Introduction

Reliable financial management is essential for mission success. This guide explains accounting services for nonprofit organizations in practical terms, what they include, why they matter, how to choose between in-house and outsourced models, and best practices you can implement right away.

What Are Accounting Services for Nonprofit Organizations?

Accounting services for nonprofit organizations encompass a specialized set of financial activities designed to meet the unique needs of tax-exempt entities. Unlike for-profit accounting, nonprofit accounting emphasizes fund accounting, donor restrictions, grant compliance, and transparent reporting to boards, donors, and regulators. These services can be delivered by internal staff, external firms, or a hybrid approach and typically include bookkeeping, financial reporting, budgeting, payroll, grant tracking, audit preparation, and compliance support.

Why Accounting Services for Nonprofit Organizations Matter

Strong accounting services for nonprofit organizations are more than back-office functions; they are strategic tools that protect reputation, ensure legal compliance, and enable better decision-making. Accurate finances increase donor confidence, improve grant eligibility, reduce the risk of penalties, and free leaders to focus on programming and fundraising. For boards and executive directors, clear financial information enables mission-aligned choices, performance measurement, and long-term sustainability planning.

Core Accounting Services for Nonprofit Organizations

Below are the core services your organization should expect from a competent provider of accounting services for nonprofit organizations. Each one addresses a specific operational or compliance need.

Fund Accounting

Fund accounting is the backbone of nonprofit financial management. It separates resources into funds according to donor restrictions, program designations, or legal requirements, ensuring that revenues and expenses are tracked and reported appropriately. Proper fund accounting prevents accidental misuse of restricted funds and simplifies audit trails.

Grant Tracking and Management

Grant tracking includes budgeting, expense allocation, reporting, and compliance monitoring tied to grant agreements. Effective grant tracking ensures that expenditures match grant budgets, deadlines are met, and required documentation is available for funders and auditors.

Budgeting and Forecasting

Accurate budgeting aligns programs with financial realities. Budgeting services include developing annual and program budgets, scenario planning, cash-flow forecasting, and variance analysis to help leaders respond to financial challenges proactively.

Payroll and Benefits Administration

Payroll for nonprofits often involves multiple funding sources and allocation of salaries across programs. Payroll services include wage calculation, tax withholding, benefits administration, and ensuring that allocation between funds is consistent, documented, and compliant with grant terms.

Compliance and Regulatory Reporting

Compliance services help nonprofits meet GAAP requirements (or other applicable accounting standards) and prepare regulatory filings such as IRS Form 990, state charity registrations, and payroll tax reporting. Staying compliant reduces legal risk and preserves tax-exempt status.

Audit Preparation and Support

Audits whether financial statement audits, A-133/Uniform Guidance single audits, or agreed-upon procedures require thorough documentation and controls. Accounting services for nonprofit organizations include pre-audit cleanup, schedule preparation, auditor coordination, and post-audit follow-up to address findings and implement control improvements.

Nonprofit-Specific Challenges and How Accounting Services Address Them

Nonprofit organizations face several accounting challenges that standard for-profit services may not adequately cover. A specialized provider understands these nuances and offers solutions tailored to the nonprofit environment.

Restricted Funds and Donor Intent

Challenge: Ensuring funds are used in accordance with donor restrictions and tracking when restrictions are met.

Solution: Implement detailed fund accounting, create clear internal policies, and use accounting software configured to tag and segregate restricted contributions.

Multiple Funding Streams

Challenge: Managing revenue from donations, grants, membership dues, program fees, and earned income while allocating costs appropriately.

Solution: Use activity-based cost allocations, maintain separate fund centers for major revenue streams, and apply consistent allocation methods documented in policies.

Grant Compliance and Reporting Deadlines

Challenge: Meeting varied reporting requirements for each grantor and avoiding disallowed costs.

Solution: Provide a grant tracking calendar, maintain expense back-up by grant, and perform regular internal reviews to verify compliance.

Limited Financial Staffing

Challenge: Small nonprofits often lack experienced finance staff, increasing operational risk.

Solution: Outsourced accounting services for nonprofit organizations can provide experienced professionals, system setup, and processes at a lower cost than hiring full-time senior staff.

Common Accounting Mistakes Nonprofits Make

Being aware of frequent mistakes helps leaders proactively fix weaknesses. Accounting services for nonprofit organizations aim to prevent these errors and strengthen financial controls.

Mixing Restricted and Unrestricted Funds

Using restricted funds for general expenses, even unintentionally, can lead to legal issues and donor distrust. Clear fund segregation and approval workflows prevent commingling.

