Introduction

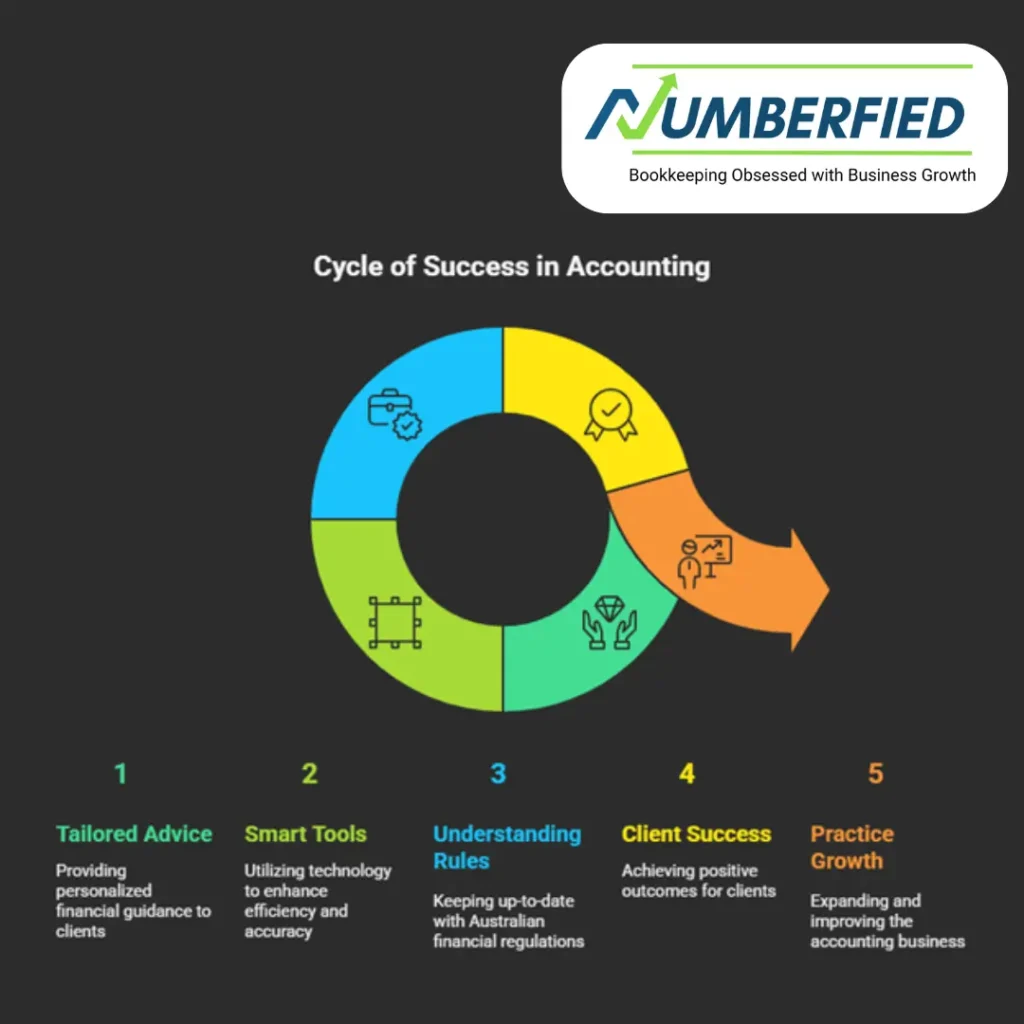

As an Australian accountant, you want your work to make a real difference- helping clients succeed while enjoying your job. That’s where a service business in accounting comes in. It’s about using your skills to offer tailored financial advice, like tax planning or audits, instead of selling products. At Numberfied, we’ve helped accountants across Australia build practices that are profitable and fulfilling. This guide explains what this model is, why it’s great for you, and how to make it work with clear, no-nonsense steps.

Key Takeaways

- A service business in accounting offers expert financial help, not physical goods.

- It builds client trust, leading to repeat business and referrals.

- Australian rules create opportunities for services like BAS preparation.

- Tech and outsourcing let you focus on high-value work.

- Numberfied supports you in creating a lasting practice.

