Introduction

For small business owners, entrepreneurs, and accountants, reliable Xero bookkeeping services can transform how you manage cash flow, invoices, payroll, and financial reporting. Whether you’re evaluating cloud accounting for the first time or ready to outsource bookkeeping and accounting to a Xero-certified bookkeeper, this guide helps you choose, set up, and optimize Xero accounting software to meet your business needs.

Why choose Xero bookkeeping services?

Xero is a leading online accounting solution designed for cloud accounting, bookkeeping, and accounting and bookkeeping workflows. With an active Xero community of accountants and a broad ecosystem of apps, Xero helps businesses automate workflows, simplify bank reconciliation, and maintain compliant financial data. Xero bookkeeping services let you focus on growth while accounting professionals handle day-to-day bookkeeping tasks, reconciliation, and reporting.

Primary benefits for small business owners

- Streamlined financial management: Xero brings bank feeds, invoices, and payment gateways into one place to speed up workflows and reduce manual entry.

- Automation and accuracy: Automated bank reconciliation, recurring invoices, and payroll features reduce errors and improve cash flow visibility.

- Real-time financial data: Access current balances, unpaid invoices, and profitability metrics anywhere with Xero US or global editions.

- Scalable bookkeeping solutions: From DIY bookkeeping software to outsourced Xero accounting services, you can scale your support as your business grows.

- Compliance and reporting: Professional Xero accounting and bookkeeping services help ensure tax compliance and provide timely financial reporting for decision-making and lender requirements.

Common types of Xero bookkeeping services

When searching for bookkeeping help, you’ll encounter several service models. Understanding each helps you align needs with budget and outcomes.

- DIY with Xero software: Small business owners use Xero accounting software themselves with access to tutorials and the Xero community. Best for businesses with simple transactions and a willingness to learn bookkeeping basics.

- Hybrid support: An accountant or bookkeeper provides periodic reviews, monthly reconciliations, and advisory services while you handle routine entries and invoicing.

- Outsourced Xero accounting: A professional bookkeeping firm or Xero partner manages all bookkeeping tasks, payroll, bank reconciliation, and reporting. Ideal for businesses wanting to fully outsource finance and accounting.

- Xero setup and training: Xero setup specialists configure accounts, connect payment gateways, establish workflows, and train your team for efficient use within Xero.

Practical benefits of using Xero

Beyond the general value of bookkeeping and accounting, Xero offers targeted benefits that help small businesses operate more efficiently and make better decisions.

Faster bank reconciliation and accurate books

Xero’s bank reconciliation tools and smart rules match transactions automatically and flag discrepancies. This reduces time spent on reconciliation and helps maintain accurate financial data for payroll, tax filing, and investor reporting.

Improved cash flow management

With automated invoicing, reminders, and integrated payment gateways, Xero helps accelerate collections. The cash flow dashboard and forecasting tools help business owners plan for upcoming obligations and make smarter financial decisions.

Centralized financial reporting

Xero consolidates invoices, expenses, payroll, and bank accounts, enabling meaningful reports and financial statements prepared by accounting professionals or your in-house team.

Seamless integrations and apps

There are hundreds of Xero apps for CRM, inventory, time tracking, and expense management. Integrations streamline operations by connecting sales platforms, payment processors, and point-of-sale systems directly to your accounting software.

Compliance and audit trail

Professional Xero bookkeeping services create clear audit trails, maintain documentation, and ensure records are compliant with tax authorities and accounting standards.

DIY vs. professional Xero bookkeeping: Which is right for you?

Choosing DIY or professional Xero bookkeeping depends on your time, expertise, complexity of transactions, and desire for strategic financial guidance. Below is a practical comparison to help decide.

DIY Xero bookkeeping

- Cost: Xero subscription plans vary; add-on costs for payroll or premium apps may apply.

- Control: You retain full control of entries, invoices, and daily bookkeeping tasks.

- Time commitment: Requires time to learn the platform and maintain books regularly.

- Best for: Very small businesses, sole proprietors, or startups with simple transactions and tight budgets.