Poor Documentation and Recordkeeping

Missing receipts, incomplete grant files, and undocumented allocations hinder audits and grant reimbursements. A disciplined document-retention policy and organized filing system are essential.

Lack of Internal Controls

Inadequate segregation of duties, weak approval processes, and unchecked access to banking can expose nonprofits to fraud. Implementing even basic controls, such as dual sign-offs, bank reconciliations, and restricted access, reduces risk significantly.

Inaccurate or Late Form 990 Filings

Filing errors or delays on IRS Form 990 can trigger penalties and damage credibility. Professional preparation and timely review are crucial to accurate disclosure and compliance.

In-House vs Outsourced Accounting Services for Nonprofit Organizations

Choosing between internal staff and outsourced providers depends on budget, complexity, and long-term strategy. Many nonprofits adopt a hybrid model that combines strengths from both approaches.

In-House Accounting: Pros and Cons

Pros: Immediate access to staff, deep institutional knowledge, and direct supervision.

Cons: Recruitment and retention costs, limited expertise for complex compliance requirements, and vulnerability to staff turnover.

Outsourced Accounting: Pros and Cons

Pros: Access to experienced nonprofit accountants, scalable services, cost-efficiency, and often stronger internal control frameworks. Outsourcing can include accounting, payroll, and CFO-level advisory as needed.

Cons: Less day-to-day presence, potential communication lags, and the need to vet providers for nonprofit experience.

Hybrid Models

Hybrid models pair a small in-house finance person with outsourced specialists for month-end close, grant reporting, audits, and CFO advisory. This approach can deliver continuity and depth without the cost of a full finance team.

Best Practices for Accounting Services for Nonprofit Organizations

Adopting these best practices will improve financial accuracy, donor confidence, and operational resilience.

1. Establish Clear Financial Policies

Create policies for fund accounting, expense approvals, travel and expense reimbursement, credit card usage, reserves, and document retention. Policies reduce ambiguity and provide a framework for consistent decisions.

2. Use Segregated Bank Accounts and Proper Fund Tracking

Where appropriate, maintain separate accounts or sub-ledgers for restricted funds. Tag transactions at the point of entry and reconcile monthly to prevent commingling.

3. Reconcile Accounts Monthly

Perform bank and credit card reconciliations monthly and review variances with program managers. Monthly reconciliation catches errors early and strengthens internal controls.

4. Implement Strong Internal Controls

Segregate duties, require dual approvals for large disbursements, and limit access to accounting systems. Regularly review user permissions and access logs.

5. Prepare Regular Management Reports

Provide timely financial statements, cash forecasts, budget vs. actual reports, and program-level dashboards to the executive director and board finance committee. Clear reporting supports strategic decisions.

6. Maintain a Grant Calendar and Checklist

Track reporting deadlines, deliverables, and required documentation for each grant. Assign responsibility and verify submissions before deadlines.

7. Invest in Training

Train program staff on allowable costs, documentation requirements, and budget responsibilities. Empowered program managers make fewer costly errors.

Tools and Software for Accounting Services for Nonprofit Organizations

Selecting the right software reduces manual work, improves accuracy, and simplifies compliance. Look for systems that support fund accounting, grant tracking, and reporting tailored to nonprofit needs.

Popular Accounting Platforms

QuickBooks Online (with nonprofit chart of accounts), Sage Intacct, Blackbaud Financial Edge NXT, Abila MIP, and NetSuite are commonly used. Smaller organizations often start with QuickBooks with nonprofit-specific configurations.

Grant and Donor Management Tools

CRM and donor platforms such as Bloomerang, Neon, DonorPerfect, and Salesforce Nonprofit Cloud integrate with accounting systems to sync contribution data and reduce reconciliation work.

Payroll and HR Software

Platforms like ADP, Paychex, Gusto, and Paylocity can handle multi-fund payroll allocations and benefits administration. Choose vendors that support nonprofit payroll nuances and grant allocations.

Expense Management and Automation

Expense tools such as Expensify, Certify, and Bill.com streamline approvals, vendor payments, and record-keeping. Automation reduces manual data entry, speeds up reimbursements, and improves audit readiness.

Choosing Software

Criteria: fund accounting capability, user permissions, reporting flexibility, integrations with donor and payroll systems, cloud access, and vendor support for nonprofit accounting services for nonprofit organizations.

