Introduction

Australian accounting firms and bookkeepers are under increasing pressure to deliver accurate financial reporting, manage payroll, meet ATO compliance, and keep client fees competitive. White label bookkeeping services offer a pragmatic model: outsource the bookkeeping and back-office accounting tasks to a specialist provider and deliver top-notch bookkeeping and accounting under your firm’s brand. This article explains how white label bookkeeping Australia works, the benefits of white-label services, and practical tips to select the best white label bookkeeping providers to fit your business needs.

What Are White Label Bookkeeping Services

White label bookkeeping services are outsourced bookkeeping and accounting solutions provided by third-party teams that perform bookkeeping tasks, reconciliation, payroll processing, accounts payable and receivable management, BAS preparation and lodgement, and financial reporting under another firm’s branding. Essentially, your accounting firm or practice receives professional bookkeeping services without the need to hire and manage an internal bookkeeping team.

These outsourced bookkeeping services commonly integrate with bookkeeping software such as QuickBooks and other white label accounting software platforms to streamline data entry, automate recurring tasks, and deliver accurate financial records. A white label BAS agent may also manage BAS lodgement and ensure ATO compliance for GST, PAYG, and fringe benefits where authorised.

Benefits for Accounting Firms

Outsourcing bookkeeping to reliable white label bookkeeping providers brings multiple benefits to accounting firms, CPAs, and bookkeepers looking to expand services without increasing overheads. Key benefits include:

- Scalability: White-label bookkeeping allows firms to scale services up or down depending on client demand without recruiting an in-house bookkeeping team.

- Cost-efficiency: Avoid payroll, training, and HR costs by using outsourced bookkeeping services for accountants. This reduces fixed expenses and converts costs to a variable model.

- Broader service offering: Offer bookkeeping and accounting services under your brand, from basic bookkeeping to full bookkeeping and accounting packages, payroll management, and BAS lodgement.

- ATO compliance and BAS assistance: Specialist providers understand Australian compliance requirements, BAS lodgement deadlines, and tax reporting obligations, helping to reduce compliance risk.

- Faster turnaround: Access a dedicated bookkeeping team and automation tools to deliver timely financial statements, tax returns, and management reports to clients.

- Improved client retention: Deliver consistent, reliable white label services that help clients streamline financial operations and cash flow, increasing satisfaction and loyalty.

- Access to expertise: Partnering with a provider gives access to professional bookkeeping services, tax experts, and white label BAS agents experienced in ecommerce bookkeeping, accounts payable, and receivable management.

- Focus on advisory work: Outsourcing bookkeeping tasks frees accountants to focus on higher-value services such as tax planning, advisory, and strategic financial advice.

How White Label Bookkeeping Works in Australia

White label bookkeeping solutions in Australia are tailored to local compliance standards, including ATO requirements and BAS lodgement. Typical workflow:

- Onboarding: The provider and your firm agree on the scope of basic bookkeeping, payroll, BAS, reporting, e-invoicing, or customised white label accounting and bookkeeping packages. Service for CPAs and accountants is defined, including security standards and confidentiality.

- Data integration: Connect client bookkeeping software, such as QuickBooks or other white label accounting software. Automation tools are configured to streamline bank feeds, reconciliations, and transaction classifications.

- Processing: The outsourcing bookkeeping team handles day-to-day bookkeeping tasks: bank reconciliations, accounts payable and receivable, payroll processing, expense categorisation, and month-end close.

- Compliance and BAS lodgement: A white label BAS agent or tax expert prepares BAS statements, GST calculations, and lodgement with the ATO on behalf of the client or as part of your firm’s services. The provider ensures records meet ATO compliance and audit standards.

- Reporting and review: Financial statements, management reports, and tax-ready packages are delivered to your firm for review, branding, and client delivery. Some providers allow direct report delivery under your label.

- Continuous support: Ongoing bookkeeping support, catch-ups, ad-hoc projects such as clean-ups or migrations, and advisory assistance are provided to meet business needs.

Workflows are typically supported by secure cloud platforms, regular communication channels, and SLAs that set expectations for turnaround times and accuracy.

