Profit is a theory. Cash is a fact. You can have a P&L statement that looks incredible, yet still struggle to make payroll on Friday. Why? Because your revenue is trapped in a PDF attachment sitting in your client’s inbox, ignored. This is the silent killer of scale. You deliver the work, send the invoice, and then wait.

You are stuck in the “Founder’s Dilemma.” Push too hard for payment, and you risk the relationship. Don’t push enough, and your business starves. There is a diplomatic solution. Accounts receivable outsourcing services do not just recover funds; they act as a buffer, protecting your reputation while experts handle the awkward financial conversations to ensure steady cash flow.

Key Takeaways

- The Psychological Buffer: How outsourcing creates a necessary separation between service delivery and payment collection.

- The Operator vs. Owner Shift: Why handling AR internally keeps you trapped in low-value administrative cycles.

- The Numberfied Method: How we integrate financial recovery with overall business strategy.

- Diplomacy Over Aggression: Understanding why modern collections require a customer-service approach.

- Cash Flow Velocity: Techniques to reduce Days Sales Outstanding (DSO) without damaging client retention.

The Operator Trap: Chasing Pennies, Losing Dollars

You started your company to solve a problem. To build something great. You did not start a company to spend your Friday afternoons refreshing your banking app and drafting awkward emails to clients who are ghosting you.

When you handle collections internally, you are operating. You are not owning.

Every minute you spend reviewing an aging report is a minute you are not selling. It is a minute you are not innovating. It is a minute you are not leading your team. The opportunity cost is massive. Consider your hourly rate. If you function as a high-level strategist worth $500 an hour, but you spend five hours a week chasing $2,000 invoices, you are losing money. You are performing a task that costs you more in lost focus than the invoice is worth.

There is also an emotional tax.

When you are the one asking for money, it changes the dynamic of the relationship. You become the nag. The transactional friction begins to erode the strategic partnership. You hesitate to upsell because they still owe you for the last project. The entire account stagnates. This fear of “rocking the boat” leads to paralysis. You let the invoice slide another week. Then another. Suddenly, your working capital is trapped in someone else’s bank account.

This is the trap. You think you are saving money by not hiring help. In reality? You are suffocating your growth.

The Psychology of the “Bad Cop” Buffer

Let’s talk about the “Relationship Shield.”

Business is personal. People buy from people. You have spent months cultivating trust with your clients. You took them to lunch. You learned about their kids. You solved their emergencies. You are the “Good Guy.”

When payment issues arise, that closeness becomes a liability. It is awkward to demand payment from a friend. Clients know this. Subconsciously, they prioritize paying the vendor who is strictly professional and impersonal over the vendor who is a “friend” and might be lenient.

This is where a third party becomes your greatest asset.

When you utilize an external partner, you introduce a layer of professional distance. You remain the person focused on their success. The outsourced team becomes the “Bad Cop.” I use that term loosely. They don’t have to be mean. They just have to be firm.

The conversation shifts. When a client calls you to complain about a payment notice, you can say: “I’m so sorry about the confusion. My finance department handles all of that automatically so I can focus on your project. Let me have them reach out to clarify.”

You have just absolved yourself of the conflict.

You are still on their team. The “finance department” (us) is the entity enforcing the policy. This structure preserves the integrity of your relationship. It allows you to maintain the role of a strategic partner. You are no longer the person reaching into their pocket. You are the person helping them succeed. The friction of the transaction is removed from the delivery of value.

