Introduction

You launched your business to solve problems for your customers, not to chase down receipts or dread tax season. We hear that exact line every week at Numberfied. Our accountancy & tax services exist to flip the script, give you clean numbers, zero surprises, and the headspace to focus on what you love. We serve owners from coast to coast, from one-person shops to companies with multiple locations. This guide lays out every piece of the puzzle, shows you the real-world wins, and walks you straight to the starting line with our team.

Here’s what you walk away with:

- Accountancy & tax services that run quietly in the background while you run the show.

- Time reclaimed, compliance locked in, and decisions backed by facts.

- Numberfied plans built around your industry, your pace, and your future.

The Real Impact of Accountancy & Tax Services on Daily Operations

Picture walking into your office knowing every dollar is accounted for and every deadline is handled. That’s the baseline accountancy & tax services we deliver. Owners who switch to us stop second-guessing bank balances and start steering with certainty. The shift happens fast, usually within the first full month. We take the routine off your plate and replace it with reports you actually use. At Numberfied, we treat your books like our own, because your success is our scorecard.

The payoff compounds. Clean data means faster loan approvals, stronger vendor terms, and the ability to spot profit leaks before they drain the tank. We don’t just keep the train on the tracks; we help you pick up speed.

Bookkeeping That Stays One Step Ahead

Your transactions don’t wait for the weekend, and neither do we. Accountancy & tax services include same-day posting for every sale, expense, and transfer. Bank feeds pull the raw data; our team adds the context, correct codes, job numbers, and customer tags. By the close of business, the day is closed in the books. You open the portal and see yesterday’s activity reflected perfectly.

We build the chart of accounts with you in the first week. Tell us how you think about costs, by department, by project, by product line, and that’s how the system runs. Recurring vendors are locked in, so the same expense never needs to be recoded. Weekly reconciliations catch the rare mismatch before it becomes a problem. Owners tell us the biggest win is logging in at 7 a.m. and knowing the cash number is dead-on. That certainty lets you open the doors, place orders, or cut checks without hesitation.

Payroll Processed Like Clockwork

Your team shows up expecting paychecks on Friday. Accountancy & tax services make sure they hit every account on the dot. We onboard new hires through a quick form, name, rate, withholdings, and direct deposit details. The system calculates gross-to-net, pulls the right federal and state rates, and files the deposits. You click approve Thursday afternoon; money moves Friday morning.

Changes slide in without drama. Someone switches from salary to hourly? Update once, done. A bonus needs to run? Add it to the next cycle. Year-end rolls around and W-2s land in employee inboxes before January 31. We handle the state unemployment reports, the 940s, the local withholdings, everything. You keep the team happy; we keep the government happy. The process is so smooth most owners forget payroll is even running until the confirmation email pings.

Monthly Reports You Open with Excitement

The first week of every month, a package lands in your inbox. Accountancy & tax services turn raw numbers into a story you can act on. Page one: three bullet points, what’s up, what’s down, what to watch. Page two: profit and loss with last year beside it. Page three: cash flow snapshot and a 90-day forecast. We flag the one line that needs your attention and schedule a 20-minute call to talk it through.

These aren’t 50-page tomes. They’re built for busy owners. Click a line and drill to the transactions behind it. Export to PDF for the bank or print for the partner meeting. The call isn’t a lecture, it’s a conversation. You say where you want to go; we show the numbers that get you there. Clients start looking forward to the first Tuesday because that’s when the new report drops.

Choosing Accountancy & Tax Services That Fit Like a Glove

One size never fits all in financial support. The right accountancy & tax services feel custom from the first call. We ask about your busiest month, your biggest headache, and your three-year picture. Then we build the plan around those answers. No cookie-cutter packages, no upselling fluff, just the pieces you need, ready to grow when you do.

Start the search by talking to owners in your network. Ask who handles their books and if they’d switch back. Then call us. We’ll walk through a live demo using your actual numbers (scrubbed for privacy). You see exactly what the portal looks like, how reports land, and how fast questions get answered.

Experience That Speaks Your Language

Your industry has its own rhythm. Accountancy & tax services work best when the team knows that rhythm cold. Restaurants track food costs daily. Contractors need job-level profit. Online sellers juggle marketplace fees. At Numberfied, we assign a lead who’s handled dozens of businesses like yours. They set up the system the way you already think, not the way a textbook says.

