Introduction

As a small to medium business owner, startup founder, entrepreneur, or self-employed professional, your time is your most valuable asset. A professional bookkeeping and tax service can reclaim hours spent on spreadsheets and receipts, allowing you to focus on growth and innovation. These integrated solutions provide the foundation for financial health, combining daily record-keeping with strategic tax planning to keep your business compliant and profitable. In this guide, we explore the key benefits of bookkeeping and tax services, compare in-house and outsourced models, outline essential offerings, highlight common pitfalls, and provide a practical selection process. We’ll also look at top providers and IRS compliance trends in 2026 to help you choose wisely.

Key Benefits of Bookkeeping and Tax Service

A quality bookkeeping and tax service delivers tangible advantages that go beyond basic compliance, empowering your business to thrive.

Ensuring IRS Compliance and Avoiding Penalties

One primary benefit of bookkeeping and tax service is maintaining IRS compliance, including accurate quarterly estimated taxes, 1099 filings, and annual returns. Professionals track deductible expenses and credits, reducing the risk of audits or fines that can cost thousands. Small business bookkeeping and tax experts handle ever-changing regulations, giving you peace of mind.

Maximising Tax Savings and Deductions

Bookkeeping and tax service providers identify overlooked deductions like home office expenses, mileage, or equipment depreciation, potentially saving 20-30% on your tax bill. Outsourced bookkeeping and tax options offer proactive planning, such as timing purchases for Section 179 deductions. This strategic approach turns tax season from a burden into an opportunity for savings.

Saving Time and Reducing Administrative Burden

Manual bookkeeping can consume 10-20 hours monthly. A virtual bookkeeping and tax service automates data entry and reconciliation, freeing you for core activities like sales or client work. Full-service bookkeeping and tax packages handle everything from payroll to financial reports, streamlining your workflow.

Providing Financial Clarity for Better Decisions

With clean, up-to-date books, bookkeeping, and tax service offers real-time insights into cash flow, profitability, and trends. Tax and bookkeeping packages include custom reports that highlight growth opportunities or cost leaks, enabling data-driven decisions. This clarity is crucial for startups scaling or self-employed professionals managing variable income.

In-House vs. Outsourced Bookkeeping and Tax Service Comparison

Choosing between in-house and outsourced bookkeeping and tax service depends on your business size and goals. Here’s a balanced view.

Cost Differences

In-house staff costs $50,000-$80,000 annually (salary, benefits, training), plus software. Outsourced bookkeeping and tax averages $300-$2,000 monthly ($3,600-$24,000 yearly), with no overhead. For SMBs, outsourcing is often 50-70% cheaper while providing similar or better expertise.

Expertise and Compliance Levels

In-house may lack specialised IRS knowledge, leading to errors. Outsourced options bring certified professionals versed in current tax codes, like the latest ERC changes. Virtual bookkeeping and tax services ensure higher compliance, especially for complex setups like multi-state taxes.

Scalability and Flexibility

In-house roles are fixed, limiting adaptability during growth. Outsourced bookkeeping and tax scales easily add payroll or advisory services as needed without hiring. Tax and bookkeeping packages offer tiered plans, making them ideal for startups with fluctuating needs.

Control and Technology Integration

In-house provides direct oversight but requires managing software updates. Outsourced uses cloud tools for real-time access and automated features, maintaining control through dashboards. Full-service bookkeeping and tax ensures seamless integration with your existing systems like QuickBooks or Xero.

Essential Services in Bookkeeping and Tax Packages

The best bookkeeping and tax service covers a comprehensive range of tasks tailored to SMB needs.

Daily Bookkeeping and Record-Keeping

This includes transaction entry, bank reconciliations, expense categorisation, and ledger maintenance. Small business bookkeeping and tax pros use automation to keep records accurate and up-to-date, preventing discrepancies during tax season.

Quarterly Tax Filings and Payments

Providers handle estimated tax payments, 941 forms for payroll taxes, and state filings. Outsourced bookkeeping and tax ensure timely submissions, avoiding underpayment penalties. They also track sales tax for e-commerce businesses.

Annual Tax Returns and Planning

Preparation and filing of 1040, 1120, or 1065 forms, maximising credits like QBI deductions. Virtual bookkeeping and tax services offer year-round planning to minimise liabilities through strategies like retirement contributions or equipment purchases.

Payroll Processing and Compliance

Calculating wages, withholding taxes, and filing W-2/1099 forms. Tax and bookkeeping packages include direct deposit, benefits management, and IRS compliance, reducing administrative hassle for businesses with employees.

Financial Reporting and Advisory

Monthly balance sheets, P&L statements, and cash flow forecasts. Full-service bookkeeping and tax includes advisory on budgeting, cost control, and growth strategies, turning data into actionable insights.

