Introduction

You started your business to make an impact – not to spend nights sorting receipts or stressing over payroll. That’s where Numberfied steps in. Our Accounting and Book keeping Services handle the numbers, clean up the chaos, and keep your finances clear and compliant.

Skip solid Accounting and Book keeping Services, and mistakes can cost you – from late payroll penalties to hidden profit gaps. We keep everything accurate and up to date, so you can focus on growing your business. Book a free strategy call, and let’s get your books back on track.

Key Takeaways

- Accounting and Book keeping Services protect you from penalties and keep your records audit-ready.

- Professional support frees up dozens of hours monthly for the work that grows your business.

- Clean financials plus monthly strategy sessions create real, measurable momentum.

- Numberfied offers flexible, month-to-month plans with no long-term lock-ins.

- One short call reveals exactly where your books stand- and the fastest path forward.

Understanding the Basics of Accounting and Book keeping Services

Every sale, every expense, every payroll run needs to be recorded properly. Accounting and Book keeping Services take care of that from the beginning to the end.

The Daily Work of Bookkeeping

Once your bank feed updates, we get to work. Customer payment? Logged and matched to the right invoice. Supplier bill? Checked, coded, and queued for payment. Payroll day? Taxes sorted, deposits made, payslips sent. Then we go line by line through your bank statement to be sure everything adds up.

Our clients notice the difference. A cafe owner gets daily sales by location. A builder sees weekly costs for each project. Both rely on our Accounting and Book keeping Services, shaped around how their business actually runs.

How Accounting Takes It Further

After the daily entries are finished and verified, we put together the complete financial reports. The income statement lays out revenue and expenses for the period. The balance sheet shows assets, liabilities, and owner equity at that moment. The cash flow statement looks ahead to the coming weeks based on open invoices and upcoming payments. We go over each report with you and point out the important details.

Why Every American Business Needs the Full System

Tax obligations vary from state to state. Payroll rules change when you add employees. Sales tax treatment depends on the type of product or service. Keeping track of all those requirements in separate places leads to mistakes. Integrated Accounting and Book keeping Services bring everything into one organized, current system.

We submit the necessary forms in every state where you do business. We figure the local payroll amounts. We keep the documentation in order for any review. You provide the information one time- we take care of the distribution, the deadlines, and the follow-up.

The Benefits of Professional Accounting and Book keeping Services

The change becomes obvious within the first full month of working together.

Compliance Becomes Automatic

We send in 1099 forms in January. We prepare quarterly estimates in March, June, September, and December. We stay on top of state sales tax, payroll tax, and other required submissions. When an audit notice arrives, it is handled with prepared files instead of last-minute searches.

Your Time Comes Back

Business owners used to give up weekends to enter data and fix reconciliations. Now, those hours are returned for customer calls, product improvements, or time away from the office. One client mentioned that he was finally able to be at his daughter’s weekend activities without bringing work along.

Costs Stay Predictable and Fair

Bringing on a full-time finance employee involves salary, benefits, payroll taxes, software subscriptions, and workspace. Our plans adjust based on the number of transactions you have. You receive high-level Accounting and Book keeping Services without carrying the ongoing fixed expenses.

Decisions Get Sharper

You see the actual profit margin on each item before deciding on a promotion. You identify which advertising approach brings the best return before committing more funds. We supply a concise monthly overview that includes three specific steps you can put into action immediately.

How to Choose the Right Accounting and Book keeping Services Provider

The partner you select should support your business now and as it develops.

Deep Experience in Your Industry

Retail operations require inventory records. Professional services need tracking for billable time. Technology companies follow subscription revenue rules. Numberfied works with clients in all these fields and designs Accounting and Book keeping Services that align with your particular processes.

Technology That Works Behind the Scenes

Current platforms link your bank accounts, credit cards, payment systems, and payroll providers without manual intervention. We configure those connections, check them regularly, and ensure the information moves smoothly.

Flexibility to Match Your Pace

You may want to include payroll handling during a hiring phase. You may decide to remove it when you switch to independent contractors. You might need more detailed reports when seeking investment. Our Accounting and Book keeping Services change with a quick discussion- no fixed bundles.

Real People, Real Access

You communicate with the same senior accountant each month. Questions receive responses on the same day. There are no automated queues or lengthy waits.

Common Challenges in Accounting and Bookkeeping and Solutions

Business owners encounter the same obstacles. We address them directly.