That experience shows up in the details. A landscaper client gets separate tracking for equipment depreciation and seasonal labor. A consultant gets billable hours tied to project codes. We’ve seen the patterns, fixed the pitfalls, and baked the lessons into every new setup. The result: onboarding finishes in weeks, not months, and the books make sense from day one.

Communication That Keeps You in the Loop

You run the business; we run the numbers. Accountancy & tax services include updates on your terms. Want a text when payroll posts? Done. Prefer a weekly cash email? Set it. Monthly calls lock to your calendar, same day, same time. Questions hit the portal and land in the lead’s inbox; replies come back before the day ends.

We speak plain English. A variance report says “marketing spend ran 12% over budget because of the trade-show booth” , not a string of accounting codes. You ask, we explain, you decide. This open line means surprises stay off the table.

Flexibility to Match Your Path

Businesses don’t grow in straight lines. Accountancy & tax services bend with the turns. Start with core bookkeeping and tax prep. Add payroll when the first employee joins. Layer in multi-state filings when the second location opens. Drop in quarterly strategy sessions when revenue hits the next level. Every piece clicks on without restarting the clock.

We review the plan every six months. If your needs shift, the service shifts. No penalties, no rework, just the right support at the right time.

Building Blocks of Accountancy & Tax Services

Every strong structure starts with solid pieces. We lay them one by one.

Transaction Management from Day One

The moment money moves, it’s recorded. Accountancy & tax services capture bank deposits, credit card charges, and cash payments in real time. Rules you approve code 90% automatically. The other 10% get reviewed and posted by noon the next day. You never open the books to a pile of uncategorized entries.

Mobile upload means a lunch receipt snapped on your phone lands coded before you finish coffee. Vendor invoices forwarded by email route to the right approver. The system learns, the backlog shrinks, the accuracy climbs.

Vendor and Customer Tracking

Know who you owe and who owes you. Accountancy & tax services maintain aging reports updated daily. Vendors on net-30 get flagged at day 25. Customers past due trigger gentle reminders you pre-approve. Payments apply to the correct invoices so balances stay clean.

We set credit terms per customer and watch for patterns. A client who always pays late gets a conversation before it hurts cash flow. A vendor offering early-pay discounts gets flagged when the math works. These small moves keep relationships strong and cash steady.

Inventory Control for Product Businesses

Stock ties up money. Accountancy & tax services track units in, units out, and units on hand. Cost layers, FIFO, LIFO, average, apply the way you choose. Slow movers show up in red on the monthly report. We run cycle counts with you and adjust books the same week.

Seasonal businesses get forecasts tied to historical sales. Order too early and cash sits; order too late and sales slip. The right balance shows in the numbers and on the shelf.

Tax Mastery Inside Accountancy & Tax Services

Taxes aren’t a once-a-year event, they’re a year-round discipline. We treat them that way.

Quarterly Checkpoints That Prevent Surprises

March, June, September, December, we sit down (virtually or in person) and run the numbers. Accountancy & tax services project the year-end liability, adjust estimated payments, and lock in deductions. Money moves to a tax escrow account so April never blindsides you.

Entity choice gets reviewed annually. S-corp: reasonable salary, LLC: pass-through, C-corp: double taxation. We model the options and pick the winner. Credits like R&D or energy efficiency trigger alerts the moment you qualify.

Filing Season Without the Frenzy

Returns start in January. Accountancy & tax services pull the data, run the calculations, and send drafts for review by February 15. Extensions file only when holding back gives a clear advantage. Most clients e-file by March 1 and sleep easy.

State and local returns ride the same timeline. Sales tax, franchise tax, and city business license, we track every jurisdiction and submit on time. Confirmation copies land in your portal the same day.

Audit Support from Notice to Close

A letter arrives. Accountancy & tax services take the wheel. We open the notice, pull every document, and draft the response. You get a copy and a five-minute summary call. Most audits close in one round because the records are complete and organized.

We run a mock audit every other year to tighten weak spots before they’re tested. The preparation turns a potential crisis into a minor inconvenience.

Planning and Forecasting Tools

Numbers without direction are noise. We give them purpose.

Budgets Built on Your Reality

We start with last year’s actuals, layer in your goals, and produce a line-item budget you can live with. Accountancy & tax services load it into the portal so every transaction checks against the plan. Monthly variance reports show green, yellow, red, clear signals to adjust.

