Introduction

You didn’t quit your day job to become a data entry clerk. Yet here you are. It is 10 PM and you are wrestling with a spreadsheet that doesn’t balance. This is the “Founder’s Curse.” You think you are saving money by doing it yourself. You aren’t. You are setting money on fire. You are missing the critical signals buried in your data because you are too busy fixing formatting errors. To scale, you must stop playing accountant. You need a small business accounting service that acts as a strategic weapon, not just a compliance necessity.

Key Takeaways

- The Operator Trap: Why doing your own books keeps you small.

- Data vs. Insight: How to turn boring P&L statements into aggressive growth strategies.

- The Numberfied Method: How our ecosystem replaces an entire finance department.

- Cash Flow Mastery: Techniques to extend your runway and self-fund expansion.

- Investor Readiness: Preparing your financials for Series A or a lucrative exit.

The Operator Trap: You Can’t Scale What You Don’t Measure

I see it constantly. Brilliant founders stuck in the weeds. You are processing payroll at 11 PM on a Friday. You are categorizing expenses in QuickBooks while your sales team needs leadership. This is the Operator Trap.

When you handle your own finances, you are looking backward. You are recording history. A strategic founder looks forward. They use data to predict the future.

The Opportunity Cost of DIY Finance

Every hour you spend wrestling with cloud accounting software is an hour you aren’t selling. It is an hour you aren’t refining your product. Calculate your effective hourly rate as a CEO. Now look at what you pay a bookkeeper. The math doesn’t work. You are the most expensive data entry clerk in the world.

Outsourcing isn’t about laziness. It is about leverage. You need to fire yourself from the finance department so you can lead the company.

The “Good Enough” Fallacy

“My cousin handles the books.” “I use a template I found online.” This mindset is why 82% of businesses fail due to cash flow mismanagement. Mediocre bookkeeping leads to mediocre decisions. You cannot make high-stakes bets on inventory or hiring if your data is three months old. You need real-time visibility. You need monthly financial statements that actually make sense.

Turning Raw Data Into A Strategic Weapon

Accounting is not about taxes. Taxes are a byproduct. Accounting is the language of business. If you don’t speak it fluently, you are flying blind.

A strategic partner takes the raw data, the receipts, the invoices, the bank feeds, and translates it into a battle plan. We don’t just tell you what you spent. We tell you why it matters.

Unit Economics and Profitability

Do you know your true Customer Acquisition Cost (CAC)? Do you know the Lifetime Value (LTV) of your best clients? Most founders guess. We don’t guess. We analyze unit economics to determine which products are actually printing money and which ones are vanity projects.

We had a client scaling a service line that was growing 20% month-over-month. On the surface, it looked incredible. But once we factored in the allocated overhead and support costs, they were losing $5 on every sale. We killed the service line. Profitability tripled in two quarters. That is the power of precision.

Forecasting, Not Just Reporting

Looking at last month’s P&L is like driving using only the rearview mirror. You need financial forecasting. You need to know that if you hire two sales reps in March, your cash trough will hit in June. This allows you to secure a line of credit now, while you don’t need it, rather than panicking when payroll bounces.

The Numberfied Ecosystem: Your Virtual Finance Department

We built Numberfied because we were tired of the traditional CPA model. The old model is broken. You talk to them once a year. They file your taxes. They send you a bill. They add zero value to your operations.

