerships

You don’t need to be an expert in every corner of bookkeeping- your partner is.

Borrowing Industry Know-How

Need retail stock accounting or franchise royalty splits? The white label crew has done it before and brings templates that work. You get the benefit of hundreds of similar files without the learning curve.

Keeping Your Team Current

Providers share updates on software changes, new ATO rulings, or STP Phase 2 tweaks. Your staff attend short webinars instead of full-day courses, staying ahead without leaving the office.

Sparking Fresh Ideas Together

Monthly catch-ups often uncover small wins: a better chart of accounts, a faster payroll run, a new KPI dashboard. Those tweaks compound across your whole client base.

Growing Revenue with White Label Bookkeeping

The books pay for themselves- and then some.

Packaging Services for Higher Fees

Offer a “complete compliance bundle” that includes bookkeeping, tax, and quarterly strategy sessions. Clients see one price for total peace of mind and happily pay the premium.

Fuelling Word-of-Mouth

When reports land early and balance perfectly, clients talk. A single glowing recommendation can cover the white label fee for months.

Measuring the Payoff

Track average revenue per client twelve months before and after the switch. The uplift usually covers the partnership cost and leaves healthy profit on top.

Conclusion

White label bookkeeping services give Australian accounting firms a straightforward way to work smarter: less admin, lower costs, unlimited scaling, happier clients, ironclad compliance, specialist backup, and fatter margins- all under your own brand. The decision isn’t about outsourcing; it’s about reclaiming your time and focus for the work that moves the needle. Here at Numberfied, we’ve helped practices from solo operators to mid-size firms make the leap and never look back. Ready to see how it fits your setup? Contact us and book a quick chat. We’ll map out a plan that slots straight into your current workflow and starts delivering from day one.

FAQs

What are white label bookkeeping services in plain terms?

You hand over the bank feeds, receipts, and invoices. The provider enters every transaction, matches the bank, and sends back a full set of accounts with your firm’s name on top. The client rings your office, sees your reports, and never knows anyone else touched the file. It all runs to ATO rules and sits inside your usual software.

How is white label bookkeeping different from regular outsourcing?

Regular outsourcing means the client might get an email from “ABC Bookkeeping Co”. White label keeps everything in your name- portal logins, PDF headers, even the support ticket. You stay the only point of contact, which keeps the relationship clean and your brand front and centre.

Will white label bookkeeping keep me ATO-compliant?

Deadlines are locked in: BAS, IAS, super, payroll tax- everything. The team prepares the file, you click lodge, or they lodge under your digital signature. Every step is logged, dated, and backed up, so an ATO review is just another Tuesday.

Which tasks usually go to the white label team?

Day-to-day coding, bank recs, credit-card matches, payroll runs, debtor chasing, creditor payments, and the full month-end pack. You pick the line- some firms send the lot, others keep property trusts or complex consolidations in-house.

Does white label bookkeeping improve client retention?

Clients get reports that balance first time, on the same day each month. That reliability frees you to ring them with ideas instead of excuses. One good strategy call later and they’re booked in for the next quarter without a second thought.

Is this model only for big firms?

Solo bookkeepers in Tamworth use it to free up weekends. Two-partner shops in Ballarat use it to take on franchises. You start with the files that hurt the most, then add more as the wins stack up.

How safe is client data?

Bank-level encryption on every transfer, separate database for each client, login codes that change every 60 days, and an insurance policy that covers any slip-up. You see the same dashboard your staff use; nothing leaves Australia unless you say so.

What makes a good white label partner?

Someone who’s lodged thousands of Australian BAS, speaks plain English, answers the phone before three rings, and can show you a live file in your colours. We do a no-charge trial file at Numberfied so you see it in action before you commit.

How quickly can we go live?

Week one we map your chart of accounts. Week two we run a test file in parallel. Week three the first live client lands. After that, new clients are onboarded in 48 hours.

Will it work with my current software?

It will. White label bookkeeping connects straight to whatever you use – Xero, MYOB, QuickBooks, or Reckon. We link it once, set the categories, and from there, the numbers move on their own. No need for spreadsheets, and your custom tracking stays exactly as it is.