Introduction

Running a small business in Australia means juggling customers, sales, marketing, and the finance side of things, from invoicing to payroll and lodging tax returns. For busy Australian business owners, accounting and bookkeeping services for small businesses are essential to keep financial records accurate, compliant, and ready to support business growth. This article explains why small business bookkeeping matters, the benefits of outsourced bookkeeping that small business owners trust, the best bookkeeping software Australia has to offer in 2025, typical bookkeeping costs Australian business owners should budget for, common bookkeeping mistakes, ATO compliance tips, and how to choose a reliable bookkeeping service or accountant.

Why Small Businesses Need These Services

Small business bookkeeping and accounting services help you manage the day-to-day accounting tasks so you can focus on growing your business. Whether you’re a tradie, café owner, consultant, or online retailer, consistent bookkeeping and accounting software that works for your business keeps financial reports accurate and tax obligations on track.

Key reasons:

- Accurate financial records to support business decisions and loan applications.

- Timely BAS and tax return lodgements to stay ATO compliant.

- Payroll and superannuation management to minimise penalties and employee issues.

- Cashflow managemen, invoices, accounts payable, and bank reconciliations to avoid surprises.

- Insightful financial reports for growth planning and performance tracking.

Common tasks a bookkeeping service typically handles:

- Bank reconciliations and accounts payable/receivable.

- Invoice creation and tracking, GST and BAS preparation.

- Payroll processing and STP reporting.

- Preparation of financial reports and year-end working papers for your tax agent or accountant.

Benefits of Outsourcing

Outsourcing your bookkeeping can be a game-changer for many Australian businesses. Outsourced bookkeeping for small business owners can be more affordable than hiring a full-time bookkeeper and provides access to expert bookkeeping services and cloud accounting systems.

Top benefits of outsourced accounting and bookkeeping:

- Cost-effective: Outsourced accounting and bookkeeping often means paying for only the services you need, avoiding the overheads of an in-house hire.

- Scalable services: Bookkeeping packages can grow with your business from basic transaction recording to full bookkeeping and accounting services.

- Access to expertise: Professional bookkeeping services bring reliable bookkeeping, experience with accounting software (Xero, MYOB, QuickBooks), and up-to-date knowledge of ATO rules.

- Improved cash flow and reporting: Timely accounts payable and receivable management, accurate financial reports, and better visibility for business decisions.

- Time to focus on core business: As a small business owner, you can focus on sales, customers, and growing your business instead of daily accounting tasks.

Practical outsourced bookkeeping services to consider:

- Monthly bookkeeping and BAS preparation.

- Payroll and superannuation processing and Single Touch Payroll (STP) reporting.

- Quarterly or monthly management reports and cash flow forecasting.

- Year-end bookkeeping and tax preparation support for your tax agent or accountant.

Top Bookkeeping Software in Australia

Cloud-based accounting has become the standard for small businesses in Australia. In 2025, the market continues to be dominated by Xero, MYOB for small businesses, and QuickBooks. Choosing the best accounting software depends on your business needs, industry, and whether you want to work with a bookkeeper or run business bookkeeping in-house.

Xero bookkeeping

Xero remains a favourite with Australian business owners and bookkeepers. It’s cloud accounting-first, integrates easily with many apps, supports bank feeds and automatic reconciliations, and is widely used by accountants and tax agents.

- Strengths: Easy bank feeds, app ecosystem, strong reporting, collaborative access for bookkeeper and accountant.

- Best for: Small businesses that want cloud accounting, frequent bank transactions, and collaboration with a professional bookkeeping service.

MYOB for small business

MYOB continues to serve many small and medium businesses, especially those needing robust payroll and award interpretation features. MYOB’s desktop and cloud offerings provide options depending on business bookkeeping needs.

- Strengths: Payroll and award settings, invoicing, and integrated tax reporting.

- Best for: Businesses with complex payroll or existing MYOB workflows.