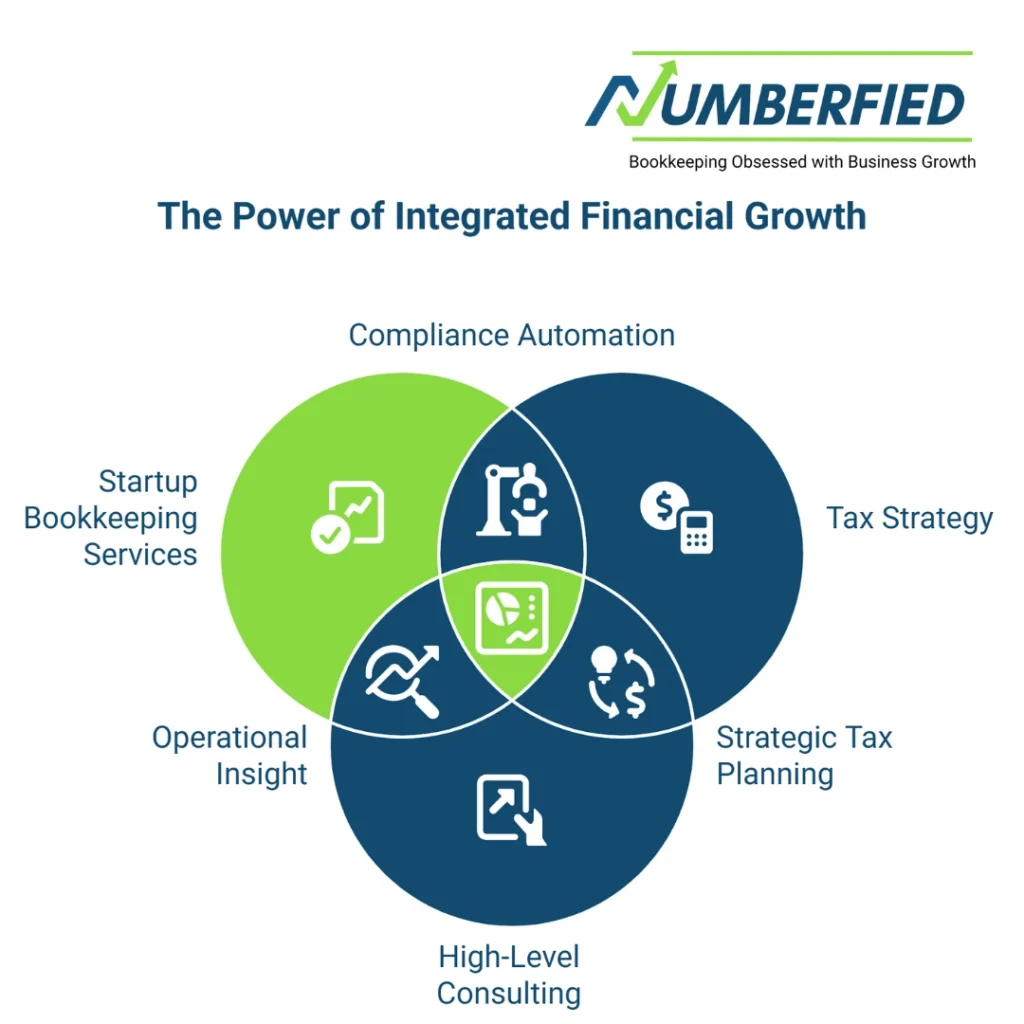

The Numberfied Ecosystem is different. We are an integrated growth platform. We combine startup bookkeeping services, tax strategy, and high-level consulting into a single engine.

Tech-Forward Implementation

We despise paper. We hate inefficiency. We deploy a stack of best-in-class tools to automate the grunt work. We integrate your CRM, your inventory management, and your bank feeds into a centralized dashboard. This isn’t just about saving time. It is about data integrity. When humans touch data fewer times, errors drop to zero.

The Virtual Controller

You don’t just get a bookkeeper. You get a virtual controller. This is someone who oversees the process, ensures GAAP compliance, and enforces financial controls. They are the gatekeeper against fraud and waste. They ensure that every dollar leaving your account has a purpose.

Why We Are Different: The Anti-Bureaucracy Approach

Most accounting firms are run by people who have never started a business. They are risk-averse. They are slow. They speak in jargon that makes you feel stupid.

We are entrepreneurs. We have met payroll on a Tuesday when the bank account was empty on Monday. We understand the stress.

We Speak “Founder”

We don’t send you a 40-page report you won’t read. We send you a one-page executive summary. Here is your cash position. Here is your burn. Here is your tax liability. Here is what you need to do next week.

We are aggressive about R&D tax credits. If you are building tech or developing new products, the government owes you money. Traditional accountants often miss this because it requires extra paperwork. We don’t miss it. We claw back every cent you are entitled to.