Key Features

When evaluating white label accounting solutions and providers, prioritise features that align with your accounting services, clients, and compliance needs:

- ATO compliance expertise: Ensure the provider understands Australian tax rules, BAS lodgment, and payroll obligations. White label BAS agents should be registered and experienced.

- Integration with bookkeeping software: Compatibility with QuickBooks, Xero, MYOB, or other systems used by your clients. Seamless integration reduces manual data entry and errors.

- Security and data protection: Robust confidentiality agreements, secure data handling, encryption, and role-based access to protect client financial data.

- Customisable service levels: Options for basic bookkeeping, bookkeeping and accounting packages, payroll management, ecommerce bookkeeping, and specialised services for CPAs.

- Transparent pricing and SLAs: Clear turnaround times, reporting cadence, and pricing models for bookkeeping outsourcing and white-label services.

- Experienced bookkeeping team: Access to professional bookkeepers, tax experts, and a white label bookkeeping team that can handle complex reconciliations and financial reporting.

- Automation and workflow tools: Features such as bank feed reconciliation, receipt capture, rules-based transaction coding, and AI-assisted categorisation to streamline bookkeeping tasks.

- Scalability: Capacity to onboard multiple clients quickly and support growth while maintaining service quality.

- Quality control and review processes: Multi-level checks to ensure accurate financial statements, payroll processing, and BAS lodgement.

- White label delivery: Ability to deliver reports and invoices under your firm’s brand so services appear as an in-house offering.