QuickBooks is flexible and user-friendly

QuickBooks offers strong bookkeeping and accounting features and is often chosen by small business owners looking for straightforward setup and good value plans.

- Strengths: Ease of use, solid invoicing and reporting, integration with payments.

- Best for: Small businesses starting cloud accounting or those seeking a simple, reliable accounting program.

Choosing between Xero, MYOB, and QuickBooks:

- Consider integrations: best bookkeeping software Australia often depends on the apps you need (e-commerce platforms, point-of-sale, payroll providers).

- Speak with your accountant or bookkeeper: Many tax agents specialise in one or more platforms and can advise which system will streamline tax and accounting tasks.

- Trial before committing: Most vendors offer free trials so you can test bank feeds, invoicing, and reporting workflows relevant to your business bookkeeping.

Costs in Australia

Bookkeeping costs Australia-wide vary depending on scope, frequency, and complexity. Understanding typical pricing helps a small business owner budget properly.

Common pricing models:

- Hourly rates: For ad-hoc bookkeeping tasks or catch-up work. Rates in Australia typically range from AUD 50–120+ per hour, depending on the bookkeeper’s experience and location.

- Fixed monthly packages: Popular for ongoing monthly bookkeeping, payroll, and BAS. Packages might start from AUD 150/month for basic services to AUD 800+/month for comprehensive bookkeeping and payroll for larger small businesses.

- Project-based fees: For software setup, migration to cloud accounting, or annual clean-up projects. One-off fees vary widely.

What influences bookkeeping costs:

- Transaction volume: More invoices, receipts, and bank feeds increase the time required.

- Payroll complexity: Multiple employees, award rates, and frequent pay cycles add costs.

- Level of service: Full outsourced accounting that includes management reporting and advisory work costs more than basic record-keeping.

- Software and integrations: Some costs include subscription fees for Xero, MYOB, or QuickBooks; others require you to pay separately.

Tips to manage bookkeeping costs:

- Keep good records: Digital invoices and receipts reduce reconciliation time and lower bookkeeping fees.

- Automate where possible: Use bank feeds, invoice automation, and cloud-based accounting tools to reduce manual work.

- Choose a suitable package: Select a bookkeeping package that matches your business bookkeeping needs rather than paying for services you don’t use.

Common Mistakes to Avoid

Many small businesses make bookkeeping mistakes that cost time and money. Avoid these common pitfalls to keep financial records reliable and tax obligations under control.

- Poor record-keeping: Missing invoices, unfiled receipts, and inconsistent accounting system use make reconciliations difficult.

- Not separating personal and business finances: Mixing accounts complicates financial reports and can create issues if you’re audited by the ATO.

- Delaying reconciliations: Falling behind on bank reconciliations leads to errors, missed payments, and inaccurate cash flow visibility.

- Ignoring payroll compliance: Incorrect superannuation or STP reporting can result in ATO penalties.

- DIY without the right knowledge: Using accounting software without understanding GST, BAS, or tax rules increases the risk of incorrect lodgements.

- Failing to back up or secure data: Even cloud accounting requires good access controls and data protection practices.

How to fix or avoid these mistakes:

- Set a weekly or monthly bookkeeping routine: Reconcile bank accounts and process invoices weekly or monthly, depending on transaction volume.

- Use cloud accounting and automation: Leverage Xero, MYOB, or QuickBooks with bank feeds and receipt capture to reduce manual tasks.

- Hire a qualified bookkeeper or outsource: Professional bookkeeping services and tax and accounting services can ensure compliance and accurate financial reports.

- Work with a registered tax agent: For tax returns and complex tax issues, a tax agent will help you meet lodgement deadlines and minimise risk.

How to Choose a Provider: Choose the best bookkeeping service or accountant

Selecting the right bookkeeping and accounting partner is a strategic decision for your business in Australia. Your chosen provider should match your bookkeeping needs, industry requirements, and growth plans.

