Introduction

Imagine this: it’s midnight, and you’re sowed in permits, trying to make intent of your books. Sound familiar? Small business life is exciting, but the financial grind? Not so much. That’s where outsourced finance and accounting swoop in. At Numberfied, we’re not just about numbers we’re about helping you grow, saving you time, and making your business dreams a reality. Please think of us as your trusty financial wingman.

Key Takeaways

- Save money and time by outsourcing your finances.

- Tap into expert know-how to boost your growth.

- See how Numberfied turns bookkeeping into your secret weapon.

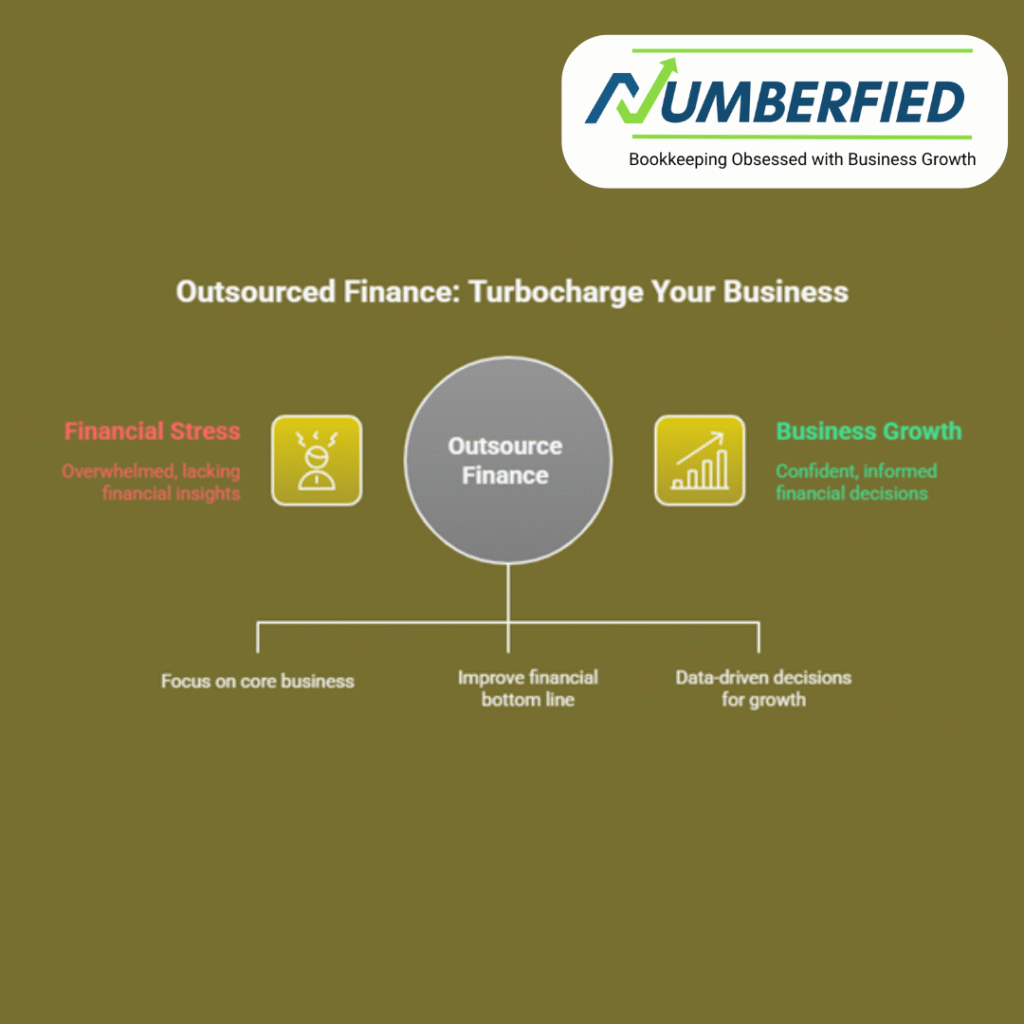

Why Outsource Your Finances?

Giving off your books might feel risky, but it’s like employing a pro to fix your car you get better results without the headache. Outsourced finance and accounting lets you concentrate on what you’re awesome at, like crafting ideal lattes or coding assassin apps.

Save Money, Stress Less

Full-time accountants cost a bundle salaries, benefits, and work. Outsourcing gives you expert help for less. A Perth bakery we know saved enough with Numberfied to upgrade their kitchen. That’s money well spent!

Experts in Your Corner

Tax rules shift faster than you can say deduction. With outsourced finance and accounting, you’ve got pros who stay on top of it all. We helped a gym owner uncover a tax break, giving them extra cash to spruce up their space.

Grow Without the Hassle

Whether you’re flying solo or running a busy shop, outsourcing grows with you no need to hire extra staff. We tweak our services to match your pace, keeping things smooth as you scale.

Turn Numbers into Growth

Outsourced finance and accounting isn’t just about tidy books it’s about using those numbers to build something incredible. Transparent finances mean bolder plans.

See Your Business Clearly

If your money feels like a mystery, we’ve got the flashlight. Detailed reports show you what’s what. A cafe owner we helped used our cash flow insights to open a second spot. Now they’re brewing success!

