Introduction

Real estate moves fast- showings, offers, closings. Somewhere in the rush, the books get messy. A good bookkeeper for real estate steps in and puts every dollar where it belongs. We’re Numberfied, and we live for this stuff. Agents, investors, and managers tell us the same thing: once the numbers are handled, everything else clicks.

Rent rolls in. Repair bills pile up. Commissions hit after the sale. Miss one line, and the whole month looks off. That’s why a steady bookkeeper is needed for real estate matters. We take the load so you can take the listings.

Key Takeaways:

- Clean books stop little slips from becoming big bills.

- Year-round tax prep saves headaches and cash.

- Your hours go to clients, not spreadsheets.

Understanding the Role of a Bookkeeper for Real Estate

Bookkeeping isn’t just punching numbers. In real estate, it’s knowing why a roof job isn’t the same as printer ink.

Daily Transaction Management

Mornings start with yesterday’s activity. When the tenant rent hits the account, we tag it to the unit. A plumber fixes a sink, and we code it for maintenance. Utilities for the fourplex get split four ways. Nothing waits until Friday. By noon, the day’s cash is mapped. Owners can pull up a property and see exactly what’s coming in and going out.

Reconciliation Processes

Bank statements land mid-month. The bookkeeper for real estate matches every line to the ledger. A $29 fee nobody remembers? Tracked down. A deposit that hasn’t cleared? Noted and followed up. One hour later, the books balance to the penny. Lenders ask for statements; we hand them over without a scramble.

Reporting and Analysis

At the end of the month, we print the story. Profit per door. Maintenance creep on the older duplex. Which building covers the office rent? Owners glance at the sheet and know whether to raise rents or replace the HVAC. Numbers stop being noise and start being direction.

Benefits of Hiring a Bookkeeper for Real Estate

Outsourcing the books isn’t losing control; it’s gaining ground.

Improved Accuracy in Records

Sticky notes and phone photos don’t cut it. The bookkeeper for real estate builds a system that flags mistakes the moment they happen. Interest stays with the loan. Taxes stay with the county. One audit, zero surprises.

Time Savings for Core Activities

No more Sunday nights chasing receipts. The bookkeeper for real estate pays the bills, posts the rent, and balances the accounts. You’re at the open house instead. One agent told us he closed three extra deals in the first quarter we took over.

Enhanced Decision-Making

You see, the duplex is barely breaking even. Sell it or renovate? The numbers decide. A bookkeeper for real estate shows the cash flow before you guess. Bad calls turn into smart moves.

Common Financial Challenges in Real Estate

Same problems, different addresses. We’ve fixed them all.

Tracking Multiple Income Streams

Rent from the triplex. Flip profit from Elm Street. Management fee from the condo board. Mix them, and you can’t tell what’s working. The bookkeeper for real estate labels every dollar. Reports show the winners and the dogs.

Managing Variable Expenses

July is quiet. August, the AC dies in two units. Costs jump. The bookkeeper for real estate logs the spike, checks last year, and sets aside a buffer. Cash stays ready instead of scrambling.

Navigating Tax Obligations

Depreciation, repairs, and improvements get one wrong, and the IRS writes back. The bookkeeper separates capital from expenses all year. April comes, and the file is fat and organized. More write-offs, less worry.

How a Bookkeeper for Real Estate Ensures Compliance

Rules are rules. Miss one, pay for it.

Adhering to Regulatory Requirements

Security deposits sit in a separate account, the law says so. Escrow money moves on schedule. The bookkeeper watches both like a hawk. One slip can stall a closing; we don’t slip.

Preparing for Tax Seasons

Tax prep starts in January, not March. The bookkeeper for real estate stacks deductible receipts month by month. The CPA gets a tidy folder, not a grocery bag. Refunds show up faster.

Implementing Internal Controls

Big checks need two signatures. Vendor lists get scrubbed quarterly. The bookkeeper sets the guardrails. Fraud stays out; trust stays in.

Choosing the Right Bookkeeper for Real Estate

Not every bookkeeper gets NOI or 1031s. Find one who does.

Industry-Specific Experience

Worked with flippers? Managed rentals? The bookkeeper who speaks your shorthand. Setup is quick, and explanations are short.

Technology Proficiency

Phone app shows cash balance between appointments. Bank feeds post overnight. The bookkeeper for real estate makes it happen without a manual.