Cash Flow Ups and Downs

We prepare a rolling cash flow projection using your recent activity. Reminders for overdue invoices are sent automatically. You receive advance notice of tight periods and can make adjustments before they become problems.

Tax Season Overwhelm

Records are closed at the end of each month. We calculate estimated taxes every quarter and assemble everything for the final return. When filing time arrives, your accountant receives one organized set of documents.

Multi-State Compliance Headaches

We follow sales figures by state and watch for economic nexus limits. When you reach a new threshold, we complete the registration, set up collection, and manage the periodic submissions. You send the sales information once, and we handle the division and reporting.

Data Security Concerns

We maintain secure systems with controlled access. Only the necessary team members view your files. Ongoing checks keep the safeguards effective.

Integrating Growth Strategies with Accounting and Book keeping Services

Accurate records maintain order. Thoughtful guidance turns them into advancement.

Every Dollar Serves a Purpose

We measure expense categories against your revenue goals. If a line item moves outside the target, we note it right away. You decide on corrections before the period ends.

Your Best Opportunities Stand Out

The transaction history shows which customers and products contribute the most. We compile that information and pass it to your sales and marketing groups.

Systems That Scale Smoothly

We write out the steps for invoicing, expense reviews, and monthly closings. Those instructions work whether you are at one million dollars in revenue or ten million.

You Lead with Confidence

We create brief financial overviews for meetings with investors, lenders, or directors. You enter the room prepared to discuss performance and future plans.

The Future of Accounting and Book keeping Services in America

The field continues to change. We stay prepared.

Automation Handles the Routine

Software manages standard entries. Our staff examines the exceptions and supplies the interpretation that informs choices.

Teams Work from Anywhere

Cloud access provides every approved user with the same current information, regardless of location.

Tax Changes Don’t Catch You Off Guard

New provisions appear frequently. We examine them, determine how they apply to you, and explain the steps to take advantage of them.

Broader Metrics in One Report

Stakeholders often request sustainability and diversity figures along with financial results. We incorporate those elements and produce unified summaries.

Conclusion

At Numberfied, we approach every client relationship as a true partnership. No extended contracts. No unexpected charges. Just expert Accounting and Book keeping Services that produce results you notice in your accounts. Go to https://numberfied.com/ and arrange your free strategy call. We will examine your books, identify the opportunities, and outline the next actions- side by side.

FAQs

What happens daily in your Accounting and Book keeping Services?

We begin when your bank feed refreshes in the morning. Every deposit is entered and linked to the corresponding invoice. Every vendor bill is reviewed, categorized, scheduled for payment, and archived. Payroll is handled on the set day- we compute taxes, arrange deposits, and distribute pay information. By the beginning of the following month, you will receive the complete set of financial statements and a brief note pointing out anything significant. The operation occurs quietly, so you can concentrate on running the business.