Make Choices That Win

Smart decisions need solid info. Outsourced finance and accounting gives you the data to plan big. We showed a retailer where they were overspending, helping them pocket an extra 10% in profits.

Focus on Your Passion

Bookkeeping steals time from your real work. Outsourcing lets you chase new clients or perfect your product. A graphic designer we work with doubled their projects after we took over their finances.

Technology Makes It Simple

Ditch the old-school ledgers modern outsourced finance and accounting use tech to keep things fast, safe, and easy.

Access Anywhere

Cloud tools let you peek at your books from anywhere a cafe, a plane, you name it. Numberfied’s platform is like your finances on speed dial. A contractor client checks invoices right from job sites.

Automation Saves Time

Manual data entry is a snooze and error-prone. Our tools automate payroll and invoicing, saving you hours. We set up auto-payroll for a shop owner, and now they spend weekends with their kids, not paperwork.

Your Data’s Locked Tight

Worried about security? Don’t be. Numberfied uses bank-grade encryption to keep your info safe. It’s like a fortress for your finances so that you can rest easy.

Busting Outsourcing Myths

Some folks shy away from outsourcing because of rumors. Let’s clear the air about what outsourced finance and accounting means.

You’re Still in Charge

Outsourcing doesn’t mean losing control. You get regular updates and call the shots. We share weekly reports with clients, so they’re always in the know.

Not Just for Big Players

Think outsourcing’s only for corporations? Think again. Small businesses get the most significant boost. A freelance photographer we helped now takes on bigger gigs, thanks to our budget-friendly support.

It’s Easier on Your Wallet

Outsourcing sounds pricey, but it’s a steal. You pay for what you need, nothing more. A craft store we serve slashed their accounting costs by 25% with Numberfied.

Finding the Perfect Financial Partner

Not all outsourcing teams are created equal. Here’s how to pick one that’s got your back, like we do at Numberfied.

Go for Know-How

You want a team with real experience. Numberfied’s crew has worked with everyone from startups to shops, so we know what clicks across the board.

Get a Custom Plan

Your business is one-of-a-kind, and your outsourcing should be too. We build services around your goals, whether it’s nailing taxes or planning a big leap.

Keep It Clear

Good communication is everything. We talk straight, no jargon, and keep you updated. Clients say it’s like chatting with a friend who happens to love numbers.

Why Numberfied Stands Out

At Numberfied, we’re not just bookkeepers we’re your growth partners. Our outsourced finance and accounting services are all about helping your business shine.

More Than Numbers

We’re here to help you dream big. A local online shop we work with boosted sales by 12% after we tweaked their pricing based on their financials. That’s the Numberfied difference.

Your Extended Team

Please think of us as part of your crew. We’re quick to answer questions and spot ways to save. One client called us their money lifesaver for catching a billing mistake early.

Big-Picture Thinking

We don’t just tidy your books; we help you plan bold moves. Whether it’s hiring new staff or launching a product, Numberfied’s outsourced finance and accounting sets you up to win.

Conclusion

Outsourced finance and accounting is like giving your business a turbo boost. It saves you time, keeps your wallet happy, and hands you the insights to grow with confidence. We’ve seen it work wonders like the cafe owner who expanded or the retailer who pocketed more profits. At Numberfied, we’re all about helping small businesses like yours chase big dreams. Want to ditch the financial stress and focus on what you love? Please pop over to https://numberfied.com/ and let’s start building your success story together.

FAQs

1. What’s included in outsourced finance and accounting?

It covers things like bookkeeping, payroll, tariff prep, and financial recommendation. At Numberfied, we tailor it to your business, so you’re not paying for stuff you don’t need. It’s like a custom financial playlist.

2. How much money can outsourcing save me?

You skip the cost of full-time staff, like salaries and benefits. A small shop we helped saved 25% a year by switching to us. That’s cash they now use to stock new products.

3. Is my data safe if I outsource?

Totally. We use super-strong encryption to protect your info. Numberfied’s systems are like a digital safe, keeping your financial details locked up tight.

4. Can tiny businesses outsource their finances?

You bet! Startups and solo owners benefit big time. We helped a tech startup focus on their app by handling their books, giving them a leg up without breaking the bank.

5. How often do I get updates on my finances?

We send weekly or monthly reports, whatever works for you. Our clients love the quick check-ins it’s like a friendly nudge to keep them on top of their numbers.

6. What if my business takes off suddenly?

We grow with you. There is no need to stress about adding staff we tweak our services. A cafe we work with doubled their locations, and we kept their finances smooth the whole way.

7. How do I know outsourcing is a good fit?

If you’re drowning in paperwork or want expert tips, it’s perfect. We helped a designer free up time for clients. Drop us a line at Numberfied to see if it’s right for you.

8. Can outsourcing make taxes easier?

Oh, yeah. Pros like us spot deductions and keep you compliant. A gym owner we helped found extra credits they missed, giving them more cash to invest in equipment.

9. How soon can I start outsourcing?

With Numberfied, you’re good to go in a few days. We check out your needs, whip up a plan, and dive in so you can get back to running your business ASAP.

10. Will I lose control if I outsource?

Nope, you’re still the boss. We keep you updated with clear reports. Our clients say it’s like having a financial co-pilot they steer, and we help navigate