What’s a Service Business in Accounting?

A service business in accounting means using your expertise to solve clients financial problems- think tax returns, budgeting advice, or audits. It’s not about selling software but giving solutions that fit each client. For Australian accountants, it’s about helping businesses meet ATO rules while planning for growth.

What Makes It Different

This model focuses on giving expert advice, like tax consulting or compliance support. You work closely with clients to understand their needs and offer answers that work. In Australia, this often means handling BAS statements or superannuation advice, following rules from the Accounting Professional & Ethical Standards Board.

How It Stacks Up Against Traditional Accounting

Traditional accounting can mean hours on repetitive tasks like data entry. A service business in accounting focuses on giving advice, like helping a small business save on taxes or manage cash flow. It’s about being a trusted partner, which builds stronger client ties in Australia’s varied market.

Why You Should Care

Understanding this model lets you focus on work that matters, like helping retailers with GST or startups with budgets. It brings more referrals and makes your job more enjoyable. Numberfied has seen accountants grow their practices by focusing on these services.

How This Model Has Changed

Accounting has shifted over time, and service-based practices are leading the charge, adapting to new needs.

From Paperwork to Real Advice

Years ago, accountants were buried in ledgers. Now, a service business in accounting uses tools like Xero to give instant advice. In Australia, the rise of self-managed super funds has pushed accountants to offer more tailored help, serving clients from Melbourne to Darwin.

Using Australian Rules to Your Advantage

ATO and ASIC rules set standards but also create openings for services like R&D tax advice or payroll support. Numberfied helps you turn these rules into ways to show your value to clients.

What’s Coming Next

New trends, like AI tools or sustainability reporting, are on the way. Australian businesses will need accountants to guide them through these shifts. Numberfied helps you stay ready to keep your practice strong.

Pieces of a Service Business in Accounting

A good service business in accounting needs a few key parts to work well.

Services That Stand Out

Your services might include tax preparation, bookkeeping, or audits, shaped for clients like tradies or tech startups. In Australia, BAS and super advice are must-haves, but things like business valuations can make you shine.

Keeping Clients Happy

Trust is the foundation. Regular catch-ups, clear reports, and knowing what clients need build loyalty. In Australia, understanding industry challenges- like cash flow for farmers- makes a difference. Numberfied believes relationships are the heart of a great practice.

Running a Smooth Operation

Smart systems, like automated invoicing or secure cloud storage, keep things on track. Australia’s Privacy Act means you need to handle data carefully. Good systems let you focus on advice, and Numberfied helps you set them up to grow.

Why This Model Is a Winner

A service business in accounting brings benefits that make your work and life better.

Clients Who Stick Around

When you tailor services to clients needs, they keep coming back. Helping a cafe with wage subsidies or a startup with budgeting shows you care. In Australia, this often leads to referrals, and Numberfied has seen practices grow this way.

More Ways to Make Money

You can move beyond hourly fees to retainers or advisory packages. In Australia, things like instant asset write-offs let you offer Service Business in Accounting to clients value. This helps your income grow.

Building Your Skills

This model pushes you to keep learning, from CPD courses to new tech. Outsourcing tasks like payroll lets you focus on bigger ideas. Numberfied’s coaching helps you build a practice that can grow.

Challenges to Handle

Every model has obstacles, but you can manage them with the right approach.

Dealing with Busy Times

Tax season can be tough, with deadlines piling up. Planning ahead and outsourcing tasks like data entry help. In Australia, July and October are big for BAS filings, and Numberfied has tools to make it easier.

Standing Out in a Busy Market

With lots of accountants out there, you need something special. Focusing on areas like property or medical practices makes you the go-to person. Numberfied helps you find your niche in places like Sydney or Brisbane.

Keeping Up with Tech

New tools, like cloud accounting, change fast. Staying current takes work but saves time. In Australia, digital lodgements via myGov are standard. Numberfied helps you use tech to your advantage.

How to Get Started or Improve

Want to start or make your practice better? Here’s how to do it.

Look at Your Current Setup

Check your services and what clients say. Are you spending too much time on admin? Could you offer more advice? In Australia, make sure your ATO registrations are current. Numberfied helps you find areas to improve.