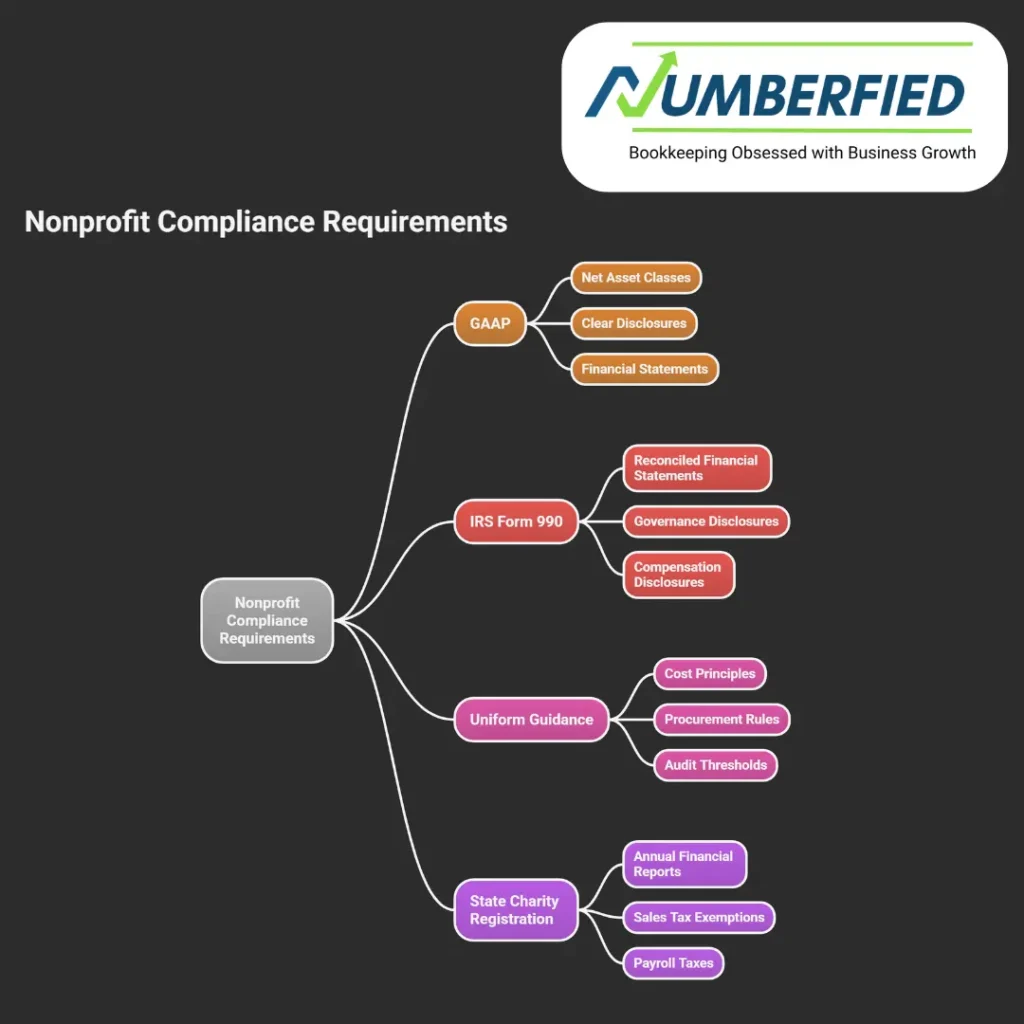

Compliance Requirements: GAAP, IRS Form 990, and Beyond

Nonprofits must follow accounting standards and regulatory filings to maintain tax-exempt status and public trust. Key compliance areas include:

Generally Accepted Accounting Principles (GAAP)

Many nonprofits follow GAAP for financial statement presentation. GAAP requires presentation by net asset class (e.g., unrestricted, temporarily restricted, permanently restricted), clear disclosures, and statements of financial position, activities, and cash flows. Accounting services for nonprofit organizations should ensure GAAP-compliant statements where applicable.

IRS Form 990

Form 990 provides the public with financial information about the organization. Accurate completion requires reconciled financial statements, disclosure of governance and compensation, and schedules specific to activities and support. Timely and accurate Form 990 filings are critical to transparency and donor trust.

Uniform Guidance (2 CFR Part 200)

Organizations receiving federal awards must comply with Uniform Guidance, which includes cost principles, procurement rules, and audit thresholds. Accounting services for nonprofit organizations should map grant budgets to allowable cost categories and prepare documentation for single audits when required.