Common Mistakes to Avoid with Bookkeeping and Tax Service

Even with professional help, pitfalls can occur. Here’s how to steer clear.

Mixing Personal and Business Expenses

Blending accounts complicates deductions and raises IRS red flags. Use separate business accounts from day one to keep bookkeeping and tax service efficient and compliant.

Delaying Service Engagement

Many wait until tax season chaos, missing proactive savings. Engage bookkeeping and tax service early to build accurate records and plan for deductions throughout the year.

Ignoring Technology Integration

Choosing a provider without compatible software leads to double entry. Ensure your bookkeeping and tax service integrates with your tools like QuickBooks or Stripe for seamless data flow.

Overlooking Regular Reviews

Assuming “set it and forget it” misses errors. Schedule monthly check-ins with your outsourced bookkeeping and tax provider to review reports and adjust as needed.

Focusing Solely on Cost

Cheap services may lack IRS expertise, leading to costly mistakes. Prioritize value in tax and bookkeeping packages; accuracy and advice often save more than the cost of low fees.

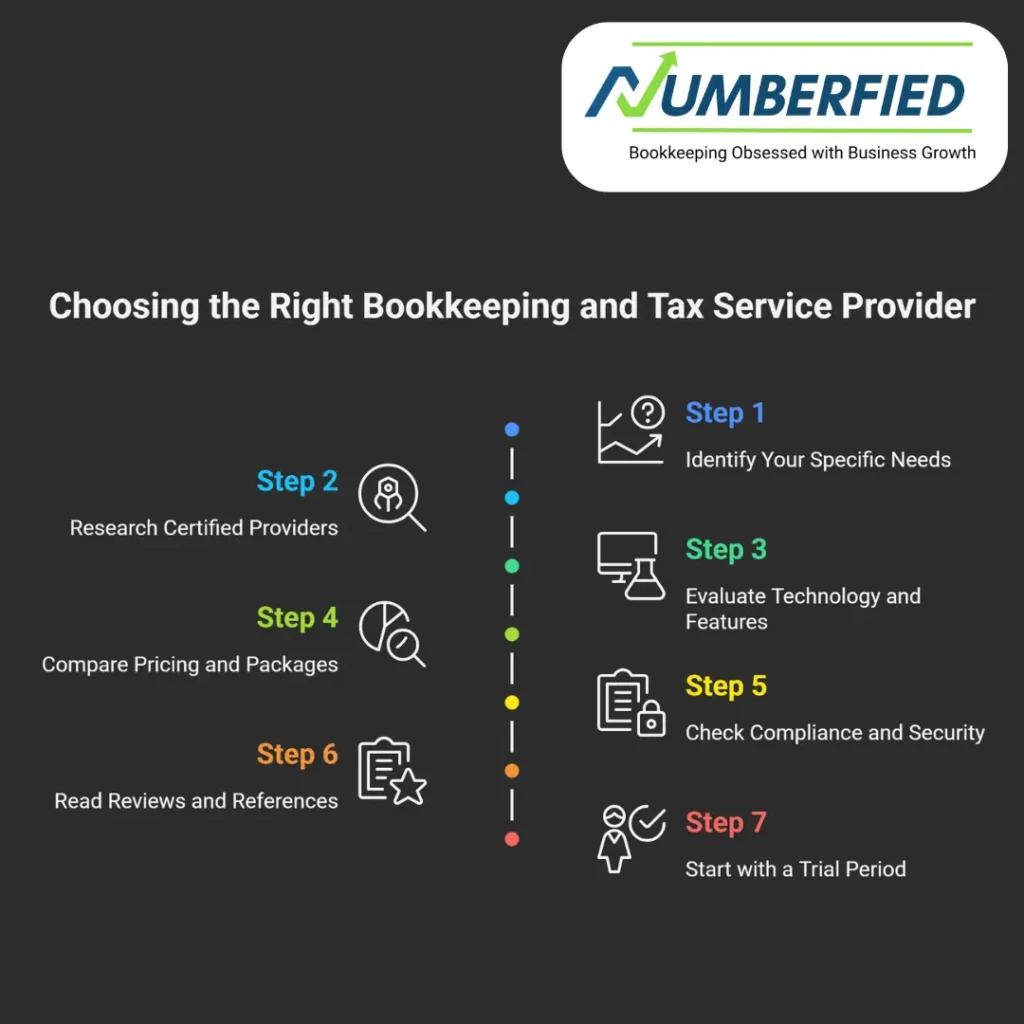

Step-by-Step Guide to Choosing Bookkeeping and Tax Service Providers

Follow this process to find a reliable partner.