Costs and Pricing Models

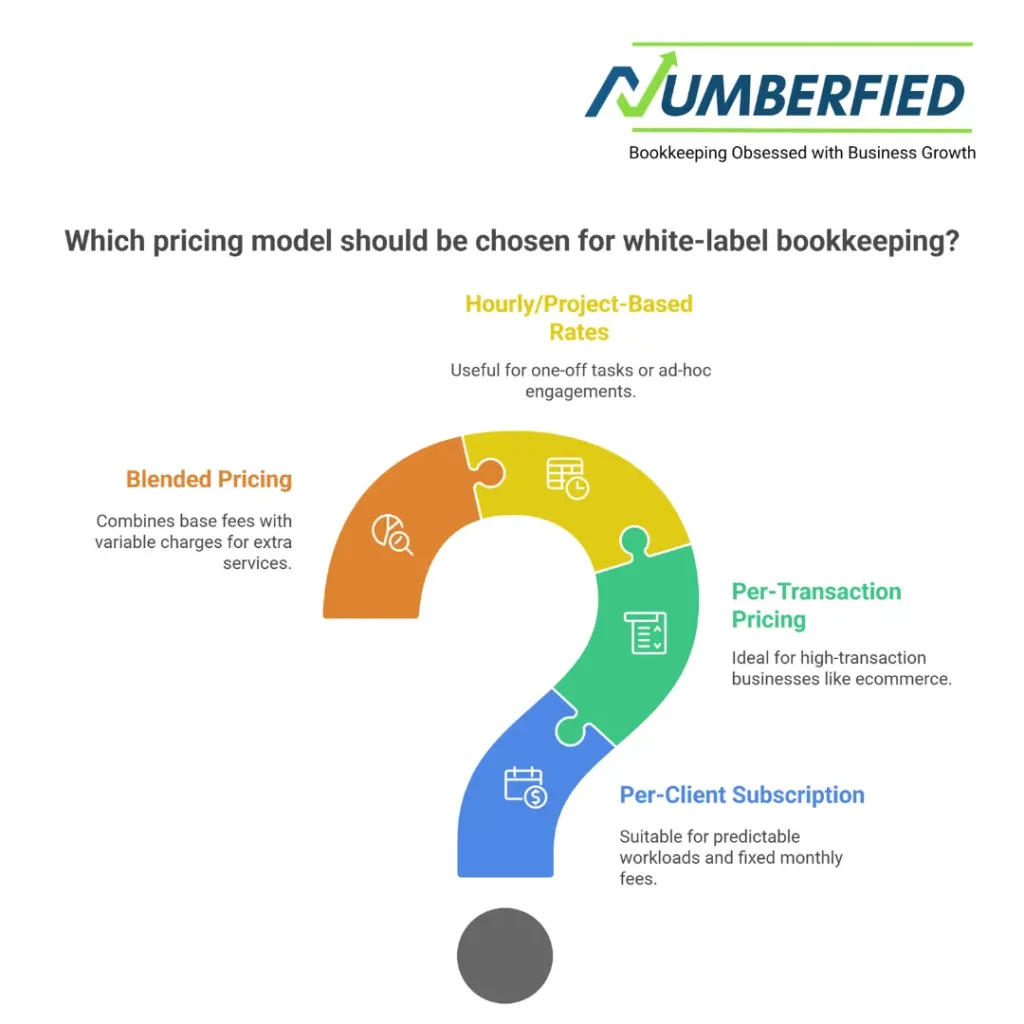

Pricing models for white-label bookkeeping vary. Common approaches include:

- Per-client subscription: A fixed monthly fee per client or per service tier (basic bookkeeping, payroll, BAS, full service). Suitable for predictable workloads.

- Per-transaction pricing: Fees based on the volume of transactions or bank feeds processed. Works well for ecommerce bookkeeping or high-transaction businesses.

- Hourly or project-based rates: Useful for one-off clean-ups, migration projects, or ad-hoc engagements.

- Blended pricing: A mix of base monthly fees plus variable charges for payroll, BAS lodgment, or extra services.

Consider:

- Recruitment, salary, and on-costs for in-house staff

- Training, software licences, and equipment

- Benefits of variable costs and scalability with outsourcing bookkeeping

- Time saved in managing bookkeeping tasks and improved turnaround for financial reporting

Practical pricing tips:

- Negotiate service tiers that match your client’s needs. Small businesses may only need basic bookkeeping, while larger clients need payroll and BAS lodgement.

- Insist on transparent pricing for ATO compliance tasks and BAS lodgements to avoid surprises at month-end.

- Ask providers for case studies showing cost savings and efficiency improvements for accounting firms that outsource bookkeeping.

Best white label bookkeeping providers

There are several reputable outsourced bookkeeping services and white-label bookkeeping providers operating in Australia and globally. When searching for the best white label bookkeeping providers, focus on those with experience in Australian bookkeeping, ATO compliance, and BAS lodgement. Typical types of providers include:

- Local Australian white label providers: Firms specialising in services in Australia that offer white label accounting and bookkeeping, registered BAS agents, and strong knowledge of tax returns, GST, T, and payroll.

- International providers with Australian capabilities: Global outsourcing companies that operate an Australian arm or partner with local tax experts to ensure ATO compliance.

- Software-first providers: Companies offering white label accounting software bundled with outsourced bookkeeping support and automation tools like QuickBooks integrations.

Some criteria to shortlist the best providers:

- Demonstrated experience with Australian accounting and bookkeeping services

- Positive client references from accounting firms and CPAs

- Ability to white-label services and deliver reports under your brand

- Strong SLAs, security policies, and proven ATO compliance processes

- Competitive pricing and transparent billing

While we won’t name specific vendors here, we will request proposals from multiple shortlisted providers, ask for sample reports, and run a pilot engagement with a small set of clients to evaluate the partnership before a full rollout.

How to Choose the Right Partner

Selecting the right white label partner is critical for maintaining the quality of your firm’s financial services. Follow this step-by-step approach:

- Define your goals: Are you looking to scale quickly, reduce costs, add BAS lodgement capability, or offer payroll and ecommerce bookkeeping? Clear objectives guide provider selection.

- Map your client needs: Segment clients by complexity, basic bookkeeping, payroll, BAS, e-commerce, or high-volume transactions, and ensure the provider can meet each segment’s needs.

- Check ATO compliance and BAS expertise: Confirm the provider’s knowledge of ATO rules, GST reporting, and ability to act as or collaborate with white label BAS agents for secure BAS lodgement.

- Evaluate technology stack: Make sure the provider supports your preferred bookkeeping software (QuickBooks, Xero, MYOB) and has automation tools to streamline reconciliation and reduce errors.

- Assess security and data management: Review data protection policies, backup procedures, and access controls to protect client financial data.

- Review processes and quality control: Ask about multi-level review processes, error rates, turnaround times, and reporting quality. Request examples of financial statements and management reports.

