Introduction

Think about closing your books each month without scrambling through receipts, filing taxes well before the rush, and catching money leaks long before they hurt. Smart tax and accounting services make that happen every day. At Numberfied, we work with companies all over the country, mixing solid software with real-world experience. We find deductions you might skip, spot trouble early, and give you numbers you can trust anytime. This guide walks you through what these services cover, the problems they solve, and the simple steps you can take right now.

Tax rules shift all the time, and old ways of doing things lead to mix-ups that pile up. Smart tax and accounting services cut out most of that mess by handling the routine stuff automatically but keeping people in the loop for the big calls. We hook up your bank accounts, keep an eye on every dollar, and only bother you when it matters. You stay in charge of your business while we keep the finances on track. Let’s get into the details and show you how it all fits together.

Key Takeaways:

- Smart tax and accounting services handle the grunt work with automation.

- Fresh data helps you make choices quickly.

- Planning ahead cuts down your tax hit.

- Everything stays in one place for compliance.

What Smart Tax and Accounting Services Include

Smart tax and accounting services wrap up bookkeeping, payroll, tax work, and advice in one smooth package. All the parts connect, so nothing gets lost, and you always have the full picture when you need it.

Daily Transaction Management

Invoices land in the system as soon as they come in, and bank payments show up without you doing a thing. The Numberfied crew checks things over each week to catch anything strange. We line up receipts with entries, put them in the right spots for taxes and reports, and add notes for later. Your books stay up to date, an d you pull up the whole story from one screen- no digging around. We also set rules so common bills like utilities or subscriptions post to the same place every time, and if something changes, we flag it for a quick look. This keeps the day-to-day running clean and lets you focus on the business instead of the paperwork.

Payroll and Benefits Administration

Pay figures out base rates, extra hours, bonuses, and what gets taken out, all exact. Smart tax and accounting services send money straight to worker accounts. We keep tabs on time off earned, deal with any required withholdings, and send in the forms on time. Bringing on someone new takes just a few clicks; letting someone go triggers the last check and any needed paperwork. You look it over and give the go-ahead once. We also handle things like health plan deductions or 401(k) matches, making sure they pull from pay correctly and report right for the year-end forms. If someone has a question about their stub, we pull it up fast and explain it clear.

Quarterly and Annual Tax Filings

Payments for estimates head out when due, and we only ask for extensions if they help. Numberfied gathers the info, sets up the forms, and files them online. We back up every claim with details on deductions and choices like faster write-offs. We go over the final version together to make sure it fits, then file it and keep a copy handy in your folder. Before anything goes out, we check for new rules or credits that popped up, and we run numbers both ways to see if grouping costs or splitting them saves more. This way, you pay what you owe but not a penny extra.

Benefits of Choosing Smart Tax and Accounting Services

Doing things the old way eats up your day and opens the door to mistakes. Newer approaches free you up and sharpen your edge. You feel the change fast, and it sticks.

Error Reduction Through Automation

Mistakes drop way down when the computer crunches the numbers and follows set rules. Smart tax and accounting services point out anything odd right away. We check it out, put it right, and keep going. Things like paying the same bill twice or putting costs in the wrong place set off a flag. We fix them that day so they don’t turn into bigger issues later. Your numbers hold up no matter who looks. We also run a second check at month-end to match bank totals and catch anything the daily sweep missed. Over time, the system learns your patterns and gets even better at spotting outliers.

Time Savings for Business Owners

You stop burning midnight oil matching up accounts because the main points show up on easy screens. Numberfied only reaches out when you need to decide something. One shop owner went from spending half a day every week on the books to just a quick look-over. That extra time goes into talking to customers or building new products. We set up alerts for things like low cash or big bills coming due, so you handle them once instead of hunting them down. Owners tell us they finally get weekends back and sleep better knowing nothing slips.

Enhanced Cash Flow Visibility

You see cash moving in and out clearly every day. We play out different paths for upcoming costs. Smart tax and accounting services help keep money ready when you need it. You get a daily snapshot of what’s on hand for bills or paydays. We look ahead a few months using what’s owed and what’s due. One builder skipped a pricey loan because we saw a late payment coming and chased it down. We also tag big one-time spends so you see how they hit the flow and plan around them. This keeps surprises off the table and lets you grab chances when they show up.

Technology Behind Smart Tax and Accounting Services

Good tools do the heavy lifting. We pick ones that fit now and later, and we make sure they play nice with what you already use.