Communication Skills

Plain talk, fast replies. The bookkeeper explains the dip in cash flow over coffee, not legalese. Monthly calls keep us on the same page.

Integrating Bookkeeping with Real Estate Operations

Books and boots on the ground work together.

Coordinating with Property Managers

Tenant skips rent, the manager texts, and the bookkeeper posts the late fee. Leak fixed, the invoice hits the ledger the same day. No double entry, no missed charges.

Supporting Investment Analysis

New fourplex on the table? The bookkeeper for real estate crunches rent, taxes, and insurance. Numbers say yes or no before the offer goes out.

Facilitating Lender Requirements

Refi package due Friday. The bookkeeper emails pulls two years of clean books, the rent roll, and the profit sheet. Lender nods, rate drops.

Technology Tools Used by a Bookkeeper for Real Estate

Tools that work, not toys.

Accounting Software Options

QuickBooks Online, classes by property. One click shows the whole portfolio or just 123 Oak Street. Set up once, run forever.

Automation Features

Rent posts on the first. Coffee run tags to the office expense. Less typing, fewer oops.

Data Security Measures

Nightly backups. Unique logins. Files locked tighter than the safe at closing.

Cost Considerations for a Bookkeeper for Real Estate Services

Think of it as cheap insurance.

Value Over Expense

One overlooked deduction costs more than a year of service. The bookkeeper finds it and prevents the next one.

Flexible Service Plans

Need just posting? Done. Add bill pay later. Grow into it, don’t overpay.

Long-Term Financial Health

Clean books sell businesses for more. Partners trust numbers they can read. Today’s cost, tomorrow’s gain.

Training and Support from Numberfied’s Bookkeeper for Real Estate

We don’t vanish after day one.

Initial Onboarding Process

Day one: pull statements. Day five: chart of accounts built. Day ten: first clean report. You’re living without the headache.

Regular Performance Reviews

Monthly call, here’s the cash, here’s the trend, here’s the fix. Your goals steer the ship.

Educational Resources

Five-minute videos on reading P&L. Tax checklist in your inbox in November. Learn while we work.

Case Studies: Success with a Bookkeeper for Real Estate

Proof in the pudding.

Streamlining Portfolio Management

Twelve rentals, weekend warrior bookkeeping. Switched to Numberfied’s bookkeeper, reconciliations down to an hour. Sold a lemon, bought two gems.

Optimizing Tax Strategies

Investor braced for a five-figure bill. Our bookkeeper split repairs from improvements. Refund paid for a new furnace.

Scaling Operations Smoothly

Brokerage hit ten agents. Commission splits stayed perfect. Cash forecast said to hire two more. The owner took a vacation, the first in years.

Future-Proofing Finances with a Bookkeeper for Real Estate

Markets wiggle. Systems don’t.

Adapting to Market Shifts

Rents flatline? The bookkeeper rewrites the forecast overnight. Expenses trimmed before the pinch.

Planning for Growth

Next deal needs $50k down. The bookkeeper shows where it sits today. Offer goes in with eyes open.

Embracing Industry Trends

New law drops. AppFolio update lands. The bookkeeper tests, adopts, and trains. You stay current without the sweat.

Conclusion

A sharp bookkeeper for real estate turns fog into focus. Daily posts, tax wins, growth plans, all handled. Numberfied makes it simple and steady.

Ready for clean books? Head to https://numberfied.com/ and let’s talk.

