Your bank balance is a lie. That is the reality most founders face when they rely on laggy financial data. Waiting until tax season to hand over a pile of receipts or a chaotic spreadsheet is not a strategy. It is negligence. The modern economy moves too fast for retrospective reporting. You need data now. Not next month. This shift is redefining what you should expect from accountancy services. We are moving from historical record-keeping to predictive financial navigation. If your finance function isn’t real-time, your business is already behind. You cannot steer a ship by staring at the wake. You must look at the horizon.

Key Takeaways

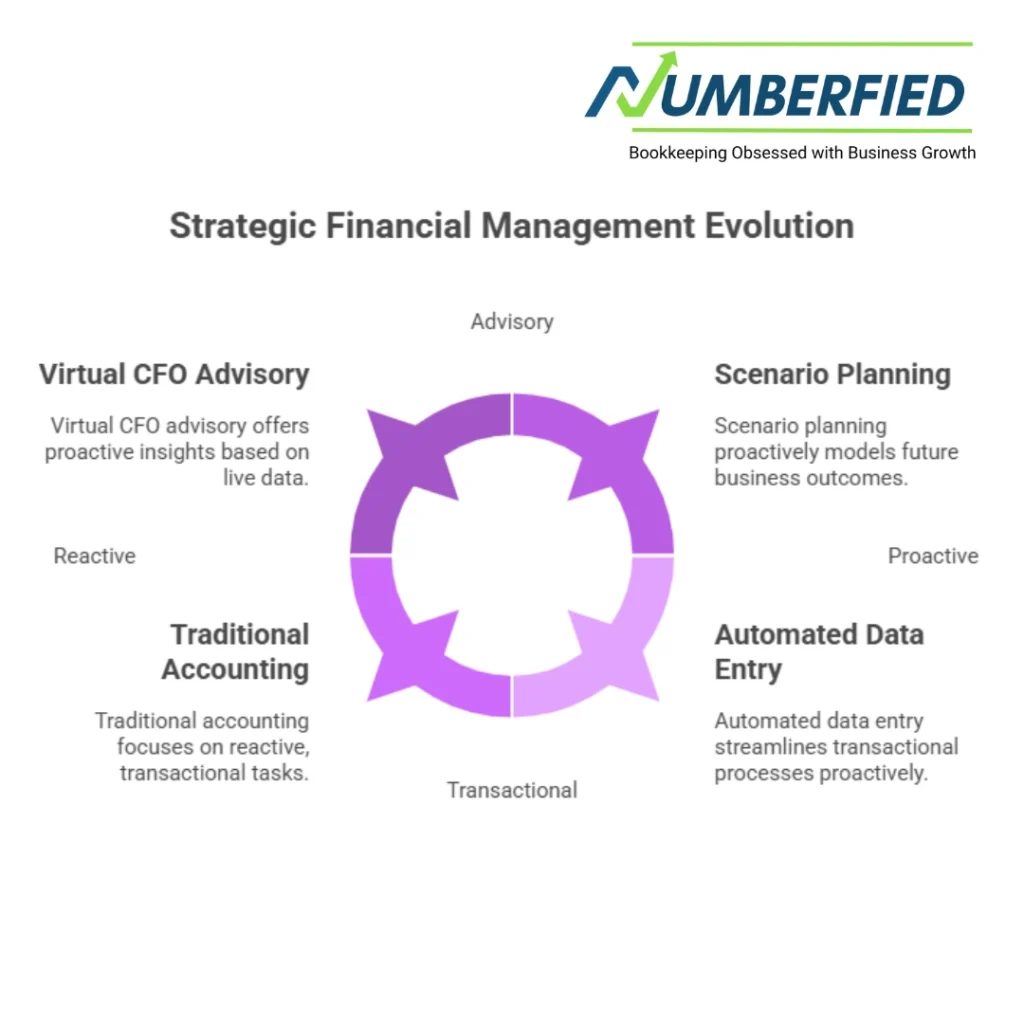

- The shift from reactive to proactive: Why looking at last month’s P&L is hurting your ability to pivot.

- The “Always-On” advantage: How cloud tools provide a pulse on your business health 24/7.