- Ask about white-labeling capabilities: Ensure the provider can deliver reports, invoices, and client communications under your firm’s branding so services appear in-house.

- Trial with a pilot: Start with a small group of clients to test the provider’s capabilities, communication, and adherence to SLAs.

- Measure and refine: Track KPIs such as time-to-close, accuracy, client satisfaction, and cost savings. Refine processes and scale progressively.

Practical negotiation points:

- Include clauses covering ATO compliance responsibilities and indemnities for inaccurate BAS lodgement.

- Set clear SLAs for turnaround, correction, and escalation paths.

- Agree on communication protocols, reporting templates, and branding requirements.

- Ensure exit provisions cover data export in standard formats for continuity.

Conclusion

White label bookkeeping services offer Australian accounting firms and bookkeepers a proven path to expand services, increase margins, and focus on higher-value advisory work. With the right partner, firms can offer bookkeeping and accounting services under their brand, ensure ATO compliance and BAS lodgement, streamline financial operations, and improve cash flow for clients.

FAQ

What is white label bookkeeping?

White label bookkeeping is a service where a third-party provider performs the bookkeeping tasks in the background, but the final work and reports are delivered to clients under your own accounting firm’s brand and logo. This allows firms to offer comprehensive bookkeeping services without expanding their in-house team, while the client remains unaware of the outsourcing.

What is white label accounting?

White label accounting involves outsourcing a range of accounting tasks, such as tax preparation, financial reporting, payroll processing, or compliance work, to a specialist provider. The provider completes the work and presents it as if it came directly from your firm, helping accounting practices scale their offerings and maintain a professional, seamless brand experience for clients.

What are the three types of bookkeeping?

The three main types of bookkeeping are single-entry bookkeeping, which records each transaction only once and suits very small operations; double-entry bookkeeping, the professional standard that records transactions as both debits and credits for greater accuracy; and virtual or remote bookkeeping, which is performed off-site using cloud software and is often outsourced or provided on a white-label basis.

What is the concept of white label?

The concept of white label refers to a business arrangement where one company produces a product or service, and another company rebrands and sells it as their own. In professional services like bookkeeping and accounting, it enables firms to expand their service range without developing the expertise or capacity internally, delivering a fully branded experience to their clients.

What are white labelling examples?

White labelling examples in the bookkeeping and accounting space include an accounting firm outsourcing daily reconciliations, payroll processing, or BAS lodgement to a white label provider, who then supplies the completed work and reports branded with the firm’s logo. Another common example is outsourcing full financial statements or compliance tasks, allowing the firm to present expanded services as entirely in-house to their clients.

What is the hourly rate for a bookkeeper in Australia?

The average hourly rate for a bookkeeper in Australia is around AU$31–$35, based on employee salaries. Rates are higher in cities like Sydney (AU$33+) or Melbourne (AU$32+), and can range from AU$25 for entry-level to AU$42 for experienced roles.

How much should you charge as a bookkeeper?

As a freelance or outsourced bookkeeper in Australia, you should charge AU$50–$100 per hour, depending on experience, location, and services (e.g., BAS lodgement). Beginners might start at AU$40–$60, while experienced or registered BAS agents often charge AU$70–$120 for added value and compliance work.

What is a bookkeeper’s hourly rate?

A bookkeeper’s hourly rate in Australia typically ranges from AU$30–$90. Employed bookkeepers average AU$31–$35, while freelance or outsourced providers charge AU$50–$100+ to cover overheads, expertise, and services like payroll or BAS preparation.

What are the benefits of using white label bookkeeping services for Australian accounting firms?

White label bookkeeping helps Australian firms scale cost-effectively by outsourcing routine tasks (e.g., reconciliations, payroll, BAS lodgement) under their own brand. Benefits include lower overheads, access to ATO-compliant expertise, faster turnarounds via automation, more focus on advisory work, flexible scaling, and preserved client relationships.

What are the most popular bookkeeping software options in Australia in 2025-2026?

The top options are Xero (market leader for ease and integrations), MYOB (strong in payroll, inventory, and ATO compliance), and QuickBooks Online (great automation and value for SMEs). Most white label providers support all three.

Also Read: Why White Label Bookkeeping Services Are Your Secret to Business Success