Introduction

Running a real estate company across the US is a daily hustle of listings, showings, and closings. Then you’ve got the admin nightmare: receipts piling up, bank statements that never seem to match, and that constant worry about missing a tax write-off. Sound familiar? That’s because it is for a lot of people. Most owners and brokers we talk to at Numberfied started feeling the same way until they brought on a bookkeeper for real estate company.

The difference is night and day. Suddenly, the numbers make sense, cash flow stays predictable, and you actually have time to focus on finding the next great deal instead of chasing down expense reports. In this guide, we’ll walk through the real challenges you face and show exactly how a bookkeeper for real estate company fixes them. We’ll share the same advice we give our clients every week, straightforward steps that work whether you’re managing five rental units or fifty agents.

Here are the main points we’ll cover:

- Daily tasks that eat your time and how to hand them off

- Common money leaks in real estate that most people miss

- Questions to ask before you hire anyone

- Simple systems that keep everything running smoothly

- Long-term wins that come from clean books

Let’s get into it.

What a Bookkeeper for Real Estate Company Actually Does Day to Day

People often think bookkeeping is just data entry. In real estate, it’s much more hands-on than that.

Recording Every Dollar That Moves

Every closing check, every maintenance invoice, every commission split, your bookkeeper for real estate company logs it the same day it happens. They set up categories that match how you actually run your business: escrow deposits in one place, marketing costs in another, agent reimbursements separate from office expenses.

We see owners breathe easier once this starts happening consistently. No more digging through email for that one receipt when tax time rolls around.

Matching Bank Feeds Every Month

By the fifth of each month, your bookkeeper for real estate company has already pulled statements and matched every transaction. They spot the double charges from vendors, flag unusual withdrawals, and make sure your trust accounts balance to the penny.

This monthly habit catches problems early. One client found a property manager who had been overcharging for lawn care for eight months, and saved them thousands once it was fixed.

Getting Ready for Tax Season All Year Long

Instead of scrambling in March, your bookkeeper for real estate company builds the tax package month by month. They track mileage for every property visit, separate capital improvements from regular repairs, and keep depreciation schedules current.

Accountants love working with files organized this way. Returns get filed faster, and you usually end up owing less because nothing gets missed.

The Money Problems That Hit Real Estate Companies Hardest

Certain issues come up again and again when we start working with new clients.

Commission Tracking That Actually Works

Split percentages, tier bonuses, referral fees, trying to calculate all this in spreadsheets leads to mistakes. Your bookkeeper for real estate company builds payout reports that update automatically when a deal closes. Agents get paid correctly and on time, which keeps your best people from jumping to competitors.

Rental Income and Expense Nightmares

Late rent checks, security deposit mix-ups, and emergency repairs at 2 a.m., property management generates constant transactions. A good bookkeeper for real estate company sets up separate accounts for each property and tracks everything individually. You can see at a glance which units make money and which ones need attention.

Closing Costs That Slip Through the Cracks

Title fees, lender charges, prorated taxes, and closing statements have dozens of line items. Your bookkeeper for real estate company pulls the HUD-1 or ALTA statement and matches every charge against your bank records. This prevents money from disappearing into vague “closing costs” categories.

How to Pick the Right Bookkeeper for Your Real Estate Company

Not every bookkeeper understands real estate accounting. Here’s what actually matters.

They Need to Speak Your Language

Ask if they’ve worked with brokerages or property managers before. Can they explain how to handle 1031 exchange timing or trust account rules in your state? A bookkeeper for a real estate company who gets these details saves you from expensive corrections later.

Current Software Skills

QuickBooks Online dominates real estate bookkeeping for good reason. Make sure your bookkeeper for a real estate company knows the real estate version with job costing and class tracking. Bonus points if they’re comfortable with AppFolio or Buildium, too.

References from People Like You

Ask for contacts from other real estate companies they’ve helped. Call them. Find out how responsive the bookkeeper is when something urgent comes up, like when you need profit numbers for a loan application due tomorrow.

Making Bookkeeping Part of Your Daily Operations

The best systems run quietly in the background.

Automatic Bank Feeds and Rules

Set up your bank to push transactions directly into QuickBooks. Your bookkeeper for real estate company creates rules so 90% of entries categorize themselves. That Home Depot charge always goes to the right property. The Starbucks run during showings hits the agent reimbursement.

