Introduction

You’re a startup creator in Australia, fueled by a great fantasy. Your desk’s a bunch of coffee mugs, your laptop’s whizzing, and you’re ready to take on the globe. Then—bang!—a stack of permits and invoices can turn your day upside down. Bookkeeping? It’s like footing on a Lego in the middle of a sprint. But here’s the deal: outsourcing bookkeeping for startups is the winning edge your business needs.

At Numberfied, we’re not just about keeping your books straight; we’re about helping your startup fly. Let’s break down why outsourcing your financial chores could be the move that puts you ahead of the pack.

.

Key Takeaways:

- Outsourcing bookkeeping for startups allows you to preserve your time and money, focusing on growth.

- Numberfied turns your numbers into a guide for smarter business moves.

- It works for any Aussie startup, from solo gigs to growing teams.

- Outsourcing keeps your finances clean and compliant, eliminating the need for stress.

What’s Outsource Bookkeeping for Startups?

Outsourcing bookkeeping for startups suggests authorizing your financial jobs to a team of experts, often operating remotely from overseas. They tackle invoices, path payments, and sell with taxation paperwork so you can keep your eyes on the reward. At Numberfied, we make it so easy that you’ll kick yourself for not starting sooner.

More Than Just Crunching Numbers

Bookkeeping isn’t just about tallying receipts. It’s about knowing where your money is and how to make more of it. Our Numberfied team digs into your finances to spot gems, like which products are raking it in or where you’re leaking cash.

Why Startups Can’t Ignore It

Startups move fast, and founders juggle a ton of roles. Bookkeeping often gets pushed aside, but sloppy books can sink you. Outsourcing keeps your finances tight, allowing you to focus on nailing that investor pitch or landing a major client.

A True Story

Take Mia, a Sydney startup founder with an app idea. She was stuck spending 12 hours a week on spreadsheets, missing time to code. After outsourcing with Numberfied, she ditched the numbers, focused on her app, and gained $45,000 in funding. That’s the power of outsourcing.

How It Saves Your Startup Money

You’re a startup—every dollar’s gotta work. Outsourcing your books might sound like a cost, but it’s a money-saver in disguise. Here’s why.

Cheaper Than Local Hires

A full-time bookkeeper in Australia can hit you for $60,000 a year or more. Outsourcing? It’s often half that. At Numberfied, our global team keeps costs low so that you can reinvest those savings into marketing, hiring, or a sleek new website.

No Training Headaches

Hiring someone means teaching them your setup. With Numberfied, our team is already well-versed in Australian tax laws and tools like Xero. They jump in and get it done; no babysitting is needed.

Avoid Pricey Mistakes

DIY bookkeeping can lead to errors, such as missing deductions or incorrect GST reporting. We once helped a Melbourne startup fix a $4,500 tax error they didn’t even know about. Outsourcing keeps your books clean and your wallet happy.

How It Lets You Chase Big Wins

Startups thrive on bold ideas and quick moves. Outsourcing bookkeeping for startups frees you to chase those wins without getting bogged down by numbers.

Time for Your Big Ideas

Bookkeeping can take up 10-15 hours a week. Outsourcing gives you that time back. One of our clients, a Perth startup founder, utilized those hours to launch a new product, which doubled her sales in just six months.

Data That Drives Smart Moves

At Numberfied, we don’t just tidy your books—we hand you reports that show what’s clicking. For example, we helped a Brisbane startup see that one service drove 70% of their profits. They doubled down and grew 20% in a year.

Less Stress, More Fire

Worrying about BAS or late invoices can dampen your enthusiasm. Outsourcing lifts that weight so you can stay focused and motivated. We’ve seen founders go from stressed to stoked once their books are handled.

Why Numberfied Makes It Dead Simple

At Numberfied, we’re not your average bookkeeping squad. We’re your startup’s wingman, making outsourcing bookkeeping for startups as easy as grabbing a beer.