Implementing Accounts Receivable Outsourcing Services Without Losing Control

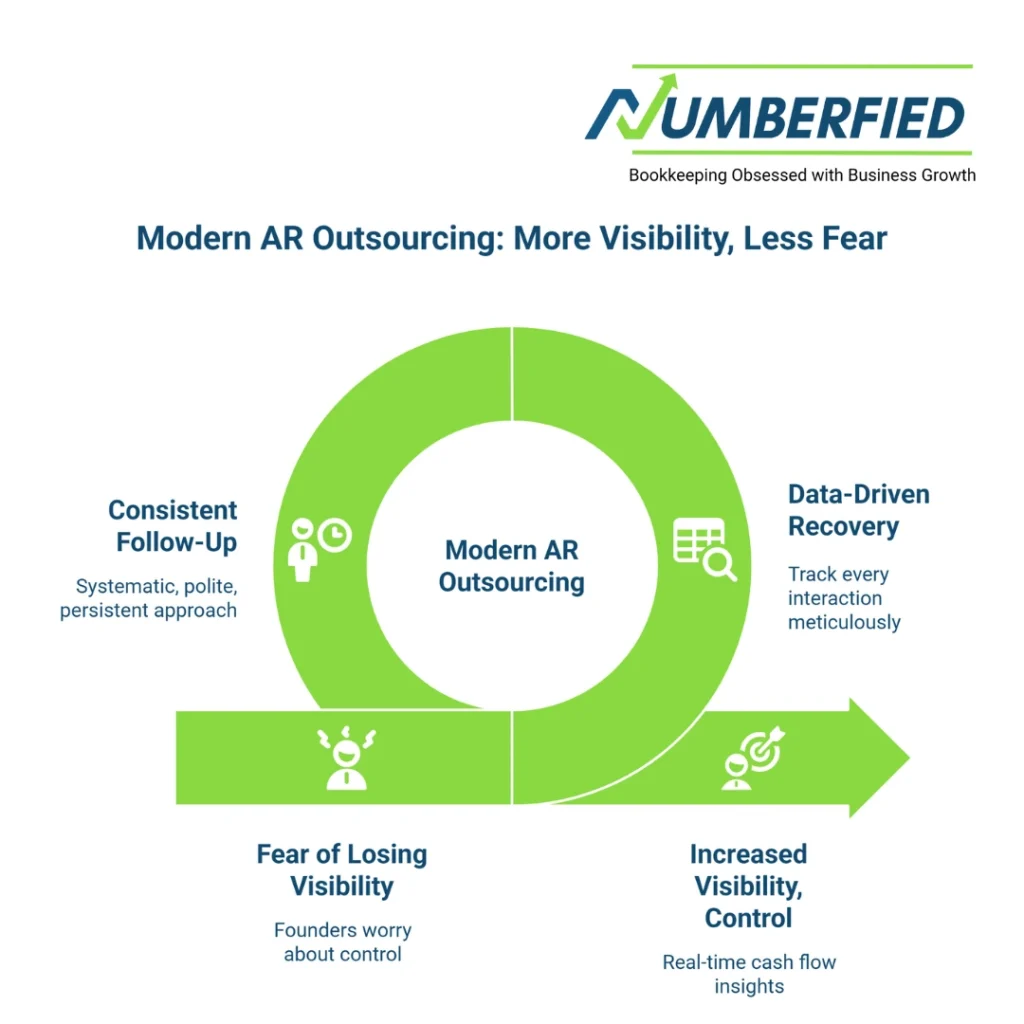

A common fear holds founders back. Fear of losing visibility.

You worry that if you hand this over, you won’t know what is happening. You worry the agency will harass your best clients. You worry about a lack of transparency. These are valid concerns with traditional agencies. However. Modern accounts receivable outsourcing services operate differently.

Control does not mean doing the work. Control means having the data.

When you outsource correctly, you should have more visibility, not less. Internal AR processes are often messy. Notes are kept on sticky pads. Reminders are in personal calendars. When you scale, that data is lost.

A professional partner brings structure. We use data-driven recovery methods. We track every interaction. We record when the email was opened. We know when the call was made. We track the promise-to-pay dates. You get a dashboard. You get a report. You see the cash flow velocity increasing in real-time.

The Diplomacy of Data

Effective AR is not about threats. It is about consistency.

Most internal teams fail because they are sporadic. They send a reminder on day 35. Then they get busy. They forget until day 60. By then, the client assumes you don’t care.

An outsourced team does not get busy with other things. This is their only thing. The follow-up is systematic. It is polite. It is persistent.

- Day 1: Invoice sent.

- Day 3 before due date: Friendly reminder.

- Day 1 past due: Professional inquiry.

- Day 7 past due: Phone call check-in.

This consistency signals to your market that you are a serious operation. It trains your clients to pay on time. It removes the emotion and replaces it with process.

The Numberfied Ecosystem: Financial Clarity Meets Operational Freedom

At Numberfied, we view AR differently. We are not a collection agency. We are a growth strategy firm that understands finance.

Most providers look at AR in a vacuum. They see a list of debts. We see the lifeblood of your business. Our approach is holistic. We integrate AR management into the broader “Numberfied Ecosystem” of bookkeeping, tax strategy, and operational scaling.

Why This Integration Matters

If your AR is disconnected from your bookkeeping, you have a mess. You might be chasing a client who already paid via a different channel. You might be harassing a client who has a valid dispute regarding a deliverable.

We close that loop.

Because we handle the full spectrum of financial data, our AR specialists are informed. They know if a credit memo was issued. They know if the client is on a retainer model. This intelligence allows us to approach collections with nuance.