Cloud-Based Accounting Software

Get in from your phone or computer anywhere with web access. Copies save themselves, and Numberfied sets who sees what. New features load quietly at night. You can okay bills or costs from wherever you are. Extra log-in steps and quick time-outs keep things locked down. We also turn on version history so you can go back if someone changes something by mistake. The mobile app lets you snap receipt photos that upload and match automatic, saving the shoebox of paper.

Secure Data Integration

Banks, cards, and sales setups link up safely, no typing the same thing twice. Smart tax and accounting services line everything up each night. What’s in the system matches the bank by morning. Sales from online carts or card readers drop into income, fees go to costs, and stock updates all at once. If you use inventory software, we tie it in so low stock warns you and posts the reorder cost right. This cuts out the end-of-day tally and keeps everything in sync no matter how many ways money moves.

Reporting and Analytics Tools

Choose what matters to you, like profit on certain items or clients. Views let you start big and zoom in. Reports can land in your email on a schedule. Flip between this year and last easily. A cafe owner watches supply costs daily and tweaks prices before profits dip. We build in graphs that show trends over months or years, and you click to see the transactions behind any bar. Custom tags let you track projects or marketing campaigns separate from the rest.

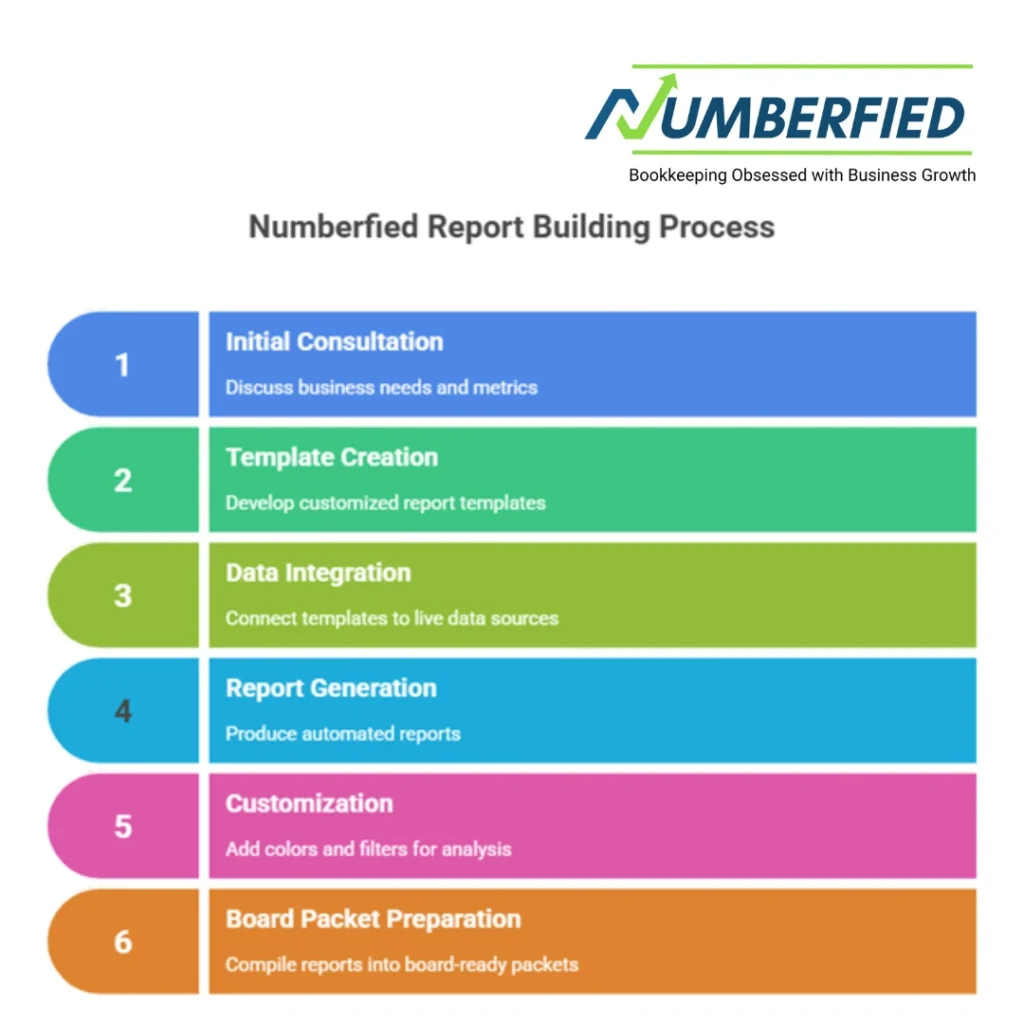

How Numberfied Implements Smart Tax and Accounting Services

We learn your setup first and tweak as you go. No two businesses run the same, so we tailor from the start.