Step 1: Identify Your Specific Needs

Determine if you need basic transaction tracking, full tax preparation, or advisory. Consider transaction volume, industry (e.g., e-commerce sales tax), and growth stage for tailored bookkeeping and tax service.

Step 2: Research Certified Providers

Look for enrolled agents (EAs) or CPAs with positive reviews on sites like Yelp or Google. Check specialisation in small business bookkeeping and tax for relevant experience.

Step 3: Evaluate Technology and Features

Ensure the provider uses cloud-based tools with bank feeds, mobile access, and IRS e-file capabilities. Ask about integrations with your existing software.

Step 4: Compare Pricing and Packages

Request detailed quotes for virtual bookkeeping and tax services. Compare inclusions like payroll or quarterly filings, aiming for transparent, value-based pricing.

Step 5: Check Compliance and Security

Verify IRS certification and data security measures (e.g., SOC 2 compliance). Full-service bookkeeping and tax providers should offer audit support.

Step 6: Read Reviews and References

Review client testimonials and request references. Look for feedback on responsiveness and tax savings achieved.

Step 7: Start with a Trial Period

Many offer 1-3 month trials. Use this to test accuracy, communication, and fit before committing long-term.

Top Providers and IRS Compliance Trends in 2026

Leading bookkeeping and tax service providers in 2026 include Bench (affordable virtual options), Bookkeeper.com (full-service for SMBs), Pilot (tech-focused for startups), and local CPA firms like H&R Block or Jackson Hewitt for personalized support.

IRS trends emphasise digital filing with 94% of returns e-filed, expanded 1099-K reporting for gig workers, and AI-driven audits targeting discrepancies in deductions. Providers are integrating blockchain for secure transactions and offering crypto tax support. Outsourced bookkeeping and tax now includes ESG reporting for socially conscious businesses. Choose providers with strong cybersecurity, as the IRS focuses on data breaches.

Conclusion

A reliable bookkeeping and tax service is indispensable for small to medium businesses, ensuring compliance, unlocking tax savings, freeing your time, and providing financial clarity. By selecting the right provider, you position your business for sustainable success. Whether you’re a startup or an established entrepreneur, investing in bookkeeping and tax service pays dividends. Ready to optimise your finances? Request a free consultation today and discover how we can support your journey.

FAQ

What is a bookkeeping and tax service?

A bookkeeping and tax service combines daily financial record-keeping (transactions, reconciliations, reports) with professional tax preparation and planning. It ensures accurate books, timely IRS filings, and maximized deductions, helping small businesses stay compliant and financially healthy.

How much does a bookkeeping and tax service cost for a small business?

Costs typically range from $300–$2,000 per month for small businesses, depending on transaction volume and services. Basic bookkeeping starts around $400–$800, while full packages (including tax returns, payroll, and advisory) often fall between $1,200–$2,000 monthly.

Is it worth hiring a bookkeeping and tax service for a small business?

Yes, it’s worth it for most small businesses. The service saves time, reduces errors, uncovers deductions, and prevents costly IRS penalties-often paying for itself through tax savings and improved financial decisions.

What services are included in bookkeeping and tax packages?

Typical packages include daily bookkeeping, bank reconciliations, accounts payable/receivable, payroll processing, monthly financial reports, quarterly tax estimates, annual tax return preparation, and basic advisory support.

Should I choose in-house or outsourced bookkeeping and tax service?

Outsourced is usually better for small businesses due to lower costs (no salary/benefits), access to certified experts, scalability, and modern cloud tools. In-house works for larger operations needing constant oversight.

Do I need a CPA for bookkeeping and tax service?

Not necessarily for basic bookkeeping, but a CPA is highly recommended for tax returns, complex deductions, audits, or business structuring. Many small businesses use a bookkeeper for daily tasks and a CPA for tax season.

How do I choose the best bookkeeping and tax service?

Look for ATO/IRS-registered providers with cloud software (QuickBooks, Xero), positive reviews, transparent pricing, and strong communication. Ask about experience with your industry and request a trial or consultation to test fit.

What are the common mistakes with bookkeeping and tax services?

Mixing personal/business expenses, delaying service engagement, ignoring technology integration, underclaiming deductions, and choosing providers based only on low price are common mistakes. Proper setup and regular reviews prevent most issues.

What are the latest trends in bookkeeping and tax services for 2026?

Trends include AI-driven automation for categorisation and reconciliation, mandatory e-invoicing, expanded Single Touch Payroll reporting, and ESG/sustainability reporting. Providers are focusing on real-time dashboards and cybersecurity.

How can I get started with bookkeeping and tax services?

Assess your needs, research registered providers, compare quotes, check software compatibility, and schedule a consultation. Many offer free initial reviews or trial periods-start today to simplify your finances and focus on growing your business. Request a free consultation to see how it works for you.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses