Introduction

Running a small business in Australia is rewarding, but the money side can be a real headache. One minute you’re serving customers, the next you’re knee-deep in receipts and tax forms. That’s where Numberfied comes in. Our Small Business Accounting, Tax & Bookkeeping service helps ensure everything runs smoothly, keeps ATO happy, and saves hours you’d rather dedicate to expanding your business. Let us handle the numbers while you focus on what matters. Our Small Business Tax & Bookkeeping service makes life simpler

key takeaways include:

Automating repetitive tasks and freeing up valuable hours each week with automation solutions like Xero is the way forward if you want to stay compliant with Australian tax regulations and keep financial information accessible regardless of location – from Sydney to Outback Australia!

Gain insights to expand your business confidently.

Why Australian Small Businesses Need These Services

A small business accounting tax & bookkeeping service is a lifeline for busy entrepreneurs. It handles everything from invoices to tax lodgments, all through user-friendly cloud platforms tailored for Australia’s unique needs.

Freedom to Work from Anywhere

Access your books on your phone while grabbing a coffee in Melbourne. Cloud systems keep data live and secure. A Numberfied client, a florist in Perth, caught a billing error on her tablet, saving $600 in minutes.

Save Money, Not Accuracy

Hiring an in-house accountant costs a fortune- think wages and super. Online services offer fixed fees, often $150-$350 monthly, delivering precision without the hefty price tag. It’s a budget win for any small business.

ATO Compliance Without the Stress

Navigating GST and BAS can be daunting. A reliable small business accounting tax & bookkeeping service automates these, ensuring error-free lodgments. One of our clients avoided a $1,000 fine thanks to our timely alerts.

Top Features to Look for in a Service

Not all services are equal. The best ones offer tools that fit Australian businesses like a glove, from local software integration to robust security.

Syncs with Xero and MYOB

Most Australian businesses use Xero or MYOB. A top service integrates smoothly, cutting manual work. Numberfied’s team set up a retailer’s books in days, halving her data entry time.

Automated Invoicing and Payments

Send invoices fast and track payments easily. Automation speeds up cash flow. A Brisbane trader we helped saw payments arrive quicker, boosting his bottom line.

Real-Time Financial Insights

Instant reports show your profits and expenses clearly. This helps plan for busy seasons, like holiday sales in Adelaide. A gym owner we know used these insights to launch a new class, increasing revenue.

Benefits That Make Your Day Brighter

A small business accounting tax & bookkeeping service does more than crunch numbers- it frees you to grow and enjoy your work.

Reclaim Your Time

No more late nights sorting receipts. Automation handles repetitive tasks. A Numberfied client, a cafe owner, now spends evenings with family instead of spreadsheets.

Fewer Errors, More Confidence

Manual mistakes can be costly. Automated reconciliations ensure accuracy. This saved one of our clients from overpaying GST, putting extra cash back in their pocket.

Scales with Your Growth

From sole traders to growing teams, these services adapt. A Sydney e-commerce store we support scaled from 100 to 1,000 transactions without missing a beat.

How Numberfied Shines for Australian Businesses

At Numberfied, we’re more than a small business accounting tax & bookkeeping service. We’re your partners, blending financial expertise with growth support to help you thrive.

Bookkeeping with a Bonus

We manage transactions and taxes, but also offer weekly coaching on business strategies. A food truck owner we helped doubled his bookings after our marketing tips.