Fast and Easy Setup

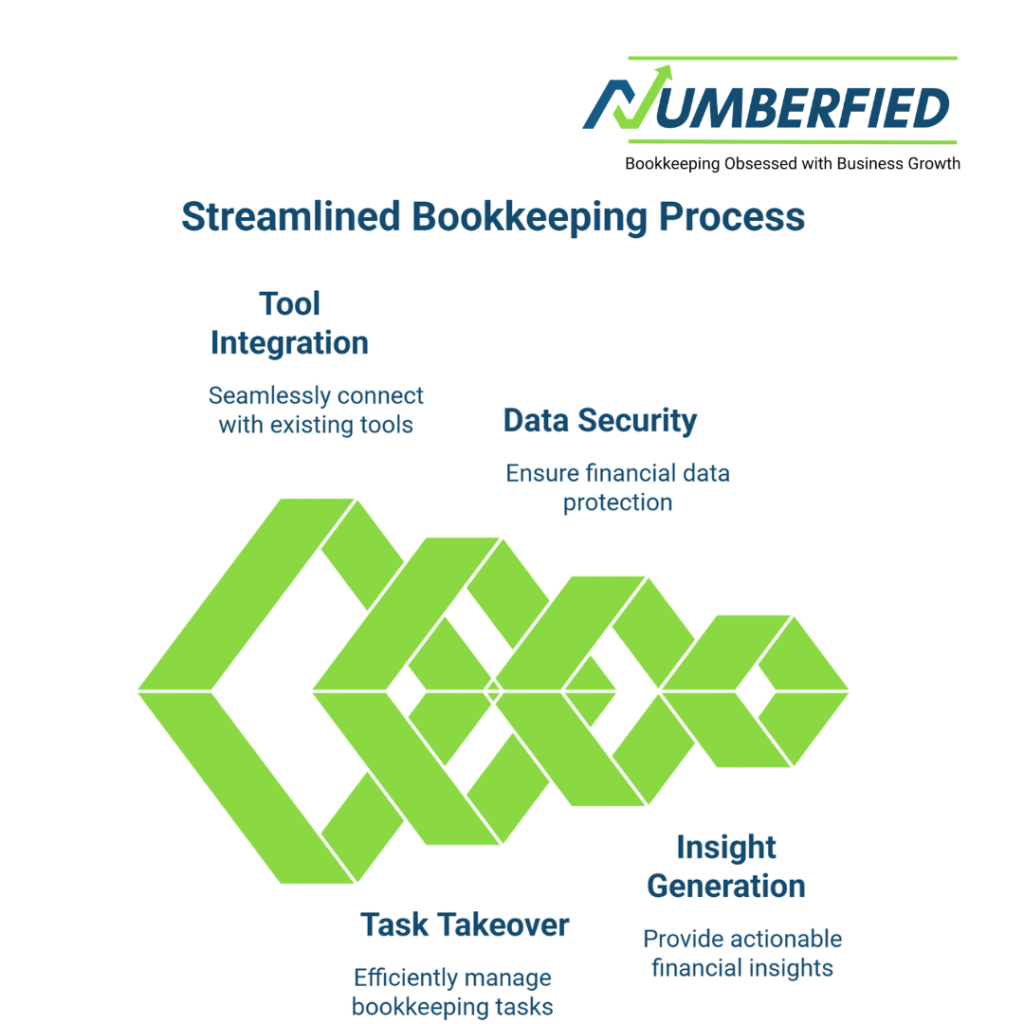

We integrate with your tools—Xero, QuickBooks, whatever you’ve—and take over tasks like paying suppliers or preparing BAS. Our team gets you rolling in days.

Data You Can Trust

We utilize top-notch encryption and comply with Australian laws to ensure the security of your financial information. One founder said, “Numberfied’s like my money’s personal bouncer.” That’s the peace of mind we bring.

Insights That Fuel Wins

Our reports don’t just show numbers—they show opportunities. We helped a Sydney startup save $2,000 a year by switching suppliers based on our expense breakdown. That’s Numberfied doing its thing.

Why Aussie Startups Are Obsessed

Outsourcing bookkeeping for startups is booming across Australia, from tech hubs in Melbourne to creative hubs in Adelaide. Here’s why it’s a crowd-pleaser.

Perfect for Lean Crews

Most startups can’t afford a full-time bookkeeper. Outsourcing suggests experienced help at a fraction of the cost, making it an perfect option for solo originators or small teams.

Scales with Your Grind

As your startup grows—perhaps by adding staff or opening a new office—your books become more complex. Numberfied grows with you, handling the extra work without spiking costs.

Made for Aussie Rules

Australian taxation laws, such as GST and BAS, can be difficult. Our team knows them inside out, keeping your books ATO-compliant. We once saved a startup $1,500 in fines by catching a BAS mistake.

Smashing Myths About Outsourcing

Some startups hold back from outsourcing, shocked by myths about safety or communication. Let’s shut those down with the facts.

It’s Not Secure

No chance. At Numberfied, we utilize bank-level encryption and adhere to strict Australian laws to ensure your data remains secure. Your financials are more secure with us than in a folder labeled “Taxes.”

Talking to the Team Will Suck

Not with us. Our crew speaks clear English and gets the Aussie startup hustle. It’s like having a mate who’s a bookkeeping guru, minus the pub tabs.