- Tech stack essentials: Understanding how Xero and QuickBooks serve as the central nervous system of your operation.

- The strategic pivot: Moving your accountant from a number cruncher to a strategic growth partner.

The Death of the Shoebox: Real-Time Data Integration

The shoebox model is dead. For decades, business owners treated accounting as a compliance burden. It was a chore to be completed once a year to keep the tax authorities at bay. You would stuff receipts into a box or a folder and hand them over to a professional who would then spend weeks data entering history. This model is fundamentally broken. It provides zero value for current decision-making.

The Latency Problem

When you operate on the shoebox model, you are operating with latency. You might think you made a profit in March. You won’t know for sure until July. In that gap, you might overhire. You might overstock inventory. You might burn cash you do not have. This latency is where businesses die. Cloud technology eliminates this gap. By integrating your bank feeds directly with your accounting software, data entry happens the moment a transaction occurs.

The API Revolution

The mechanism behind this is the API (Application Programming Interface). It allows your bank, your Stripe account, and your credit cards to talk to your ledger. There is no human intervention required for the initial data fetch. The transaction happens. The software records it. The books are updated. This is not just about saving time on data entry. It is about the integrity of the data itself. Human error is removed from the acquisition stage. You are working with raw, verified financial truth.

Why “Always-On” Visibility is Non-Negotiable

Modern business is a war for efficiency. Margins are tight. Competition is fierce. If you do not have “always-on” visibility, you are fighting with a blindfold.

Cash Flow is Oxygen

Profit is theory. Cash is fact. You can be profitable on paper and still go bankrupt if your cash flow is mismanaged. Real-time integration gives you a live view of your cash position. You can see exactly what is coming in and what is going out today. Not what went out last week. This allows for immediate course correction. If a client payment is late, you know instantly. You can chase it before it becomes a bad debt. If a massive expense hits, you can adjust your spending elsewhere immediately.

Making Decisions in the Now

Imagine you are running a marketing campaign. It is burning cash. In the old model, you wouldn’t know if that spend converted into ROI until the end of the quarter. With cloud integration, you can cross-reference ad spend with revenue spikes in real-time. You can kill a losing campaign on Tuesday morning rather than bleeding money until Friday. This agility is the primary competitive advantage of modern startups. They do not wait for reports. They look at the dashboard and act.

Leveraging Xero and QuickBooks for Automation

We need to talk about the tools. Xero and QuickBooks Online are not just digital versions of a paper ledger. They are ecosystems. They are the operating system for your finance department.

The Ecosystem Advantage

These platforms do not stand alone. They connect. They integrate with your CRM. They talk to your inventory management system. They sync with your payroll software. This creates a single source of truth. When your sales team closes a deal in Salesforce, the invoice can be generated automatically in Xero. When you sell a product on Shopify, the inventory asset value is adjusted in QuickBooks. The silo between “operations” and “finance” dissolves.

OCR and Receipt Capture

Let’s discuss the tactical removal of friction. Optical Character Recognition (OCR) tools like Dext (formerly Receipt Bank) or Hubdoc have changed the game. You buy a coffee for a client meeting. You snap a photo of the receipt on your phone. The app reads the vendor, the date, the amount, and the tax. It pushes that data into the accounting software and attaches the image to the transaction. The physical receipt goes in the trash. The audit trail is digital, searchable, and permanent. No more lost paper. No more faded ink.

From Compliance to Advisory: The Strategic Shift

This is where the role of the founder changes. When the machine handles the data entry, the human can handle the strategy.

The Virtual CFO

Your relationship with your finance team shifts from transactional to relational. You stop paying them to type numbers. You start paying them to interpret numbers. This is the rise of the Virtual CFO. Because the data is live, your accountant can look at your dashboard on a Wednesday and call you with a warning. “Your margins are slipping on product B.” “Your payroll ratio is too high for your current revenue.” This is proactive advisory. It is the difference between a scorekeeper and a coach.

Scenario Planning

With accurate, real-time data, you can model the future. We call this scenario planning. What happens if revenue drops 20% next month? What happens if we hire three new developers? Cloud platforms allow us to plug these variables into forecasting tools like Fathom or Float. We can stress-test the business against different realities. You are no longer guessing. You are calculating risk based on hard data. This builds confidence in investors and stakeholders. They see that you know your numbers inside and out.