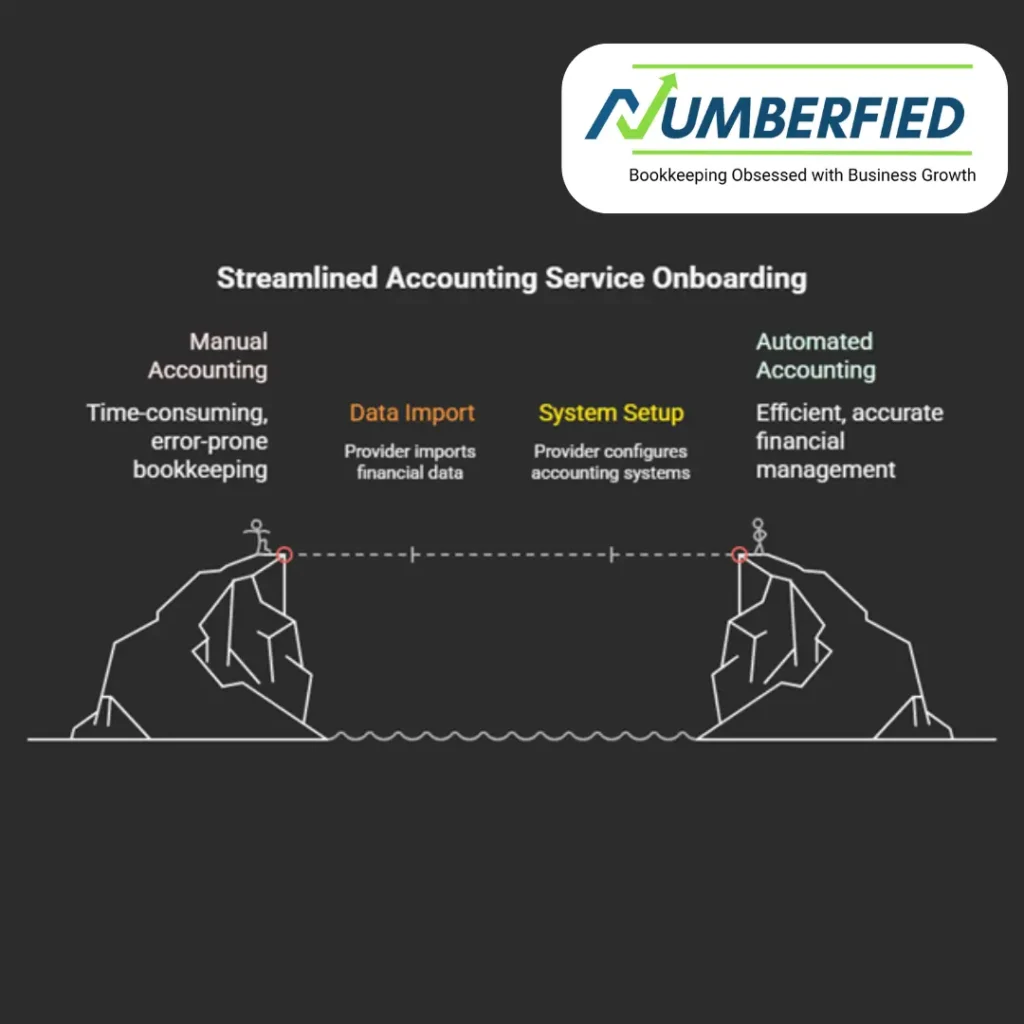

Easy Setup, No Fuss

Our onboarding is quick and painless, syncing with your systems in days. A sole trader we supported was amazed at how fast she started managing her books.

Join Our Australian Business Network

Connect with other entrepreneurs for tips and referrals. It’s like a friendly catch-up, with Numberfied clients sharing ideas to spark growth.

Choosing the Right Service for You

Picking a small business accounting tax & bookkeeping service takes a little thought. Here’s how to find the perfect fit for your Australian business.

Match Features to Your Needs

Sole traders need basics like invoicing, while larger teams require payroll. List your priorities. A Numberfied client chose us for our all-in-one package, saving her hours weekly.

Check Local Knowledge

Ensure the provider understands ATO rules. Reviews can confirm their expertise. Our clients love Numberfied’s deep knowledge of Australian tax laws.

Compare Costs and Benefits

Avoid hidden fees. Numberfied’s clear plans offer premium features at affordable rates, as our clients happily share.

Tackling Common Challenges

Even the best small business accounting tax & bookkeeping service faces hurdles. Here’s how to overcome them with ease.

Keeping Data Secure

Top services use encryption to protect your info. Numberfied’s secure systems give clients peace of mind, so they focus on running their business.

Smooth Transitions

Switching to a new system can feel tricky. Good providers offer training. A Numberfied client laughed about his initial nerves but now loves the simplicity.

Tool Compatibility

Make sure your small business accounting tax & bookkeeping service fits perfectly with your existing software.

AI for Faster Bookkeeping

AI will soon categorize expenses instantly, saving more time. Early users we’ve seen cut admin hours significantly.

Mobile Access for Busy Australians

Manage books from your phone, perfect for life on the go in Australia. From Darwin to Tassie, it’s all at your fingertips.

Streamlined ATO Links

Expect direct ATO integrations for faster lodgments. This will make BAS and GST even easier to handle.

Conclusion

A small business accounting tax & bookkeeping service is your ticket to stress-free finances in Australia. It automates tasks, ensures ATO compliance, and provides insights to fuel growth. At Numberfied, we combine expert bookkeeping with personalized coaching to help your business soar. Whether you’re a freelancer in Fremantle or a retailer in Canberra, we’re here to simplify your numbers. Visit https://numberfied.com/au/ today to discover how we can make your financial life a breeze!

FAQs

1. How does a small business accounting tax & bookkeeping service save me time?

Numberfied simplifies tasks like invoicing and reconciliations to free up hours for customer interactions instead of paperwork – clients of Numberfied like Melbourne baker, Regan Browne have even claimed evenings back for themselves with Numberfied!

2. Can these services handle complex tax requirements?

Yes, they manage GST, BAS, and superannuation with precision. Automated tools ensure compliance with ATO rules. A Numberfied client in Brisbane avoided penalties thanks to our accurate lodgments.

3. Are online services affordable for startups?

Absolutely, with plans starting at $100-$300 monthly, they’re cheaper than hiring staff. You get expert results without the overhead. Numberfied’s affordable packages suit new businesses perfectly.

4. How do I start using a small business accounting tax & bookkeeping service?

It’s simple: the provider imports your data and sets up your systems. Numberfied’s quick onboarding had a Sydney freelancer up and running in just a few days.

5. What if I use unique software for my business?

Top services integrate with platforms like Xero or QuickBooks. Numberfied customizes setups to match your tools, ensuring a smooth workflow for any Australian business.

6. How secure are my financial records online?

Leading services use bank-level encryption and comply with Australian privacy laws. Numberfied’s secure systems protect your data, giving you confidence to focus on growth.

7. Can these services help me plan for growth?

Yes, they provide reports to track profits and expenses so as to assist your decisions and guide your strategy.

8. Do I need to be tech-savvy to use these services?

Not at all! User-friendly platforms and support make it easy. Numberfied’s team guides clients, like a Darwin mechanic, to use our tools confidently with minimal tech know-how.

9. How often should I check my financials with these services?

Weekly glances catch issues early, while monthly reports offer deeper insights. Automated alerts keep you informed effortlessly. Numberfied’s small business accounting tax & bookkeeping service makes this quick and simple.

10. Can these services support seasonal businesses?

small business accounting tax & bookkeeping service is ideal for fluctuating workloads, like tourism in Queensland. Plans adjust to your needs, and data helps plan for peaks. A Numberfied client’s tour business thrives with our flexible support.