Build a Strong Set of Services

Create a service business in accounting that fits your strengths, such as tax planning for small businesses or startup forecasting. Try new services with a few clients first. Numberfied can help you design services that work in Australia.

Plan to Grow

Get the word out through blogs or local business groups. Working with financial planners can bring in more clients. Keep track of what works and adjust. Numberfied’s ideas make growth feel doable.

Tech as Your Helper

Tech can make a service business in accounting easier and better for clients.

Picking Good Tools

Choose software like QuickBooks that works for Australian rules. Look for tools that connect easily with client systems. Numberfied suggests tools that are simple and can grow with you.

Talking to Clients Better

Online portals for sharing files or video calls for remote clients make things easy. In Australia, this helps you work with clients in rural areas. Numberfied uses these to keep clients happy.

Keeping Data Safe

Australia’s privacy laws mean you need secure systems. Encryption and backups protect client info. Numberfied focuses on security so you and your clients feel confident.

Things to Know in Australia

Local factors shape how your service business in accounting works.

Working with ATO and ASIC Rules

You need to follow tax and corporate laws. Getting BAS or FBT lodgements right builds trust, and advice on concessions adds value. Numberfied makes sure you stay on track.

Focusing on Key Industries

From tourism in Queensland to mining in WA, every industry has different needs. Services like tax advice for farmers make you stand out. Numberfied helps you connect with Australia’s economy.

Reaching Clients Across Australia

Digital marketing and webinars let you connect with clients from Hobart to Darwin. Being reliable opens doors. Numberfied’s network helps you grow nationwide.

Stories That Show It Works

Seeing how others succeeded can show you what’s possible with a service business in accounting.

A Brisbane Practice That Grew

One accountant offered budgeting advice and grew their clients using cloud tools. Listening to clients was key. Numberfied can help you do the same.

What Regional Practices Teach Us

A practice in Geelong worked with hospitality clients, offering tax advice for seasonal businesses. Being adaptable was key. Numberfied shares these stories to inspire you.

Keeping Track of Success

Look at things like how many clients stay or refer others. In Australia, fast BAS processing is a good sign. Numberfied helps you track and celebrate your progress.

Conclusion

A service business in accounting is about helping clients succeed and building a practice you’re proud of. By focusing on tailored advice, using smart tools, and understanding Australian rules, you can create a business that lasts. Whether you’re just starting or want to grow, Numberfied is here to help. Visit https://numberfied.com/au for a free consultation and start building your practice today.

FAQs

What does a service business in accounting involve?

It’s about giving financial advice, like tax prep or budgeting, that fits each client. In Australia, this includes BAS or super help. Numberfied helps you offer services that make a real impact.

How’s it different from regular accounting?

Regular accounting often means doing basic tasks like filings. A service business in accounting focuses on advice, like tax planning. Numberfied helps you make this change to connect better with clients.

Why’s this good for Australian accountants?

It works with local needs, like R&D tax advice or GST help, letting you serve different industries. Numberfied helps you use these to grow your practice.

What problems might I face?

Tax season can be busy, and tech changes fast. Competition in places like Melbourne means you need a specialty. Numberfied’s outsourcing and training help you stay focused.

How can tech help my practice?

Software like MYOB makes compliance easier, and portals help you talk to clients. In Australia, this speeds up BAS work. Numberfied shows you how to use tech well.

Why are client relationships important?

They keep clients coming back and bring in referrals. Advice for industries like retail builds trust. Numberfied’s ideas help you connect with clients.

How do Australian rules affect this?

ATO and ASIC rules mean you need to be accurate, but they also let you offer advice on things like concessions. Numberfied helps you stay compliant while helping clients.

How do I get started?

Look at your services, add ones like financial planning, and spread the word through networks. Numberfied gives you plans to make it easy.

Can outsourcing help me?

Outsourcing tasks like bookkeeping saves time for bigger tasks, saving money. In Australia, it helps with super rules. Numberfied’s services let you focus on growing.

How do I know if I’m doing well?

Check if clients stay or refer others. In Australia, quick BAS processing is a good sign. Numberfied helps you keep track of your progress.