Steps to choose the best bookkeeping or accounting service:

- Define your business bookkeeping needs: Determine whether you need basic transaction recording, payroll and BAS, or a full outsourced accounting solution that includes advisory services.

- Check qualifications and experience: Look for registered BAS agents, tax agents, and bookkeepers with experience in small businesses in Australia and the accounting software you plan to use (Xero accounting software, MYOB, QuickBooks).

- Ask about services for small businesses: Confirm the range of services, including payroll, BAS preparation, tax and accounting services, financial reports, and cloud accounting support.

- Request references and case studies: Speak with other Australian business owners who use the provider to understand responsiveness and reliability.

- Understand pricing and packages: Compare bookkeeping packages and what’s included (monthly reconciliations, payroll, BAS lodgement), and align with bookkeeping costs Australia estimates.

- Confirm compliance and security: Ensure the provider follows ATO-compliant processes, STP for payroll, and has robust data security and backup procedures.

- Look for proactive communication and advisory: The best bookkeeping services do more than record transactions; they help you interpret financial reports and support business growth decisions.

Questions to ask a potential bookkeeper or accounting service:

- Are you a registered BAS agent or tax agent?

- Which accounting program do you specialise in: Xero, MYOB, or QuickBooks?

- How do you handle payroll, superannuation, and STP reporting?

- What is included in your bookkeeping packages, and how are additional tasks charged?

- Can you help with software migration and training for our team?

Outsourcing tips:

- Start with a trial period or a small monthly package to test the working relationship.

- Document processes and provide the bookkeeper with access to your accounting system and bank feeds.

- Schedule regular catch-ups monthly or quarterly to review financial reports and make informed business decisions.

ATO Compliance Tips

ATO compliance is a core part of bookkeeping and accounting services for small businesses. Staying up to date with rules ensures you avoid penalties and keep your financial records accurate.

Practical ATO compliance tips for small business bookkeeping:

- Register for GST if your turnover is $75,000 or more, or sooner if you prefer to claim GST credits.

- Lodge BAS on time and ensure GST reporting matches your accounting records.

- Use Single Touch Payroll (STP) for employee reporting and keep payroll records accurate for superannuation obligations.

- Keep records for at least five years: invoices, receipts, bank statements, payroll, and tax invoices to support any ATO review.

- Engage a registered tax agent before tax deadlines. Tax agents have extended lodgement timeframes and expertise to optimise tax outcomes.

- Ensure your accounting software is set up correctly for GST, payroll categories, and the chart of accounts to avoid misreporting.

ATO considerations:

- Continued emphasis on real-time reporting and digital record-keeping means cloud accounting is essential to remain compliant.

- ATO data-matching programs are more advanced, ensuring your invoices, wage records, and bank transactions reconcile regularly.

- Stay informed about changing rules for contractor classification, jobkeeper-style support (if introduced for specific programs), and any temporary relief measures aimed at small businesses.

Insights into accounting software trends, bookkeeping solutions

As we move through 2025, the bookkeeping and accounting landscape for Australian business owners shows clear trends that impact how small businesses manage financial operations.

Key insights for small businesses:

- Cloud accounting dominance: Xero accounting software, MYOB, and QuickBooks continue to integrate deeper with payment, payroll, and e-commerce platforms, making automation easier.

- AI and automation: Automated bank reconciliation, invoice data capture, and categorisation reduce manual bookkeeping time and lower bookkeeping costs.

- Advisory-focused bookkeeping: Providers are shifting from transaction processing to offering management reporting and financial advice to help businesses grow.

- Subscription-based services: Bookkeeping packages and bundled advisory services make outsourced accounting predictable and affordable for small businesses.

How to leverage trends to grow your business:

- Adopt cloud-based accounting and connect it to your payments and banking. This improves cash flow visibility and reduces manual entry.

- Automate recurring invoices and payment reminders to improve collections and reduce days sales outstanding.

- Use monthly financial reports and KPIs to make data-driven business decisions and plan for growth.