Weekly 15-Minute Check-ins

Fifteen minutes every Monday morning keeps everyone aligned. You review anything that needs approval, ask questions about unusual charges, and plan for upcoming expenses. These short meetings prevent small issues from becoming big problems.

Monthly Financial Packets

By the 10th of each month, you get a simple packet: profit and loss by property, cash balance forecast, and any red flags. Your bookkeeper for a real estate company highlights what matters so you can make decisions fast.

What You Gain When Your Books Stay Clean

The benefits keep growing the longer you maintain good records.

Better Lending Terms

Banks love organized financials. When you’re ready to buy that next apartment building, your bookkeeper for a real estate company delivers three years of clean reports that make lenders compete to give you the best rates.

Smarter Selling Decisions

Want to know what your brokerage is really worth? Accurate books show the true value of your recurring revenue streams and agent contracts. Buyers pay more for businesses with documented profits.

Peace of Mind That Lets You Sleep

Perhaps the biggest win: you stop worrying about money at night. Your bookkeeper for a real estate company handles the details so you can focus on growing your business and enjoying the rewards.

Using Modern Tools with Human Oversight

Technology handles the repetitive work while people catch what software misses.

Cloud Accounting That Works Anywhere

Access your numbers from your phone while walking a property. Approve bills from the closing table. Your bookkeeper for a real estate company updates everything in real time, so you’re never working with old information.

Custom Dashboards for What Matters

See vacancy rates, average days to close, and cash on hand with one glance. Your bookkeeper builds these views based on what actually drives your business decisions.

Bank-Level Security Without the Hassle

All data encrypted, automatic backups, limited access, your bookkeeper for a real estate company manages the technical side, so you don’t have to think about it.

Growing Together as Your Company Expands

The right bookkeeping relationship scales with you.

Starting Small and Adding Services

Begin with basic transaction recording and monthly reconciliations. Add payroll when you hire your first assistant. Bring on bill pay when you own twenty properties. Your bookkeeper for a real estate company adjusts as your needs change.

Planning for the Future

Quarterly strategy sessions look ahead: How much cash do you need for the next acquisition? When should you set up separate entities? Your bookkeeper becomes a trusted advisor who helps map the path forward.

Conclusion

Every successful real estate company we work with at Numberfied has one thing in common: they stopped trying to handle their own books. Bringing on a dedicated bookkeeper for real estate company freed them to do what they do best: find deals, serve clients, and build wealth.

The numbers tell the story. Owners who delegate financial management consistently grow faster and stress less. If you’re ready to make this shift in your business, we’re here to help.

Visit https://numberfied.com/ today and schedule a quick call. We’ll review where you are now and show you exactly how a bookkeeper for a real estate company can transform your operations. Let’s get your financial house in order so you can focus on closing more deals tomorrow.