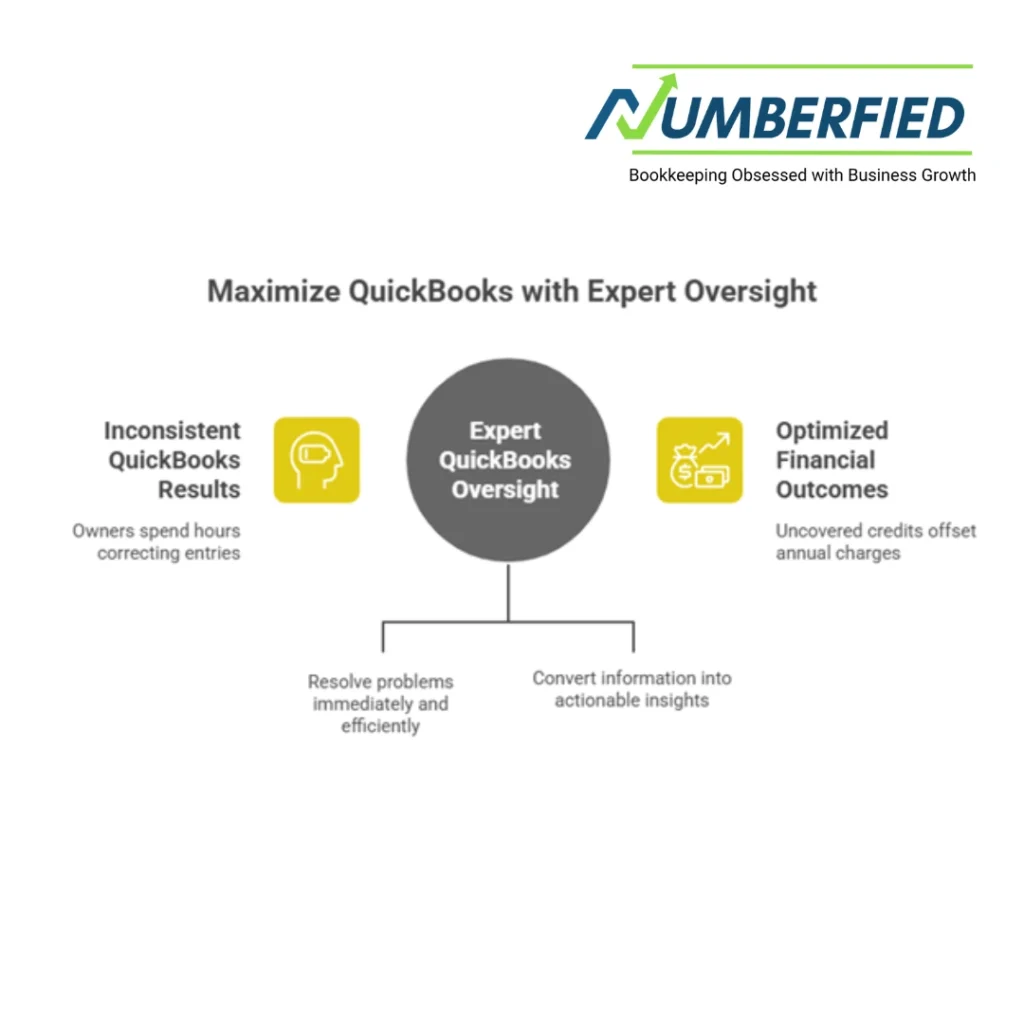

I already use QuickBooks. Why bring in professional Accounting and Book keeping Services?

QuickBooks offers a solid foundation but still demands consistent attention and knowledge to produce the best results. Owners frequently dedicate several hours weekly to correcting entries or locating missed deductions. We oversee the platform around the clock, resolve problems immediately, and convert the information into practical suggestions. One client uncovered credits that offset our charges for the entire year.

How do Accounting and Book keeping Services help reduce taxes legally?

We examine your quarterly records to ensure every permissible deduction is captured- mileage logs, home office costs, equipment purchases, research expenses. We arrange the timing of expenditures and classify items to obtain the maximum benefit under the regulations. Clients get detailed, documented approaches that decrease their tax obligation while remaining completely within the law.

I run an accounting firm. How does Numberfied support white-label Accounting and Book keeping Services?

You forward the client files to us through a secure channel. We perform the reconciliations, make necessary adjustments, calculate depreciation, and prepare the tax organizer. All materials come back bearing your firm’s branding and are ready for direct presentation to the client. This arrangement lets you handle additional volume during busy times or take on specialized work without expanding your permanent team.

How is growth coaching built into regular Accounting and Book keeping Services?

Every client participates in planned review meetings. We look at important indicators- gross margin, collection periods, expense percentages- and establish concrete improvement goals. We provide specific tasks with assigned responsibilities and due dates. The following meeting evaluates the outcomes and determines the next area to address.

Do I need a long-term contract to start Accounting and Book keeping Services?

No. The arrangement operates month to month with straightforward billing. You can modify the scope or take a break with thirty days’ notice. Most clients remain because the books stay correct, the submissions stay timely, and the advice continues to add value.

How quickly does cash flow improve with Accounting and Book keeping Services?

Most clients experience more consistent patterns within the first complete billing period. We set invoice terms to net fifteen days, send automated follow-ups, and create a forward-looking cash projection from your actual figures. The outcome is fewer unexpected shortfalls and improved forecasting.

What software platforms do you use with Accounting and Bookkeeping Services?

QuickBooks Online serves as our primary tool. We link it directly to your bank accounts, credit cards, payment gateways, and payroll systems. You retain your usual access while we handle the data management and flow.

How do you handle compliance for businesses operating in multiple states?

We monitor sales totals by state and watch for the points where registration becomes required. When you meet a threshold in a new area, we take care of the signup, configure collection, and submit the necessary reports. You supply the overall sales numbers one time- we divide them and file with each jurisdiction.

What sets Numberfied apart from large national Accounting and bookkeeping service providers?

You deal with the same experienced accountant every month. The standard fee covers payroll processing, tax submissions, and quarterly strategy reviews. Arrange a free strategy call to review your situation and receive the initial three recommendations to advance your business.