Professional Xero bookkeeping (outsourced)

- Cost: Outsourced Xero bookkeeping typically ranges from $250–$900/month, depending on transaction volume, payroll, and level of service.

- Expertise: Work with Xero-certified bookkeepers, accountants, or Xero partners who understand bookkeeping and accounting best practices.

- Scalability: Firms can scale support as your business and complexity grow.

- Best for: Small business owners who need accurate financial data, regular reconciliations, payroll processing, and compliance support without allocating internal resources.

If cost is a major consideration, start with a hybrid model: DIY core tasks with monthly outsourced reconciliations and reporting. When revenues grow, or you need reliable financial planning, move to a full outsourced Xero accounting and bookkeeping service.

Top Xero features and apps every business should know

These Xero features and third-party apps help businesses streamline financial operations and scale accounting workflows.

Essential Xero features

- Bank reconciliation: Auto-matching transactions and reconciliation rules speed up the month-end close.

- Invoicing and payments: Create customizable invoices and accept online payments through integrated payment gateways.

- Payroll: Process payroll, manage deductions, and comply with payroll regulations (availability varies by region).

- Expense tracking: Capture and code expenses from receipts via mobile apps.

- Financial reporting: Pre-built and customizable reports for profit and loss, balance sheet, cash flow, and tax.

Popular apps that integrate with Xero

- Bill.com, Hubdoc: Streamline bill capture, approvals, and payments.

- Stripe, PayPal, Square: Payment gateways for faster invoice payments and cash flow.

- Receipt Bank / Dext: Automate receipt capture and expense coding.

- Fathom, Spotlight, G-Accon: Advanced reporting and business intelligence tools for accountants and finance teams.

- WorkflowMax, Deputy: Time tracking and workforce management integrated with billing and payroll.

Common mistakes to avoid with Xero bookkeeping services

Even with powerful accounting software, mistakes happen. Avoid these common pitfalls to protect your financial data.

- Neglecting regular reconciliation: Skipping bank reconciliation creates inaccurate books and increases tax risks.

- Poor chart of accounts setup: A messy chart of accounts leads to unreliable financial reporting and difficulty in financial analysis.

- Not using automation: Manual entry where automation exists wastes time and introduces errors use bank rules, recurring invoices, and app integrations.

- Ignoring user permissions: Granting broad access to staff can compromise security and compliance use role-based permissions.

- Failing to back up documents: Keep digital records organized within Xero or connected apps to meet audit requirements.

Step-by-step guide to choosing or setting up Xero bookkeeping services

Follow these practical steps to choose the right Xero bookkeeping service and set it up efficiently for your business.

Step 1: Define your business needs

List the tasks you want covered: bank reconciliation, invoicing, payroll, accounts payable, monthly reporting, tax preparation, or financial planning. Determine whether you need full outsourced bookkeeping, a hybrid model, or training and Xero setup help.

Step 2: Establish a budget

Understand current market rates for Xero bookkeeping. Outsourced services commonly cost between $250 and $900 per month. Lower-cost packages typically cover basic reconciliation and reporting; higher tiers include payroll, complex reconciliations, and advisory services.

Step 3: Find Xero-certified providers

Search the Xero advisor directory, look for Xero partners, or ask your accounting network for referrals. Prioritize providers with experience in your industry and positive client testimonials. Check if they offer comprehensive Xero accounting and bookkeeping services and expertise in integrations or payment gateways relevant to your business.

Step 4: Evaluate processes and technology

Ask potential bookkeepers about their workflow: how they handle bank feeds, invoicing, document capture, reconciliation, payroll, and financial reporting. Confirm which apps they use (e.g., Dext, Hubdoc, Bill.com) and how they ensure secure access and backups.

Step 5: Review sample reports and communication cadence

Request sample monthly or quarterly reports and a proposed communication schedule. Decide on deliverables that matter to you: cash flow forecasts, P&L analysis, or KPI dashboards.

Step 6: Onboard and set up Xero

An effective Xero setup includes: configuring the chart of accounts, connecting bank feeds, setting up tax rates, integrating payroll and payment gateways, and creating templates for recurring invoices. If you’re switching systems, plan a data migration with your provider to import historical financial data and reconcile opening balances.

Step 7: Establish ongoing review and optimization

Schedule regular reviews with your bookkeeper or accountant. Use these meetings to refine workflows, review financial performance, and implement automation or app integrations that further streamline operations.

How accountants and bookkeepers add strategic value

Hiring accounting professionals for Xero bookkeeping does more than tidy up the books. Accountants and bookkeepers provide financial planning, tax advice, and strategic guidance. They can help forecast cash flow, analyze profitability by product or service, and set up internal controls that protect your business.

Related terms and services to consider

When evaluating Xero bookkeeping services, be aware of related offerings that may benefit your business: Xero accounting, cloud bookkeeping with Xero, Xero-certified bookkeeper, outsourced Xero services, and Xero advisor support. These terms align with services like payroll management, bank reconciliation, Xero setup, and ongoing financial reporting.

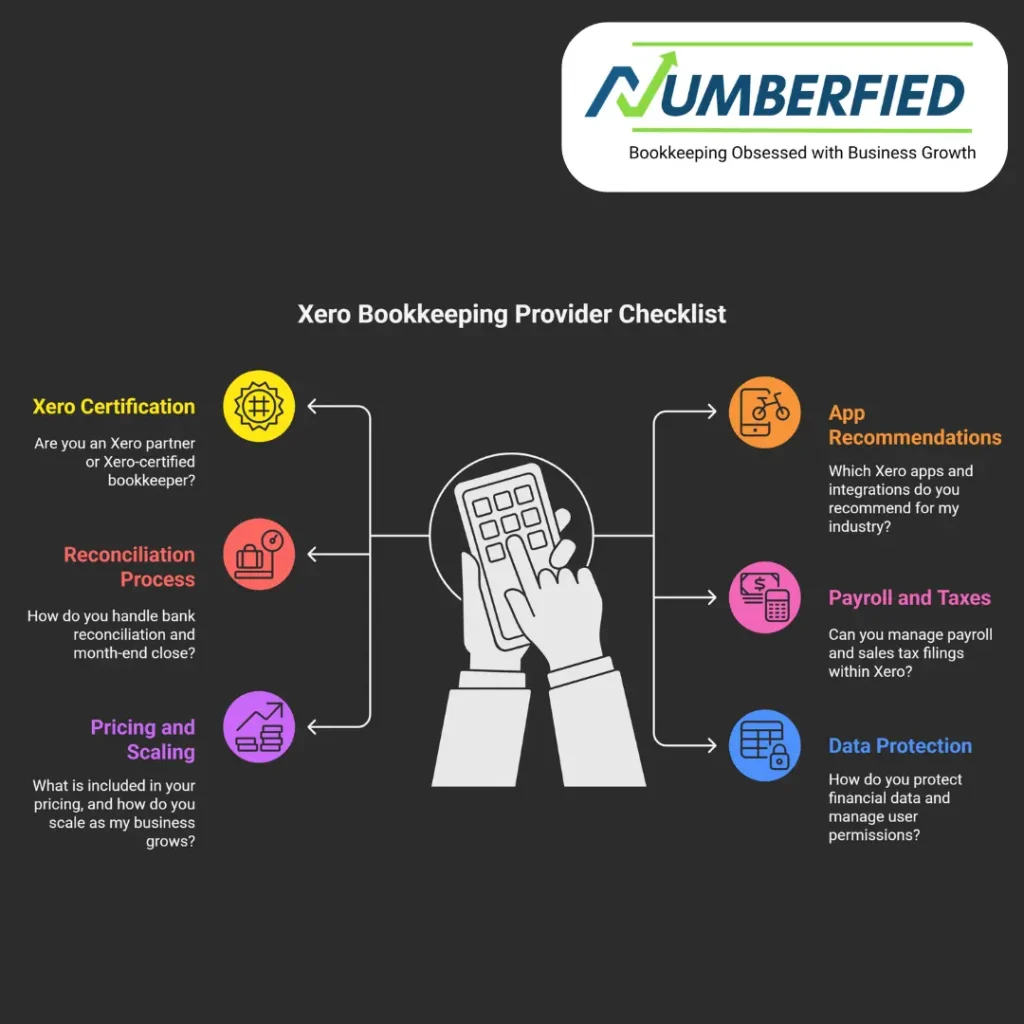

Checklist: What to ask a Xero bookkeeping provider

- Are you an Xero partner or Xero-certified bookkeeper?

