Introduction

You closed the deal. The contract is signed for $120,000. Your sales team is popping champagne. You feel rich. But when you look at the bank account to pay the server bills next week, the money isn’t there. This is the silent killer of subscription businesses. It is the gap between what you sold and what you have actually earned.

Most founders treat their bank balance as their financial scorecard. That is a fatal mistake. In the subscription economy, cash and revenue are rarely the same thing. One pays the bills today. The other builds value for tomorrow. If you confuse them, you will run out of runway while thinking you are profitable. This guide breaks down why specialized saas accounting services are necessary to untangle this financial knot and keep your company alive.

Key Takeaways

- The Difference Matters: Why bookings, billings, and revenue are distinct financial events.

- The Cash Trap: How successful sales months can actually cause a cash flow crisis.

- The CPA Problem: Why generalist accountants often misclassify deferred revenue.

- The Fix: implementing proper revenue recognition (ASC 606) to see your real growth.

- The Metrics: Essential KPIs that tell the true story of your business health.

The Unholy Trinity: Bookings, Billings, and Recognized Revenue

To the untrained eye, a sale is a sale. In SaaS, a sale is a three-part timeline. If you do not understand the distinction, your financial model is fiction.

Bookings: The Promise

This is the value of the contract between you and the customer. If a client signs a two-year contract for $24,000 a year, your booking is $48,000. It is a critical metric for sales performance. It tells you the market demand for your product. However, bookings are not money. You cannot pay payroll with bookings. They are simply a commitment.

Billings: The Invoice

This happens when you actually collect the money. Using the example above, you might invoice the client $24,000 upfront for the first year. Now you have cash. This is where the confusion starts. Many founders see this cash influx and call it “revenue.” It isn’t. It is a liability. You owe the customer twelve months of service. If you spend that money like it is profit, you are in trouble.

Revenue: The Delivery

Revenue is recognized only when the service is provided. This is the core of accrual accounting. If you billed $24,000 for the year, you can only recognize $2,000 as revenue in Month 1. The remaining $22,000 sits on your balance sheet as “Deferred Revenue.”

Distinguishing these three elements is the only way to understand your actual burn rate.

The “Growing Broke” Phenomenon in Subscription Models

Growth costs money. In traditional retail, you buy a widget for $5 and sell it for $10. You get your profit immediately. SaaS works backward.

You invest a lot of money in the process of obtaining a new customer (CAC). In the beginning, the company bears the costs of marketing, sales commissions, and onboarding support. For instance, if the price of a customer acquisition, who will give you a revenue of $500 a month, is $5,000, then it will require a period of ten months to return the invested money.

The Cash Flow Trough

If you sign 100 new customers this month, your revenue looks great on a graph. But your bank account takes a massive hit. You just spent $500,000 in acquisition costs (100 x $5,000). You only collected $50,000 in the first month’s billings. You are $450,000 in the hole cash-wise, even though your company is “growing.”

This is the “Cash Flow Trough.”

If you rely on a simple P&L statement, it might show you are profitable if you are wrongly recognizing that upfront cash as revenue. You will think you have a surplus. You will hire more devs. You will upgrade the office. Then, three months later, payroll bounces. Specialized financial modeling prevents this by forecasting the trough before you fall into it.

Why Your Local CPA is Killing Your Valuation

I have seen it a dozen times. A founder hires a family friend or a local tax accountant to handle the books. It works for a while. Then the founder tries to raise a Series A. The VC’s audit team takes one look at the books and laughs.

The Cash Basis Mistake

Generalist accountants love “Cash Basis” accounting because it is simple. Money in equals income. Money out equals expense. This is fine for a coffee shop. It is disastrous for SaaS. Under cash basis, that $24,000 upfront payment looks like a massive profit in January and zero revenue in February. Your monthly recurring revenue (MRR) is fluctuating wildly just like a roller coaster. Because of those fluctuations, it is very difficult to sort out churn or growth rates and to figure them accurately.

The Deferred Revenue Trap

A generalist often treats prepayments as immediate income. This inflates your taxes. You end up paying taxes on money you haven’t technically earned yet. Worse, it hides your liabilities. If that customer cancels in month three, you owe them a refund. If you already spent the money and paid taxes on it, you are bleeding cash twice.

An accountant that understands GAAP (Generally Accepted Accounting Principles) and ASC 606 is what you require. These aren’t just buzzwords. They are the rules of the road for subscription valuation.

How Expert SaaS Accounting Services Fix the Forecast

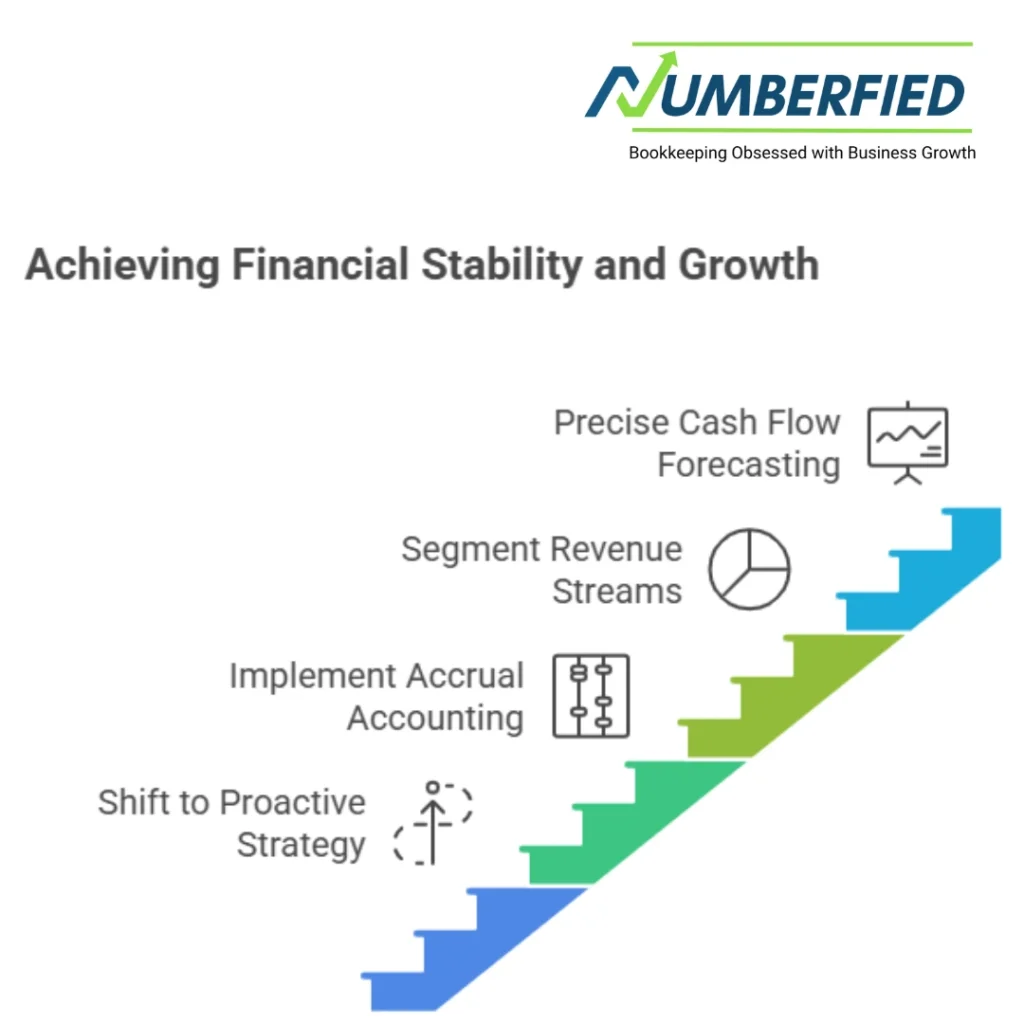

This is where the shift happens. You move from reactive bookkeeping to proactive strategy. By engaging specialized saas accounting services, you gain access to a financial infrastructure built for recurring revenue.

Implementing Accrual Accounting

We force the switch to accrual accounting. We match revenue to the period where the service is delivered. This smooths out your income statement. It turns that jagged roller coaster of cash deposits into a smooth, upward-trending line of recognized revenue. This is what investors want to see. It proves the stability of your business model.

Segmenting Revenue Streams

Not all revenue is created equal. A specialized service will separate your Setup Fees, Consulting/Service Revenue, and Subscription Revenue.

- Subscription Revenue: This is high-value. It commands high multiples in valuation.

- Service Revenue: This is one-time revenue. It is low margin and hard to scale.

If you lump these together, you dilute your valuation. We separate them to show investors exactly how scalable your core product is.

Precise Cash Flow Forecasting

We build models that ignore the “vanity metrics” of total contract value. We look at cash collections. We map out your burn rate against your billing cycles. We tell you exactly when you need to raise capital or slow down hiring, usually six months before the crisis hits.

