Why Small Business Bookkeeping Services Matter

Effective bookkeeping is the foundation of every healthy small business. Small business bookkeeping services help Australian business owners stay compliant with the ATO, manage cash flow, prepare accurate financial statements, and free up time to focus on growth. Whether you’re a sole trader, a partnership, or a small company, professional bookkeeping reduces errors, improves decision-making, and often saves money by identifying tax deductions and avoiding penalties.

Key Benefits of Professional Bookkeeping

- Compliance and BAS lodgement: Ensures timely Business Activity Statement (BAS) preparation and lodgement so GST, PAYG, and other obligations are met.

- Accurate payroll management: Timely pay runs, superannuation calculations, Single Touch Payroll (STP) reporting, and PAYG withholding handling reduce legal risk.

- Improved cash flow: Regular reconciliations and expense tracking help forecast cash flow and identify bottlenecks.

- Better financial insights: Clean books provide reliable reports for budgeting, pricing, and strategic decisions.

- Time and cost savings: Outsourcing bookkeeping frees owner time and can be more cost-effective than hiring in-house staff.

- Scalability: Services can grow with your business, from basic transaction recording to full CFO-level reporting and advisory.

Core Services Explained

BAS Lodgement

BAS lodgement is a core service for businesses registered for GST. Bookkeepers prepare, review, and lodge your BAS with the ATO, ensuring GST, PAYG instalments, and other liabilities are accurately reported. Regular BAS management avoids late lodgement penalties and ensures correct input tax credits.

Payroll and STP Reporting

Payroll services include calculating wages, PAYG withholding, superannuation, leave accruals, and providing payslips. Modern bookkeepers handle Single Touch Payroll (STP) reporting so employee and employer obligations are automatically reported to the ATO each pay run.

Bank Reconciliations and Account Reconciliation

Reconciliations match bank and credit card statements to your accounting records, quickly identifying discrepancies, fraud, or missing transactions. Regular reconciliations keep financial records accurate and simplify year-end reporting and BAS preparation.

Cloud Accounting Setup and Management

Cloud accounting platforms like Xero, MYOB Essentials, and QuickBooks Online are popular in Australia. Bookkeepers set up charts of accounts, automate bank feeds, configure GST settings, train staff, and maintain the system so your books are always up to date and accessible from anywhere.

Accounts Payable and Receivable

Managing invoices, supplier payments, and debtor follow-ups improves cash flow and vendor relationships. Bookkeepers can implement invoicing automation, payment terms, and debtor management processes to minimise late payments and disputes.

Financial Reporting and Advisory

Beyond data entry, bookkeepers produce monthly and quarterly reports such as profit and loss, balance sheet, and cash flow statements. Many provide advisory insight, cost analysis, budgeting, and KPI tracking to help business owners make informed decisions.

Pricing Models for Small Business Bookkeeping Services

Bookkeeping pricing in Australia varies; common models include:

- Hourly rates: Pay only for the time used. Suitable for irregular or ad-hoc tasks, but can be unpredictable for ongoing needs.

- Fixed monthly packages: A set fee for a defined scope (e.g., monthly reconciliations, payroll, and BAS). Ideal for predictable budgeting and small businesses with consistent volume.

- Per-transaction pricing: Fees based on the number of transactions processed. Works for businesses with fluctuating transaction volumes.

- Project-based fees: One-off fees for specific tasks such as system migration, clean-up, or year-end preparation.

- Value-based or retainer advisory: Higher-level advisory services are often charged as retainers, delivering ongoing strategic support beyond basic bookkeeping.

Typical costs vary by complexity and region. Simple monthly bookkeeping packages may start from a few hundred dollars per month, while full-service packages including payroll and BAS can range higher. Always confirm what is included: frequency of reconciliations, BAS lodgement, payroll limits, and any additional fees.