State Charity Registration and Local Requirements

Many states require charities to register and file annual financial reports. Sales tax exemptions, payroll taxes, and employee classification laws also have state-specific requirements. Stay current with filing schedules and thresholds.

How to Select an Accounting Services Provider for Your Nonprofit

Choosing the right provider is a critical decision. Use the following checklist to vet candidates:

- Nonprofit experience: Do they understand fund accounting, grants, and Form 990?

- Range of services: Can they handle bookkeeping, payroll, audit prep, and CFO advisory?

- References: Do they have current nonprofit clients you can contact?

- Technology: Do they use nonprofit-compatible systems and offer secure cloud access?

- Scalability: Can they scale services as your organization grows?

- Communication: Will you have a predictable reporting cadence and a clear point of contact?

Request a proposal that outlines deliverables, service levels, staff qualifications, and pricing. A short trial period or a phased engagement can reveal fit before a long-term commitment.

Measuring the Impact of Accounting Services for Nonprofit Organizations

Effective accounting services should produce measurable improvements. Track these indicators to evaluate performance:

- Timeliness of financial close and reports

- Number of audit findings and time to resolve them

- Accuracy and timeliness of grant reports and reimbursements

- Cash-flow predictability and reserve levels

- Reduction in payroll and compliance errors

- Board satisfaction with financial reporting clarity

Regularly review these metrics with your provider to drive continuous improvement.

Conclusion

Accounting services for nonprofit organizations are not optional; they are central to trust, compliance, and mission delivery. Whether you need day-to-day bookkeeping, grant compliance expertise, or strategic CFO guidance, a specialized provider can fill gaps, reduce risk, and free your leadership to focus on impact.

FAQ

Is there a free version of QuickBooks for nonprofits?

QuickBooks does not offer a completely free version specifically for nonprofits, but QuickBooks Online has discounted nonprofit pricing (often 30–50% off standard rates through the Intuit Nonprofit program).QuickBooks Online Essentials or Plus is commonly used at reduced rates for eligible 501(c)(3) organizations.

What is the best accounting for nonprofits?

The best accounting software for nonprofits is generally QuickBooks Online (with nonprofit discount) or Aplos, both of which are widely used for fund accounting and donor tracking. Aplos is purpose-built for nonprofits with strong fund and grant tracking features. Other strong options include Xero (with nonprofit pricing) and Wave (free but limited for complex nonprofit needs).

What accounting system do nonprofits use?

Most nonprofits in the US use QuickBooks Online due to its affordability, nonprofit discount, ease of use, and integration with donor platforms. Aplos is popular for organizations needing advanced fund accounting and grant management. Xero and NetSuite are also used by larger nonprofits that require multi-entity or international capabilities.

Is there a free alternative to QuickBooks for nonprofits?

Yes, Wave is a popular free alternative to QuickBooks for nonprofits, offering free invoicing, expense tracking, and basic reporting . Wave is ideal for very small nonprofits or those with simple finances.

Is there a separate QuickBooks for nonprofits?

No, there is no separate QuickBooks product made exclusively for nonprofits.QuickBooks Online offers special discounted pricing and nonprofit eligibility through Intuit’s Nonprofit program.

What is the best accounting method for nonprofit organizations?

The best accounting method for nonprofit organizations is accrual-basis accounting, as required by GAAP (Generally Accepted Accounting Principles) for most nonprofits. Accrual basis properly matches revenues and expenses to the period they occur, which is essential for grant reporting and financial transparency.

What accounting method do most nonprofits use?

Most nonprofits use accrual-basis accounting because it is required by GAAP and provides a more accurate picture of financial health for donors, grantors, and regulators. Accrual basis tracks revenues when earned and expenses when incurred, not when cash changes hands.

What are the accounting methods for nonprofits?

The two primary accounting methods for nonprofits are accrual-basis (revenues/expenses recorded when earned/incurred) and cash-basis (recorded when cash is received/paid).

Accrual-basis is required by GAAP and most funders, while cash-basis is simpler and allowed for small nonprofits under revenue thresholds.

What is the 80/20 rule for nonprofits?

The 80/20 rule (Pareto Principle) for nonprofits states that 80% of funding typically comes from 20% of donors or revenue sources. It highlights the importance of focusing on major donors, grants, or programs that generate the majority of income.

Do nonprofits use QuickBooks?

Yes, many nonprofits use QuickBooks, particularly QuickBooks Online, due to its nonprofit discount, ease of use, and strong reporting features. It is one of the most popular accounting tools for small to medium-sized nonprofits.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses