Introduction

Choosing outsourced accounting firm services can transform how your business manages financial operations. Whether you’re a startup, an SMB, or a growing enterprise with an in-house accounting department, outsourcing your accounting offers a way to streamline bookkeeping, optimize cash flow, and access controller and CFO-level advisory without hiring a whole internal accounting team. This guide explains the core benefits, compares in-house vs. outsourced accounting, outlines types of services from back-office bookkeeping to virtual CFO services, lists common mistakes, and gives a step-by-step plan to choose an outsourced accounting partner that fits your business needs.

Why consider outsourced accounting and finance services?

Outsourced accounting provides scalable, cost-effective accounting solutions that let business owners focus on core business activities. Many finance outsourcing firms and outsourced accounting firms deliver reliable financial reporting, payroll services, internal controls, and advisory services that help you make informed decisions in real-time. Outsourcing your accounting needs gives access to accounting professionals, accounting software expertise, and a complete accounting solution that can be customized to your accounting requirements and business growth goals.

Key benefits at a glance

- Cost savings: Outsourced accounting firm services often run at a fraction of the cost of hiring a whole accounting department, with no benefits, recruiting, or overhead. You gain flexible pricing and predictable monthly expenses.

- Expertise: Access to CPAs, controllers, and virtual CFOs who offer advisory services, controller services, and financial management across industries.

- Scalability: Services for your business can scale with growth, add bookkeeping, payroll services, or CFO services as complexity increases without rebuilding your internal accounting team.

- Compliance and audit readiness: Outsourced teams maintain internal controls, prepare financial information for audit, and keep your accounting processes aligned with best practices and regulatory changes.

- Focus on core business: Outsourcing back-office accounting frees founders and existing accounting teams to prioritize strategy, sales, and product development.

In-house accounting vs outsourced accounting: a practical comparison

Deciding whether to keep an in-house accounting team or partner with an outsourced accounting firm depends on cost, control, complexity, and strategic priorities. Below is a side-by-side look at how the accounting function performs in each model.

Cost and flexibility

In-house accounting: Fixed salaries, benefits, recruiting costs, training, and office overhead. Scaling requires more hires and long lead times.

Outsourced accounting: Variable monthly fees, fewer upfront costs, and the ability to scale services up or down. Outsourced accounting firm services often provide value through bundled bookkeeping services, payroll services, and advisory services at predictable rates.

Expertise and coverage

In-house accounting: May offer deep knowledge of your company’s operations and culture, but can be limited by individual expertise. Hiring specialized skills like a controller or CFO can be costly.

Outsourced accounting: Provides a team of accounting professionals with cross-industry experience and access to specialized roles, including CPAs, controllers, and fractional CFOs on demand. For many businesses, outsourced finance and accounting services deliver higher quality financial reporting and internal controls than a small in-house accounting team.

Control and integration

In-house accounting: Greater direct control over processes and immediate coordination with leadership. Easier to embed internal accounting team members in daily operations.

Outsourced accounting: Requires strong vendor management and clear SLAs. The best outsourced firms partner with your existing accounting team and customize workflows using cloud-based solutions and shared accounting software to provide real-time financial data.

When to outsource versus build in-house

Consider outsourcing if you want to optimize costs, access specialized accounting services for growth, or lack the bandwidth to maintain best-practice accounting processes. Consider an in-house accounting team when your business needs deep operational embedding, has unique industry-specific accounting requirements, or when the finance department plays a strategic, full-time role in daily decision-making.

Types of outsourced accounting firm services: from bookkeeping to CFO-level

Outsourced accounting firms offer a range of services to match finance and accounting needs at every stage of growth. Here are standard services and how they support business growth and profitability.

Bookkeeping and client accounting services

Bookkeeping services handle daily transactional work: accounts payable, accounts receivable, bank reconciliations, and maintaining the general ledger. Client accounting services provide month-end close, financial reporting, and reconciliations, delivering timely financial information for business owners.

Payroll and back-office accounting

Payroll services and back-office accounting streamline employee pay, tax filings, benefits deductions, and payroll compliance. Outsourced providers integrate payroll into accounting software, helping maintain internal controls while reducing risk.