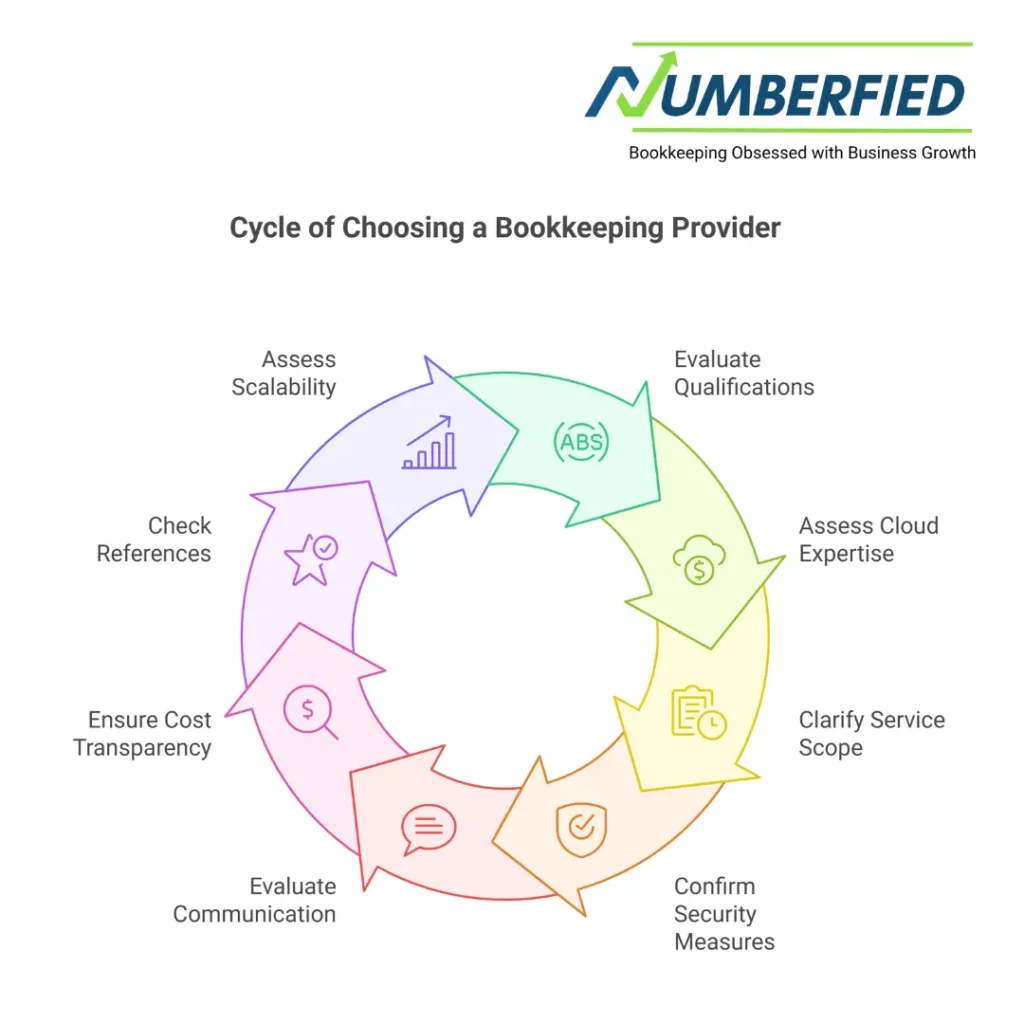

How to Choose the Right Small Business Bookkeeping Provider

Choosing the right provider ensures you get reliable, compliant, and value-driven services. Consider the following:

- Qualifications and experience: Look for BAS agents registered with the Tax Practitioners Board (TPB) and with experience in businesses in your industry.

- Cloud expertise: Ensure they are proficient with your chosen accounting platform (Xero, MYOB, QuickBooks) and can handle integrations with POS, e-commerce, or payroll systems.

- Service scope and SLAs: Clarify what tasks are included, turnaround times for reconciliations and BAS lodgement, and reporting frequency.

- Security and data privacy: Confirm secure data handling, regular backups, and compliance with Australian privacy standards.

- Communication and accessibility: Choose a provider who communicates clearly, offers training, and provides easy access to financial reports.

- Cost transparency: Get a detailed fee schedule, including out-of-scope charges, to avoid surprises.

- References and reviews: Ask for client references or check online reviews to gauge reliability and service quality.

- Scalability and advisory capability: If you plan to grow, pick a bookkeeper who can scale services and provide strategic financial advice.

Onboarding and Working Effectively with Your Bookkeeper

Streamline onboarding by preparing bank statements, previous BAS returns, payroll records, supplier lists, and access to cloud accounts. Agree on a communication cadence, reporting templates, and a process for handling queries. Regular catch-up, monthly or quarterly, to ensure alignment and let your bookkeeper offer timely insights.

Common Mistakes to Avoid

- Delaying reconciliations compounds errors and complicates BAS lodgement.

- Choosing the cheapest option without checking qualifications or TPB registration.

- Failing to integrate key systems (bank feeds, POS, invoicing), causing manual work and mistakes.

- Ignoring red flags in financial reports, small issues early can become large problems later.

Conclusion

Small business bookkeeping services in Australia are essential for ensuring compliance, managing cash flow, and driving growth. Whether you need BAS lodgement, payroll, reconciliations, or cloud accounting setup, the right bookkeeper adds value by saving time, reducing risk, and providing actionable financial insights. Compare providers on qualifications, cloud expertise, service scope, and pricing to find the best fit for your business.

Frequently Asked Questions

What does a bookkeeper do for a small business?

A bookkeeper records financial transactions, reconciles accounts, prepares BAS, manages payroll, issues invoices, and produces reports so you have accurate financial records.

Do I need a registered BAS agent?

You don’t always need a BAS agent, but a TPB-registered BAS agent is authorised to lodge BAS on your behalf and provides extra assurance of compliance.

How often should my accounts be reconciled?

Monthly reconciliations are typical for most small businesses; high-volume or retail businesses may benefit from weekly reconciliations.

Can bookkeepers handle Single Touch Payroll (STP)?

Yes. Experienced bookkeepers perform STP reporting as part of payroll services and ensure employee and employer obligations are met.

Which cloud accounting software is best for small businesses in Australia?

Xero, MYOB, and QuickBooks Online are widely used. The best choice depends on your business size, integrations, and budget.

How much do bookkeeping services cost?

Costs vary by service scope and transaction volume. Expect simple monthly packages from a few hundred dollars; full-service solutions cost more. Always request a clear fee schedule.

How do bookkeepers help with taxes?

Bookkeepers prepare records that your accountant uses for tax returns, identify deductible expenses, and ensure GST and PAYG obligations are correctly reported via BAS.

Can I keep some bookkeeping tasks in-house?

Yes. Many businesses retain in-house responsibility for daily tasks and outsource complex or time-consuming tasks like BAS lodgement, reconciliations, or payroll to a bookkeeper.

What information do I need to provide to my bookkeeper?

Provide bank statements, invoices, receipts, payroll records, supplier details, previous BAS returns, and login access to cloud accounting platforms and bank feeds.

How quickly can I switch bookkeepers?

Switching is usually straightforward: new bookkeepers perform a handover, migrate cloud data if needed, and complete an initial clean-up. Time required depends on the size and condition of your records.

Also Read: How Small Business Bookkeeping Services Can Supercharge Your Australian Venture