Introduction

You started your company because you saw a need and knew you could fill it. The last thing you expected was to spend Friday nights hunting for a missing receipt or staring at a spreadsheet that refuses to balance. At Numberfied, we talk to owners just like you every single day. That is exactly why we created accountant services for small businesses that work as you do. We handle the daily grind of numbers so you can handle the daily joy of building your company. This guide walks you through every detail, every decision point, and every outcome you can expect when you partner with us.

Here are the main ideas we cover:

- Accountant services for small business keep every transaction in its proper place and every deadline met.

- Owners gain back weekly hours to focus on customers, products, and growth.

- Numberfied structures every plan around your specific industry, current size, and future goals.

Why Small Businesses Choose Accountant Services

Owners start out doing everything themselves. It makes sense in the beginning. Then the orders roll in, the team grows, and the paperwork multiplies. Accountant services for small business step in before minor oversights become significant problems.

Daily Accuracy That Builds Trust

Every sale, every expense, every payroll entry lands exactly where it belongs. When the books stay current, you open the report and know the numbers tell the truth. Our team reviews every transaction the same day it posts.

Hours Returned to What Matters Most

Bookkeeping steals time from client calls, product design, and family dinners. Hand the task to accountant services for small business and watch those hours reappear on your calendar. Most owners report an immediate difference in their weekly schedule.

Compliance Handled Without Extra Effort

New tax rules appear, payroll forms change, and sales-tax thresholds shift. We track every requirement across every state where you operate. Filings leave on time, penalties stay at zero, and you stay focused on the work in front of you.

How to Select the Right Accountant Services for Small Business

Plenty of firms say they serve small companies. The difference shows up in the first conversation and the first monthly report. You need a partner who understands your busiest month, your average sale size, and your five-year plan.

Industry Knowledge That Matches Your Operation

A construction company tracks job costs differently from how an online retailer tracks inventory. Numberfied serves contractors in Texas, California boutiques, and New York consultants. We speak the language of your specific business.

Reports Written for Owners, Not Accountants

Every month, you receive a one-page summary with three key figures: money in, money out, money left. Bullet points explain any change. You read it in five minutes and understand exactly where you stand.

Technology That Fits Into Your Day

Upload a receipt from the job site with your phone. Approve payroll while waiting for a delivery. Bank feeds import overnight. You see live numbers without opening a new program or learning a new system.

Core Tasks Included in Accountant Services for Small Business

We cover the full cycle of financial operations. Every client starts with the foundation, then adds modules as the company grows.

Bookkeeping Completed Every Day

Transactions import automatically. Our team categorizes each one within 24 hours. Bank statements are reconciled by the tenth of the following month. You always see yesterday’s activity today.

Payroll Processed on Your Schedule

New employees are onboard in minutes. Paychecks hit direct deposit on the exact day you choose. W-2s and 1099s are filed automatically at year-end. You review and approve with one click.

Monthly Financial Package Delivered on Time

Profit and loss statement, balance sheet, and cash-flow reports arrive in the first week of every month. Side-by-side comparisons show this year versus last year. Three highlighted items tell you what to watch.

Tax Planning Integrated into Accountant Services for Small Business

Taxes happen every quarter, every payroll, every purchase. Planning starts in January and continues through December.

Quarterly Review Meetings

We meet in March, June, September, and December to project liability, set aside funds, and capture new deductions. Estimated payments leave your account on the due date without you lifting a finger.

Deduction Documentation Built In

We track every allowable expense, including home office space, vehicle mileage, professional development courses, and cell phone usage. Clients routinely find write-offs they never claimed on their own.

Early Filing Every Year

Most business and personal returns are transmitted to the IRS by mid-February. Extensions file only when a clear advantage exists. You receive organized copies for your files the same week.

Budget Development and Tracking

A budget turns last year’s results into this year’s roadmap. We build it together and review it together.

Historical Data Forms the Base

We pull 12 to 24 months of actual transactions, adjust for known changes, and create line-item targets you can follow. The budget lives in the same portal as your live books.

Monthly Variance Reports

Green means on track, yellow means watch, red means adjust. Each line shows actual versus budget with a short explanation. You make course corrections before the month closes.

Future Scenario Planning

Adding a new location? Launching a product line? We run three versions- conservative, expected, and aggressive- so you see the financial impact before you commit.

Cash Flow Management Through Accounting Services

Profit on paper does not pay the electric bill. Cash in the bank does.

Weekly 13-Week Forecast

Updated every Monday. Shows incoming payments, outgoing bills, and the buffer required. Owners use the printout when talking to their bank about credit lines.

Receivables Collection Process

Emailed invoices include a pay-now button. Automatic reminders go out at 7, 14, and 21 days. Average collection time drops several days for most clients.

Payables Scheduled for Maximum Advantage

Net-30 vendors receive payment on day 30. Early-pay discounts apply only when the savings outweigh the interest. Cash stays in your control longer.

Strategic Guidance Beyond the Numbers

Numbers provide the facts. Advice provides the direction.

Expense Review Sessions

Every quarter, we examine the top ten spending categories. We identify swaps, renegotiations, or consolidations that keep quality high and costs controlled.

Break-Even Calculations for New Hires

Know the exact revenue needed to cover a new employee before you post the job listing. We include payroll taxes, benefits, and workspace costs in the model.

Pricing Strategy Checkups

Test a rate increase on paper first. We show customer retention projections and profit impact so you move forward with confidence.

Technology Platform Supporting Accountant Services for Small Business

We use the same secure systems trusted by large corporations, scaled perfectly for Main Street operations.

Cloud-Based Accounting Access

Log in from any device. You see the same real-time data our team sees. No more emailing files back and forth.

Mobile Receipt Capture

Take a picture of a lunch receipt or forward a supplier invoice by email. The expense lands in the books, coded and ready for approval.

Security Standards That Protect Your Data

Daily backups, end-to-end encryption, two-factor authentication, and regular third-party audits keep every file safe and private.

Growth Support as Your Company Expands

Your accounting needs evolve with your revenue. Our accountant services for small business evolve right alongside you.

Multi-Location Reporting

Separate profit centers for each shop or division, roll up into one master view. You see individual performance and company totals with one login.

Multi-State Tax Compliance

Sell into a new state, and we will activate Nexus tracking, collect the right rate, and file the return. No manual research required on your end.

System Integrations That Save Time

Connect your point-of-sale, e-commerce platform, or CRM directly to the general ledger. Sales ring up and books update without double entry.

Onboarding Process from Start to Live

Week one: discovery call, document checklist, access setup. Week two: historical data import, chart of accounts rebuild, opening balances verified. Week three: portal training, first live payroll run, initial budget draft. Month two onward: full monthly close, strategy session, ongoing support.

Voices from Numberfied Clients

“Used to dread the first of the month. Now I look forward to the clean report.” – Maria, catering company owner, Denver.

“Found deductions on equipment I bought two years ago. Wish I had switched sooner.” – Greg, auto repair shop, Phoenix

“Multi-state sales tax runs itself. I haven’t opened a state portal in months.” – Priya, online craft supplier, Atlanta.

Conclusion: Your Next Step Forward

Accountant services for small business transform financial stress into financial strength. Clean books, predictable cash flow, strategic insight- all delivered consistently without drama. Stop guessing and start knowing. Visit https://numberfied.com/ right now, complete the short form with your name, email, and biggest finance challenge, and expect a call from our team tomorrow. We will outline a custom plan, answer every question, and schedule your onboarding before the week ends.