Discovery and Setup Phase

We start by hearing what bugs you most. Then we grab old reports and build your account list to match how you work. Numberfied ties it all together, brings in past years for patterns, and shows your people how it runs. Most folks are rolling in under two weeks. We test the bank links live, run a fake payroll to check, and fix any hiccups before real money moves. Your team gets cheat sheets and a go-to person for the first month.

Ongoing Monitoring and Adjustments

We wrap up each month and look for slips. Smart tax and accounting services bend with your growth– new spots or lines fit right in. Adding web sales means we set up tax rules that week. We check in every few months to clean up and add what’s new. If you switch vendors or banks, we update the feeds the same day. Quarterly calls go over what’s working and what to tweak next.

Year-End Close and Planning

We lock the year’s numbers and dig into what worked. Talks for next year start early. We figure out write-offs on new gear, spot losses to use, and map owner pay to save on taxes. We pull reports on top expenses and revenue drivers to guide budgets. By November, you have a draft plan to review and lock before the holidays hit.

Tax Planning Strategies in Smart Tax and Accounting Services

Looking ahead always beats fixing at the last minute. We keep an eye on the calendar and the rules.

Deduction Identification

We go over every cost to find what counts. Gear buys, trips, even part of your phone bill. Smart tax and accounting services keep proof ready- miles from your app, office space measured out, early business costs spread right. It all stands up if someone checks. We group similar items to see if bundling or splitting helps more, and we note changes in use so nothing gets claimed wrong.

Entity Structure Review

Changing how your business is set up can shift taxes a lot. We compare now and what could be. Numberfied handles the forms and sets fair pay levels when it makes sense. Savings often pay our way the first year. We watch profit levels and owner draws to know when the switch tips in your favor, and we walk you through the state filings too.

Credit and Incentive Research

Upgrades for energy, new hires, or testing ideas can bring money back. We line your work up with what’s out there. A factory got a nice check on new machines because we caught it during a regular look. We file the paperwork and track the refund so it hits your account fast. State programs get the same hunt, and we remind you when to reapply.

Compliance Management with Smart Tax and Accounting Services

Missing a rule hurts. We stay on top of them all and make the process painless.

Federal Requirement Tracking

Payroll sends, year-end forms, business taxes- all go out online with proof. Smart tax and accounting services match quarter reports to pay runs. Worker forms balance exactly before they go out. We keep copies of every confirmation and note any follow-ups needed. If a form changes mid-year, we update and test before the next due date.

State and Local Obligations

Selling in new places starts tax collection. We figure rates, pull data, and pay on time. Numberfied updates for new addresses or rules. Pay in different states uses local tables. We watch sales by zip code to catch nexus early and set up the right filings. Multi-state owners get one report that covers everything.

Industry-Specific Regulations

Food places report tips, builders do certified pay. We have lists for your line of work. One hauler dodged a big fine because we fixed a fuel report quick. We build the extra steps into the normal flow so they don’t feel like add-ons. Annual training keeps the team sharp on your field’s quirks.

Financial Reporting Through Smart Tax and Accounting Services

Numbers need to make sense fast. We set them up that way and teach you to read them quick.

Profit and Loss Statements

Income and costs split by area or type, with last times next to them. Smart tax and accounting services give managers their own views to watch budgets. We add notes on big swings and what caused them. Monthly packets go to owners and banks with the same clean look.

Balance Sheet Reviews

What you have, owe, and keep- updated live with notes on changes. Main ratios sit up front for quick checks. We point out when debt creeps or cash builds, and suggest moves. Lenders get the same sheet without extra work.

Custom Management Reports

Name your top measures, and we build screens that update themselves. Numberfied breaks down odd jumps so you fix them early. One agency tracks client hours against billings and spots unprofitable accounts fast. We export to spreadsheets if you need to tweak further.

Scaling Your Business with Smart Tax and Accounting Services

Getting bigger adds layers. We handle them and keep things simple.

Multi-Location Support

Each place tracks separate but rolls up together. Smart tax and accounting services compare spots easily. Shared costs split fair. Managers see their numbers; owners see the whole. Opening a new branch means copying the setup and linking it in.

International Transaction Handling

Overseas deals change to dollars right, with any holds or reports. Books stay clean for U.S. rules. We track exchange rates daily and post gains or losses where they belong. Export docs stay ready for customs or audits.

Acquisition and Merger Support

Good records speed checks. Numberfied sets up combined books day one. We track buy details and extras. Due diligence pulls clean data fast, and we map the new chart to avoid double work. Post-close, one system runs it all.