Beyond the Balance Sheet: SaaS Metrics That Drive Strategy

Accounting is not just about taxes. In SaaS, your financial data feeds your operational metrics. If the inputs are wrong, your decisions will be wrong.

CAC Recovery Time

This is the most critical speed limit for your growth. How many months does it take to earn back the money you spent to get a customer?

- < 12 Months: You are healthy.

- < 6 Months: You are a rocket ship. Invest more in sales.

- > 18 Months: You are in trouble. You are lending money to your customers interest-free.

A specialized financial team tracks this dynamically. We look at how changes in your pricing or marketing spend affect this timeline immediately.

LTV:CAC Ratio

Lifetime Value (LTV) divided by Customer Acquisition Cost (CAC). The golden standard is 3:1. You want to make three dollars for every dollar you spend. If your ratio is 1:1, you are growing broke. If your ratio is 5:1, you are growing too slowly. You are underinvesting in marketing.

Churn: The Leaky Bucket

There are two types of churn, and generalists mix them up.

- Customer Churn: The percentage of clients who leave.

- Revenue Churn: The percentage of revenue lost.

You can lose 5% of your customers but only 1% of your revenue if the customers leaving are on your smallest plans. Conversely, losing one “Enterprise” client can devastate your revenue even if your customer churn looks low. We drill down into Net Revenue Retention. If this number is over 100%, your business can grow even without adding new customers. That is the holy grail.

Structuring Your Financial Tech Stack for Clarity

You cannot manage this on a spreadsheet. Excel is prone to human error. As you scale, you need a tech stack that automates the flow of data from the sale to the bank.

The CRM to GL Connection

Your CRM (Salesforce, HubSpot) tracks bookings. Your General Ledger (QuickBooks, Xero) tracks cash. There is often a disconnect here. We integrate these systems. When a deal closes in HubSpot, it should trigger a billing schedule in your accounting software.

Subscription Management Engines

Without tools such as Stripe, Chargebee, or Recurly it would be a nightmare to manage upgrades, downgrades, and prorations. These tools are essential as they take care of all the intricacies in account changes. If a customer upgrades their plan in the middle of the month, calculating the revenue recognition manually is a nightmare. These tools automate it.

However, these tools must be configured correctly. I have seen founders set up Stripe to dump one lump sum deposit into QuickBooks daily. It becomes a black box. We configure the mapping so that every cent is categorized correctly—taxes, fees, revenue, and cash.

The Visualization Layer

Finally, you need a dashboard. Tools like SaaSOptics or Maxio sit on top of your ledger. They pull the data and visualize your MRR, ARR, and Churn in real-time. This is your cockpit. You don’t drive a car by looking at the engine; you look at the dashboard. The same applies to your business.

Conclusion

Scaling a SaaS company is an exercise in managing time lag. There is a lag between product development and sales. There is a lag between closing a deal and getting paid. There is a lag between spending cash and recognizing revenue.

If you navigate these lags with a generic map, you will get lost. You need a financial model that respects the physics of the subscription economy. You need to know the difference between the cash in your hand and the revenue on your books.

Never allow your achievement to become your defeat. Make sure that your financial plan is in line with your business model. When you have clarity on your numbers, you stop guessing. You stop reacting. You start building a machine that generates wealth, not just invoices. Specialized saas accounting services are the investment that protects every other investment you make.

FAQs

1. What is the difference between bookings and revenue?

Bookings represent the value of a signed contract. Revenue is the income recognized only after the service is actually delivered to the customer over time.

2. Why is my cash flow negative if my profit is positive?

Profit on paper (accrual basis) includes revenue you have earned, but you might not have collected the cash yet. Or, you spent cash on assets/debts that don’t hit the P&L immediately.

3. What is deferred revenue?

Deferred revenue is money you have collected from customers for services you haven’t provided yet. It is a liability (debt) on your balance sheet, not income.

4. Do I really need to use accrual accounting for my startup?

Yes. If you want to raise investment or sell your company, investors demand accrual accounting (GAAP) to see the true health and liabilities of the business.

5. How often should I update my cash flow forecast?

Weekly. In a high-growth SaaS environment, burn rates change fast. A monthly review is often too late to catch a cash crunch.

Need to Stop Growing Broke?

Your financial data should be an asset, not a liability. At Numberfied, we don’t just count the beans; we help you plant them. Let’s build a financial model that scales as fast as you do. Book Your Free Strategy Call with Numberfied Today!

Also Read: Why Cloud-Based Bookkeeping and Accounting Services Will Transform Your Business!