FAQs

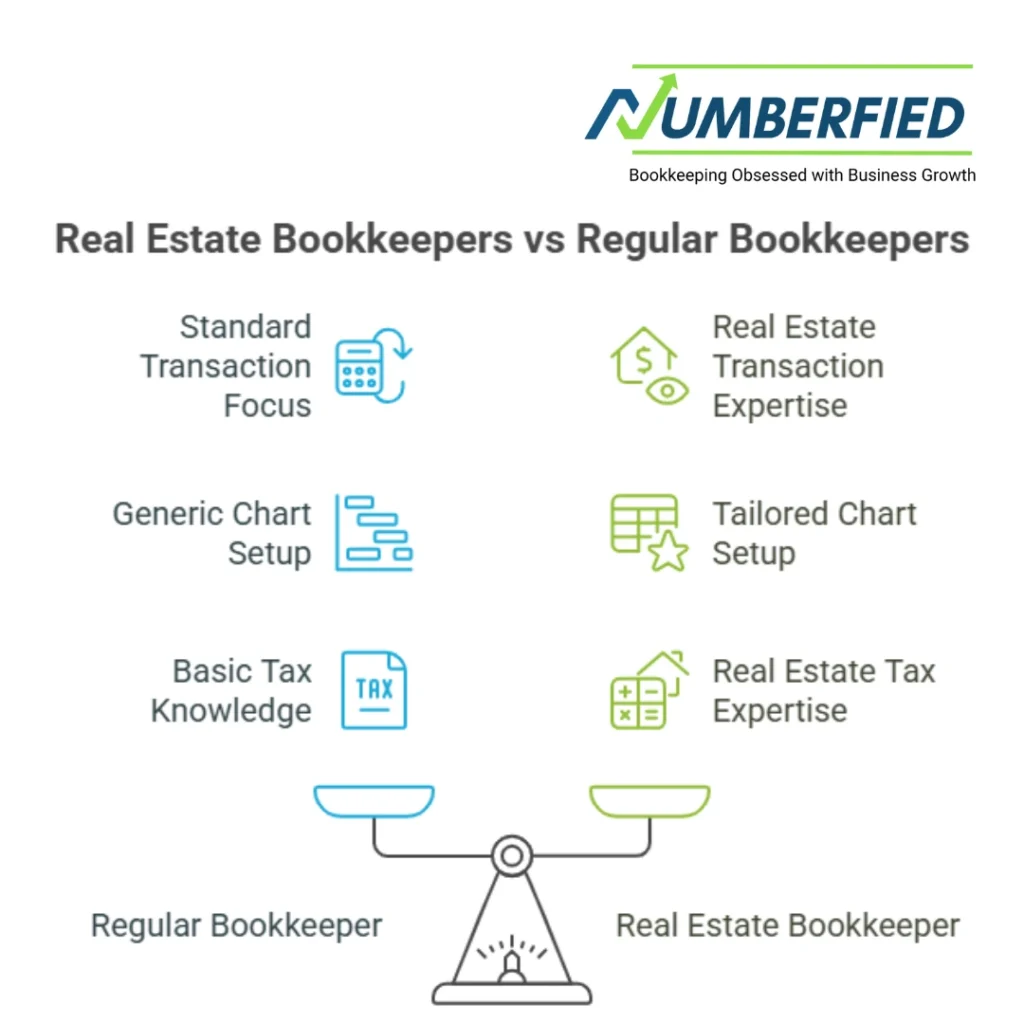

What does a bookkeeper for real estate company do differently than a regular bookkeeper?

They understand the specific transactions that happen in real estate daily. Commission splits, trust account rules, and property-specific expense tracking aren’t standard in most businesses. A bookkeeper for real estate company sets up your charts of accounts properly from day one and knows which expenses qualify for real estate tax treatment.

How quickly can I get set up with a new bookkeeper?

Most clients are fully transitioned within two weeks. Your new bookkeeper for a real estate company connects your bank accounts, imports historical data, and starts processing current transactions right away. The first month focuses on cleaning up any backlog while establishing new workflows.

Will I still have control over my money?

Absolutely. You approve every payment and see every transaction. Your bookkeeper for real estate company prepares bills for your review and processes payments only after you sign off. Many clients use mobile approval apps that take ten seconds per bill.

What if I only have a few properties? Do I really need this?

Even small portfolios benefit. One rental property can generate hundreds of transactions per year between mortgage payments, insurance, repairs, and tenant deposits. A bookkeeper for a real estate company saves you hours every month and usually finds deductions that more than cover their fee.

How much time will this save me each week?

Most owners report saving 8-15 hours per week once everything runs smoothly. No more weekend catch-up sessions on receipts. No more late nights before tax deadlines. Your bookkeeper for real estate company handles the routine work while keeping you informed.

Can you work with my current CPA?

Yes, and we encourage it. Your bookkeeper for a real estate company provides clean, organized files that make your accountant’s job easier. Many CPAs actually refer clients to us because they prefer working with properly maintained books.

What software do you use?

We primarily use QuickBooks Online with the real estate-specific setup, but we adapt to whatever system works best for your team. Your bookkeeper for real estate company can work in AppFolio, Buildium, or Propertyware, depending on your property management needs.

How do you handle multiple entities?

We set up each LLC or corporation separately while consolidating reports when you need the big picture. Your bookkeeper for real estate company tracks inter-company transactions and keeps everything properly separated for both management and tax purposes.

What happens if I sell a property?

Your bookkeeper for real estate company handles all the closing entries, calculates gain or loss, tracks 1031 exchange funds if applicable, and provides documentation for your tax return. They make sure every dollar is accounted for through the entire process.

How do I know this is worth the investment?

Look at what your time is worth. If you’re spending ten hours a month on bookkeeping tasks that a professional bookkeeper for a real estate company handles for less than your hourly rate, the math works. Most clients find additional tax savings and prevent errors that make the service pay for itself multiple times over.