It’s Only for Big Dogs

Wrong. Outsourcing bookkeeping for startups works for businesses of any size. We’ve helped everyone from one-person to 15-person squads, tailoring our services to fit their needs.

Conclusion

Outsourcing bookkeeping for startups isn’t just about saving time—it’s about giving your company the edge to succeed. With Numberfied, you get pure books, sharp insights, and more time to chase your goals. Whether you’re a sole creator in Sydney or a growing team in Perth, we’re here to help you rise without the pressure.

Ready to ditch the permits and make tides? Give Numberfied a call today and visit our website at https://numberfied.com/au — your startup is prepared to soar.

FAQs

What is outsourcing bookkeeping for startups?

It utilizes a remote team to manage your financial tasks, including invoices, payments, and taxations. It’s more cost-effective than engaging a regional bookkeeper and just as trustworthy. At Numberfied, we utilize tools like Xero to ensure your books are accurate and compliant with Australian accounting and tax laws. This saves you time, so you can focus on creating your startup. It’s ideal for founders who want to miss the paperwork and concentrate on their big visions. We’ve helped startups across Australia streamline their finances and grow faster.

Is my financial data secure when outsourced?

You bet. Numberfied utilizes bank-level encryption and yields with Australian rules to ensure your data remains safe. Our crew handles your financials with consideration and conducts regular security assessments. You can focus on running your startup without worrying about your numbers being at risk. We’ve never had a security issue, and our clients trust us to keep their data secure and protected. Your financials are safe with us.

Can small startups afford to outsource?

For sure. Small startups save significantly—often 40-50% less—by hiring remotely. It’s ideal for firms with limited budgets that require professional assistance. Numberfied tailors our services to your setup, so you get top-notch bookkeeping without draining your funds. This frees up cash for things like marketing or product tweaks. We’ve helped solo founders and small teams across Australia keep their finances sorted without breaking the bank.

How does outsourcing save time for founders?

It takes bookkeeping off your plate, freeing up hours you’d spend on receipts or BAS. Our client Jake, a Sydney startup founder, saved 12 hours a week and used it to pitch investors. Numberfied’s team performs fast, ensuring your books are prepared when you need them. This allows you to focus on big-picture tasks, such as product launches or client outreach. Less time on numbers means more time to grow your startup.

Is outsourcing compliant with Australian tax laws?

Absolutely. Our team knows Australian tax laws cold, ensuring your books meet ATO standards, like GST and BAS. Numberfied checks everything carefully, so you’re always compliant. We’ve saved clients thousands by catching tax errors before they became fines. You can focus on your startup without worrying about tax headaches. Compliance is our jam, and we’ve got you covered.

What makes Numberfied different from other services?

Numberfied isn’t just about bookkeeping—we’re about helping your startup win. We dig into your books to find ways to save or earn more, like spotting pricey suppliers. Our team feels like part of your crew, offering personalized support to make your business stronger. We’ve helped startups across Australia turn their finances into a growth tool. With Numberfied, you’re getting a mate, not just a service.

What tools does Numberfied use for bookkeeping?

We use cloud fora like Xero, MYOB, and QuickBooks, so you can check your financials anytime. Our team is familiar with these tools, ensuring accuracy and simplicity. You receive clear reports without including to do any of the weighty lifting. These tools sync with your company, making it easy to stay on top of your digits. Numberfied makes bookkeeping a breeze, no matter your setup.

How long does it take to start outsourcing with Numberfied?

It’s quick—just a few days. We chat about your needs, link up with your software, and get rolling. There’s no disruption to your startup’s flow. Numberfied makes the switch smooth, so you’re saving time and money fast. We’ve had clients up and running in less than a week with zero hassle. You’ll be amazed at how easy it is to get started.

Can outsourcing help my startup grow?

You bet. Outsourcing bookkeeping for startups provides you with more time and insights to make informed decisions. We helped a Brisbane startup save $2,000 per year by optimizing expenses, which they reinvested in marketing. Numberfied’s reports show you where to save or invest, helping your business thrive. With less time on books, you can focus on scaling, pitching, or building your brand. Growth’s our goal, and we’re here to help.

How do I get started with Numberfied?

It’s a piece of cake. Visit our website at https://numberfied.com/au/ for a free chat about your startup’s needs. We’ll craft a plan that fits, connect with your tools, and get going. In a few days, you’ll have a team handling your books, letting you focus on making your startup a hit. Numberfied’s here to make your financials stress-free and your growth unstoppable. Reach out today!