FAQs

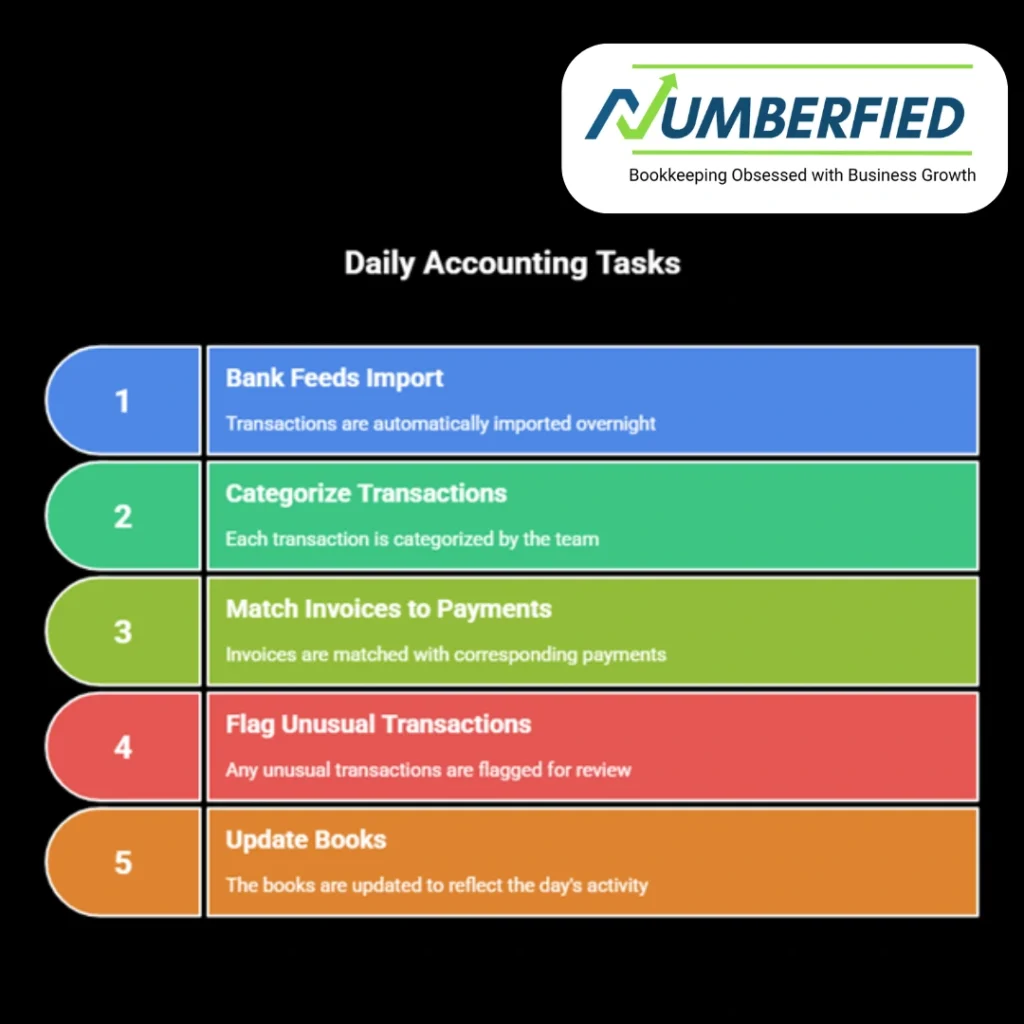

What daily tasks do accountant services for small business complete without my involvement?

Bank feeds import every transaction overnight. Our team categorizes each entry the same morning, matches invoices to payments, and flags anything unusual for your quick review. By the close of business, the books reflect the day’s complete activity.

I run a seasonal business- how do accountant services for small business adjust for slow months?

We build the budget around your historical patterns, set higher targets for peak seasons, and create cash reserves during busy periods. Monthly reports highlight the buffer so you enter slow months prepared.

How quickly can you clean up books that have fallen behind for several months?

Provide bank statements, credit card downloads, and any existing files. We rebuild the chart of accounts, recode line by line, and deliver verified opening balances within 10 to 14 business days. The first clean month closes on schedule.

What support do I receive if the IRS sends an audit notice?

We gather every requested document, organize by year and category, draft the response, and manage all correspondence. You receive copies of everything. Most audits close with no adjustment when the records are complete.

Can I continue using my current accounting software with accountant services for small business?

Yes. We work inside your QuickBooks Online file or maintain a parallel system and sync monthly. Desktop users migrate to the cloud during onboarding with full history preserved and no data loss.

How does pricing work for accountant services for small business at Numberfied?

A flat monthly fee covers all core tasks. The quote factors average monthly transactions, payroll headcount, and operating states. You receive the exact number after the discovery call with no hidden charges.

Do you offer a tax-only option separate from full accountant services for small business?

We provide standalone tax packages that include quarterly estimates, year-end filings, and one planning session. Many clients begin there and add bookkeeping once they experience the efficiency.

How do e-commerce sellers benefit specifically from accountant services for small business?

Daily sales data pulls from Shopify, Amazon, and Etsy platforms. We match deposits, allocate marketplace fees, update cost of goods sold, and maintain inventory valuation. Sales tax is collected and remits automatically across jurisdictions.

What guarantees accompany accountant services for small business?

Accuracy guarantee fixes any error on our end at our expense. Satisfaction guarantee allows cancellation after the first three months with no penalty. Onboarding guarantee delivers clean books within 30 days or the first month is free.

How do I begin working with Numberfied’s accountant services for small business today?

Visit https://numberfied.com/, fill in your name, email, primary finance concern, and preferred call time. A team member contacts you within one business day to schedule a 20-minute discovery call and build your custom roadmap.

Read Also: Online Accounting and Bookkeeping Services: Growing Your Business with Numberfied