- Which Xero apps and integrations do you recommend for my industry?

- How do you handle bank reconciliation and month-end close?

- Can you manage payroll and sales tax filings within Xero?

- What is included in your pricing, and how do you scale as my business grows?

- How do you protect financial data and manage user permissions?

Final considerations and next steps

Adopting Xero bookkeeping services is a strategic move to improve financial accuracy, free your time, and gain actionable business insights. Whether you opt for DIY, hybrid, or fully outsourced Xero accounting and bookkeeping, the key is consistency regular reconciliations, accurate invoicing, and using automation to streamline repetitive tasks.

If you’re a small business owner or entrepreneur, start by defining your needs and budget, reviewing potential Xero partners, and planning a clear onboarding timeline. Accountants and bookkeepers experienced with Xero accounting software can help you customize workflows, ensure compliance, and provide the financial reporting you need to grow.

Take action: Get expert Xero help today.

Ready to streamline your accounting and bookkeeping with expert Xero bookkeeping services? Book a free Xero consultation with our Xero-certified team to assess your business needs, estimate monthly costs, and plan a tailored Xero setup. Let us help businesses like yours automate workflows, improve cash flow visibility, and deliver compliant, timely financial reports.

Book a free Xero consultation.

FAQ

How much should I pay for bookkeeping services?

Small businesses typically pay $300–$2,000 per month for outsourced bookkeeping services, depending on transaction volume, complexity, and extras like payroll. Basic plans start around $300–$500, while more comprehensive services reach $1,000–$2,000. Hourly rates average $40–$100.

Do I need a bookkeeper if I use Xero?

Xero automates many tasks like bank reconciliation and invoicing, so simple businesses can manage without a full-time bookkeeper. However, most owners benefit from a professional for accurate categorization, compliance, tax prep, and insights especially as complexity grows.

Do you need a bookkeeper if you have Xero?

Xero handles core bookkeeping efficiently for straightforward needs, but a bookkeeper ensures error-free records, proper tax handling, and strategic advice. It’s not required, but recommended for peace of mind and to avoid costly mistakes.

At what point do I need a bookkeeper?

You likely need a bookkeeper when transaction volume exceeds 100–200 monthly, you add payroll/inventory, struggle with reconciliations/reports, or face tax complexity. Early signs include spending too much time on books or risking compliance issues.

Can I use Xero without an accountant?

Yes, Xero is user-friendly and doesn’t require an accountant for basic use like invoicing and tracking. However, an accountant is advised for tax planning, filings, audits, and advanced advice to maximize deductions and compliance.

How much should you pay a bookkeeper per month?

Expect $300–$2,000 monthly for outsourced services, varying by business size and needs. Simple Xero-based bookkeeping starts lower ($250–$800), while full-service with advisory is higher.

Do accountants prefer Xero or QuickBooks?

Preferences vary by region: QuickBooks dominates in the US for its features, payroll, and familiarity. Xero is favored internationally (e.g., UK, Australia, NZ) and by many for its intuitive interface, unlimited users, and integrations.

Do accountants prefer QuickBooks or Xero?

US accountants often prefer QuickBooks for robust US tax tools and market share. Globally, Xero wins for ease of use, collaboration, and modern design many switch to Xero for cleaner workflows.

What is the most effective accounting software for accountants?

QuickBooks Online leads in the US for comprehensive features and support. Xero excels globally for usability and integrations. Effectiveness depends on needs both are top-tier in 2025.

Why do accountants prefer Xero?

Accountants like Xero for its clean interface, unlimited users, strong bank reconciliation, open APIs/integrations, and real-time collaboration. It reduces manual work and feels more modern than competitors.

Read Also: Why Everyone’s Switching to Xero Bookkeeping Services And You Should Too!