FAQs

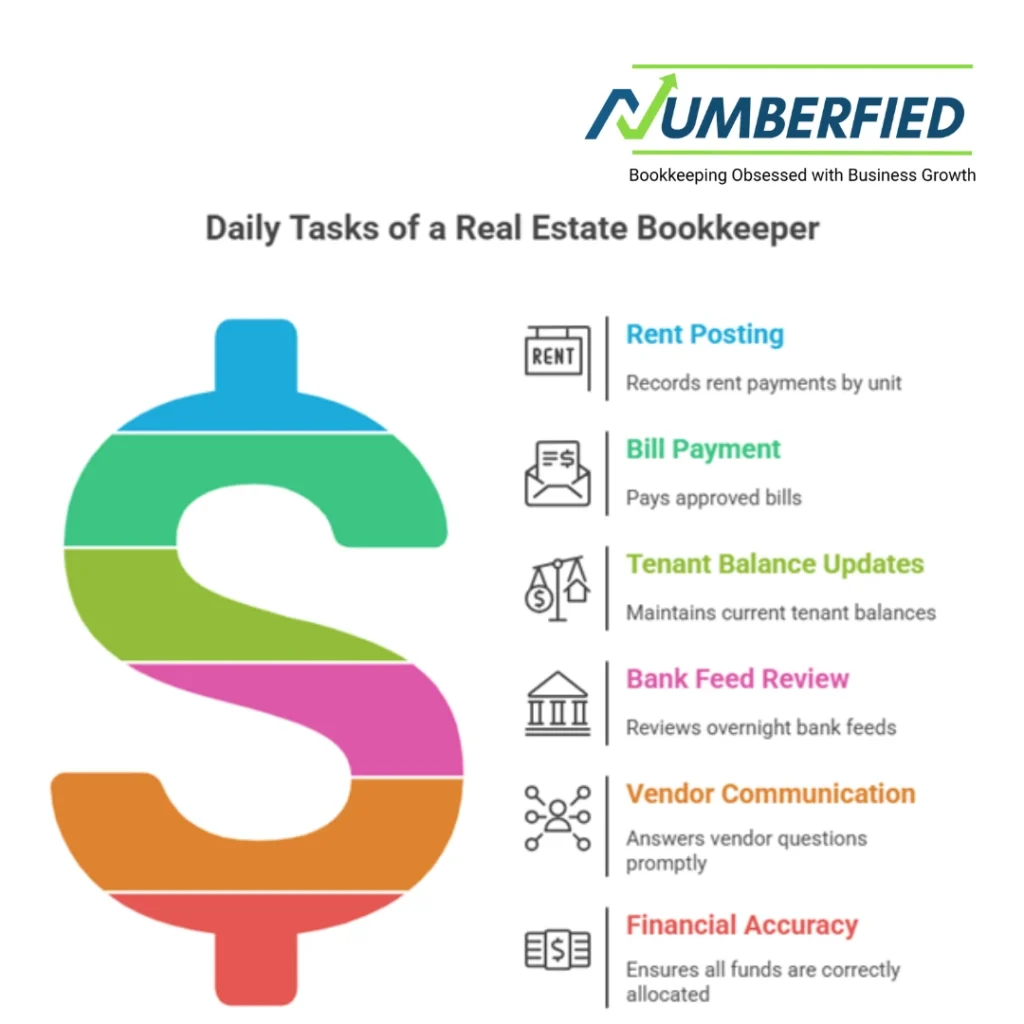

What does a bookkeeper for real estate do daily?

Posts rent by unit, pays approved bills, and updates tenant balances. Bank feed comes in overnight, reviewed by lunch. Vendor questions answered the same day. Every dollar lands where it should before the close of business.

How can a bookkeeper for real estate help with taxes?

Tags: deductible miles, insurance, interest as they hit. Capital jobs go on a depreciation list. January rolls around, the CPA gets a fat, neat file. Refunds land quicker.

Why choose Numberfied as your bookkeeper for real estate?

We only do real estate. Escrow, deposits, commissions, we get it. Your bookkeeper knows your buildings by name. Answers come the same day, reports come clean.

What software does a bookkeeper for real estate use?

QuickBooks Online with property classes. Bank feeds nightly. AppFolio sync for rent rolls. Check the numbers from your phone at the closing table.

How does a bookkeeper save time?

Rent auto-posts. Bills pay with a click. Reconciliations take an hour, not a weekend. You’re at the open house, not the spreadsheet.

Can a bookkeeper for real estate handle multiple properties?

Each building has its own class. Drill down to the unit or roll up to the portfolio. Add a new duplex, five minutes to set up.

What compliance issues does a bookkeeper address?

Security deposits in trust accounts. 1099s out January 31. Property tax deadlines are on the calendar. One rule missed can kill a deal; we don’t miss.

How quickly can I start with a bookkeeper for real estate at Numberfied?

Sign today, bank access tomorrow. The current month starts posting in 48 hours. First clean close in 30 days.

Does a bookkeeper for real estate provide financial advice?

We show the numbers, here’s the cash burner, here’s the star. Your CPA decides the strategy; we make sure the data is rock solid.

What makes real estate bookkeeping different?

Escrow flows, prorations at closing, depreciation over 27.5 years, and deposits as liabilities. A general bookkeeper lumps it wrong. A bookkeeper sets it right from the jump.

Read Also: Why Accounting and Bookkeeping Services Will Change Your Business for the Better!