Controller services and financial reporting

Controller services include month-end close oversight, consolidated financial statements, variance analysis, and establishing accounting processes. These services are ideal for businesses that need accurate financial reporting and stronger internal accounting controls without hiring a full-time controller.

Fractional CFO and advisory services

Virtual CFO services or fractional CFOs provide strategic financial management: cash flow forecasting, budgeting, KPI development, fundraising support, and profitability analysis. For startups and scaling companies, CFO services accelerate decision-making and help secure capital by presenting clean financials and strong financial management to investors.

Audit support and compliance

Outsourced firms can prepare financial statements for audits, ensure compliance with tax and regulatory requirements, and implement best practices for internal controls that auditors expect.

Specialized accounting and finance technology

Many outsourced accounting solutions include implementation and management of accounting software, cloud-based solutions, and integrations that provide real-time dashboards and automated workflows, helping your accounting team or outsourced partner deliver timely, accurate financial data.

Common challenges and mistakes when outsourcing your accounting

Outsourcing your accounting yields big rewards, but businesses often stumble on avoidable issues. Knowing the common mistakes helps you select the right partner and set expectations.

Poor scoping and unclear expectations

Failing to define services, deliverables, timelines, and ownership leads to gaps. Create a detailed statement of work that spells out responsibilities for bookkeeping, payroll, financial reporting, and who handles vendor payments or reconciliations.

Not integrating accounting software and systems.

Many businesses expect the outsourced provider to use their existing accounting software, but don’t plan for data migration or integrations. Ensure your outsourced firm can customize workflows and use compatible cloud-based solutions to sync bank feeds, payroll, and inventory systems.

Insufficient communication and vendor oversight

Set regular check-ins, reporting schedules, and escalation paths. Without transparent governance, financial data quality and timeliness can suffer.

Choosing the wrong scope of services

Outsourcing only parts of the accounting function without coordination can create handoff problems. Consider a partner that offers comprehensive services or a plan to integrate with your in-house accounting team.

Step-by-step guide to choosing an outsourced accounting firm

Follow these steps to evaluate and select a partner that supports your accounting needs and business growth.

1. Assess your accounting and finance needs

Document current pain points: bookkeeping backlog, inconsistent financial reporting, payroll headaches, or lack of economic strategy. Determine whether you need bookkeeping services, controller services, virtual CFO services, or a combination.

2. Define scope, outcomes, and KPIs

Define specific deliverables: monthly financial statements, cash flow forecasts, payroll compliance and KPIs like close time, accuracy rates, or days payable outstanding. This ensures measurable expectations for the outsourced accounting firm.

3. Evaluate firm expertise and industry fit

Ask about experience with businesses of your size and industry, certifications (CPA, bookkeeping credentials), and whether they provide advisory services or controller functions. Review client references and sample deliverables.

4. Review technology stack and integrations

Confirm the accounting firm uses cloud-based solutions, supports your accounting software, and can integrate with payroll platforms, CRM systems, and bank feeds to provide real-time financial information.

5. Consider security, controls, and compliance

Assess their approach to internal controls, data security, access permissions, and audit readiness. Ensure they support regulatory compliance and maintain best practices for financial operations.

6. Pricing models and total cost

Compare pricing structures hourly, fixed monthly, or tiered packages and evaluate the total cost versus hiring in-house. Consider the value of advisory and controller services when calculating ROI.

7. Onboarding and transition plan

Look for a straightforward onboarding process: data migration, timeline for clean-up work, training for your team, and a plan to hand over recurring tasks. A phased approach often works best; start with bookkeeping cleanup and add controller or CFO services after you have stable financial reporting.

8. Trial period and SLAs

Negotiate a trial period or pilot engagement with service level agreements for turnaround times, reporting cadence, and escalation. This helps test compatibility and operational fit before committing long-term.

Top outsourced accounting firms and trends to watch in 2026

As businesses continue to seek scalable accounting solutions, several trends and leading providers stand out for 2026.

Key trends

- Cloud-native accounting solutions: Firms that combine accounting expertise with automated cloud-based workflows and AI-assisted reconciliations deliver faster closes and more accurate financial data.

- Fractional CFO adoption: Growing businesses prefer fractional CFO and virtual CFO services to receive high-level advisory without the expense of a full-time CFO.

- Integrated payroll and back-office services: Bundled payroll, benefits administration, and bookkeeping continue to be popular for simplifying compliance and payroll tax filings.

- Data-driven advisory: Advanced analytics, scenario planning, and KPI dashboards are becoming standard offerings from top outsourced finance and accounting services.

Leading categories of providers in 2026

- Boutique CFO and advisory firms: Specialized in startup fundraising, profitability improvement, and investor reporting.

- Full-service outsourced accounting firms: Offer end-to-end accounting solutions bookkeeping, controller services, payroll services, and audit-ready financial statements.

- Technology-first providers: Combine accounting professionals with best-in-class accounting software and automation tools for real-time financial reporting.

When evaluating firms, prioritize those that can customize services to your business needs, partner with existing accounting teams, and demonstrate measurable outcomes like reduced close time or improved cash flow forecasting.

How to measure success after outsourcing

Set quantitative and qualitative metrics to evaluate an outsourced accounting partnership:

- Timeliness of monthly close and financial reporting

- Accuracy and reduction in reconciliation errors

- Improvement in cash flow forecasting and days sales outstanding

- Cost savings compared to in-house alternatives

- Quality of advisory and strategic guidance from the controller or CFO services

Regularly review these metrics with your provider and adjust the scope to optimize results and align with business growth.

Real-world examples: typical engagement models

Here are standard engagement models you’ll encounter:

- Full accounting outsourcing: Outsourced accounting firm handles all bookkeeping, payroll, financial reporting, and tax-ready statements, best for companies that want to replace an entire in-house accounting department.

- Hybrid model: An internal accounting team handles day-to-day operations while outsourced accounting supports complex tasks like controller services, audit prep, or CFO advisory useful when partnering with your existing accounting team.

- Project-based support: Short-term engagements for cleanup work, system migrations, or preparing for a fundraising round or audit.