Quarterly refresh keeps the budget current. A new marketing push or equipment buy slides in without breaking the model. You steer by a map that updates as the road changes.

Cash Flow Projections You Trust

Every Monday a 13-week forecast lands. Accountancy & tax services pull committed payables, expected receivables, and payroll runs to paint the picture. Peaks and valleys show up early so you line up credit or push collections.

Bank presentations include the forecast printed and bound. Lenders see the plan and the discipline behind it. Approvals come faster.

Growth Scenarios That Light the Path

Want to add a location? Hire five people? Launch a new line? Accountancy & tax services build three versions, conservative, base, aggressive. Each shows revenue ramp, expense load, cash dip, and break-even month. You pick the pace with eyes open.

The same models work for succession planning or sale prep. Every big move rests on solid math.

Technology Backbone of Accountancy & Tax Services

Tools make the impossible routine.

Portal Access on Any Screen

Phone, tablet, laptop, the view is the same. Accountancy & tax services live in a secure cloud you reach with one login. Dashboards load in seconds. Approve, upload, review, anywhere you have signal.

Two-factor authentication and end-to-end encryption keep everything locked down. Daily backups mean zero data risk.

Automation That Thinks Ahead

Rules you set once run forever. Accountancy & tax services code rent to the same account every month. Subscription renewals flag for review. Bank rules catch 85% of transactions on import. The other 15% get human eyes the same day.

Time saved compounds. What took four hours a week now takes four minutes.

Connections to Your World

Shopify sales, Square deposits, Expensify receipts, accountancy & tax services pull them all. No CSV uploads, no manual matching. The general ledger updates the moment the sale rings.

Custom integrations handle unique setups. The goal: one source of truth for every system.

Growing Without Growing Pains

Expansion shouldn’t break the books.

Multi-Site Roll-Up Reporting

Open a second shop, and the system adds it in a day. Accountancy & tax services track each location separately and roll up to the parent view. Profit per site, shared overhead allocation, intercompany transfers, all automatic.

Local tax rules apply per address. One login sees everything.

Cross-Border Sales Compliance

Sell to Canada or Europe? Accountancy & tax services register for VAT, calculate duties, and file returns. Currency converts at the daily rate. Books stay GAAP clean.

Executive-Level Advisory

Revenue climbs, stakes rise. Add CFO hours, board packages, investor decks, cap table management. Same team, deeper bench.

Onboarding: From Hello to Live in Four Weeks

Week one: discovery call, document list, access setup. Week two: data import, cleanup, opening balances locked. Week three: first payroll, first report, portal training. Week four: full close, strategy session, handshake.

Owners Who Made the Switch

“Finally understand where every dollar goes without spending my weekend.” – Jake, gym chain, Colorado

“Tax planning alone paid for the service in the first quarter.” – Sarah, marketing agency, Georgia

“Added a second state and didn’t feel a thing.” – Carlos, distributor, Arizona

Conclusion: Take the First Step Today

Accountancy & tax services hand you back control and clarity. Stop wrestling numbers and start building your business. Head to https://numberfied.com/, drop your name, email, and top finance worry in the form. We call tomorrow, map the plan, and get you live before the month ends.