We don’t just ask for money. We identify why they aren’t paying.

Is it a cash flow issue on their end? We can negotiate a payment plan that gets you paid sooner than waiting for a lump sum. Is it a dispute about the service? We flag that immediately to your operations team so you can fix the client issue before it becomes a churn statistic.

We turn AR into a feedback loop.

If we notice that 30% of your invoices are unpaid because clients don’t understand your billing terms, we fix the terms. If we see a specific service line consistently results in late payments, we analyze the quality of that service. We use financial data to diagnose operational health.

Differentiation: The “White-Glove” Recovery Standard

The horror stories are real. We have all heard them. A business hires a collection agency. The agency starts screaming at clients. The agency threatens legal action on day two. The money is recovered, but the client is lost forever. The brand is tarnished.

This is the “strong-arm” fallacy. It assumes that intimidation is the only way to get paid.

That might work for a telecom giant selling $50 subscriptions. It does not work for a B2B service provider with $10,000 contracts. Your reputation is your currency. You cannot afford to burn bridges.

Our differentiation is simple: We treat your clients like our clients.

We operate as an extension of your brand. We adopt your tone of voice. We use your email domain if necessary. We are brand ambassadors who happen to specialize in finance.

The Diplomatic Pivot

Our team is trained in negotiation, not interrogation. We approach non-payment as a problem to be solved together.

- The Traditional Agency Approach: “Pay this now or we report you to the credit bureau.”

- The Numberfied Approach: “We noticed this is outstanding. Is there an issue with the invoice formatting, or can we assist in setting up a payment schedule to get this cleared up?”

The result is the same: You get paid. The aftermath is different. In the first scenario, the client hates you. In the second, the client respects you. We often find that clients who go through our recovery process end up staying longer. They appreciate the professionalism. They appreciate the flexibility we offer within the boundaries of your policy.

We protect the relationship while securing the asset.

Scaling Up: From Cash-Starved to Cash-Rich

What happens when you fix this?

When you stop bleeding cash, everything changes. Predictability returns. When you know that your DSO (Days Sales Outstanding) is 35 days, not 90, you can plan.

You can hire that new VP of Sales. You can invest in that marketing campaign. You can upgrade your software stack.

Trapped capital is the enemy of scale. Millions of dollars are sitting in the “Accounts Receivable” line item of small businesses across the world. It is dead money. It does nothing for you there.

By utilizing a dedicated partner, you accelerate the velocity of money through your business. You turn “billed revenue” into “bankable cash” faster.

This is how you move from a frantic operator to a calculated owner. You build systems that ensure the machine runs without your manual intervention. You build a “Relationship Shield” that protects your time and your brand equity.

Stop being the bank for your clients. Start being the CEO of your future.

Conclusion

The friction of asking for money destroys more business relationships than poor service ever will. It is an unnecessary burden. It forces you to play a role that contradicts your position as a trusted advisor. By implementing accounts receivable outsourcing services, you are not admitting defeat. You are making a strategic decision to professionalize your financial operations.

You protect your client relationships. You stabilize your cash flow. You free your mind from the anxiety of the “check is in the mail” lie. At Numberfied, we exist to facilitate this transition. We take the weight of administration off your shoulders so you can get back to doing what you do best: Growing your empire. The money is yours. It is time you actually had it.

FAQs

1. Won’t my clients know I hired a third party and get offended?

Not if it is done right. We operate as your internal finance department. To them, it looks like you just got more professional and organized. It signals growth, not desperation.

2. Do I lose control over who gets contacted and when?

No. You set the parameters. We execute the strategy. You can “whitelist” sensitive clients or tell us to pause on specific accounts. You drive the car; we just maintain the engine.

3. Is this only for massive corporations with thousands of invoices?

Absolutely not. Small businesses need this more than anyone. One late $10,000 payment hurts you more than it hurts a Fortune 500 company. If you are growing, you need this system.

4. How is this different from a factoring company?

Factoring companies buy your debt and take a massive percentage. They own the invoice. We manage the process. You keep your equity and the vast majority of your revenue. We are a service, not a loan shark.

5. Can you integrate with the accounting software I already use?

Yes. We work with Xero, QuickBooks, and major ERPs. We don’t want to reinvent your wheel. We want to make your wheel spin faster.

Let’s Fix Your AR Process

Your cash is stuck. Let’s go get it.

You have done the work. You deserve the payment. Stop letting awkward conversations hold your revenue hostage. Book a FREE strategy call with Numberfied today.

Also Read: Why Your USA Business Needs Bookkeeping & Accounting Services