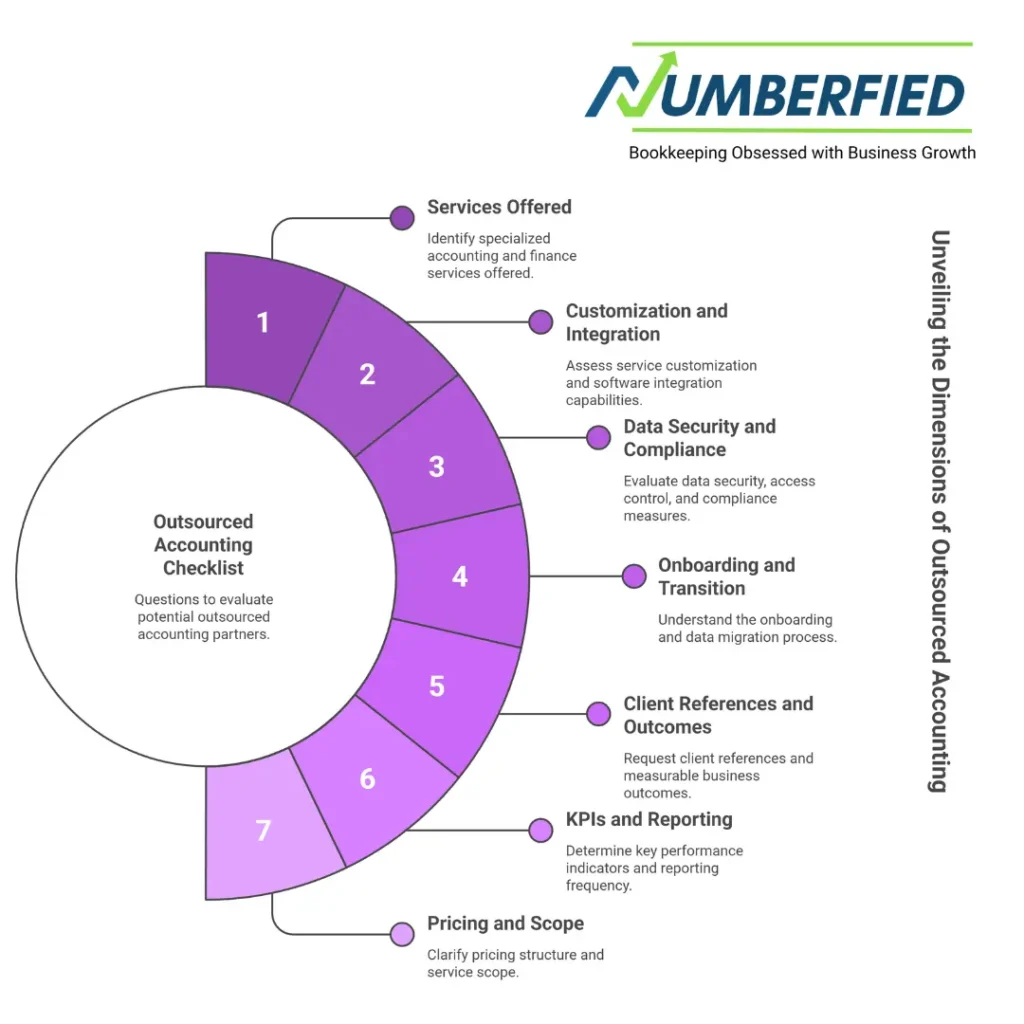

Checklist: questions to ask potential outsourced accounting partners

- What accounting and finance services do you specialize in? (bookkeeping, controller, CFO services, payroll?)

- Can you customize services for our business and integrate with our accounting software?

- How do you handle data security, access control, and compliance?

- What is your onboarding and transition process for migrating financial data?

- Can you provide client references and examples of measurable business outcomes?

- What KPIs and reporting cadence will you deliver?

- How do you price services, and what is included or considered out of scope?

Final recommendations for business owners, startups, and CFOs

Outsourced accounting firm services can be a strategic lever to improve financial management, reduce costs, and accelerate business growth. Whether you need bookkeeping services, controller-level oversight, or fractional CFO advisory, choose a firm that aligns with your finance and accounting needs, uses cloud-based accounting software, and offers clear KPIs and a robust onboarding plan. Partnering with the right outsourced accounting provider lets your business access accounting professionals who implement best practices, strengthen internal controls, and deliver the financial information needed to make informed decisions and increase profitability.

Conclusion

If you’re considering outsourcing your accounting, start with a 30–60 day pilot: scope bookkeeping cleanup, implement accounting software integrations, and establish monthly reporting. Use the pilot to evaluate responsiveness, data quality, and how well the outsourced accounting firm partners with your internal team.

Ready to optimize your accounting processes and focus on growing your business? Contact a vetted outsourced accounting firm to request a free consultation, sample financial report, and a customized plan that aligns with your accounting requirements and business goals. Whether you need bookkeeping services, payroll, controller services, or fractional CFO support, outsourcing your accounting can deliver scalable, compliant, and cost-effective finance management so you can concentrate on what matters most: growing your business and improving profitability.

Frequently Asked Questions

What are outsourced accounting firm services?

They are professional accounting tasks performed by an external firm, including bookkeeping, payroll, tax compliance, and financial reporting.

Why choose an outsourced accounting firm?

To reduce costs, access specialized expertise, improve accuracy, and free internal staff to focus on core business activities.

Which services do outsourced accounting firms typically offer?

Common services include bookkeeping, payroll, tax preparation, financial statements, accounts payable/receivable, and CFO-level advisory.

How secure is my financial data with an outsourced firm?

Reputable firms use encryption, secure servers, access controls, and regular audits to protect client data; always verify their security measures.

How much do outsourced accounting firm services cost?

Costs vary by service scope, company size, and complexity; many firms offer fixed monthly packages or hourly rates tailored to needs.

Can outsourced accounting services scale as my business grows?

Yes, firms can expand services and staffing levels to match growth, providing flexible support from basic bookkeeping to strategic finance.

How do I transition my accounting to an outsourced firm?

Typical steps include an initial assessment, data migration, process mapping, access setup, and a phased handover with training and support.

Will outsourcing affect my control over finances?

No outsourcing enhances control through regular reports, dashboards, and communication while you retain decision-making authority.

How do outsourced accounting firms ensure compliance with tax laws?

They keep up-to-date with tax regulations, apply best practices, perform timely filings, and coordinate with tax advisors to minimize risks.

How do I choose the right outsourced accounting firm services provider?

Evaluate experience in your industry, service offerings, technology stack, client references, pricing transparency, and data security practices.

Read Also: Why Accounting and Bookkeeping Services Will Change Your Business for the Better!