FAQs

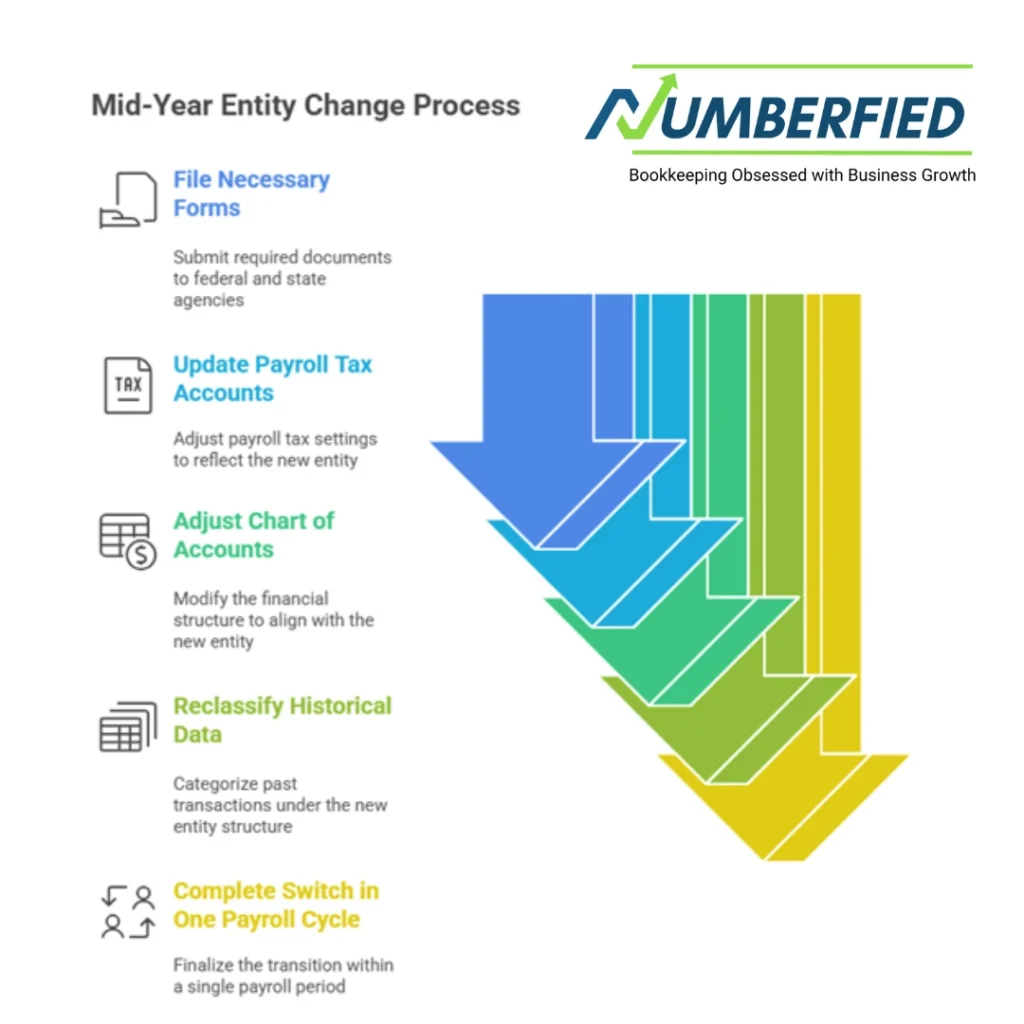

How do accountancy & tax services manage a mid-year entity change?

We file the necessary forms with federal and state agencies, update payroll tax accounts, and adjust the chart of accounts. Historical data reclassifies under the new structure. The switch completes in one payroll cycle with no disruption to employees or vendors.

What if I use industry-specific software for billing?

We build direct connections or scheduled imports so invoices flow to the general ledger automatically. Custom fields map to your accounting codes. You bill in your system; books update without extra work.

Do accountancy & tax services cover grant reporting for funded startups?

Grant budgets load as separate cost centers. Expenses tag to the grant code on entry. Quarterly draw reports generate with one click. Compliance documentation stays audit-ready year-round.

How are capital asset purchases handled?

We record the asset, set depreciation schedules, and track location or department. Disposals calculate gain or loss automatically. Tax forms like 4562 populate from the register.

Can accountancy & tax services help with cost allocation across departments?

Department codes apply at the transaction level. Overhead allocates by headcount, square footage, or revenue share, your choice. Monthly reports show true profit per department.

What support exists for a business sale or acquisition?

We prepare due diligence packages, quality of earnings reports, and working capital calculations. Tax implications model under multiple structures. The process runs parallel to your legal team.

How does the team handle employee expense reimbursements?

Employees submit via mobile app with receipt photo. Approvals route to managers. Reimbursements bundle with payroll or cut separate checks. All miles and categories track for tax reporting.

Is there a way to track customer profitability?

Customer tags apply to revenue and direct costs. Accountancy & tax services generate reports showing gross profit per client. Top and bottom performers highlight instantly.

What happens if I miss providing a document during tax prep?

We flag the missing item, set a reminder, and hold the return until complete. Extensions file automatically if needed. No penalties, no rush fees.

How do I know the service is worth the investment?

Schedule the discovery call. We review your current setup, estimate hours saved, and project tax savings. Most owners see the math clear in the first conversation.