How Cloud Technology Redefines Accountancy Services

The very definition of what you buy when you hire a firm is changing. It is no longer about hours worked. It is about value delivered.

Scalability without Headcount

In the past, as your transaction volume grew, your accounting fees grew linearly. More paper meant more hours. Cloud technology breaks this correlation. Automation rules can handle thousands of transactions as easily as they handle ten. Bank rules can automatically categorize recurring expenses. This means your accountancy services can scale with your revenue without becoming a massive overhead burden. You get enterprise-level reporting without the enterprise-level staff costs.

Security and Compliance

There is a misconception that the cloud is less secure than a desktop computer. The opposite is true. A desktop computer can be stolen. A hard drive can fail. A server room can flood. Cloud platforms use bank-level encryption. They have redundancy. They have backups of backups. Furthermore, tax laws change. VAT rates change. Reporting standards change. Cloud software updates automatically. You do not have to install a patch or buy a new version to be compliant with the latest regulations. The risk of being fined for non-compliance due to the use of outdated software is totally removed.

Implementing the Stack: What Growth Requires

Adopting this tech stack is not a magic pill. It requires a deliberate implementation strategy. It requires a change in culture.

Cleaning the Data

It is not possible to build a skyscraper on a swamp. Net clean your existing data if you still want to integrate these tools. Garbage in results in garbage out. This is typically the most uncomfortable part of the operation.. You have to reconcile the old accounts. You have to categorize the uncategorized. But once the foundation is clean, the structure rises quickly.

The Onboarding Phase

Your team needs to buy in. If your sales team refuses to use the CRM correctly, the integration with accounting fails. If your staff keeps buying things with personal cash instead of the corporate card, the feed breaks. Implementation is 20% technology and 80% psychology. You must enforce the protocols. “If it isn’t in Dext, it didn’t happen.” “If the invoice isn’t in Xero, it doesn’t get paid.” Rigid discipline in the beginning creates total freedom later on.

Continuous Optimization

The tech stack is not static. New apps emerge. New integrations become available. Your finance function should be under constant review. Are we using the best tool for inventory? Is there a better way to handle foreign exchange? Being “tech-enabled” is a state of mind. It is a commitment to perpetual improvement.

The businesses that win in the next decade will be the ones that can process information the fastest. Money loves speed. Cloud accounting removes the friction that slows you down. It gives you the clarity to move fast and the control to move safely.

Conclusion

The era of the historian accountant is over. You need a navigator. The integration of cloud technology with financial services is not an optional upgrade. It is the standard. If you are still relying on annual reports and shoeboxes, you are operating with a handicap. Real-time data gives you the power to act, to pivot, and to capitalize on opportunities the moment they arise. Do not let your finance function be the anchor that drags you down. Make it the engine that drives you forward. Demand more from your accountancy services. Demand visibility. Demand speed.

FAQs

1. Is cloud accounting actually safe from hackers?

Yes. It is safer than your office server. Providers like Xero use industrial-strength encryption and multi-factor authentication. Your physical hard drive is the weak link, not the cloud.

2. Will this technology replace my accountant?

No. It replaces the data entry clerk. It frees your accountant to actually analyze the data and give you advice on how to grow. You get a brain, not just a pair of hands.

3. Can I migrate to the cloud in the middle of a financial year?

Yes. It requires a “conversion balance” to ensure the numbers match up. A professional can handle this transition so you don’t lose historical data.

4. How much time does this really save me?

Hours per week. Automated bank feeds and receipt capture eliminate manual typing. The real time saved, however, is in not having to fix errors later.

5. Is Xero better than QuickBooks?

It depends on your business. Xero is often favored for its clean interface and strong inventory integrations. QuickBooks has a massive user base and great reporting. Both are superior to Excel.

Take the Next Step

Stop driving blind. If you don’t know your numbers today, you can’t grow tomorrow. At Numberfied, we build financial systems that scale. Let’s get your data out of the shoebox and into the cloud. Book your FREE strategy call now

Also Read: Accountancy Services Growing Your Business with Numberfied