- Partner with a bookkeeper or outsourced accounting provider that offers proactive insights and support for business bookkeeping services.

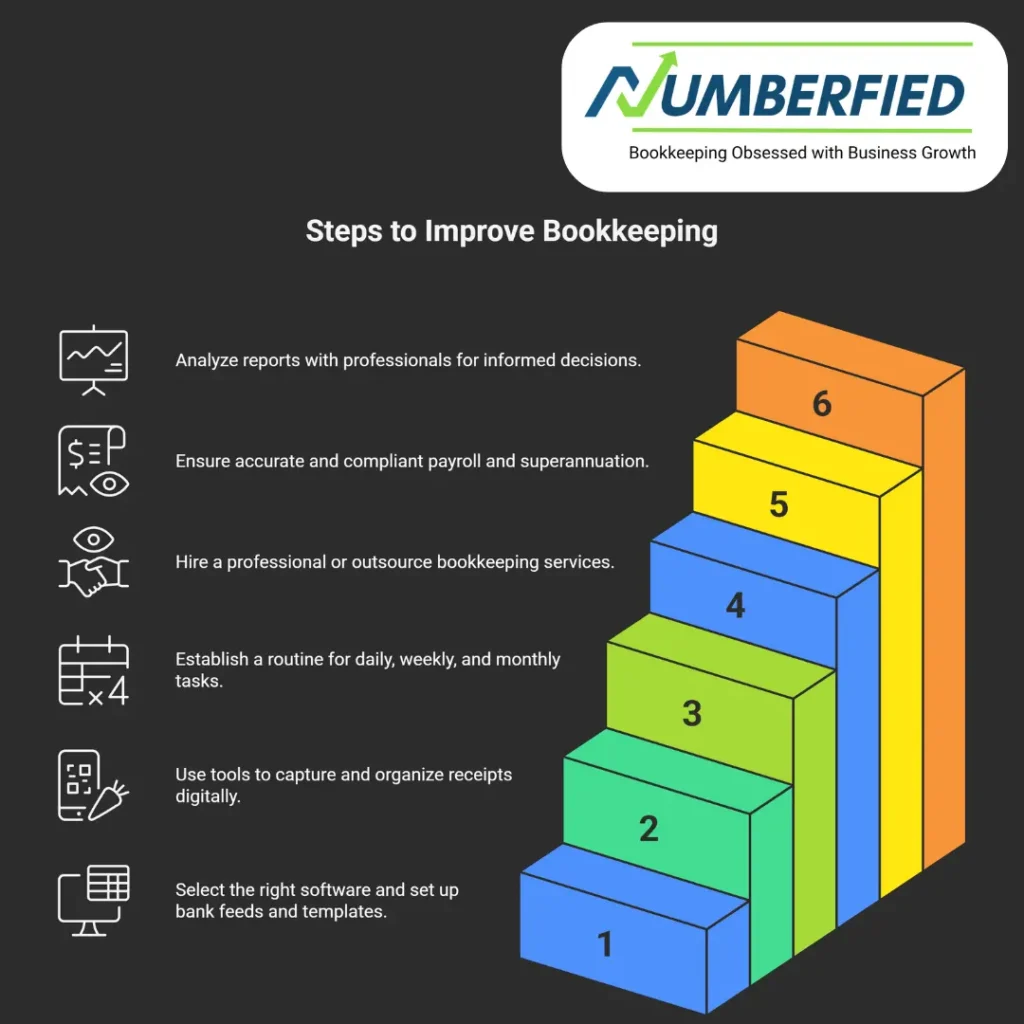

Practical Steps to Implement

If you’re ready to improve bookkeeping in your small business, here are practical steps to implement a reliable accounting and bookkeeping process.

- Choose the right accounting program (Xero, MYOB, QuickBooks) and set up bank feeds and invoice templates.

- Digitise receipts and use receipt capture tools to reduce manual data entry.