Security Measures in Smart Tax and Accounting Services

We guard your info tight and test the locks regular.

Data Encryption Standards

Everything scrambles coming and going. Smart tax and accounting services pass outside checks regular. We use the same level banks do and renew keys on schedule. Client files stay separate even from each other.

Access Controls and Audit Trails

Extra log-ins and set rights keep folks in their lanes. Every move logs for looking back. We review the trail if something seems off and lock accounts that sit unused. New hires get rights only after training.

Disaster Recovery Planning

Copies in different spots, tested often. You get back quick no matter what. We run full restores quarterly and keep a hot site ready. Paper backups of key docs live offsite too.

Selecting a Provider for Smart Tax and Accounting Services

The right fit goes past tools to how we work together and back our word.

Team Qualifications

Our pros keep learning and hold top marks. Smart tax and accounting services use that know-how for you. We pair you with someone who’s seen your kind of business before. Continuing ed credits stay current every year.

Client Communication Style

We check in how you like, answer fast. Numberfied keeps things clear. Weekly emails sum up what’s done; calls happen when you want. No jargon unless you ask for it.

Service Level Agreements

What we promise shows in writing. We stick to it. Response times, close dates, everything spelled out. If we miss, we make it right.

Next Steps to Engage Smart Tax and Accounting Services

Starting is easy and low pressure.

Schedule an Introductory Call

Set a short talk about where you stand. Smart tax and accounting services start by hearing you out. We ask questions, listen hard, and sketch what could change.

Review Current Financial Processes

Send a couple reports for a free look. Numberfied points out wins and fixes, no push. We mark quick hits and longer plays, all in plain talk.

Receive a Tailored Proposal

You get a plan with steps and costs soon. Move when it suits. We lay out months one by one and what you see each time.

Conclusion

Smart tax and accounting services give you steady ground without the hassle. Machines do the repeat jobs; people handle the smart ones. Numberfied works with you to turn numbers into moves that build your company.

You get fewer slip-ups, more hours, and lower taxes. It all ties together. Your money side finally pulls its weight and helps you grow.

Head to https://numberfied.com/ or call us to try smart tax and accounting services that match what you need. We’re ready when you are.

FAQs

1. How do smart tax and accounting services deal with busy seasons?

The setup handles more work without slowing. Numberfied looks at past peaks, sets extra views, and lines up help. Money forecasts cover the ups and downs. We preload recurring bills and watch cash closer, sending heads-up if balances dip. Past clients sail through holidays or summer rushes with no late nights.

2. What hooks work for shop sales systems in smart tax and accounting services?

We link common ones so sales drop in live, money shows right, fees hit costs. Daily bank matches kill end-of-day work. Inventory ties in so stock counts stay true, and low items ping you to reorder. One retailer cut count time from days to hours.

3. How does Numberfied build reports just for my business in smart tax and accounting services?

We ask what you watch during start-up, then make templates that pull fresh data. They go out how you want for meetings. We add colors for good or bad trends and let you filter by date or type. Board packets come ready to print or share.

4. Can smart tax and accounting services split costs over teams?

Rules share things like rent by people or space. Numberfied keeps it fair for true team profits. We set drivers that update automatic, like headcount from payroll. Monthly views show who’s over or under so managers adjust fast.

5. What if bank matches don’t line up with smart tax and accounting services?

We hunt the difference- fee, timing, or mistake. Fix it with your okay and stop it happening again. We add a rule or note the bank to watch that type. Full notes go in the file for next time.

6. How are log-ins set for my crew in smart tax and accounting services?

We give rights by job, track changes. Numberfied checks with you now and then. New folks get temp access till trained, and old ones lock when they leave. Reports show who did what if questions come up.

7. Do smart tax and accounting services help make budgets?

We use old numbers and goals to build one, check monthly. Alerts ping when close to limits. We sit with you to set targets and load them in. Variance notes explain why and what to do next.

8. What if someone leaves- how do smart tax and accounting services keep going?

Steps stay written in the system. Numberfied fills in or trains new folks smooth. We run parallel for a week if needed and hand over clean files. Nothing stops because one person walks.

9. How does Numberfied use what I say to better smart tax and accounting services?

We ask regular, meet quarterly. Changes come from that and we tell you. Small tweaks like new alert levels or report layouts happen fast. Big ideas go into the whole system for everyone.

10. Can smart tax and accounting services make forecasts for bank loans?

We build years ahead with linked statements. Numberfied tweaks and packs it for lenders. We add notes on assumptions and best/worst cases. Banks like the clean backup and ask fewer questions.

Read Also: Why Absolute Bookkeeping Services Are Your Ticket to Financial Freedom