Proactive Tax Planning

Most founders find out how much tax they owe on April 14th. That is negligence. We run tax projections quarterly. We tell you in October that you are going to have a massive bill, and we give you three strategies to reduce it before the year ends. That is the difference between a vendor and a partner.

Choosing The Right Small Business Accounting Service

Not all firms are created equal. When you are looking for a small business accounting service, you need to look for specific red flags. Avoid firms that bill by the hour. They are incentivized to work slowly. We bill on value and scope.

Demand Industry Expertise

If you run a SaaS company, do not hire a generalist who works with restaurants. You need someone who understands SaaS metrics tracking. You need someone who knows how to recognize revenue properly under ASC 606. If you are in ecommerce, you need someone who understands inventory turnover and landing costs.

At Numberfied, we specialize. We understand the nuances of digital businesses, agencies, and high-growth startups. We don’t try to be everything to everyone.

Scalability is Non-Negotiable

Your needs today are different from your needs in two years. You might need simple bookkeeping now. Next year, you might need fractional CFO services. You shouldn’t have to switch firms every time you hit a revenue milestone. We scale with you. We have packages that take you from Day 1 to Exit.

Scaling Up: From Bootstrap to Series A

If your goal is to raise capital or sell your company, your financials are your resume. Investors do not trust messy books. They will tear your valuation apart during due diligence if your numbers don’t add up.

Investor Reporting Standards

Venture capitalists expect a certain format. They want to see burn rate analysis. They want to see runway extension strategies. They want clear, auditable financials.

We prepare you for the seed round before you even start pitching. We build the data room. We organize your contracts. We ensure that when an investor asks a hard question, you have the answer immediately. This confidence signals competence. It drives up your valuation.

The Exit Strategy

You are building this business to eventually leave it. Maybe you want to sell to a competitor. Maybe you want to go public. Maybe you just want to pass it to your kids.

Whatever the exit, you need clean history. A buyer pays for predictable cash flow. If your records are a disaster, they will walk away. We build scalable financial systems that prove your business is a machine, not a hustle.

Conclusion

Stop treating accounting like a chore. It is the backbone of your strategy. It is the map that tells you where the landmines are.

You did not start a business to become a bookkeeper. You started it to build something massive. To disrupt an industry. To create wealth.

The difference between the businesses that scale and the ones that stagnate is financial clarity. You need a partner who fights for your bottom line. You need insights that drive action. You need the Numberfied small business accounting service.

Get out of the spreadsheet. Get back to business.

FAQs

Why shouldn’t I just hire a cheap freelancer for bookkeeping?

Because you get what you pay for. Cheap freelancers are data entry clerks. They don’t understand strategy, tax planning, or compliance nuances. When the IRS audits you or an investor asks for a specific report, that “cheap” freelancer will cost you a fortune in clean-up fees.

What is the difference between a bookkeeper and a Fractional CFO?

A bookkeeper records the past. A Fractional CFO designs the future. Bookkeepers handle transactions and reconciliations. A CFO handles financial forecasting, cash flow strategy, and fundraising prep. Numberfied provides both.

How does outsourcing accounting help with cash flow?

We implement rigorous accounts receivable processes to get you paid faster. We also analyze your burn rate to identify waste. We give you visibility so you can see cash crunches months in advance and adjust before it becomes a crisis.

Can you help me prepare for a VC funding round?

Yes. That is our specialty. We clean up your historical data, build a defensible financial model, and create the reports investors demand. We ensure your unit economics look solid and your growth story is backed by hard data.

Do I lose control of my money if I outsource?

No. You gain control. You still approve payments and sign checks. We just do the heavy lifting of preparing the data so you can make decisions. You will have more clarity on your money than you ever did doing it yourself.

Stop guessing. Start growing. Your financials are telling you a story. Are you listening? Book your Free Strategy Session with Numberfied today. We’ll tear apart your P&L, find the leaks, and build a roadmap to 2X your profit. Get Your Financial Audit Now.