- Set a bookkeeping schedule: daily for invoices and payments, weekly for reconciliations, and monthly for BAS and management reports.

- Engage a registered bookkeeper or outsource to an affordable bookkeeping service that offers the services for small businesses you need.

- Ensure payroll and superannuation are processed correctly and comply with STP and ATO rules.

- Review financial reports with your bookkeeper and accountant to align on business decisions and tax planning.

Conclusion

Accounting and bookkeeping services for small businesses are more than compliance tasks; they are tools to help you manage cash flow, make better business decisions, and grow your business. Whether you choose to adopt Xero, MYOB for small businesses, or QuickBooks, or outsource bookkeeping to a reliable bookkeeping service, the key is consistency, accurate financial records, and working with professionals who understand Australian business needs.

Next steps for small business owners:

- Assess your bookkeeping needs and transaction volume.

- Trial or upgrade to a cloud accounting system that suits your business’s bookkeeping.

- Consider outsourcing to an expert bookkeeping service to reduce bookkeeping costs in Australia and gain time to focus on customers.

- Work with a registered tax agent or accountant for tax returns and compliance advice.

Frequently Asked Questions

What is the difference between bookkeeping and accounting?

Bookkeeping focuses on recording daily financial transactions, such as sales, purchases, receipts, and payments, while accounting interprets, classifies, analyzes, reports, and summarizes that financial data to provide insights and support decision-making and tax compliance.

Does my small business need both bookkeeping and accounting services?

Most small businesses benefit from both: bookkeeping ensures accurate records, and accounting turns those records into financial statements, budgets, tax filings, and strategic advice. The level of service depends on your size, complexity, and growth plans.

How often should bookkeeping be done?

Bookkeeping should be done regularly, daily or weekly for transaction entry and reconciliations, and monthly for bank reconciliations and financial statement preparation. Regular work prevents errors and gives timely insight into cash flow and performance.

Can I use accounting software instead of hiring a bookkeeper?

Accounting software (QuickBooks, Xero, FreshBooks, etc.) is powerful and cost-effective, but small business owners often hire a bookkeeper or accountant to set up the system, maintain accurate records, reconcile accounts, and interpret reports. A hybrid approach with software plus professional support is common.

What services are typically included in small business bookkeeping and accounting packages?

Typical services include transaction entry, bank reconciliations, accounts payable and receivable management, payroll processing, monthly financial statements, tax preparation and filing, sales tax reporting, budgeting, and periodic financial reviews or advisory sessions.

How much do bookkeeping and accounting services cost for small businesses?

Costs vary by location, complexity, and service level. Bookkeeping can range from a few hundred to several thousand dollars per month. Accounting and advisory services may be charged hourly or via monthly retainers. Many firms offer tiered packages, basic bookkeeping, payroll add-ons, and full-service accounting.

Is outsourcing bookkeeping and accounting secure?

Reputable providers use secure cloud platforms, encrypted data transmission, access controls, and regular backups. Ask providers about their security policies, data handling, and compliance with standards like SOC 2. Maintain internal controls and limit access to sensitive financial information.

How does outsourcing bookkeeping help my business grow?

Outsourcing frees up the owner’s time, ensures accurate and timely financials, improves cash flow management, helps with tax planning, and provides reliable reports for decision-making and fundraising. Professional insight can identify cost savings and profitability improvements.

What should I look for when choosing an accounting or bookkeeping provider?

Look for industry experience, technology stack compatibility, transparent pricing, clear communication, references or reviews, relevant certifications (CPA, bookkeeping credentials), and a service scope that matches your needs (payroll, taxes, advisory).

How do we start working with a bookkeeping/accounting service?

Onboarding typically includes a discovery call to assess needs, document collection (bank statements, prior financials, tax returns), system setup or migration to your chosen software, establishing workflows and access, and a regular reporting schedule. Expect an initial cleanup period to bring records up to date.

Also Read: Why Accounting and Bookkeeping Services for Small Businesses Are Your Australian Secret Weapon